Printable Real Estate Purchase Agreement Form

State-specific Guidelines for Real Estate Purchase Agreement Documents

Real Estate Purchase Agreement Subtypes

Real Estate Purchase Agreement - Usage Guidelines

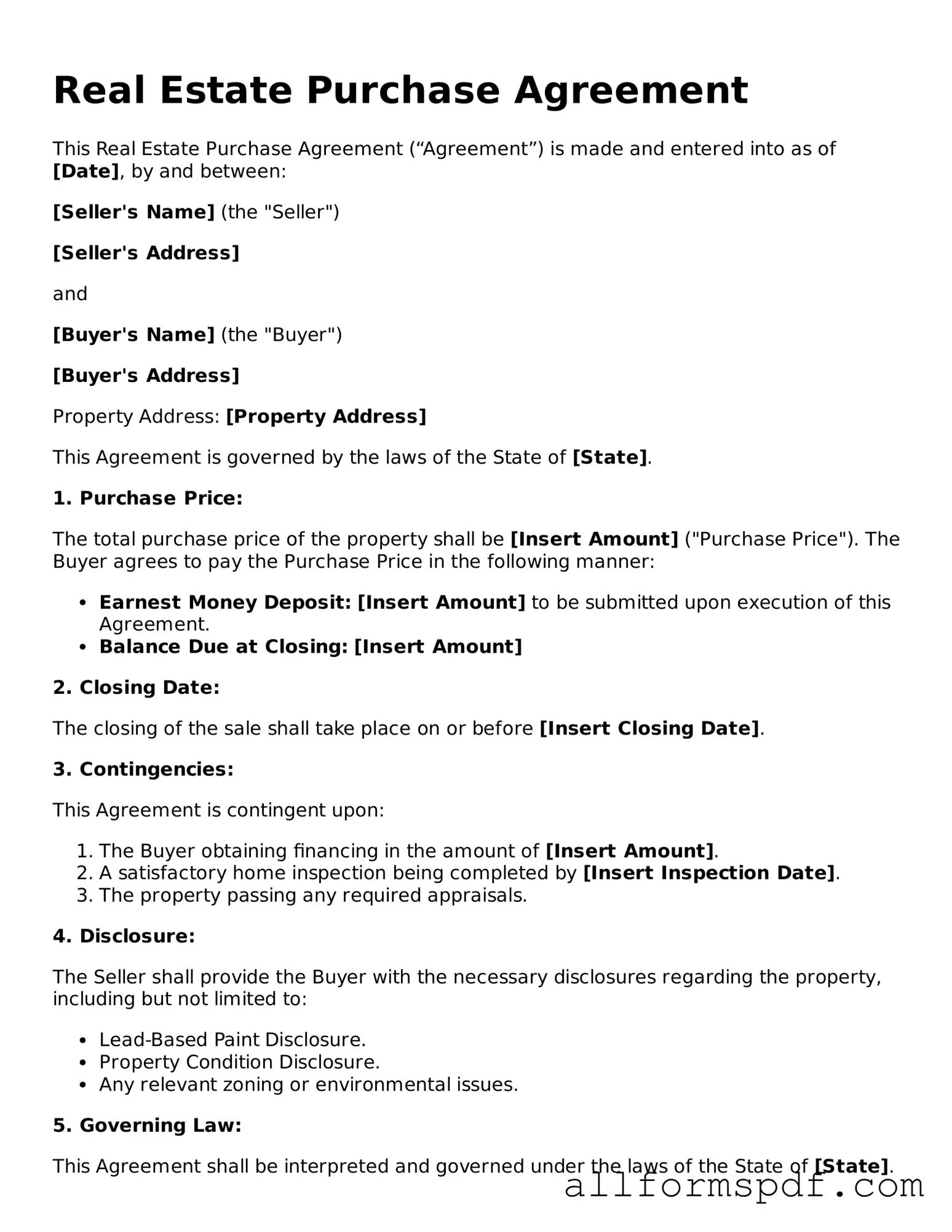

Completing a Real Estate Purchase Agreement is an essential step in the home buying process. This document lays the groundwork for the transaction and outlines the terms agreed upon by both the buyer and the seller. Once the form is filled out correctly, it will be ready for signatures and further processing.

- Obtain the Form: Start by downloading or requesting a copy of the Real Estate Purchase Agreement form from a reliable source, such as a real estate agent or legal website.

- Fill in Buyer Information: Enter the full names and contact information of all buyers involved in the transaction.

- Fill in Seller Information: Provide the full names and contact details of the seller(s).

- Property Description: Accurately describe the property being purchased, including the address and any relevant details such as lot number or parcel identification.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Deposit Amount: Specify the amount of earnest money that the buyer will put down as a show of good faith.

- Financing Terms: Indicate how the buyer plans to finance the purchase, whether through a mortgage, cash, or other means.

- Contingencies: List any conditions that must be met for the sale to proceed, such as inspections or financing approvals.

