Printable Promissory Note Form

State-specific Guidelines for Promissory Note Documents

Promissory Note Subtypes

Promissory Note - Usage Guidelines

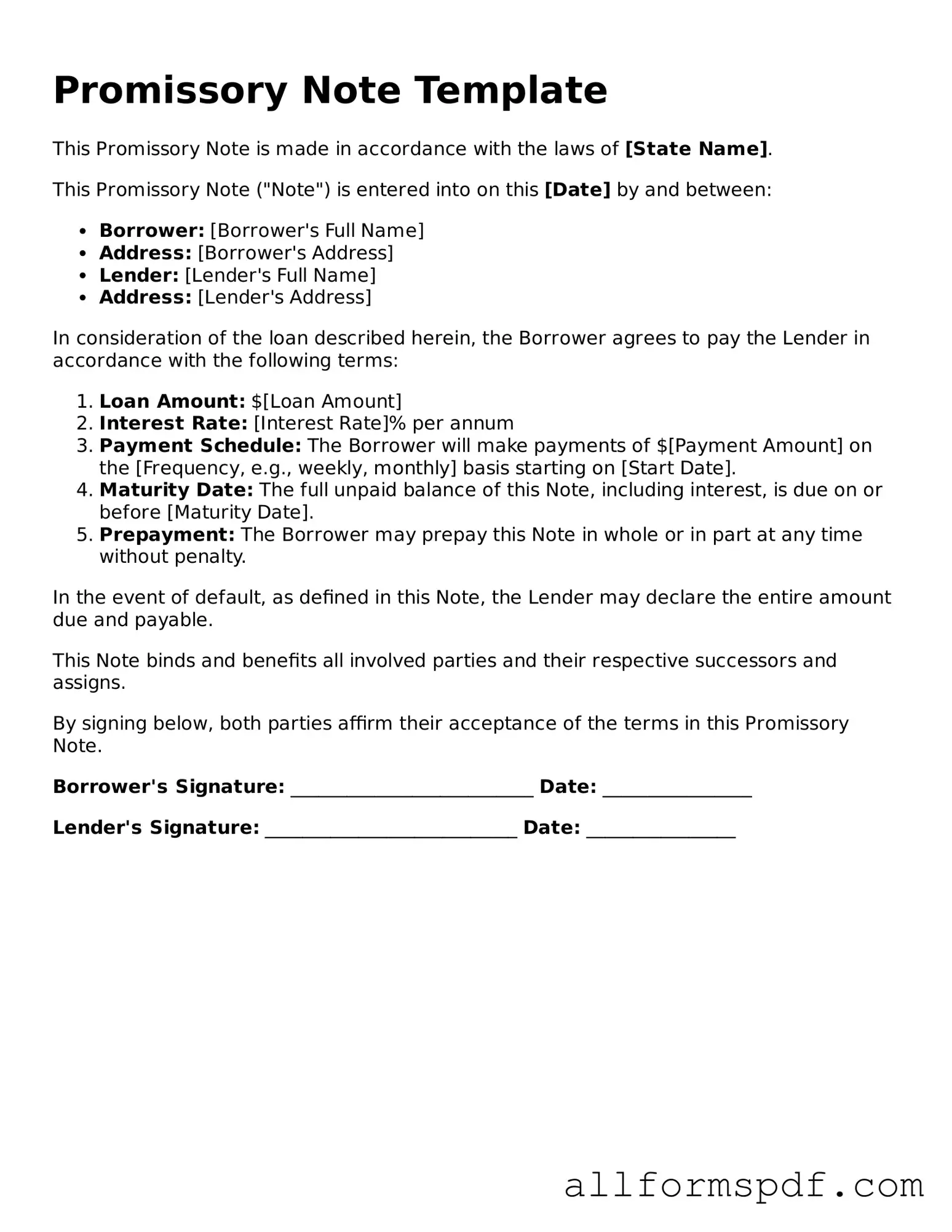

After obtaining the Promissory Note form, it is essential to fill it out accurately to ensure clarity and enforceability. Once completed, the form will need to be signed by both the borrower and the lender, and copies should be distributed to all parties involved.

- Begin by entering the date at the top of the form. This date should reflect when the note is being executed.

- In the first blank, write the full name of the borrower. Ensure that the name matches their legal identification.

- Next, fill in the lender’s name in the designated space. Like the borrower, this should be the lender's legal name.

- Specify the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate, if applicable. This should be a percentage and clearly stated to avoid confusion.

- Set the repayment schedule. Outline the frequency of payments, such as weekly, monthly, or annually, and include the due date for the first payment.

- Include any late fees or penalties for missed payments. Clearly state the amount and the conditions under which these fees apply.

- Provide a section for any prepayment options. Specify if the borrower can pay off the loan early without penalties.

