Printable Quitclaim Deed Form

State-specific Guidelines for Quitclaim Deed Documents

Quitclaim Deed - Usage Guidelines

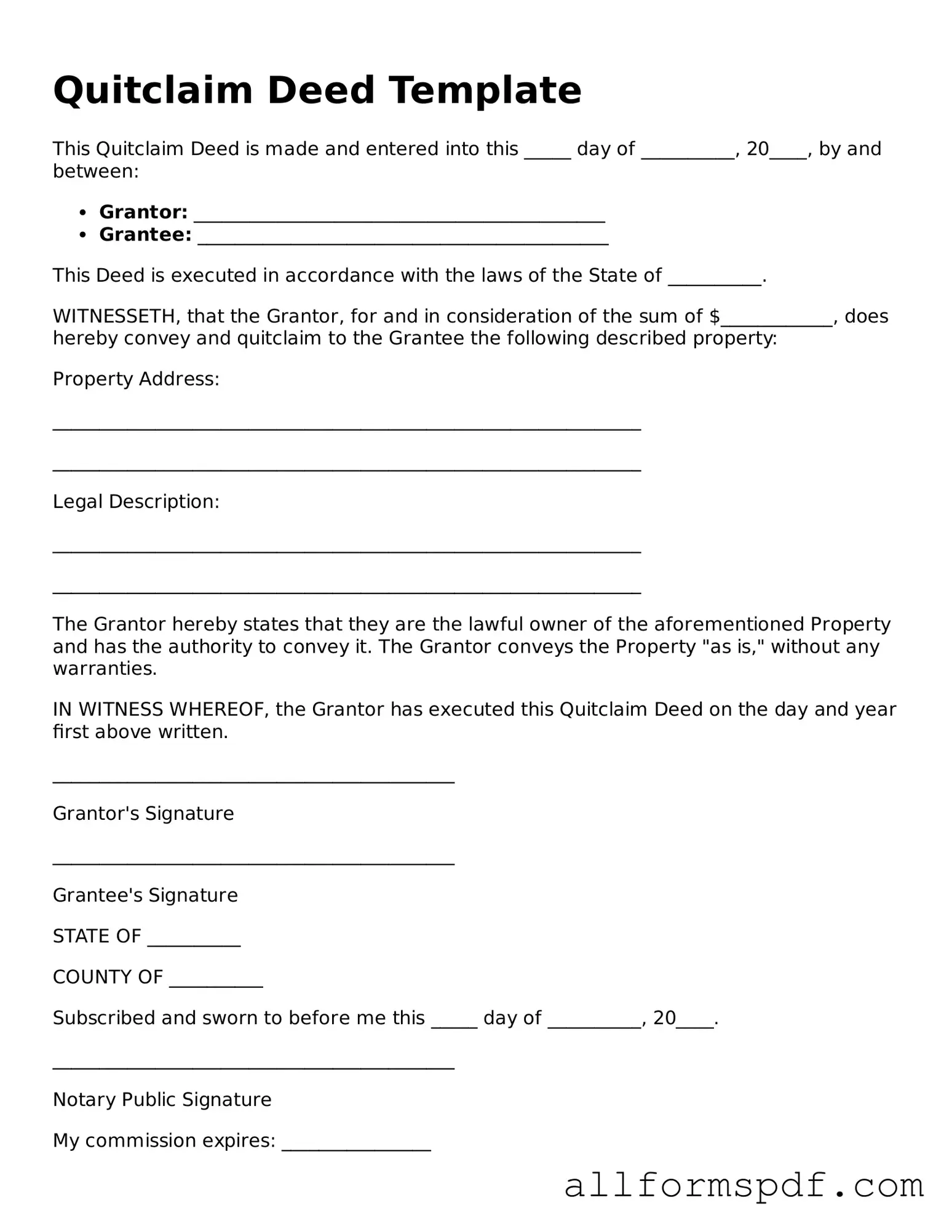

Once you have the Quitclaim Deed form ready, it is important to ensure that all information is filled out accurately. After completing the form, it will need to be signed and notarized before being filed with the appropriate local government office.

- Start by entering the date at the top of the form.

- In the section for the grantor (the person transferring the property), write the full legal name of the individual or entity.

- Next, provide the address of the grantor, including the city, state, and zip code.

- For the grantee (the person receiving the property), write the full legal name of the individual or entity.

- Enter the address of the grantee, including the city, state, and zip code.

- In the description section, include a clear and accurate description of the property being transferred. This may include the parcel number or legal description.

- If applicable, include any additional terms or conditions of the transfer in the designated area.

- Ensure that the grantor signs the form in the presence of a notary public.

- After notarization, make copies of the completed form for your records.

- Finally, file the original Quitclaim Deed with the appropriate county recorder’s office.

