Printable Owner Financing Contract Form

Owner Financing Contract - Usage Guidelines

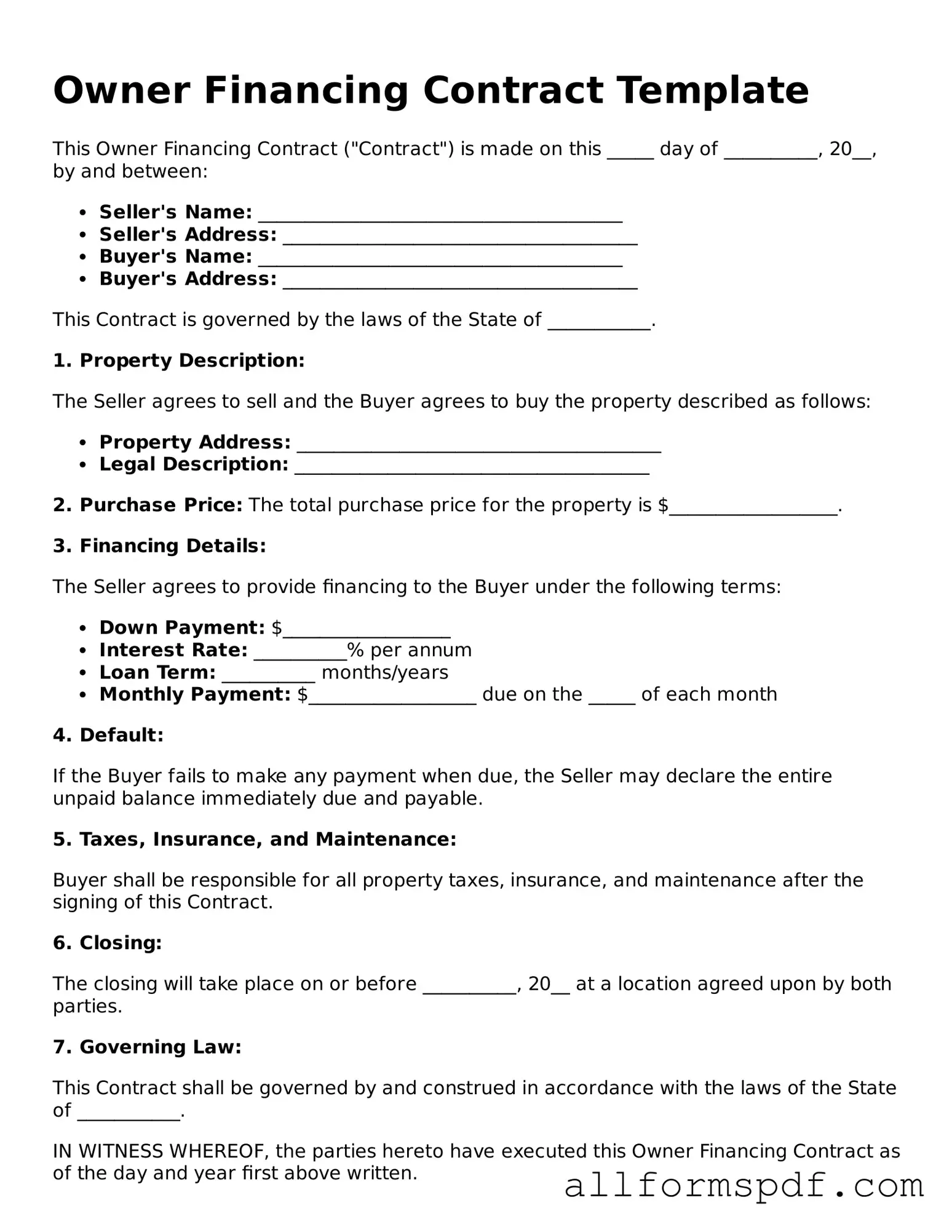

Filling out the Owner Financing Contract form is an important step in establishing the terms of a real estate transaction. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Below are the steps to complete the form effectively.

- Obtain the Form: Start by acquiring the Owner Financing Contract form from a reliable source, such as a real estate office or online template provider.

- Read the Instructions: Before filling out the form, take a moment to read any accompanying instructions to understand the requirements.

