Printable Vehicle Release of Liability Form

Vehicle Release of Liability - Usage Guidelines

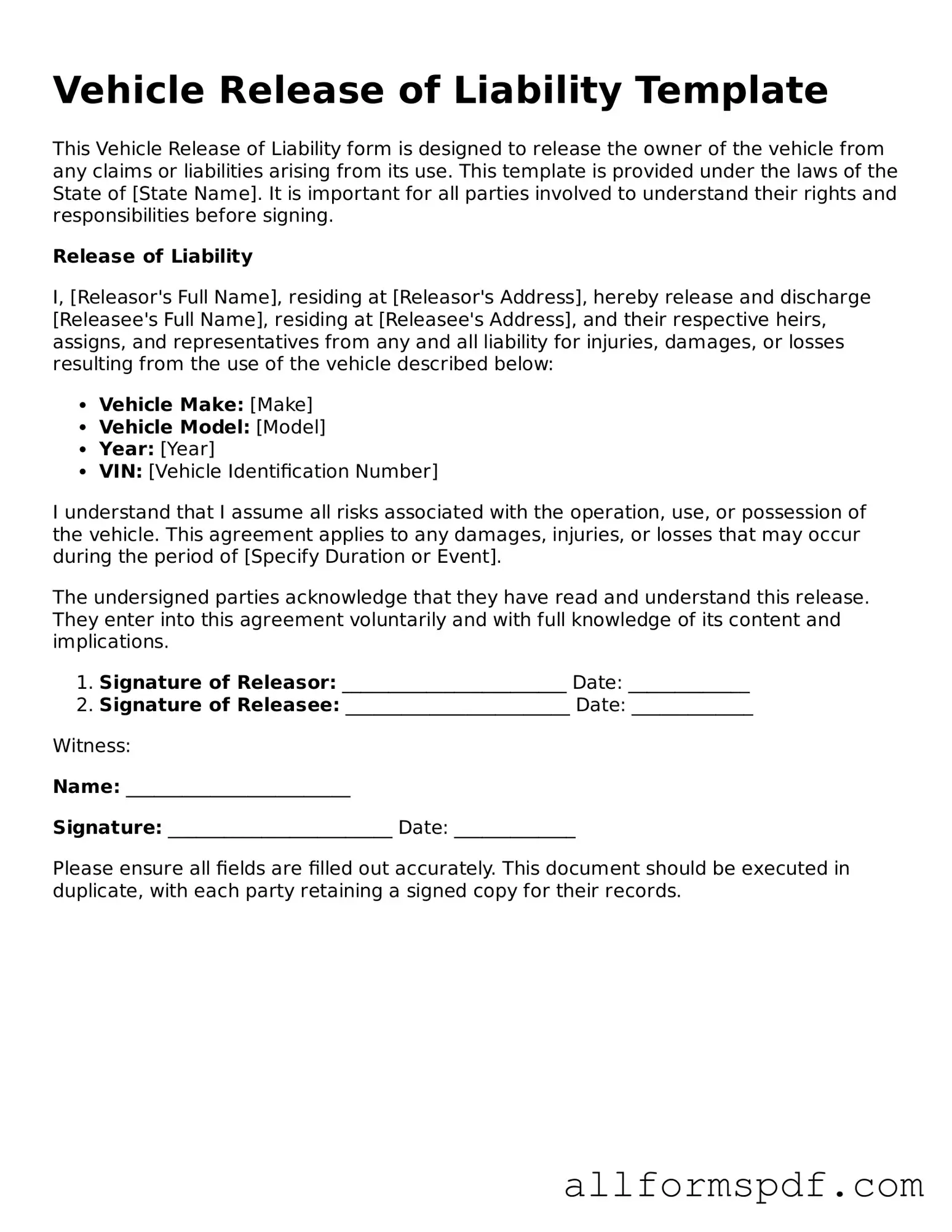

After gathering the necessary information, you can proceed to fill out the Vehicle Release of Liability form. This form is essential for transferring responsibility for a vehicle from one party to another. Follow the steps carefully to ensure accuracy and completeness.

- Obtain the Vehicle Release of Liability form from your local Department of Motor Vehicles (DMV) or download it from their website.

- Begin by entering the date at the top of the form.

- Provide your name and contact information in the designated fields.

- Fill in the details of the vehicle, including the make, model, year, and vehicle identification number (VIN).

- Include the name and contact information of the new owner who will assume responsibility for the vehicle.