- Closing Date: Set a tentative date for when the transaction will be finalized and ownership transferred.

- Signatures: Ensure that all parties involved sign and date the agreement to make it legally binding.

After completing the form, review it carefully to ensure all information is accurate and complete. This attention to detail will help prevent misunderstandings and facilitate a smoother transaction process. Once finalized, the agreement can be submitted to the appropriate parties for further action.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are six common misconceptions about the REPA:

-

The REPA is only necessary for large transactions.

This is not true. A Real Estate Purchase Agreement is important for any property transaction, regardless of size. It protects both the buyer and seller by clearly outlining the terms of the sale.

-

Verbal agreements are enough.

Many people believe that a verbal agreement suffices. However, verbal agreements can lead to misunderstandings and disputes. A written REPA provides clarity and serves as a legal record.

-

All REPA forms are the same.

This misconception overlooks the fact that REPA forms can vary by state and even by specific transactions. It's essential to use the correct form that complies with local laws and regulations.

-

Once signed, the REPA cannot be changed.

This is misleading. While the REPA is a binding contract, parties can negotiate changes before closing. Any modifications should be documented in writing and signed by both parties.

-

The REPA only protects the buyer.

In reality, the REPA protects both parties. It ensures that the seller receives payment and the buyer receives the property as agreed. Each party has rights and obligations outlined in the agreement.

-

You don’t need a lawyer to draft a REPA.

While it is possible to create a REPA without legal assistance, having a lawyer review or draft the agreement can help avoid potential pitfalls. A legal professional can ensure that all necessary terms are included and that the document complies with local laws.

By addressing these misconceptions, individuals can approach the Real Estate Purchase Agreement with a clearer understanding, leading to smoother transactions.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do read the entire agreement thoroughly before signing.

- Do ensure that all parties involved are clearly identified.

- Do specify the purchase price and any deposits required.

- Do outline any contingencies, such as financing or inspections.

- Do include a timeline for closing the transaction.

- Don't leave any sections blank; fill in all required information.

- Don't ignore local laws and regulations that may affect the agreement.

- Don't rush the process; take your time to ensure accuracy.

- Don't hesitate to seek legal advice if you have questions.

Following these guidelines can help facilitate a smoother transaction and protect your interests throughout the process.

Popular Documents

Can I Print My Own Ds-11 Form? - Review all guidelines for the passport application before completing the DS-11.

When engaging in business activities or partnerships, it is crucial to have a Florida Non-disclosure Agreement (NDA) in place to safeguard confidential information. This legally binding document not only adheres to Florida's specific statutes and regulations but also ensures that all parties fully comprehend the ramifications of sharing sensitive material. To access the appropriate documentation for your needs, consider visiting All Florida Forms, which provides the necessary resources for creating a secure collaboration environment.

Ms Word Chart Examples - Organize information logically to enhance readability and comprehension.

Common mistakes

Filling out a Real Estate Purchase Agreement can be a daunting task. Many people make mistakes that can lead to complications down the line. One common error is failing to provide accurate property details. Buyers often overlook the importance of including the correct address, legal description, and parcel number. This information is crucial for identifying the property in question and ensuring that all parties are on the same page.

Another mistake is not specifying the purchase price clearly. While it may seem straightforward, ambiguity can lead to disputes. Buyers should ensure that the price is stated clearly and that any contingencies related to financing or inspections are well-defined. This clarity helps prevent misunderstandings and sets clear expectations for both parties.

People also frequently neglect to include important timelines. Timelines for closing, inspections, and contingencies should be clearly outlined in the agreement. Without these timelines, the process can become chaotic, leading to delays and frustration. Buyers and sellers must agree on a schedule to ensure a smooth transaction.

Additionally, some individuals fail to consider the inclusion of contingencies. These are conditions that must be met for the sale to proceed. Common contingencies include financing approval and home inspections. Omitting these can leave one party vulnerable if issues arise. It is essential to protect your interests by including appropriate contingencies in the agreement.

Lastly, many overlook the importance of signatures. An unsigned agreement is not legally binding. All parties involved must sign the document for it to be valid. This is a critical step that should not be rushed or forgotten. Ensure that every necessary signature is obtained to avoid any potential legal issues.

Key takeaways

When dealing with a Real Estate Purchase Agreement, understanding the key aspects can make a significant difference in the transaction process. Here are some important takeaways to consider:

- Accuracy is Essential: Ensure that all information, including names, property details, and terms, is filled out correctly. Mistakes can lead to delays or disputes later on.

- Contingencies Matter: Pay attention to contingencies included in the agreement. These conditions can protect you, allowing you to back out if certain criteria are not met.

- Review All Terms: Carefully review all terms and conditions before signing. This includes payment schedules, closing dates, and any included fixtures or appliances.

- Legal Counsel is Beneficial: Consider seeking legal advice before finalizing the agreement. A knowledgeable professional can help identify potential issues and ensure your interests are protected.