Printable Release of Promissory Note Form

Release of Promissory Note - Usage Guidelines

After completing the Release of Promissory Note form, it is important to ensure that all information is accurate and that the document is signed appropriately. This will help facilitate the next steps in the process, which may involve filing the document with the relevant parties or agencies.

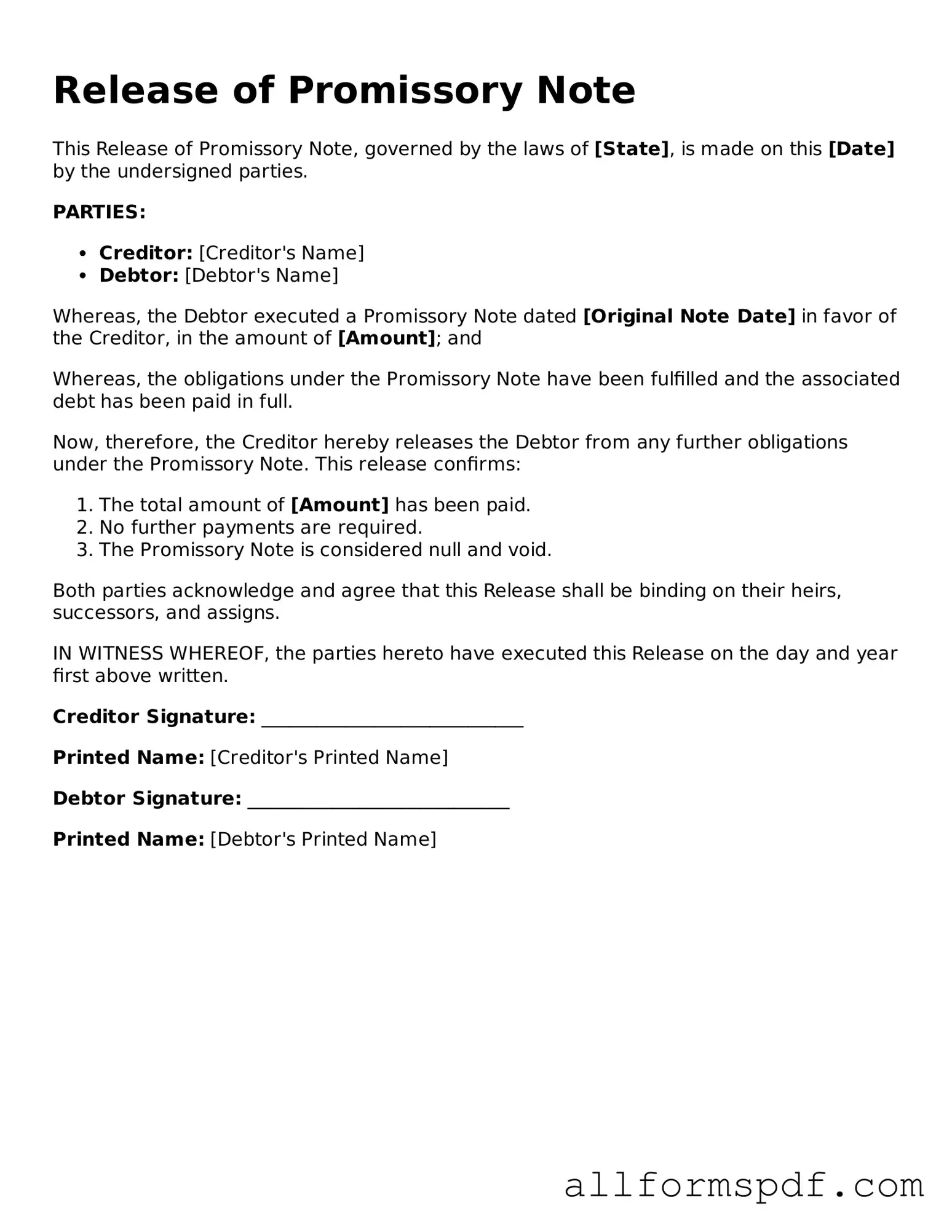

- Begin by entering the date at the top of the form.

