Printable Prenuptial Agreement Form

State-specific Guidelines for Prenuptial Agreement Documents

Prenuptial Agreement - Usage Guidelines

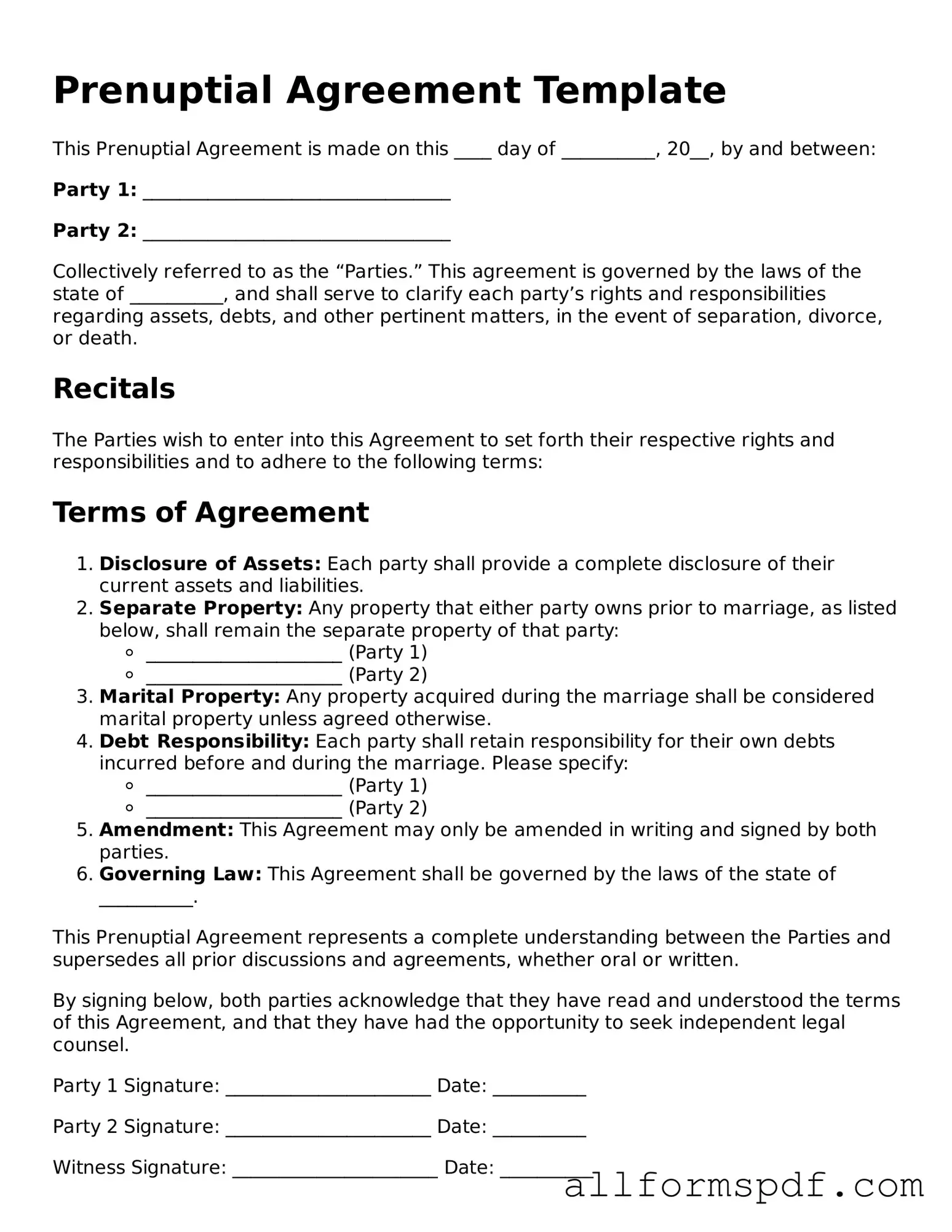

Filling out a Prenuptial Agreement form requires careful attention to detail. This document is essential for couples who want to outline their financial rights and responsibilities before marriage. Follow these steps to ensure the form is completed accurately.

- Obtain the Form: Access the Prenuptial Agreement form from a reliable source, such as a legal website or a family law attorney.

- Read Instructions: Review any accompanying instructions carefully to understand the requirements and implications of the agreement.

- Identify Parties: Clearly state the full legal names of both parties involved in the agreement.

- Provide Contact Information: Include current addresses, phone numbers, and email addresses for both parties.

- Detail Assets: List all assets owned by each party, including property, bank accounts, investments, and personal belongings.

