Fill Out Your Payroll Check Form

Payroll Check - Usage Guidelines

Completing the Payroll Check form is an essential task that ensures employees receive their due wages accurately and on time. Following these steps will help you fill out the form correctly, making the payroll process smooth and efficient.

- Gather necessary information: Before you start, collect details such as the employee's name, address, Social Security number, and pay rate.

- Fill in the employee's name: Write the full name of the employee receiving the check at the top of the form.

- Enter the employee's address: Below the name, include the employee's current address, ensuring accuracy for tax and record-keeping purposes.

- Provide the Social Security number: Write the employee's Social Security number in the designated space to comply with tax regulations.

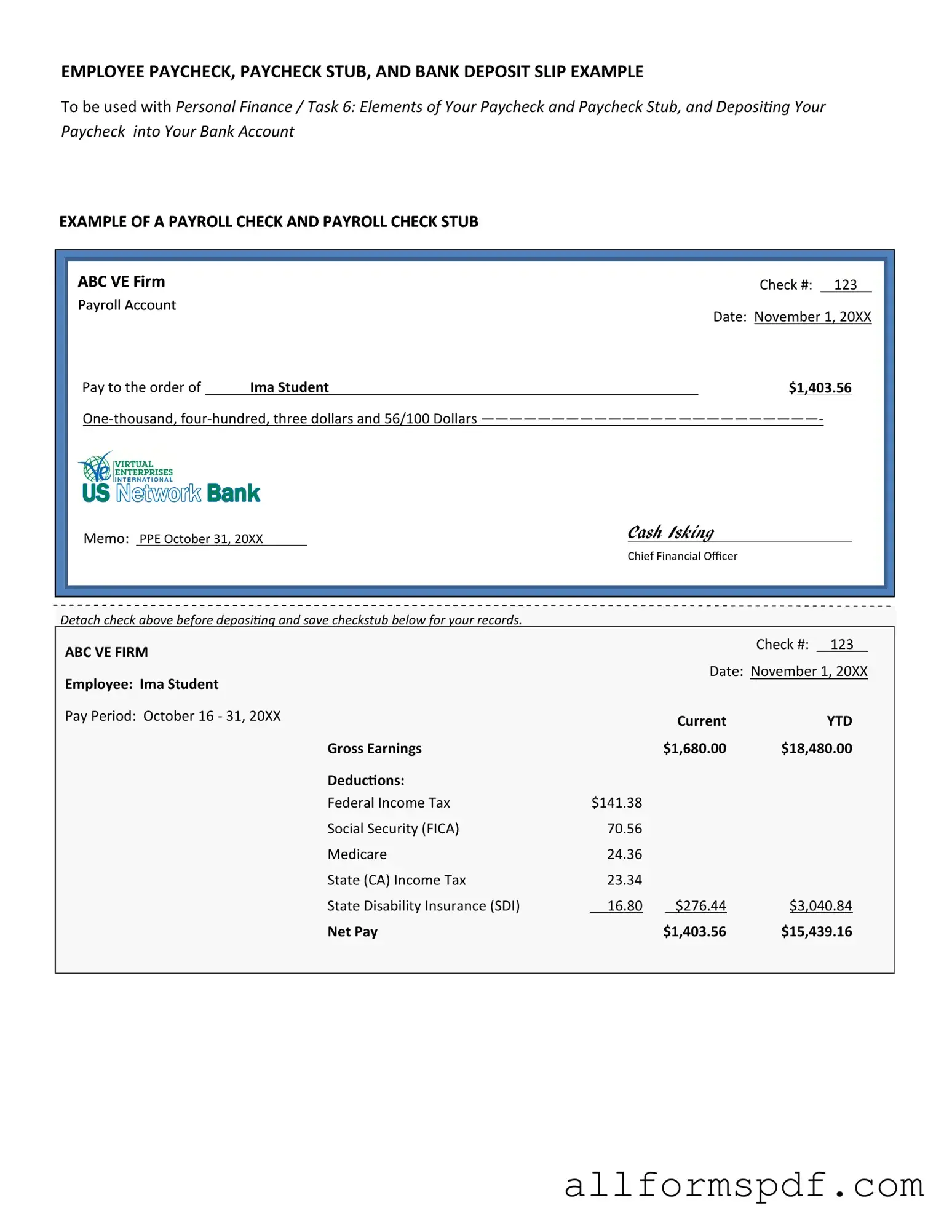

- Specify the pay period: Indicate the start and end dates of the pay period for which the employee is being compensated.

