Printable Vehicle Repayment Agreement Form

Vehicle Repayment Agreement - Usage Guidelines

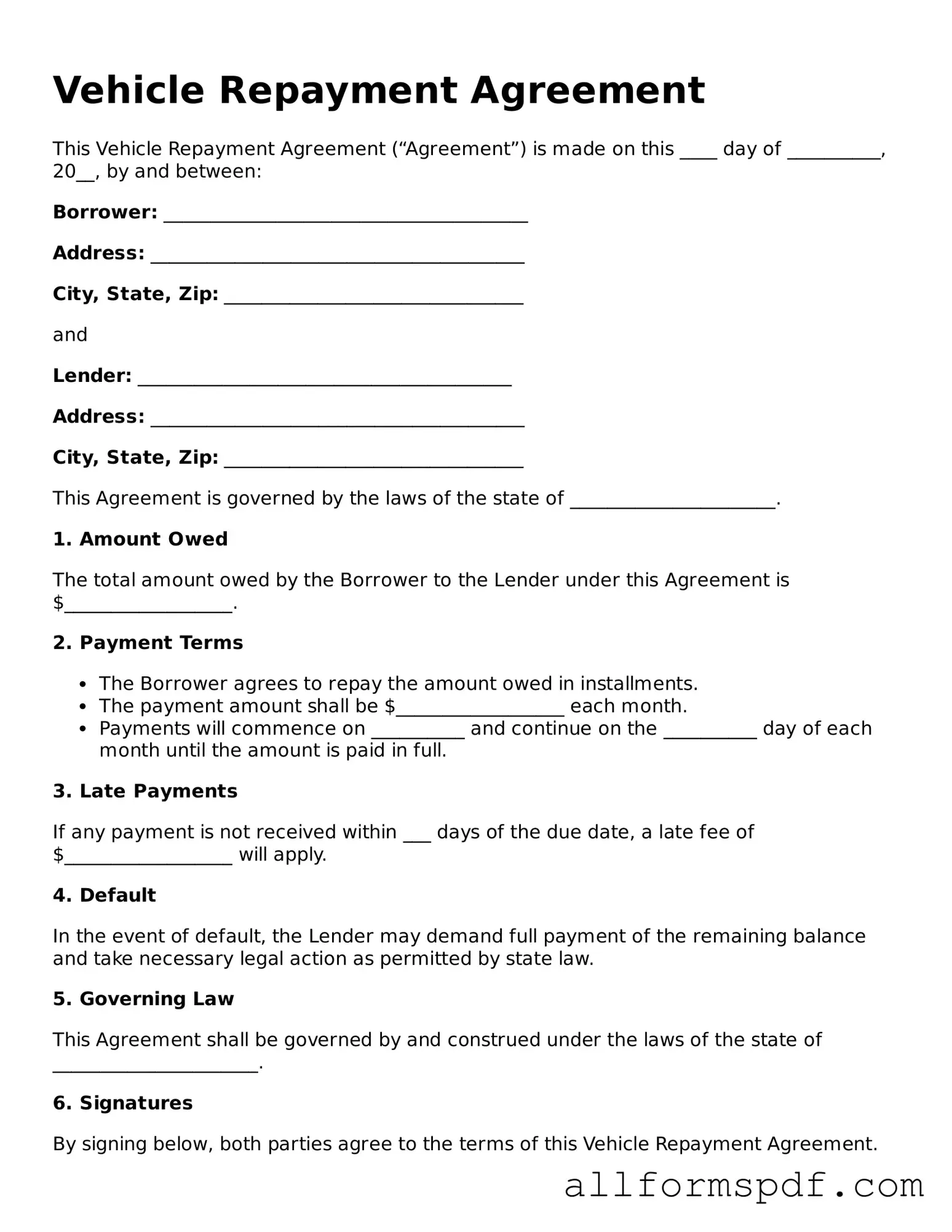

Completing the Vehicle Repayment Agreement form is an important step in managing your vehicle-related financial obligations. Once you have filled out the form, you will need to review it carefully before submitting it to ensure all information is accurate and complete.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including street, city, state, and zip code.

- Fill in your phone number and email address for contact purposes.

- Specify the make, model, and year of the vehicle involved in the agreement.

- Enter the Vehicle Identification Number (VIN), which can typically be found on the dashboard or inside the driver's side door.

- Indicate the total amount owed on the vehicle.

- Outline the proposed repayment terms, including the amount and frequency of payments.

- Sign and date the form to confirm your agreement to the terms outlined.

After completing these steps, double-check all entries for accuracy. This will help prevent any delays in processing your agreement.

