Printable Partial Release of Lien Form

Partial Release of Lien - Usage Guidelines

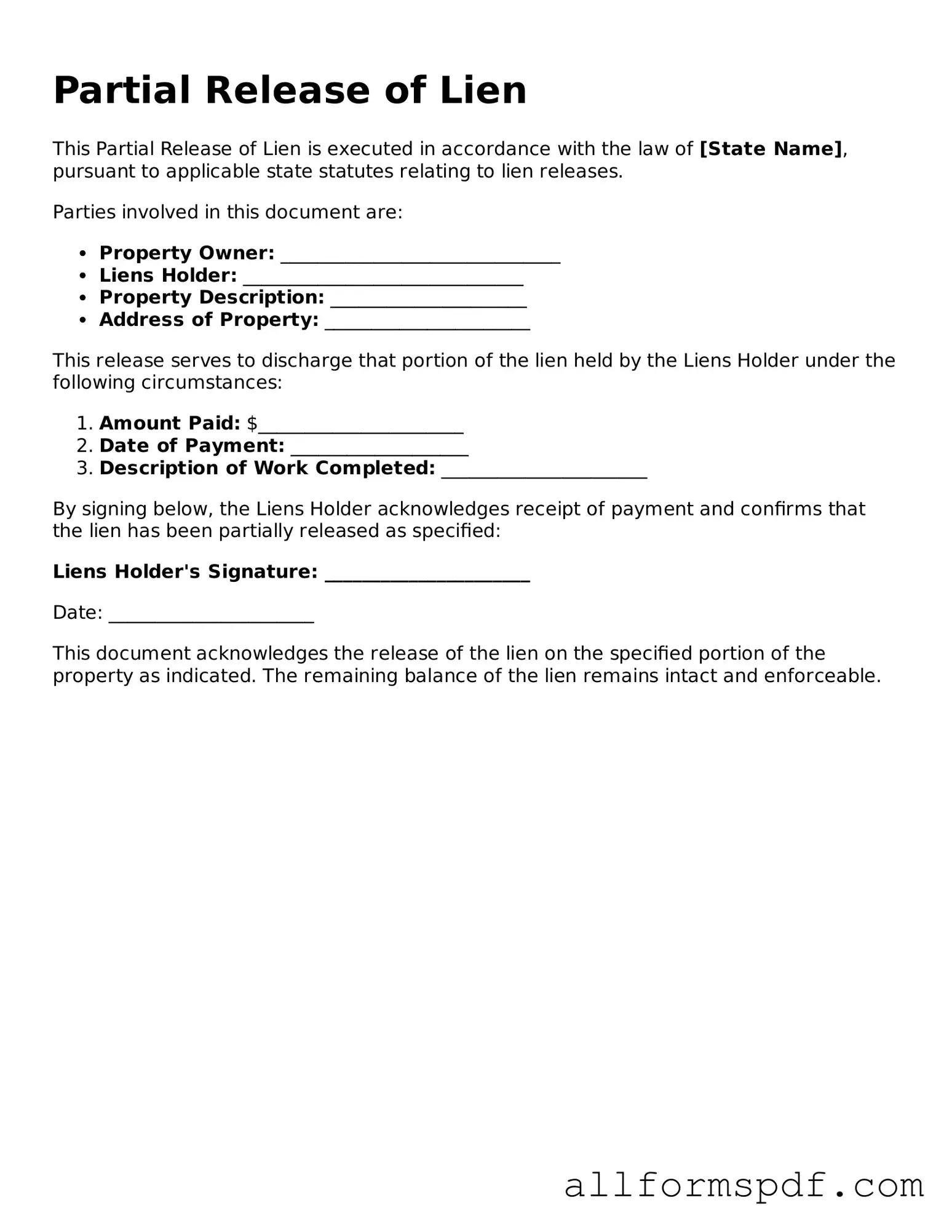

After you have gathered the necessary information, you are ready to fill out the Partial Release of Lien form. Completing this form accurately is important to ensure that the lien is released as intended. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name of the property owner or the individual who has the lien against their property.

- List the address of the property associated with the lien.

- Identify the lien claimant by writing their name and contact information.

- Clearly state the amount being released from the lien.

- Include a description of the work performed or the reason for the lien.

- Sign and date the form. Ensure that the signature is from the lien claimant or an authorized representative.

