Fill Out Your Sample Tax Return Transcript Form

Sample Tax Return Transcript - Usage Guidelines

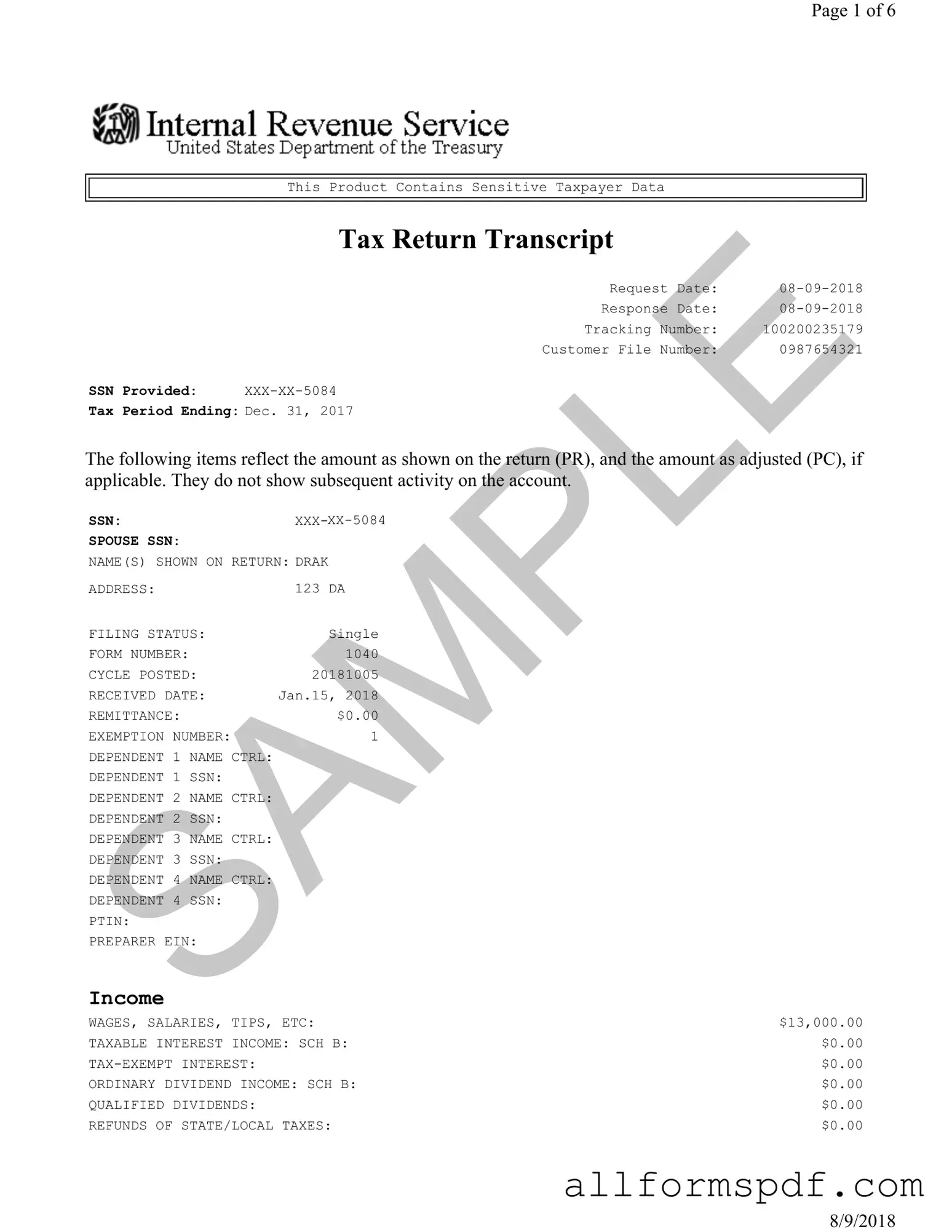

Filling out the Sample Tax Return Transcript form requires careful attention to detail. Each section contains specific information that is essential for accurately reporting your financial situation. Make sure to have all necessary documents on hand to assist you as you complete the form.

- Start by entering the Request Date and Response Date at the top of the form.

- Locate the Tracking Number and Customer File Number. Fill these in accurately.

- Provide your Social Security Number (SSN) and your spouse's SSN, if applicable.

- Enter your name as shown on the return, along with your address and Filing Status.

- Fill in the Form Number and Cycle Posted information.

- Indicate the Received Date and any Remittance amount.

- List the Exemption Number and any dependents, including their names and SSNs, if applicable.

- Complete the income section, including wages, salaries, tips, and any other income sources.

- Document any adjustments to income, such as educator expenses or self-employment tax deductions.

- Fill in the Adjusted Gross Income based on the information provided.

- Calculate your Taxable Income and Tentative Tax using the figures from the previous sections.

- List any credits, such as the Child Tax Credit or Education Credit, and total them at the end.