- Finally, leave space for both parties to sign and date the form. Signatures should be accompanied by printed names for clarity.

Misconceptions

Understanding the Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can cloud this understanding. Here are eight common myths about Promissory Notes and clarifications for each.

- Misconception 1: A Promissory Note is the same as a loan agreement.

- Misconception 2: Promissory Notes do not need to be in writing.

- Misconception 3: Only banks can issue Promissory Notes.

- Misconception 4: A Promissory Note is not legally binding.

- Misconception 5: You cannot transfer a Promissory Note.

- Misconception 6: All Promissory Notes must be notarized.

- Misconception 7: Interest rates on Promissory Notes are always fixed.

- Misconception 8: A Promissory Note is only for personal loans.

A Promissory Note is a simpler document that outlines the borrower's promise to repay a specific amount. In contrast, a loan agreement is more comprehensive and includes terms like interest rates, repayment schedules, and collateral.

While oral agreements can exist, a written Promissory Note provides legal protection and clarity. A written document is far more reliable in case of disputes.

Individuals and businesses can create Promissory Notes. Anyone lending money can utilize this form to formalize the agreement.

When properly executed, a Promissory Note is indeed a legally binding contract. It obligates the borrower to repay the loan under the specified terms.

Promissory Notes can be transferred to another party. This process is known as endorsement, allowing the new holder to collect the debt.

While notarization adds an extra layer of authenticity, it is not a legal requirement for all Promissory Notes. The necessity for notarization may depend on state laws.

Interest rates can be either fixed or variable, depending on the agreement between the lender and borrower. The terms should be clearly stated in the document.

Promissory Notes can be used in various contexts, including business loans, real estate transactions, and even student loans. Their versatility makes them a valuable tool for many financial situations.

Dos and Don'ts

When filling out the Promissory Note form, it is important to follow certain guidelines to ensure accuracy and clarity. Here is a list of what you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information, including names, addresses, and amounts.

- Do sign and date the form in the appropriate places.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use unclear language or abbreviations.

- Don't forget to check for spelling errors.

- Don't submit the form without reviewing it thoroughly.

Popular Documents

Tax Form for Mortgage Interest - Provides a summary of recent transaction activity.

For individuals and businesses looking to navigate their confidentiality needs, a well-crafted Non-disclosure Agreement can be pivotal. Accessing the appropriate documentation is vital; thus, referring to our guide on the Non-disclosure Agreement form in Arizona can help clarify your requirements. Visit this link for more information: guide to the Non-disclosure Agreement form.

What Is an Example of a Codicil? - A codicil adapts your estate plans to shifting priorities.

Common mistakes

Filling out a Promissory Note form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary parties. It is crucial to list both the borrower and the lender clearly. Omitting one party can create confusion and may render the note unenforceable.

Another mistake is neglecting to specify the loan amount. While it may seem obvious, writing down the exact amount in both numerical and written form helps to avoid misunderstandings. If the amounts do not match, it can lead to disputes later on.

People often overlook the importance of detailing the repayment terms. This includes the interest rate, payment schedule, and any late fees. Without clear terms, borrowers may not understand their obligations, which can lead to missed payments and strained relationships.

Additionally, many individuals forget to include a date. A Promissory Note should always have a date of execution. This date establishes when the agreement takes effect and is important for tracking payment schedules.

Another common error is failing to sign the document. A Promissory Note requires signatures from both parties to be legally binding. Without signatures, the document lacks validity, and the agreement may not be enforceable in court.

Some people also make the mistake of not having witnesses or notarization when required. Depending on state laws, having a witness or notarizing the document can add an extra layer of protection and legitimacy to the agreement.

Moreover, individuals sometimes use vague language in the note. Clear and specific language is essential to avoid ambiguity. Phrases that are too broad can lead to different interpretations, which can complicate matters if disputes arise.

Another issue arises when people forget to keep copies of the signed Promissory Note. Both parties should retain a copy for their records. This ensures that everyone has access to the terms agreed upon, which is vital for future reference.

Finally, some individuals fail to review the completed form thoroughly before submission. Taking the time to double-check for errors or omissions can save significant trouble later. A careful review can help ensure that all information is accurate and complete.

Key takeaways

When filling out and using a Promissory Note form, there are several important points to keep in mind. Here are key takeaways to consider:

- Clearly state the amount being borrowed. This should be a specific dollar amount.

- Include the names and addresses of both the borrower and the lender. Accurate information is essential.

- Specify the interest rate, if applicable. This can be a fixed or variable rate.

- Outline the repayment terms. Detail how and when the borrower will repay the loan.

- Include any late fees or penalties for missed payments. This helps set expectations.

- Ensure both parties sign the document. Signatures confirm agreement to the terms.

- Keep a copy of the signed note for your records. This is important for future reference.

By following these guidelines, you can create a clear and effective Promissory Note that protects both parties involved.