- Have the form notarized if required by your state’s laws.

Once you have completed the form, make sure to keep a copy for your records. You will then need to file the form with the appropriate office, usually the county clerk or recorder's office, to ensure the release is officially recognized.

Misconceptions

Understanding the Partial Release of Lien form is essential for property owners and contractors alike. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- It eliminates the entire lien. A partial release does not remove the entire lien; it only releases a portion of the claim against the property. This means that the remaining amount is still enforceable.

- It is only for contractors. While often used by contractors, property owners can also initiate a partial release. It serves both parties in a transaction.

- It must be filed immediately. There is no strict deadline for filing a partial release, but it should be done promptly after payment to avoid disputes.

- It requires a lawyer. Although legal advice can be helpful, it is not mandatory to have a lawyer to complete a partial release. Many people handle it themselves.

- It is the same as a full release. A partial release is distinctly different from a full release. A full release removes all claims, while a partial release only addresses a specific part.

- Once filed, it cannot be changed. A partial release can be amended or revoked if necessary, but this requires additional documentation and proper procedures.

Being informed about these misconceptions can help you navigate the process more effectively.

Dos and Don'ts

When filling out the Partial Release of Lien form, it's important to follow certain guidelines to ensure everything goes smoothly. Here are some dos and don'ts to keep in mind:

- Do double-check all information for accuracy before submission.

- Do ensure that the form is signed by the appropriate parties.

- Do keep a copy of the completed form for your records.

- Do file the form with the correct local authority promptly.

- Don't leave any required fields blank; this could delay processing.

- Don't forget to include any necessary attachments or supporting documents.

- Don't assume that verbal agreements are sufficient; everything should be documented.

Discover More Types of Partial Release of Lien Documents

What Is a Waiver and Release Form - Participants are encouraged to disclose any pre-existing conditions before signing.

Unconditional Waiver - Helps prevent disputes regarding payments and contractor services.

The Vehicle Release of Liability form is a crucial document that is used when the ownership of a vehicle is being transferred from one person to another. This form officially releases the seller from any future claims of damage or liability related to the vehicle after the sale is complete. It serves as a vital record that helps protect both parties involved in the transfer of ownership. For more information on this important document, visit TopTemplates.info.

Tattoo Consent Forms - In case of disputes, the form can be a reference point for both parties.

Common mistakes

Filling out a Partial Release of Lien form can be a straightforward process, but many individuals and businesses make common mistakes that can lead to complications. One frequent error is neglecting to include accurate property descriptions. A precise description is essential to ensure that the lien is correctly associated with the right property. Omitting details or using vague language can result in legal disputes or delays in processing.

Another mistake is failing to provide all necessary signatures. A Partial Release of Lien typically requires the signatures of all lienholders involved. If one signature is missing, the release may not be valid, leaving the lien intact and potentially causing issues for the property owner.

People often overlook the importance of dates. The date on the form should reflect when the lien is being released. If the date is incorrect or missing, it can create confusion regarding the timeline of the lien's status. This oversight can complicate future transactions related to the property.

Additionally, some individuals forget to check local requirements. Different jurisdictions may have specific rules about how a Partial Release of Lien should be completed or filed. Ignoring these local regulations can lead to the form being rejected or deemed ineffective, which can be frustrating for all parties involved.

Another common error is not providing sufficient supporting documentation. Often, a Partial Release of Lien should be accompanied by proof of payment or other relevant documents. Without these, the release may not hold up if challenged, causing further complications down the line.

Finally, people sometimes fail to file the form correctly. After completing the Partial Release of Lien, it is essential to file it with the appropriate local office, such as the county recorder or clerk’s office. Neglecting this step can leave the lien on record, which may affect future sales or financing options for the property.

Key takeaways

When filling out and using the Partial Release of Lien form, keep these key takeaways in mind:

- Understand the Purpose: A Partial Release of Lien allows a property owner to release a portion of the lien on their property. This can be essential when payments are made for specific work or materials.

- Accurate Information is Crucial: Ensure that all details, such as the property description, lien claimant, and the amount being released, are correct. Mistakes can lead to delays or legal complications.

- Obtain Necessary Signatures: The form must be signed by the lien claimant. Without the proper signatures, the release may not be valid.

- File the Form Promptly: After completing the form, file it with the appropriate county office as soon as possible. This protects your rights and ensures that the release is officially recorded.