- Disclose Debts: Document any debts or liabilities each party has, such as loans, credit card debts, or mortgages.

- Discuss Financial Arrangements: Outline how finances will be managed during the marriage, including income, expenses, and savings.

- Include Additional Provisions: If desired, add any specific clauses regarding spousal support, property division, or other relevant issues.

- Review the Agreement: Both parties should review the completed form thoroughly to ensure accuracy and clarity.

- Sign the Document: Each party must sign and date the agreement in the presence of a witness or notary, if required.

Once the form is completed and signed, consider consulting with a legal professional to ensure that it meets all necessary legal standards and adequately protects both parties' interests.

Misconceptions

Many people have misconceptions about prenuptial agreements. Understanding the truth can help couples make informed decisions. Here are six common misconceptions:

- Prenuptial agreements are only for the wealthy. This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial situation. It can help clarify financial responsibilities and protect individual assets.

- Prenuptial agreements are only for divorce. While they do provide guidelines for separation, they can also address financial matters during the marriage. This includes how to manage joint accounts and expenses.

- Signing a prenuptial agreement means you expect the marriage to fail. Many couples view it as a proactive step. It shows that both parties are committed to open communication about finances.

- Prenuptial agreements are difficult to enforce. When drafted correctly, they are legally binding. Both parties should fully disclose their financial situations and have independent legal advice.

- Prenuptial agreements can cover anything. There are limits to what can be included. For example, they typically cannot dictate child custody arrangements or child support.

- Prenuptial agreements are only for heterosexual couples. This is a misconception. Same-sex couples can and should also consider prenuptial agreements to protect their interests.

By addressing these misconceptions, couples can approach prenuptial agreements with clarity and confidence.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it’s important to approach the process carefully. Here are ten things to consider:

- Do communicate openly with your partner about your financial situation.

- Do consult with a lawyer who specializes in family law.

- Do be honest about your assets and debts.

- Do discuss your expectations for the future.

- Do ensure both parties understand the terms of the agreement.

- Don't rush the process. Take your time to review everything.

- Don't hide any financial information from your partner.

- Don't assume that a prenup is only for the wealthy.

- Don't use the agreement as a tool for manipulation or control.

- Don't forget to update the agreement if your financial situation changes.

Popular Documents

Citi Bank Voided Check - Use this form to connect with your employer for direct payments.

For anyone involved in a motorcycle transaction, understanding the requirements of a Motorcycle Bill of Sale is crucial for a smooth process. This document not only verifies ownership transfer but also provides security for both parties. For more information, you can refer to a helpful source on the necessary details: important Motorcycle Bill of Sale insights.

Letter of Intent Template - A Letter of Intent is often critical in complex transactions.

Common mistakes

Filling out a prenuptial agreement form can be a daunting task. Many individuals make mistakes that can lead to complications later. One common error is not fully disclosing assets. Both parties must provide a complete and honest account of their financial situation. Failing to do so can render the agreement unenforceable in court.

Another frequent mistake is using vague language. Clarity is essential in legal documents. If terms and conditions are not clearly defined, it can lead to misunderstandings and disputes in the future. Specificity helps ensure that both parties understand their rights and responsibilities.

People often overlook the importance of independent legal advice. Each party should consult their own attorney before signing the agreement. This step ensures that both individuals understand the implications of the document. Without proper legal guidance, one party may feel pressured into agreeing to terms that are not in their best interest.

Timing is also crucial when preparing a prenuptial agreement. Many couples wait until the last minute to draft and sign the document. This can create a perception of coercion, which may invalidate the agreement. It is best to start the process well in advance of the wedding date.

Lastly, individuals sometimes forget to update their prenuptial agreements after major life changes. Events such as the birth of a child, significant changes in income, or the acquisition of new assets can all impact the terms of the agreement. Regularly reviewing and updating the document ensures it remains relevant and fair.

Key takeaways

When considering a prenuptial agreement, there are several important points to keep in mind. These agreements can help clarify financial expectations and protect both parties. Here are key takeaways to consider:

- Open Communication is Essential: Discussing the terms of the agreement openly can strengthen your relationship. Honesty about financial matters is crucial.

- Consider Future Changes: Life circumstances can change. Make sure your agreement includes provisions for future events, such as children or changes in income.

- Legal Guidance is Important: Consulting with a legal professional can help ensure that the agreement is fair and enforceable. This step can protect both partners.

- Review Regularly: Revisit the agreement periodically. Changes in your life or financial situation may necessitate updates to the terms.

Taking these steps can lead to a clearer understanding and a stronger foundation for your marriage.