Fill Out Your P 45 It Form

P 45 It - Usage Guidelines

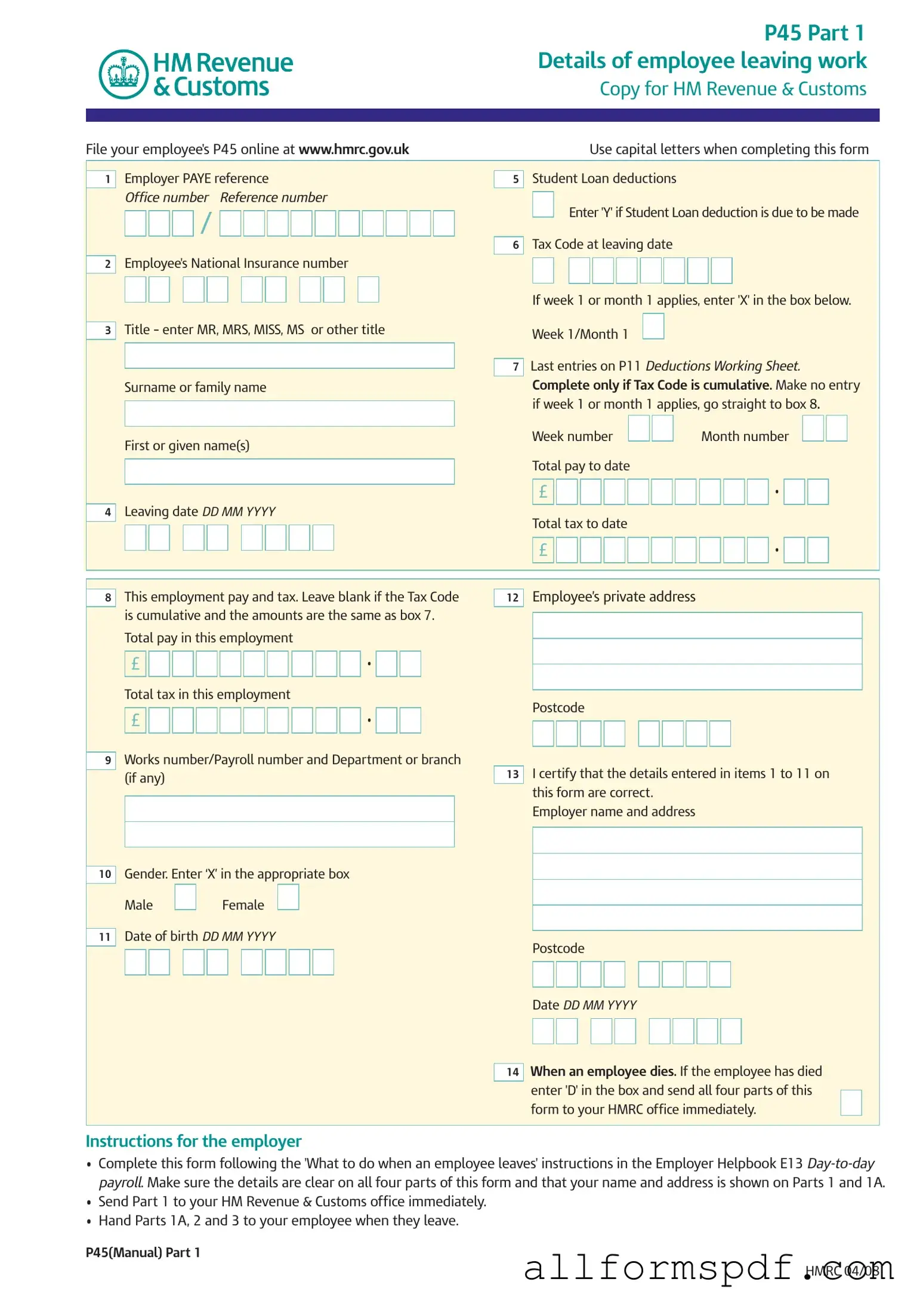

Completing the P45 IT form is essential when an employee leaves a job. This process ensures that the employee's tax records are accurately maintained and that they receive the correct tax treatment in their future employment or claims. Follow these steps to fill out the form correctly.

- Begin with Part 1 of the P45 form. Clearly print the employer PAYE reference in the designated box.

- Enter the office number and reference number in the appropriate fields.

- Provide the employee's National Insurance number accurately.

- Indicate the title of the employee (MR, MRS, MISS, MS, or other).

- Fill in the surname or family name and the first or given name(s) of the employee.

- Record the leaving date in the format DD MM YYYY.

- Input the total pay to date and total tax to date in the specified fields.

