Fill Out Your Texas residential property affidavit T-47 Form

Texas residential property affidavit T-47 - Usage Guidelines

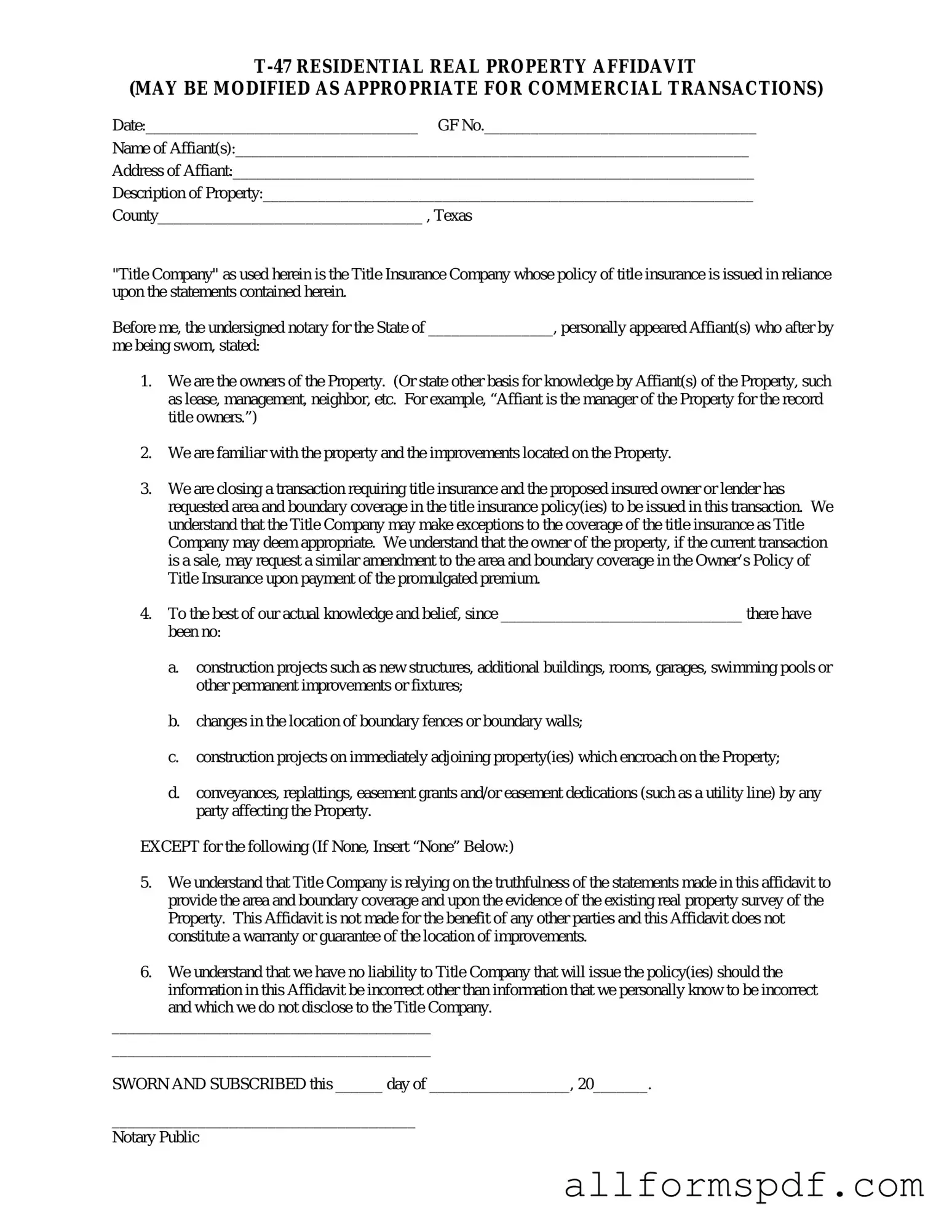

Completing the Texas residential property affidavit T-47 form is an important step in your property transaction. This form helps clarify ownership and other relevant details about the property. Below are the steps to fill out the form accurately.

- Begin with your personal information. Enter your full name, address, and contact details at the top of the form.

- Provide the property address. Ensure that the address is complete and accurate, including the city, state, and zip code.

- Identify the type of property. Indicate whether the property is a single-family home, multi-family unit, or another type of residential property.

- List any existing liens or encumbrances on the property. This includes mortgages, loans, or any other financial obligations.

- Sign and date the affidavit. Your signature confirms that the information provided is true and correct to the best of your knowledge.

- Have the affidavit notarized. This step is essential for the affidavit to be considered valid.

After completing the form, make sure to keep a copy for your records. You will then need to submit the original affidavit to the appropriate authority as part of your property transaction process.

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Here are some common misconceptions that can lead to confusion for homeowners and buyers alike.

-

The T-47 form is only necessary for new construction.

