Printable Single-Member Operating Agreement Form

Single-Member Operating Agreement - Usage Guidelines

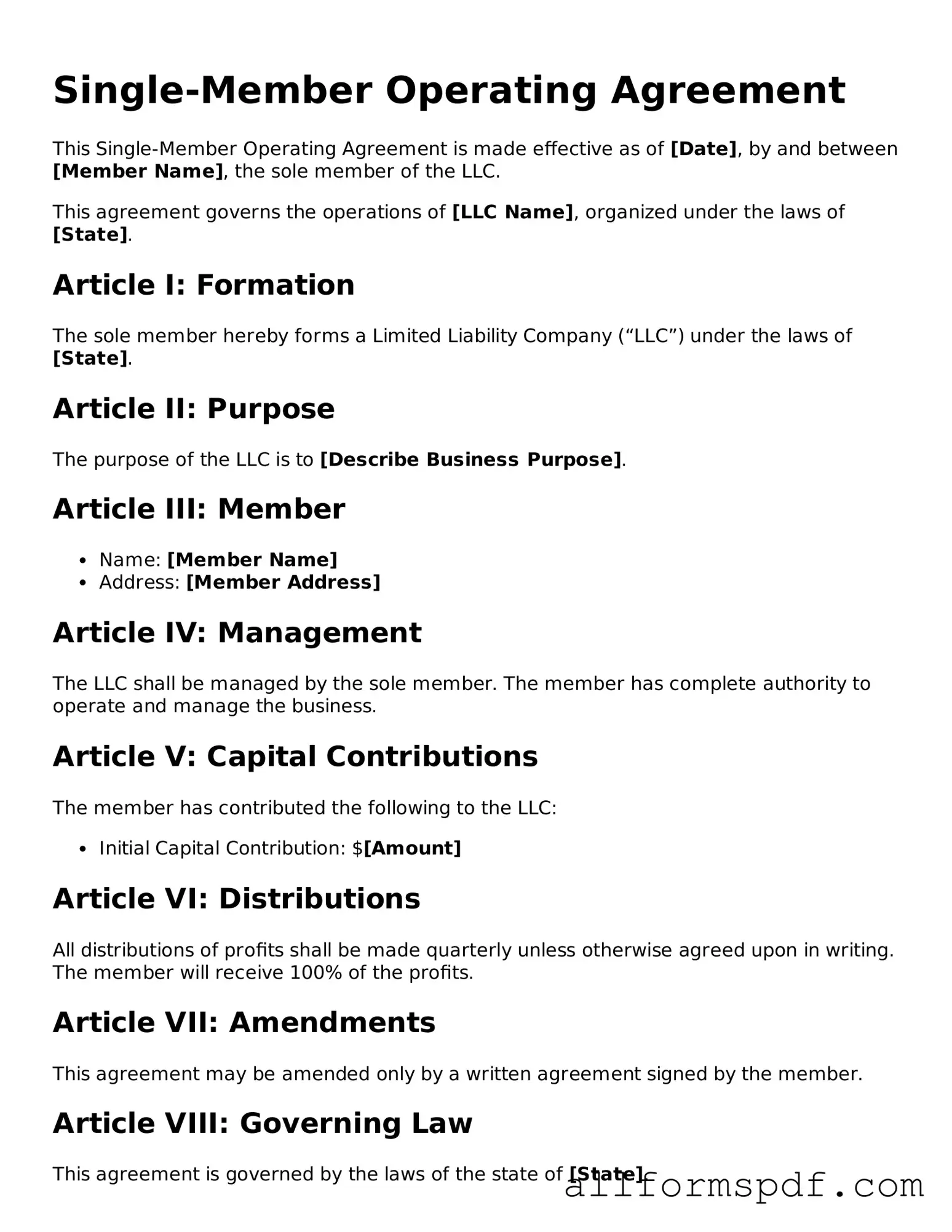

Once you have the Single-Member Operating Agreement form, you can begin filling it out. This document will help outline the structure and management of your business. Follow these steps carefully to ensure all necessary information is provided.

- Start with the name of your business. Write it clearly at the top of the form.

- Enter your name as the sole member of the business. This identifies you as the owner.

- Provide the business address. Include the street address, city, state, and zip code.

- Specify the purpose of your business. Write a brief description of what your business will do.

- Indicate the date the agreement is being executed. This is usually the date you are filling out the form.

- Detail the management structure. State that you, as the sole member, will manage the business.

- Include any additional provisions if necessary. This could cover topics like profit distribution or decision-making processes.

