Fill Out Your Profit And Loss Form

Profit And Loss - Usage Guidelines

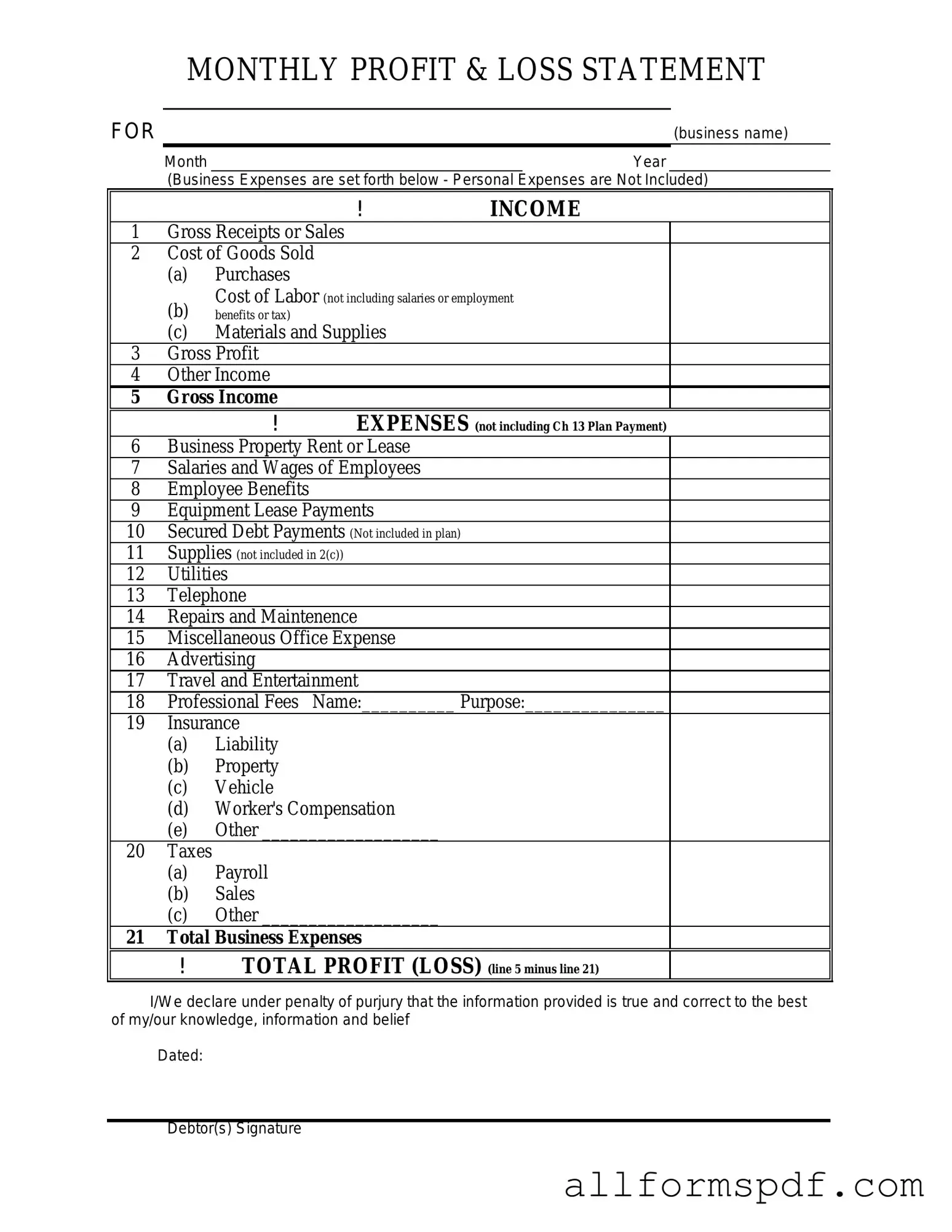

Filling out the Profit and Loss form is an important step in understanding your financial performance. It helps you track income and expenses over a specific period. Here’s how to complete it effectively.

- Gather your financial documents. Collect bank statements, receipts, and invoices for the period you are reporting.

- Start with your income. List all sources of income. This includes sales revenue, interest income, and any other earnings.

- Calculate total income. Add up all the income sources to get your total income for the period.

- List your expenses. Write down all business-related expenses. This can include rent, utilities, salaries, and materials.

- Calculate total expenses. Add all the expenses together to find your total expenses for the period.

- Determine your profit or loss. Subtract total expenses from total income. If the result is positive, you have a profit. If it's negative, you have a loss.

- Review your entries. Double-check all numbers for accuracy. Ensure that everything is correctly categorized.

- Submit the form. Once everything looks good, submit the form to the appropriate entity or keep it for your records.