This is not true. The T-47 form is required for any transfer of property, regardless of whether it is new or existing construction.

-

The form is only relevant for residential properties.

While the T-47 is primarily used for residential properties, it can also apply in certain circumstances to other types of real estate transactions.

-

Completing the T-47 form guarantees a clean title.

Filling out the T-47 does not guarantee that the title is free of issues. It is simply a declaration of ownership and property details.

-

Only the seller needs to sign the T-47 form.

Both the seller and the buyer may need to sign the form, depending on the specifics of the transaction.

-

The T-47 form is not legally binding.

This is a misconception. The form is a legal document that can have significant implications in a real estate transaction.

-

Filing the T-47 form is optional.

In many cases, it is a requirement for title companies to process the transaction, making it essential rather than optional.

-

The T-47 form can be filled out after closing.

This is incorrect. The T-47 form should be completed prior to closing to ensure all parties have accurate information.

-

The T-47 form is the same as a property survey.

The T-47 is not a survey. It is an affidavit that provides information about the property, while a survey is a detailed map of the property’s boundaries.

-

You can use a generic affidavit instead of the T-47 form.

Using a generic affidavit is not advisable. The T-47 form has specific legal language and requirements that must be met for it to be valid.

Understanding these misconceptions can help ensure a smoother transaction process for all parties involved. Always consult with a real estate professional if you have questions or concerns regarding the T-47 form.

Dos and Don'ts

When filling out the Texas residential property affidavit T-47 form, it's important to be careful and thorough. Here are some key dos and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Do check for any required attachments or additional documentation.

- Don't leave any fields blank unless instructed to do so.

- Don't use correction fluid or tape on the form.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to review the form for any errors before submission.

- Don't submit the form without confirming it meets all requirements.

Other PDF Forms

Load Calculation Formula - This form sets the foundation for all subsequent electrical work in a project.

The Florida Vehicle POA form 82053 is a legal document that allows someone to appoint another person to handle tasks related to their vehicle on their behalf. This could range from registration and titling to the sale or purchase of the vehicle. For more information on this form and other related documents, you can visit All Florida Forms, which provides a convenient way for vehicle owners to ensure their affairs are managed even when they cannot handle them personally.

Childcare Invoice - Helps prevent disputes about payment for child care services.

Common mistakes

Filling out the Texas residential property affidavit T-47 form can be a straightforward process, but several common mistakes often occur. One frequent error is providing inaccurate property descriptions. The property address should be clear and precise. Omitting essential details, such as the county or zip code, can lead to confusion and delays in processing.

Another common mistake is failing to include all required signatures. The T-47 form requires signatures from all parties involved in the transaction. If a signature is missing, the form may be deemed incomplete, which can stall the entire process. It is important to double-check that everyone has signed before submitting.

People sometimes overlook the importance of dates. Each signature on the T-47 form must be accompanied by the date it was signed. Neglecting to provide these dates can result in questions about the validity of the document. Ensuring that all signatures are dated correctly can help avoid complications.

Some individuals may not fully understand the implications of the affidavit. The T-47 form is a sworn statement, and any false information can have serious consequences. It is crucial to provide truthful and accurate information. Misrepresentation, even if unintentional, can lead to legal issues later on.

Another mistake is not reviewing the entire form before submission. It is easy to overlook small errors, such as typographical mistakes or incorrect information. Taking the time to review the form carefully can help catch these errors before they become problematic.

In addition, people may fail to provide adequate supporting documentation. The T-47 form may require additional documents to substantiate the information provided. Not including these documents can lead to delays or rejection of the affidavit.

Some individuals may also underestimate the importance of notarization. The T-47 form must be notarized to be legally valid. Skipping this step can render the affidavit ineffective. Ensuring that a notary public properly witnesses the signatures is essential.

Another common oversight is not keeping copies of the submitted form. After submission, it is wise to retain a copy for personal records. This can be helpful for future reference or in case any issues arise later.

Finally, individuals may not be aware of the specific filing requirements for their county. Each county in Texas may have different rules regarding the submission of the T-47 form. Checking local regulations can prevent unnecessary complications.

Key takeaways

When it comes to the Texas residential property affidavit T-47 form, understanding its purpose and proper use is essential. Here are some key takeaways to keep in mind:

- The T-47 form serves as an affidavit of property ownership, confirming the details about a property’s title and any encumbrances.

- This form is typically required by lenders during the closing process for a residential property transaction.

- Accuracy is crucial. Ensure that all information provided is correct to avoid delays in the closing process.

- Both the seller and buyer should review the form to ensure all parties agree on the property’s status.

- It’s important to sign the T-47 in the presence of a notary public to validate the document.

- Keep a copy of the completed T-47 form for your records, as it may be needed for future reference.

- Consulting a real estate professional can provide guidance and help navigate any complexities associated with the form.