Printable Transfer-on-Death Deed Form

State-specific Guidelines for Transfer-on-Death Deed Documents

Transfer-on-Death Deed - Usage Guidelines

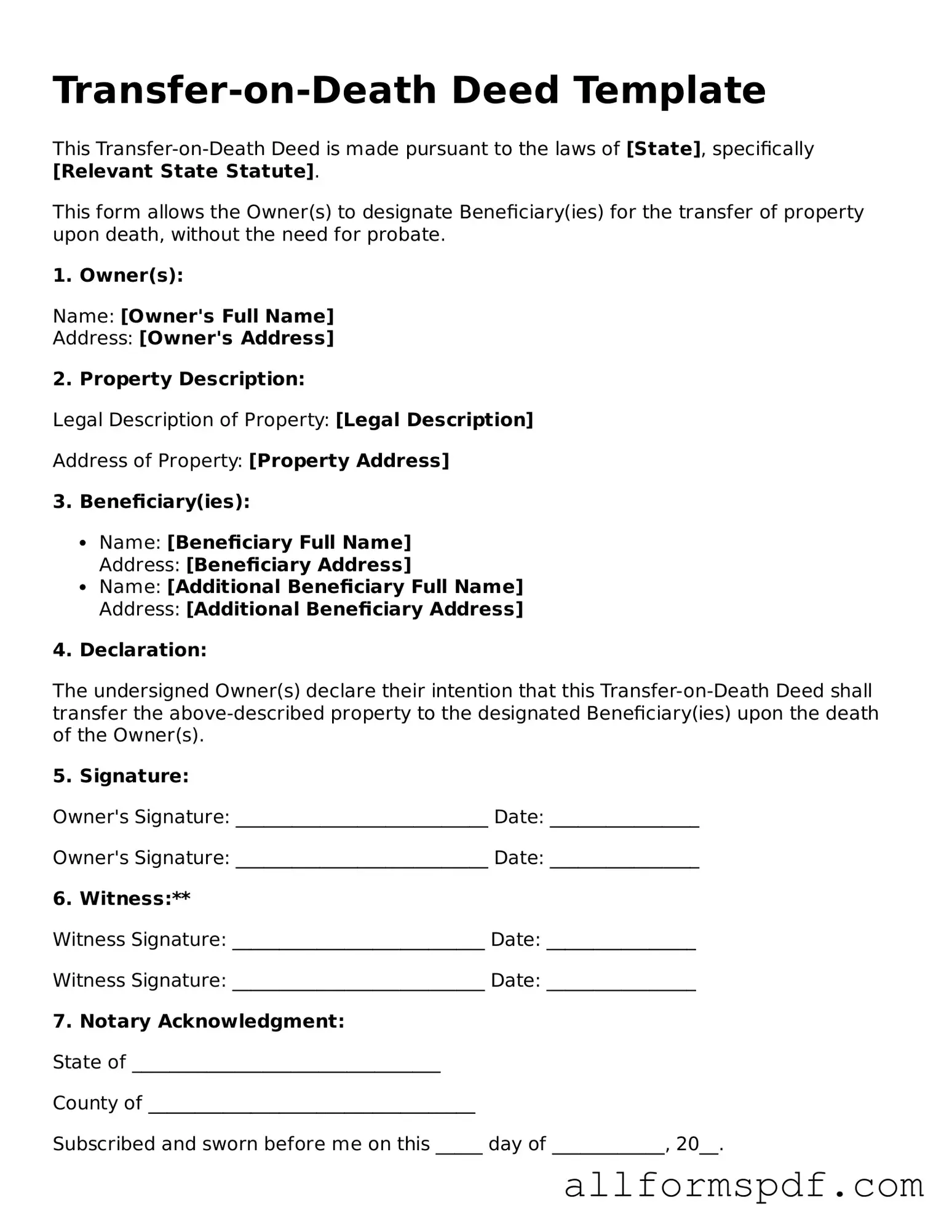

Once you have gathered the necessary information, you are ready to fill out the Transfer-on-Death Deed form. This document allows you to designate a beneficiary who will receive your property upon your passing, without going through probate. Follow these steps carefully to ensure the form is completed accurately.

- Obtain the form: Find the Transfer-on-Death Deed form specific to your state. You can often download it from your state’s official website or obtain it at a local government office.

- Fill in your information: At the top of the form, write your full name, address, and any other identifying details as required.

- Describe the property: Clearly identify the property you wish to transfer. Include the address and any legal descriptions necessary to specify the property accurately.

- Designate the beneficiary: Write the full name and address of the person you wish to inherit the property. Make sure to double-check the spelling and accuracy of this information.

- Include alternative beneficiaries (optional): If you want to name more than one beneficiary, list their names and addresses. You may also indicate what happens if the primary beneficiary cannot inherit.

- Sign the document: You must sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public sign and seal the document, confirming your identity and that you signed the form willingly.

- File the deed: Submit the completed and notarized form to the appropriate county office where the property is located. This may be the county clerk or recorder's office.

After submitting the form, keep a copy for your records. It’s essential to ensure that your beneficiary is aware of the deed and its implications, as this can help prevent confusion in the future.