Misconceptions

Misconceptions surrounding the Vehicle Repayment Agreement form can lead to confusion for individuals involved in vehicle financing. Here are nine common misconceptions and clarifications regarding this important document:

- The Vehicle Repayment Agreement is only for new vehicles. This is incorrect. The agreement applies to both new and used vehicles, as long as financing is involved.

- Signing the agreement means I own the vehicle outright. Not true. Signing the agreement indicates that you are entering into a financing arrangement, and the lender typically holds the title until the loan is paid off.

- I can change the terms of the agreement after signing. This is a misconception. Once signed, the terms are binding unless both parties agree to modifications.

- The Vehicle Repayment Agreement guarantees loan approval. This is misleading. The agreement is a document that outlines terms but does not guarantee financing. Approval depends on creditworthiness and other factors.

- All lenders use the same Vehicle Repayment Agreement form. This is false. Different lenders may have their own versions of the agreement, which can vary in terms and conditions.

- I can ignore the agreement if I change my mind about the vehicle. This is not advisable. Ignoring the agreement can lead to legal consequences and impact your credit score.

- The Vehicle Repayment Agreement includes insurance requirements. This is a misconception. While lenders often require insurance, the specifics are typically outlined in separate documents.

- I can sell the vehicle anytime after signing the agreement. This is misleading. Selling the vehicle usually requires the lender's consent until the loan is fully paid.

- The agreement is only important during the repayment period. This is incorrect. The agreement may also have implications for the vehicle's resale value and future financing opportunities.

Understanding these misconceptions can help individuals navigate their vehicle financing agreements more effectively and avoid potential pitfalls.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the form; take your time to avoid mistakes.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Alter or erase any information on the form.

- Don't: Ignore deadlines for submission.

Popular Documents

Bill of Sale for Travel Trailer - Facilitates easy transfer of titles when switching ownership.

Parking Spot Lease Agreement - Sets a timeline for any required improvements to the space.

When utilizing a General Bill of Sale form, it's essential to have a clear understanding of the involved parties and the items being sold. Such a document not only serves as proof of purchase but also plays a crucial role in protecting both the buyer and seller. For additional guidance and resources, you can visit OnlineLawDocs.com, which provides helpful information on creating and utilizing these forms effectively.

Letter of Intent to Purchase Property - This document can be an essential first step in a successful transaction.

Common mistakes

Completing a Vehicle Repayment Agreement form can be straightforward, but many individuals encounter common pitfalls. One frequent mistake is failing to provide accurate personal information. This includes not only names and addresses but also the correct vehicle identification number (VIN). Incorrect details can lead to complications in processing the agreement.

Another common error is neglecting to read the terms and conditions carefully. Individuals may skip over important clauses that outline responsibilities and consequences. Understanding these terms is crucial for both parties involved, as it sets clear expectations and helps avoid future disputes.

Many people also forget to include all necessary documentation. Supporting documents, such as proof of income or identification, may be required to finalize the agreement. Without these, the form may be deemed incomplete, causing delays or rejection of the application.

Some individuals make the mistake of not signing the form. A signature is essential as it indicates agreement to the terms outlined in the document. Omitting a signature can render the entire form invalid, leading to further complications.

Inaccurate financial information is another frequent issue. When individuals provide misleading or incorrect figures regarding their income or expenses, it can result in unfavorable terms or even denial of the agreement. Being honest and precise is vital for a successful outcome.

People sometimes overlook the importance of dates. Failing to include the correct date on which the agreement is signed can create confusion. It is essential to ensure that all dates are accurate and align with the rest of the information provided.

Some may not seek assistance when needed. If unsure about how to fill out the form, individuals might hesitate to ask for help. Seeking guidance from a knowledgeable source can clarify doubts and prevent errors.

Another mistake involves not keeping a copy of the completed form. After submission, it is important to retain a copy for personal records. This can be helpful for future reference or in case of disputes.

Lastly, individuals sometimes fail to follow up after submitting the form. Checking in on the status of the agreement can ensure that everything is processed correctly and that there are no outstanding issues that need to be addressed.

Key takeaways

Filling out and using the Vehicle Repayment Agreement form can be straightforward if you keep a few key points in mind. Here are some important takeaways to consider:

- Accurate Information: Ensure that all details about the vehicle, including make, model, and VIN, are filled out correctly. This helps avoid any confusion later.

- Clear Terms: Clearly outline the repayment terms, including the amount owed, payment schedule, and interest rates, if applicable. This clarity benefits both parties.

- Signatures Required: Both the borrower and lender must sign the agreement. This step is crucial as it indicates mutual consent to the terms laid out.

- Keep Copies: After completing the form, make sure to keep copies for your records. Having documentation can be helpful in case of disputes.