Printable Promissory Note for a Car Form

Promissory Note for a Car - Usage Guidelines

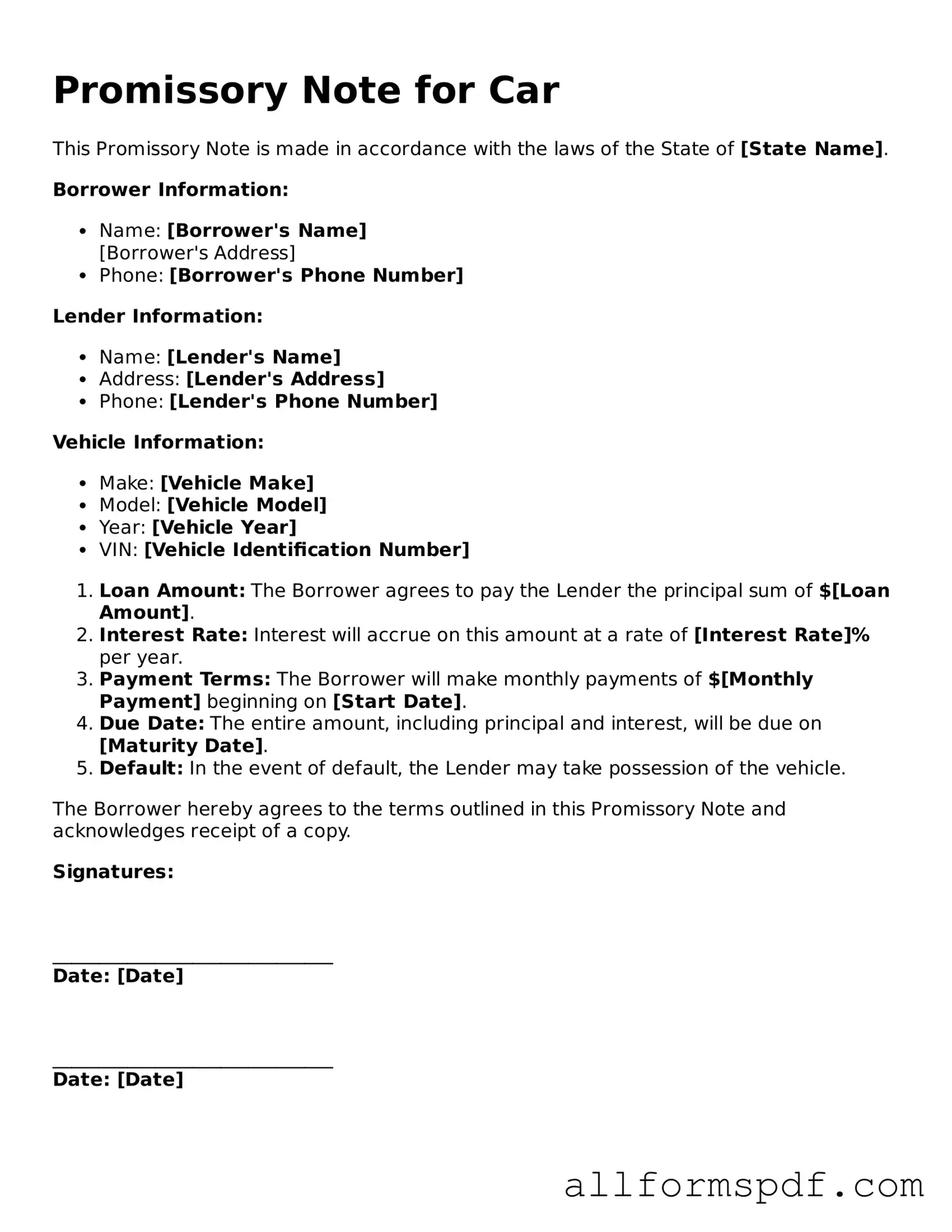

Completing the Promissory Note for a Car form is an important step in establishing a clear agreement between the borrower and the lender. This document outlines the terms of the loan, including payment amounts and due dates. Ensure that all information is accurate and complete to avoid any misunderstandings in the future.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Write the full name of the borrower. This should include first name, middle initial (if applicable), and last name.

- Provide the borrower's address. Include street address, city, state, and zip code.

- Enter the full name of the lender. This may be an individual or a financial institution.

- List the lender's address. Include street address, city, state, and zip code.

- State the principal amount of the loan in numbers and words. This is the total amount borrowed for the car.

- Specify the interest rate. Clearly indicate whether it is fixed or variable.

- Detail the payment schedule. Include the frequency of payments (e.g., monthly, bi-weekly) and the due date for each payment.

- Indicate the maturity date. This is the date by which the loan must be fully paid off.

- Include any late fees or penalties that may apply if payments are missed.

- Have the borrower sign and date the form at the bottom. If applicable, a witness may also need to sign.