Misconceptions

Understanding the Transfer-on-Death (TOD) deed is crucial for effective estate planning. Unfortunately, several misconceptions can lead to confusion and mismanagement of assets. Here are six common misconceptions about the Transfer-on-Death deed form:

-

It only applies to real estate.

Many people believe that a TOD deed can only be used for real property. While it is primarily designed for real estate, it does not cover personal property, such as vehicles or bank accounts, unless those assets are specifically included in the estate plan.

-

It automatically transfers property upon death.

Some individuals think that a TOD deed automatically transfers ownership as soon as the owner passes away. However, the transfer only occurs after the owner’s death and must be recorded in the appropriate jurisdiction to be effective.

-

It eliminates the need for a will.

There is a misconception that having a TOD deed means a will is unnecessary. In reality, a TOD deed only addresses specific assets. A comprehensive estate plan, including a will, is still essential to manage all aspects of one's estate.

-

It can be revoked easily.

While a TOD deed can be revoked, it is not as simple as just deciding to cancel it. Revocation typically requires specific legal procedures, such as filing a new deed or a formal document that clearly states the intention to revoke.

-

All states recognize the Transfer-on-Death deed.

Not every state in the U.S. allows for TOD deeds. Some states have adopted this option, while others have not. It's vital to check the laws in your state to understand if a TOD deed is a valid option for you.

-

Beneficiaries can access the property before the owner’s death.

Many people mistakenly believe that beneficiaries can take possession of the property before the owner dies. This is incorrect; the property remains under the owner's control until death, and beneficiaries have no rights to it until that time.

Awareness of these misconceptions can help individuals make informed decisions regarding their estate planning. It is always advisable to consult with a legal professional to ensure that your estate plan aligns with your wishes and complies with state laws.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, there are important dos and don’ts to keep in mind. Here’s a list to guide you through the process.

- Do ensure that the deed is signed in front of a notary public.

- Do clearly identify the property being transferred.

- Do include the full names and addresses of the beneficiaries.

- Don't forget to check your state’s specific requirements for the deed.

- Don't leave any sections of the form blank; complete all required fields.

- Don't assume that the deed is effective without proper recording; submit it to the appropriate office.

By following these guidelines, you can ensure that your Transfer-on-Death Deed is completed correctly and meets all necessary legal standards.

Discover More Types of Transfer-on-Death Deed Documents

California Corrective Deed - This form helps clarify any incorrect information about ownership.

In the context of risk management and liability protection, obtaining a Hold Harmless Agreement can be crucial for parties involved in high-risk activities. This legal document not only clarifies responsibilities but also ensures peace of mind by outlining what each party is accountable for. For residents in Florida seeking to create this important agreement, they can find necessary templates and resources at All Florida Forms.

Common mistakes

Filling out a Transfer-on-Death Deed (TOD Deed) can be a straightforward process, but mistakes can lead to complications. One common error is failing to include all necessary information about the property. It’s essential to provide a clear description, including the property address and legal description. Omitting this information can create confusion and may even invalidate the deed.

Another frequent mistake involves not properly identifying the beneficiaries. It’s crucial to use full names and, if possible, include their relationship to you. Vague references like “my children” can lead to disputes later. Clear identification ensures that your wishes are honored and that there’s no ambiguity about who should inherit the property.

People often overlook the importance of signatures. The deed must be signed by the person transferring the property, and in some states, it may require witnesses or notarization. Skipping this step can render the deed ineffective. Always double-check the requirements in your state to ensure compliance.

In addition to signatures, the timing of the deed’s execution is vital. Some individuals mistakenly believe that simply filling out the form is enough. The deed must be filed with the appropriate county office before it can take effect. Delaying this step can result in the deed not being recognized when it’s needed.

Another common oversight is failing to consider tax implications. While a TOD Deed can help avoid probate, it may still have tax consequences. Not consulting with a tax professional can lead to unexpected financial burdens for your beneficiaries. Understanding these implications ahead of time can help you make informed decisions.

Finally, many people neglect to review their TOD Deed regularly. Life changes, such as marriage, divorce, or the birth of a child, can affect your beneficiaries. Keeping the deed up to date ensures that it reflects your current wishes. Regular reviews can prevent misunderstandings and ensure that your intentions are clear.

Key takeaways

When considering a Transfer-on-Death (TOD) Deed, it is important to understand its purpose and how to properly fill it out. Below are key takeaways that can help guide individuals through the process.

- The Transfer-on-Death Deed allows individuals to transfer real estate to a beneficiary upon their death without going through probate.

- To create a valid TOD Deed, the form must be filled out completely and accurately, including the names of the property owner and the designated beneficiary.

- It is essential to sign the deed in front of a notary public. This ensures that the document is legally recognized.

- Once completed, the TOD Deed must be recorded with the appropriate local government office, typically the county recorder’s office, to be effective.

- Beneficiaries named in the deed do not have any rights to the property until the owner passes away.

- The property owner can revoke or change the TOD Deed at any time during their lifetime, as long as they follow the proper procedures.

- It is advisable to consult with a legal professional to ensure that the TOD Deed aligns with overall estate planning goals.

- Different states may have specific rules regarding TOD Deeds, so it is important to be aware of local laws and requirements.