Misconceptions

There are several misconceptions surrounding the Profit and Loss (P&L) form that can lead to confusion. Here are four common misunderstandings:

-

It only shows revenue.

Many people believe that the P&L form only reflects the income generated by a business. However, it also includes expenses, which are crucial for understanding the overall financial health of the company. The P&L shows both sides to give a complete picture of profitability.

-

It is the same as a balance sheet.

Some individuals think that the P&L form and the balance sheet are interchangeable. While both documents are important financial statements, they serve different purposes. The P&L focuses on income and expenses over a specific period, while the balance sheet provides a snapshot of the company’s assets, liabilities, and equity at a single point in time.

-

Only large businesses need a P&L form.

This misconception suggests that only big companies require a P&L form for their financial reporting. In reality, any business, regardless of size, can benefit from maintaining a P&L. It helps owners understand their financial performance and make informed decisions.

-

It is only useful for tax purposes.

Some may think that the P&L form is only necessary for tax filings. While it does play a role during tax season, it is also a valuable tool for internal management. Business owners can use it to track performance, identify trends, and make strategic plans for the future.

Dos and Don'ts

When filling out the Profit and Loss form, it’s essential to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do ensure all figures are accurate and up-to-date.

- Do categorize income and expenses clearly for better understanding.

- Do review the form for any errors before submission.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; provide information wherever applicable.

- Don't use vague descriptions; be specific about each income and expense item.

- Don't forget to include all sources of income, no matter how small.

By following these guidelines, you can ensure that your Profit and Loss form is completed accurately and effectively.

Other PDF Forms

Can You Print Out a W9 Form - The W-9 is considered a safe form, as it only collects basic identification.

What Is Immunization Records - Ensure that all relevant dates are filled out accurately.

By completing the Asurion F-017-08 MEN form, users can effectively navigate the claims process for device protection, allowing for a smoother resolution to any issues encountered. To begin the journey toward resolving your claim efficiently, make sure to Fill PDF Forms without delay.

Florida Family Law Financial Affidavit Short Form - Filing this affidavit is a vital part of the legal process in Florida family law.

Common mistakes

Filling out a Profit and Loss (P&L) form can seem straightforward, but many people make common mistakes that can lead to inaccurate financial reporting. One frequent error is failing to include all income sources. It’s essential to capture every dollar earned, whether from sales, services, or other revenue streams. Omitting even a small amount can skew the overall picture of a business’s financial health.

Another common mistake is misclassifying expenses. When expenses are categorized incorrectly, it can affect tax deductions and financial analysis. For instance, mixing up operational costs with capital expenditures can lead to misunderstandings about profitability. It’s important to be diligent about where each expense falls on the form.

Some individuals overlook the importance of updating the form regularly. A P&L statement should reflect the most current financial data. If you only update it annually or infrequently, you may miss out on critical insights into your business’s performance. Regular updates allow for timely adjustments and better decision-making.

Another mistake is ignoring seasonal variations. Many businesses experience fluctuations in income and expenses based on the time of year. Failing to account for these changes can lead to misinterpretations of financial stability. It’s wise to analyze trends over multiple periods to gain a clearer understanding of performance.

Some people also make the mistake of not reconciling figures. Before finalizing the P&L, it's crucial to ensure that the numbers match up with bank statements and other financial records. Discrepancies can indicate errors that need correction, and reconciling helps maintain accuracy.

Additionally, neglecting to include non-operating income and expenses can lead to an incomplete financial picture. These items, such as interest income or investment losses, can significantly impact the bottom line. Including them ensures that the P&L reflects all aspects of financial performance.

Another error is failing to analyze the results after filling out the form. Simply completing the P&L isn’t enough; it’s crucial to interpret the data. Understanding trends and variances can help identify areas for improvement and inform future business strategies.

Lastly, not seeking professional help when needed can be a significant oversight. If the process feels overwhelming or complex, consulting with a financial advisor or accountant can provide clarity and ensure accuracy. They can help navigate any tricky areas and provide valuable insights into best practices.

Key takeaways

Filling out and using the Profit and Loss form is essential for understanding your business's financial health. Here are some key takeaways to keep in mind:

- Ensure all income sources are accurately reported. This includes sales, services, and any other revenue streams.

- Track all expenses carefully. Categorize them into fixed and variable costs for better analysis.

- Use consistent time periods for reporting. Monthly, quarterly, or yearly reports provide clarity and help in trend analysis.

- Review the form regularly. Frequent updates allow for timely adjustments in business strategies.

- Compare your Profit and Loss statements over different periods. This helps identify growth patterns or potential issues.

- Consult with a financial advisor if needed. They can provide insights that enhance your understanding of the data.

- Keep supporting documents organized. Receipts and invoices should be readily available for reference.

- Understand the significance of net profit. This figure is crucial for assessing overall business performance.