- Sign and date the form. Your signature confirms that you agree to the terms outlined in the agreement.

After completing the form, keep a copy for your records. You may also want to consult with a professional to ensure that everything is in order before moving forward with your business plans.

Misconceptions

Many people have misunderstandings about the Single-Member Operating Agreement form. Here are five common misconceptions:

- It’s not necessary for single-member LLCs. Some believe that because there’s only one owner, an operating agreement isn’t needed. However, having this document clarifies your business structure and helps protect your personal assets.

- It’s only for large businesses. Many think that operating agreements are only for bigger companies. In reality, even small businesses benefit from having clear guidelines about management and operations.

- It must be filed with the state. There’s a belief that the operating agreement needs to be submitted to the state. In fact, it’s an internal document. You keep it for your records, and it doesn’t need to be filed.

- It’s a complicated document. Some fear that creating an operating agreement is too complex. While it should cover important aspects of your business, it can be straightforward and tailored to your needs.

- It can’t be changed once created. Many assume that once the operating agreement is in place, it can’t be modified. This isn’t true. You can update it as your business evolves or your needs change.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it is important to approach the task with care. Here are six key things to consider:

- Do: Clearly state the purpose of your business. This sets the foundation for your agreement.

- Do: Include your name and contact information. Accurate identification is crucial.

- Do: Specify the management structure. Detail how decisions will be made within your business.

- Don't: Rush through the form. Take your time to ensure all information is accurate and complete.

- Don't: Leave sections blank. Every part of the form should be filled out to avoid confusion later.

- Don't: Ignore state-specific requirements. Each state may have unique laws regarding operating agreements.

By following these guidelines, you can create a comprehensive and effective Single-Member Operating Agreement.

Common mistakes

Filling out a Single-Member Operating Agreement form can seem straightforward, but many individuals make common mistakes that can lead to complications down the road. One frequent error is failing to clearly define the purpose of the business. Without a specific purpose outlined, the agreement may lack clarity and lead to confusion about the business’s goals and operations.

Another common mistake is neglecting to include the member's name and contact information. This information is crucial, as it establishes the identity of the owner and ensures that all parties know who is responsible for the business. Omitting this detail can create legal ambiguity, making it difficult to enforce the agreement.

People often overlook the importance of detailing the management structure. While a single-member LLC may seem simple, it’s essential to specify how decisions will be made and who has the authority to act on behalf of the business. Failing to clarify this can lead to misunderstandings and disputes, even among solo owners.

Additionally, many individuals forget to include provisions for the handling of profits and losses. Clearly stating how profits will be distributed and how losses will be managed is vital for financial clarity. Without this information, the agreement may not provide a solid foundation for the business's financial operations.

Another mistake is not addressing the dissolution process. Life is unpredictable, and circumstances may arise that require the business to close. Outlining the steps for dissolution in the operating agreement can save time and reduce stress when the need arises. Ignoring this aspect can lead to complications and potential legal issues later on.

Lastly, many people fail to review and update their operating agreement regularly. As a business evolves, changes may occur that necessitate updates to the agreement. Keeping the document current is essential for ensuring it remains relevant and legally binding. Neglecting this can result in outdated terms that no longer reflect the business's operations.

Key takeaways

Filling out a Single-Member Operating Agreement is a crucial step for any sole proprietor looking to establish a formal business structure. Here are some key takeaways to keep in mind:

- Understand the Purpose: This agreement outlines the management structure and operational guidelines for your business. It serves as a roadmap for how your business will be run.

- Identify the Member: Clearly state that you are the sole member of the LLC. This helps define ownership and limits liability.

- Define Business Activities: Describe the nature of your business activities. This ensures clarity and purpose in your operations.

- Outline Financial Contributions: Specify any initial contributions you are making to the business. This could include cash, property, or services.

- Establish Management Structure: Even as a single member, outline how decisions will be made. This helps maintain order and clarity.

- Detail Profit Distribution: Clearly state how profits will be distributed. This is essential for tax purposes and personal financial planning.

- Include Amendment Procedures: Life changes, and so do businesses. Include how amendments to the agreement can be made in the future.

- Address Dissolution: Outline the process for dissolving the LLC if necessary. This prepares you for unforeseen circumstances.

- Seek Legal Guidance: While this is a straightforward document, consulting with a legal professional can help ensure all bases are covered.

- Keep It Updated: Regularly review and update the agreement as your business evolves. This keeps your operations aligned with your current goals.

By following these key takeaways, you can create a solid foundation for your business, ensuring that you are prepared for both opportunities and challenges ahead.