- Calculate the gross pay: Determine the total amount earned by the employee during the pay period, including any overtime or bonuses.

- Deduct taxes and other withholdings: List any deductions such as federal and state taxes, Social Security, and health insurance premiums.

- Calculate net pay: Subtract the total deductions from the gross pay to arrive at the net pay amount.

- Sign the form: The authorized person must sign the form to validate the payroll check.

- Distribute the checks: Finally, ensure the checks are distributed to the employees on the designated pay date.

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are six common misconceptions:

-

Payroll checks are always issued on a specific day.

While many companies have a set payday, some may vary based on their payroll schedule or policies. It's important to confirm the specific timing with your employer.

-

All deductions are automatically correct.

Deductions for taxes, benefits, and other items are not always accurate. Employees should regularly review their pay stubs to ensure that all deductions are correct.

-

Payroll checks are the only form of payment.

Many employers offer direct deposit as an option. Some may also provide payment through payroll cards or electronic transfers, which can be more convenient for employees.

-

Only full-time employees receive payroll checks.

Part-time employees, interns, and contractors can also receive payroll checks. The method of payment depends on the employer’s policies and the employee's classification.

-

Payroll checks are the same as pay stubs.

A payroll check is the actual payment issued, while a pay stub provides a detailed breakdown of earnings and deductions. Both are important but serve different purposes.

-

Employees cannot dispute payroll errors.

Employees have the right to question and dispute any discrepancies in their payroll. It’s advisable to address any issues promptly with the payroll department.

By clarifying these misconceptions, employees can better understand their payroll checks and ensure they are receiving the correct compensation for their work.

Dos and Don'ts

When filling out a Payroll Check form, attention to detail is essential. Here are some important dos and don’ts to keep in mind.

- Do double-check employee information for accuracy.

- Do ensure that the payment amount is clearly stated.

- Don't leave any fields blank unless instructed to do so.

- Don't forget to sign the form before submission.

By following these guidelines, you can help ensure that the payroll process runs smoothly and efficiently.

Other PDF Forms

Agreement Lease - Documentation ensures that both parties are protected under the law.

Understanding the significance of the Florida Motor Vehicle Power of Attorney form is crucial, as it not only empowers an individual to delegate vehicle-related tasks but also ensures that these responsibilities can be effectively managed even in their absence. For more resources, you can visit All Florida Forms, which provides comprehensive information about various legal documents in Florida.

Printable Basketball Player Evaluation Form - Assess interaction with teammates to encourage positive team dynamics.

Texas Odometer Disclosure Statement - This form serves as a legal declaration of mileage and should be treated seriously.

Common mistakes

Filling out a Payroll Check form may seem straightforward, but many people stumble in a few key areas. One common mistake is failing to double-check personal information. When individuals enter their name, address, or Social Security number incorrectly, it can lead to significant delays in receiving payment. Even a small typo can create confusion and frustration.

Another frequent error involves miscalculating hours worked. Employees sometimes forget to account for overtime or take into consideration unpaid breaks. This oversight can result in underpayment, which not only affects finances but can also lead to disputes with employers. It's essential to keep accurate records of hours worked to avoid this pitfall.

Many also overlook the importance of understanding tax deductions. Some people might not realize that certain deductions apply to their paychecks. Without proper knowledge, they may end up with unexpected amounts after taxes are taken out. Staying informed about tax obligations can help individuals manage their finances better.

Lastly, neglecting to sign the form is a surprisingly common mistake. A signature is often required to validate the document. Without it, the Payroll Check form may be considered incomplete, causing delays in processing. Always remember to review the entire form before submission to ensure that every necessary step has been completed.

Key takeaways

Filling out and using the Payroll Check form is a critical task for any business. Here are some key takeaways to keep in mind:

- Accuracy is essential. Ensure all employee information is correct, including names, addresses, and Social Security numbers.

- Calculate wages carefully. Double-check the hours worked and the pay rate to avoid errors in compensation.

- Include deductions. Be aware of any necessary tax withholdings and other deductions that need to be applied to the gross pay.

- Use the correct format. Follow the guidelines for how to fill out the form, including any required signatures and dates.

- Keep records. Retain copies of all payroll checks and forms for your records. This can help in case of audits or disputes.

- Understand state regulations. Different states have varying laws regarding payroll, so familiarize yourself with local requirements.

- Review regularly. Regularly check the Payroll Check form process to ensure compliance and efficiency in your payroll system.

By following these guidelines, you can streamline your payroll process and minimize potential issues.