- Sign and date the form to confirm the transfer of liability.

- Submit the completed form to your local DMV office, or follow the instructions provided for online submission.

Misconceptions

When it comes to the Vehicle Release of Liability form, many people have misunderstandings that can lead to confusion. Here are nine common misconceptions, along with clarifications to help you navigate this important document.

- It absolves all liability. Many believe that signing this form completely frees the seller from any responsibility. In reality, it typically releases liability for specific events, like accidents that occur after the sale.

- It’s only necessary for private sales. Some think this form is only needed when selling a vehicle privately. However, it can also be beneficial in transactions with dealerships or other businesses.

- It’s the same as a bill of sale. While both documents are important, they serve different purposes. The bill of sale proves ownership transfer, whereas the release of liability focuses on protecting the seller from future claims.

- It’s a one-size-fits-all document. Many assume that a standard form works for every situation. However, the specifics can vary by state and individual circumstances, making it essential to use a form tailored to your needs.

- Once signed, it cannot be contested. Some people think that signing the form means it’s ironclad. However, if there’s evidence of fraud or misrepresentation, it may still be challenged in court.

- It protects the buyer as well. This form primarily protects the seller. Buyers should be aware that it does not shield them from issues related to the vehicle after the sale.

- It eliminates the need for insurance. A common misconception is that this form means the seller no longer needs to maintain insurance. In fact, sellers should keep insurance until the transfer is fully complete.

- It’s not legally binding. Some believe that because it’s a simple form, it lacks legal weight. In fact, when properly filled out and signed, it is a legally binding document.

- It can be signed after the sale. Many think they can sign the form at any time. However, it should be completed at the time of the sale to ensure it accurately reflects the transaction.

Understanding these misconceptions can help ensure a smoother vehicle sale process. Always consider consulting with a professional to ensure all legal bases are covered.

Dos and Don'ts

When filling out the Vehicle Release of Liability form, it’s important to get it right. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the vehicle and the parties involved.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

By following these guidelines, you can help ensure that your form is filled out correctly and effectively protects your interests.

Discover More Types of Vehicle Release of Liability Documents

What Is a Waiver and Release Form - This form is critical for organizing events that involve physical or recreational activities.

When participating in activities that involve potential risks, it is essential to have a clear understanding of legal protections in place, such as the Release of Liability form, which can help clarify responsibilities and mitigate liability for participants and organizers alike.

Common mistakes

Completing a Vehicle Release of Liability form is a crucial step in transferring ownership of a vehicle. However, many individuals make common mistakes that can lead to complications later on. Understanding these pitfalls can help ensure a smoother process.

One frequent error occurs when individuals fail to provide accurate vehicle information. This includes the Vehicle Identification Number (VIN), make, model, and year. If any of this information is incorrect or incomplete, it may result in delays or disputes regarding ownership.

Another mistake involves neglecting to sign and date the form. A signature is essential for validating the document. Without it, the form may not be considered legally binding. Additionally, the date serves as a record of when the liability was released, which can be important for future reference.

People often overlook the necessity of providing the correct information for both the seller and the buyer. Missing or incorrect names, addresses, or contact information can create confusion and hinder communication. This can lead to issues if either party needs to be contacted regarding the vehicle in the future.

Furthermore, many individuals do not keep a copy of the completed form for their records. Retaining a copy is important for both parties involved. It serves as proof that the liability was released and can protect against any potential claims that may arise after the transfer.

Lastly, failing to check local regulations can result in further complications. Different states may have varying requirements for the release of liability. It is essential to verify that the form complies with local laws to avoid any legal issues down the line.

Key takeaways

When dealing with the Vehicle Release of Liability form, understanding its purpose and proper usage is crucial. Here are some key takeaways to keep in mind:

- The form serves as a legal document that releases one party from liability for any injuries or damages that may occur during the use of a vehicle.

- It is essential to fill out the form completely and accurately to ensure its validity. Missing information can lead to complications down the line.

- Both parties involved should sign the form to confirm their agreement to the terms outlined within it.

- Be sure to keep a copy of the signed form for your records. This can serve as proof of the agreement in case of future disputes.

- Consider having the form notarized. While not always necessary, notarization can add an extra layer of authenticity to the document.

- Review local laws and regulations regarding the use of the form, as requirements may vary by state.

- Using the form does not absolve a party from all responsibility. Negligence or illegal actions can still result in liability.

- Consulting with a legal professional before completing the form can provide clarity and ensure that all aspects are covered appropriately.