- If applicable, check the box for week 1/month 1 and enter 'X' if this applies.

- Complete the tax code at the leaving date.

- Fill in the works number/payroll number and department or branch, if any.

- Provide the employee’s private address and postcode.

- Certify the accuracy of the details by signing and dating the form.

- Send Part 1 to HM Revenue & Customs immediately.

- Hand Parts 1A, 2, and 3 to the employee upon their departure.

After completing the P45 form, ensure that all parts are properly distributed. The employee will need Parts 1A, 2, and 3 for their records and future employment. It's crucial to handle this process promptly to avoid any tax complications for both the employer and the employee.

Misconceptions

Misconception 1: The P45 form is only necessary for tax purposes.

While the P45 does play a significant role in tax calculations, it also serves other important functions. For example, it helps new employers understand an employee's previous pay and tax deductions. This information is crucial for ensuring the correct tax code is applied in the new job.

Misconception 2: Employees do not need to keep their P45 once they start a new job.

Many people believe that once they hand over their P45 to their new employer, they no longer need it. This is not true. Employees should keep their P45, especially Part 1A, as it may be needed for future tax returns or to claim tax refunds.

Misconception 3: The P45 form is the same for every employee.

This is misleading. The P45 form can vary based on the employee's specific situation, such as whether they are on a week 1 or month 1 tax code. Each form is tailored to reflect the individual's pay, tax deductions, and other relevant details.

Misconception 4: Employers can delay sending the P45 to HMRC.

Some employers think they can wait to send the P45 to HMRC after processing other payroll tasks. However, they must send Part 1 of the P45 immediately after the employee leaves. Timely submission helps ensure that tax records are accurate and up to date.

Dos and Don'ts

When filling out the P45 IT form, it’s essential to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do:

- Do use capital letters throughout the form to maintain clarity.

- Do ensure all necessary details, such as the employee's National Insurance number and PAYE reference, are filled in correctly.

- Do double-check the leaving date to avoid any discrepancies.

- Do send Part 1 to HM Revenue & Customs immediately after completion.

- Do provide Parts 1A, 2, and 3 to the employee upon their departure.

- Don’t leave any required fields blank unless instructed to do so.

- Don’t use incorrect titles or abbreviations; stick to MR, MRS, MISS, MS, or other accepted titles.

- Don’t forget to certify the details entered in items 1 to 11 are correct before submission.

- Don’t alter any parts of the form once completed; keep them as is.

Other PDF Forms

Miscellaneous Information - Multiple versions of the form exist based on the method of filing (e.g., paper vs. electronic).

Filing the Florida Sales Tax form accurately is crucial for compliance with state regulations, as it ensures that businesses report their sales correctly and avoid potential penalties. For those in need of guidance and additional resources, All Florida Forms offers a comprehensive selection to assist with this process, helping to streamline tax reporting and make it easier to understand the requirements involved.

I134 - The I-134 is a significant factor in humanitarian cases as well.

Common mistakes

Completing the P45 IT form can be straightforward, but mistakes are common. One frequent error is failing to use capital letters throughout the form. This is essential for clarity and helps ensure that information is processed correctly. If someone neglects this guideline, it may lead to delays or issues with tax records.

Another mistake occurs when individuals do not accurately enter their National Insurance number. This number is crucial for identifying an employee's tax records. Omitting or incorrectly inputting this number can create complications in the future, especially regarding tax deductions and benefits.

Many people also forget to check the appropriate boxes for the week 1 or month 1 tax codes. If someone is on a week 1 or month 1 basis, they must mark the 'X' box. Failing to do so can result in incorrect tax calculations, leading to overpayment or underpayment of taxes.

Additionally, some individuals mistakenly leave out their total pay and tax amounts for the employment period. These figures are vital for the new employer and HMRC to determine the correct tax status. Incomplete entries can cause significant confusion and may require additional follow-up.

Lastly, a common oversight involves not signing or dating the form. The certification at the end of the P45 IT form confirms that the information provided is accurate. Without a signature and date, the form may be deemed invalid, leading to further complications for both the employee and employer.

Key takeaways

When filling out the P45 form, use capital letters to ensure clarity and avoid errors.

Make sure to complete all required sections, including the employee's National Insurance number and the Tax Code at the time of leaving.

It is essential to send Part 1 to HM Revenue & Customs (HMRC) immediately after the employee leaves.

Provide Parts 1A, 2, and 3 to the employee upon their departure. These parts are important for their tax records.

If the employee is going to a new job, they must give Parts 2 and 3 to their new employer to avoid paying too much tax.

In case of an employee's death, mark the form accordingly and send all parts to HMRC without delay.