- Provide details about any payments made, including federal income tax withheld and any estimated tax payments.

- Finally, indicate the Amount You Owe or any refund expected.

After completing the form, review all entries for accuracy. This ensures that your information is correct and complete before submission. Keep a copy for your records, and if needed, consult a tax professional for further assistance.

Misconceptions

Understanding the Sample Tax Return Transcript can be challenging. Here are five common misconceptions about this form:

- It's the same as a full tax return. A Sample Tax Return Transcript provides a summary of your tax return, not the complete document. It does not include all details or attachments.

- It shows current account activity. The transcript reflects only the amounts as shown on the return and any adjustments made. It does not display any subsequent transactions or changes.

- It can be used to file taxes. The transcript is not a substitute for a tax return. It is intended for informational purposes only and should not be used for filing.

- It's only for individuals with complex tax situations. Anyone can request a Sample Tax Return Transcript, regardless of their tax situation. It can be useful for various purposes, including loan applications.

- It contains sensitive information. While the transcript does include personal information, it is designed to protect taxpayer privacy. Sensitive data is often redacted or limited.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, it's important to approach the task with care. Here are four key things to keep in mind:

- Do ensure accuracy: Double-check all the information you enter. Mistakes can lead to delays or complications.

- Do use clear handwriting: If you're filling out a paper form, make sure your writing is legible to avoid any misinterpretations.

- Don't rush through the process: Take your time to review each section. Hurrying can result in overlooked details.

- Don't forget to sign and date: An unsigned form is incomplete and may be rejected, so ensure you provide your signature where required.

Other PDF Forms

Better Business - Charging for services that were part of an initial promotion.

To streamline the process of managing your finances and ensuring accuracy in your records, you might find it helpful to use a resource like Legal PDF Documents, which provides templates and guidelines for completing the ADP Pay Stub form effectively.

Simple Shared Well Agreement Form - It clarifies that the supplying party retains ownership of the well itself.

Common mistakes

Filling out the Sample Tax Return Transcript form can seem straightforward, but there are common mistakes that people often make. Understanding these pitfalls can help ensure that your tax return is processed smoothly and accurately.

One frequent error is not including the correct Social Security Number (SSN). The SSN is a crucial part of your tax return, and any discrepancies can lead to delays or complications. Always double-check that the SSN provided matches the one on your official documents. This small detail can save you a lot of headaches later on.

Another mistake involves the filing status. Selecting the wrong filing status can affect your tax liability and eligibility for certain credits. For instance, if you are married but file as single, you may miss out on significant tax benefits. Be sure to review the criteria for each filing status before making your selection.

People also often overlook the importance of accurately reporting income. Whether it’s wages, business income, or other sources, every dollar counts. Misreporting your income can lead to penalties or an audit. Make sure to gather all relevant documents and verify that your reported amounts align with what’s on your W-2s or 1099s.

Additionally, many individuals fail to account for adjustments to income. Deductions like educator expenses or self-employment tax deductions can significantly reduce your taxable income. Not including these adjustments means you could end up paying more tax than necessary. Review your eligibility for these deductions carefully.

Another common oversight is neglecting to sign and date the form. A tax return without a signature is considered incomplete and can result in delays. Always remember to sign and date your return, as this confirms that the information provided is accurate to the best of your knowledge.

Finally, some individuals forget to keep copies of their submitted forms. This can be a problem if questions arise later or if you need to reference your previous filings. Keeping a copy of your tax return is a good practice that can help you in the future.

By being aware of these common mistakes, you can take steps to avoid them. A careful review of your tax return can lead to a smoother filing process and potentially save you money in the long run.

Key takeaways

Filling out and using the Sample Tax Return Transcript form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to help you navigate the process effectively:

- Understand the Purpose: The transcript provides a summary of your tax return information, which can be useful for verifying income or applying for loans.

- Check for Accuracy: Ensure that all personal information, such as your name and Social Security Number, is correct. Mistakes can lead to delays or complications.

- Review Income Details: The transcript lists various types of income, including wages, business income, and interest. Familiarize yourself with these figures as they reflect your financial situation.

- Identify Adjustments: Look for any adjustments to your income. These can affect your taxable income and may impact your tax liability.

- Know Your Deductions: The form outlines your standard deduction and any additional deductions. Understanding these can help you maximize your tax benefits.

- Tax Credits Matter: Be aware of any credits listed on the transcript. They can significantly reduce your tax bill.

- Payments and Refunds: The transcript shows any payments made and whether you owe money or are due a refund. This is crucial for planning your finances.

- Use for Verification: When applying for loans or financial aid, this transcript can serve as proof of income, making it a valuable document.

- Keep It Secure: Since the transcript contains sensitive information, store it safely to protect your identity and financial data.

By keeping these takeaways in mind, you can effectively utilize your Sample Tax Return Transcript form and ensure that your tax-related processes run smoothly.