Misconceptions

Understanding the Quitclaim Deed can be challenging, and several misconceptions can lead to confusion. Here are seven common misunderstandings about this important legal document:

-

A Quitclaim Deed Transfers Ownership Completely.

Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only transfers the interest that the grantor has in the property, which could be none at all.

-

Quitclaim Deeds Are Only for Family Transfers.

While often used among family members, quitclaim deeds can be utilized in various situations, including business transactions and divorce settlements.

-

Quitclaim Deeds Offer Buyer Protection.

This is a misconception. A quitclaim deed does not guarantee that the grantor has clear title to the property, leaving the buyer vulnerable to potential claims.

-

They Are Only Used in Real Estate Transactions.

Quitclaim deeds can apply to various types of property interests, including personal property and intangible assets, not just real estate.

-

Once Signed, a Quitclaim Deed Cannot Be Revoked.

While a quitclaim deed is generally permanent, it can be revoked through a legal process if both parties agree to it.

-

Quitclaim Deeds Are the Same as Warranty Deeds.

These two types of deeds serve different purposes. A warranty deed provides a guarantee of clear title, whereas a quitclaim deed does not offer any such assurances.

-

Quitclaim Deeds Are Only Valid If Notarized.

While notarization is important for many legal documents, the validity of a quitclaim deed can also depend on state laws, which may not always require notarization.

Clearing up these misconceptions is essential for anyone considering using a quitclaim deed. Understanding its limitations and uses can help avoid potential pitfalls in property transactions.

Dos and Don'ts

When filling out a Quitclaim Deed form, it is important to approach the task with care. Here are some essential guidelines to consider:

- Do ensure that all names are spelled correctly. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Don't leave any fields blank. Every section of the form should be completed to avoid delays or complications.

- Do provide a clear legal description of the property. This should include details such as the parcel number and any relevant boundaries.

- Don't forget to sign the form. Both the grantor and any required witnesses must provide their signatures for the deed to be valid.

- Do check local requirements. Some states may have specific regulations regarding the form or additional documents needed.

- Don't submit the form without making copies. Keeping a copy for your records is essential for future reference.

Discover More Types of Quitclaim Deed Documents

Free Michigan Lady Bird Deed Pdf - It provides flexibility and control, allowing the property owner to decide their future course of action.

Problems With Transfer on Death Deeds California - Beneficiaries have no rights to the property while you are still living.

When preparing a Last Will and Testament, it's essential to utilize reliable resources to ensure the document aligns with legal standards and effectively reflects your wishes. For those in Florida, a great option is the All Florida Forms, which can assist in creating a comprehensive estate plan that protects your assets and provides for your loved ones.

Gift Deed - This agreement can allow for the smooth transfer of ownership rights.

Common mistakes

Filling out a Quitclaim Deed form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One significant error is not including the full legal names of all parties involved. This includes both the grantor, who is transferring the property, and the grantee, who is receiving it. Using nicknames or initials can create confusion and may render the deed invalid.

Another frequent mistake is failing to accurately describe the property being transferred. It’s crucial to provide a clear and precise description, including the property address and any relevant parcel numbers. Omitting this information or being vague can lead to disputes or challenges regarding ownership in the future.

Many people overlook the importance of having the Quitclaim Deed notarized. A notary public’s signature adds a layer of authenticity to the document, confirming that the parties involved are who they claim to be. Without notarization, the deed may not be accepted by some institutions or could be challenged in court.

In addition, individuals often forget to check local laws regarding recording the deed. Each state has its own requirements and deadlines for recording property transfers. If the deed is not recorded in a timely manner, the grantee may lose their rights to the property, or the transaction may be questioned.

Lastly, neglecting to consult with a legal expert can be a costly mistake. While it may seem like an unnecessary expense, professional guidance can help ensure that all aspects of the Quitclaim Deed are properly addressed. This can prevent future legal issues and provide peace of mind for both parties involved.

Key takeaways

When filling out and using a Quitclaim Deed form, keep these key takeaways in mind:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without guaranteeing the title. It’s commonly used between family members or in divorce settlements.

- Gather Required Information: You will need the full names of the grantor (the person transferring the property) and grantee (the person receiving the property), along with the property description.

- Check Local Requirements: Different states have specific rules regarding Quitclaim Deeds. Verify any local requirements for execution and recording.

- Signatures Matter: Ensure that the grantor signs the document in front of a notary public. This step is crucial for the deed to be legally binding.

- Record the Deed: After signing, file the Quitclaim Deed with the county recorder’s office where the property is located. This step is essential for public notice.

- Consider Legal Advice: If you’re unsure about the process or implications, consulting with a legal professional can provide clarity and ensure proper handling.

- Keep Copies: Always retain copies of the completed Quitclaim Deed for your records. This documentation is important for future reference.