- Provide a copy of the completed form to both the borrower and lender for their records.

Misconceptions

Understanding the Promissory Note for a Car can be challenging. Here are nine common misconceptions that people often have:

- A Promissory Note is the same as a car title. This is not true. A promissory note is a financial document that outlines the borrower's promise to repay a loan, while a car title proves ownership of the vehicle.

- Only banks can issue a Promissory Note. In reality, any individual or entity can create a promissory note. It is simply a written promise to pay a specified amount.

- A Promissory Note must be notarized. Notarization is not a requirement for all promissory notes. While it can add an extra layer of security, it is not legally necessary.

- Once signed, a Promissory Note cannot be changed. This is a misconception. Both parties can agree to modify the terms of the note, but any changes should be documented in writing.

- A Promissory Note guarantees loan approval. Signing a promissory note does not guarantee that the loan will be approved. Lenders consider various factors before making a decision.

- Promissory Notes are only for large loans. Promissory notes can be used for any amount, big or small. They are simply a way to formalize a loan agreement.

- Defaulting on a Promissory Note has no consequences. This is false. Failing to repay a promissory note can lead to legal action, damage to credit scores, and other financial repercussions.

- All Promissory Notes are the same. Promissory notes can vary significantly in terms, conditions, and legal requirements. It's important to tailor the document to the specific agreement.

- Only one copy of a Promissory Note is needed. It is advisable for both parties to keep a signed copy of the note for their records. This ensures clarity and serves as proof of the agreement.

Dos and Don'ts

When filling out a Promissory Note for a car, it is essential to follow certain guidelines to ensure accuracy and legality. Below is a list of dos and don'ts that can help streamline the process.

- Do provide accurate personal information, including your full name and address.

- Do specify the loan amount clearly to avoid any misunderstandings.

- Do include the interest rate, if applicable, to outline the cost of borrowing.

- Do state the repayment schedule, detailing when payments are due.

- Do ensure both parties sign and date the document to validate the agreement.

- Don't leave any sections blank, as this may lead to confusion later.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to keep a copy for your records after signing.

- Don't ignore state laws that may affect the terms of the note.

Discover More Types of Promissory Note for a Car Documents

Release of Promissory Note - Obtaining and filing this release is a responsible step in managing personal finances.

To create a valid and enforceable loan agreement, individuals can utilize a variety of resources, such as templates available online. One useful resource for drafting such documents is the NY PDF Forms, which provides a comprehensive Promissory Note template that ensures all necessary details are included for clarity and legality.

Common mistakes

Filling out a Promissory Note for a Car can seem straightforward, but several common mistakes can lead to complications down the line. One frequent error occurs when individuals fail to clearly specify the loan amount. This detail is crucial; without it, both parties may have differing interpretations of the agreement. Ensure that the amount is not only written numerically but also spelled out in words to avoid any ambiguity.

Another common mistake involves neglecting to include the interest rate. Some individuals assume that the lender will remember or that it’s an implied term. However, without a clearly defined interest rate, confusion can arise, especially if payments are missed. It is essential to explicitly state the interest rate, along with any applicable fees, to maintain transparency.

In addition to these oversights, people often forget to include the payment schedule. This schedule should outline when payments are due and the total duration of the loan. A lack of a defined schedule can lead to misunderstandings about when payments should be made, potentially resulting in late fees or damage to credit scores. Clarity in the payment timeline is vital for both the borrower and the lender.

Finally, many individuals overlook the importance of signatures. A Promissory Note is not legally binding without the appropriate signatures from both parties. Failing to sign the document or omitting a witness signature can render the agreement unenforceable. Always double-check that all required signatures are present before finalizing the document to ensure its validity.

Key takeaways

When filling out and using the Promissory Note for a Car form, it's essential to understand its purpose and the details required. Here are some key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines the terms of a loan for purchasing a vehicle. It serves as a promise to repay the borrowed amount.

- Include Clear Terms: Clearly state the loan amount, interest rate, repayment schedule, and any penalties for late payments. This ensures both parties have a mutual understanding.

- Identify the Parties: Clearly identify the borrower and the lender. Include full names and addresses to avoid any confusion later on.

- Signatures Matter: Both parties must sign the document. This signifies agreement to the terms laid out in the promissory note.

- Keep Copies: After signing, make copies of the completed promissory note. Both the borrower and lender should retain a copy for their records.

- Consider Legal Advice: If you have any uncertainties about the terms or implications, it may be wise to consult with a legal professional before finalizing the document.

- Review Before Signing: Take the time to review the note carefully. Ensure all details are accurate and reflect the agreement between both parties.

- Know Your Rights: Familiarize yourself with your rights and obligations under the note. This knowledge can help prevent misunderstandings and disputes in the future.

By following these key points, you can effectively fill out and utilize the Promissory Note for a Car form, ensuring a smoother transaction for both the borrower and the lender.