- Provide the name of the borrower in the designated section.

- Next, include the name of the lender.

- Fill in the amount of the promissory note being released.

- Indicate the date the promissory note was originally executed.

- In the appropriate space, write the reason for the release of the promissory note.

- Both the borrower and lender must sign the form in the designated areas.

- Print the names of the borrower and lender beneath their signatures.

- Include the date of signatures next to each signature.

- Review the completed form for any errors or omissions.

Misconceptions

Understanding the Release of Promissory Note form can be tricky. Here are some common misconceptions about this form that you should know:

- It cancels the debt automatically. Many believe that filling out this form means the debt is wiped out. In reality, it confirms that the borrower has fulfilled their obligation.

- Only banks can issue a Release of Promissory Note. This is not true. Any lender, including private individuals, can provide this release once the debt is settled.

- The form is not legally binding. Some think that because it’s a simple form, it lacks legal weight. However, once signed, it holds legal significance.

- You don’t need to keep a copy. It's a mistake to overlook keeping a copy of the signed release. This document serves as proof that the debt has been satisfied.

- It must be notarized. While notarization can add an extra layer of verification, it is not always required for the release to be valid.

- It only applies to personal loans. This form can be used for various types of loans, not just personal ones, including business loans and mortgages.

- All lenders use the same form. Different lenders may have their own versions of the release. It’s important to ensure you’re using the correct one for your situation.

- Once signed, it can’t be changed. If there’s an error, you can amend the form, but both parties must agree to the changes and sign again.

Being aware of these misconceptions can help you navigate the process more effectively. Always consult with a professional if you have specific questions or concerns.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to ensure accuracy and clarity. Here are some essential dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the parties involved.

- Do include the correct date when signing the form.

- Do double-check all figures and amounts to avoid mistakes.

- Do sign the form in the designated area.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to keep a copy for your records.

Discover More Types of Release of Promissory Note Documents

Bill of Sale With Promissory Note for Automobile - Can include fixed or variable interest rates depending on lender preference.

To facilitate the creation of a legally binding agreement, individuals can utilize resources such as the NY PDF Forms which provide templates for drafting a New York Promissory Note, ensuring all necessary terms are properly outlined and in accordance with state laws.

Common mistakes

Filling out a Release of Promissory Note form can be a straightforward process, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary parties. The form should clearly identify both the borrower and the lender. Omitting one of these parties can render the document ineffective, potentially causing disputes over the agreement.

Another mistake often seen is the incorrect or incomplete description of the promissory note being released. This includes not specifying the amount, date, or terms of the original note. Without this information, it may be unclear which note is being released, leading to confusion or legal challenges in the future.

Additionally, many people neglect to sign the form. A signature is essential for validating the release, and without it, the document holds no legal weight. In some cases, individuals may also forget to date the form. A missing date can create ambiguity regarding when the release took effect, which could be crucial in any potential disputes.

Moreover, individuals sometimes fail to provide adequate consideration for the release. In legal terms, consideration refers to something of value exchanged between parties. If the form does not indicate what the lender receives in return for releasing the note, it may be challenged later, undermining the release's validity.

Lastly, overlooking the need for notarization can be a significant oversight. While not always required, having the document notarized adds an extra layer of authenticity and can help prevent future disputes. Many individuals mistakenly believe that a simple signature is sufficient, but notarization can bolster the document's credibility in the eyes of the law.

Key takeaways

When filling out and using the Release of Promissory Note form, keep these key points in mind:

- Understand the Purpose: This form serves to officially release the borrower from the obligation of the promissory note. Ensure you know why you are using it.

- Complete All Required Fields: Fill in all necessary information accurately. Missing details can lead to complications later.

- Obtain Signatures: Both the lender and borrower must sign the form. Without these signatures, the release is not valid.

- Keep Copies: After completing the form, make copies for both parties. This provides proof of the release for future reference.