- Fill in the Seller's Information: Enter the full name, address, and contact details of the seller at the designated section.

- Provide the Buyer's Information: Similarly, input the buyer's full name, address, and contact details in the appropriate area.

- Describe the Property: Clearly describe the property being sold, including the address, legal description, and any relevant details.

- Specify the Purchase Price: Indicate the total purchase price of the property, ensuring accuracy in the amount stated.

- Outline the Financing Terms: Detail the financing terms, including the down payment amount, interest rate, and repayment schedule.

- Include Additional Terms: If there are any additional terms or conditions, make sure to write them down in the designated section of the form.

- Signatures: Ensure both the seller and buyer sign the form where indicated. This may require witnessing or notarization, depending on state laws.

- Make Copies: After completing and signing the form, make copies for both parties to retain for their records.

Once the form is completed, it is advisable to review it for accuracy before proceeding with the next steps in the real estate transaction. This will help prevent any misunderstandings or disputes in the future.

Misconceptions

Understanding owner financing can be challenging, and several misconceptions often arise. Here are eight common misunderstandings regarding the Owner Financing Contract form:

-

Owner financing is only for buyers with bad credit.

This is not true. While owner financing can be a viable option for buyers with credit issues, it is also used by individuals with good credit who prefer the flexibility of this arrangement.

-

Owner financing means the seller has to accept a lower price.

Not necessarily. The seller can negotiate the price just like in any traditional sale. Owner financing does not automatically mean a lower sale price.

-

The process is always complicated.

While it can be complex, many owner financing transactions are straightforward. With clear communication and proper documentation, the process can be smooth.

-

Owner financing is illegal in some states.

This is a misconception. Owner financing is legal in all states, although specific regulations may vary. It is essential to understand local laws and requirements.

-

Only residential properties can be financed this way.

Owner financing can be used for various property types, including commercial real estate. The key is the agreement between the buyer and seller.

-

The seller is responsible for the buyer's mortgage.

This is false. In an owner financing arrangement, the buyer is responsible for making payments directly to the seller, not to a traditional mortgage lender.

-

All owner financing agreements are the same.

Each agreement can be customized to fit the needs of both parties. Terms such as interest rates, payment schedules, and duration can vary significantly.

-

Owner financing is a risky option for sellers.

While there are risks, such as the possibility of default, many sellers find owner financing to be a secure way to sell their property while generating income.

By addressing these misconceptions, individuals can make more informed decisions regarding owner financing. Understanding the facts can lead to a successful transaction for both buyers and sellers.

Dos and Don'ts

When filling out the Owner Financing Contract form, it's important to approach the task with care. Here are five things you should and shouldn't do:

- Do read the entire contract carefully before filling it out.

- Do ensure all parties involved understand the terms of the agreement.

- Do provide accurate and complete information in each section of the form.

- Do consult with a legal professional if you have any questions.

- Do keep a copy of the signed contract for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't make assumptions about terms; clarify anything that seems unclear.

- Don't ignore local laws or regulations that may affect the contract.

- Don't forget to have all parties sign the contract before finalizing it.

Discover More Types of Owner Financing Contract Documents

Real Estate Agent Termination Letter - Can be used to reclaim earnest money if termination is justified.

When navigating the complexities of a real estate transaction in Texas, one critical resource for buyers and sellers is the Texas Real Estate Purchase Agreement form, as it establishes the formal terms of the deal. For comprehensive guidance on this important document, you can refer to https://smarttemplates.net/fillable-texas-real-estate-purchase-agreement/, which provides insights and templates to help facilitate a smooth and effective transaction.

Common mistakes

When filling out an Owner Financing Contract form, many individuals make common mistakes that can lead to misunderstandings or even legal issues down the line. One frequent error is failing to clearly define the terms of the financing. This includes the interest rate, payment schedule, and loan duration. If these details are vague or omitted, both the buyer and seller may have different expectations, which can result in disputes later on.

Another mistake often seen is neglecting to include important information about the property being financed. It's crucial to provide a complete description of the property, including its address, legal description, and any unique features. Without this information, the contract may lack clarity, making it difficult to enforce the agreement if any issues arise.

Additionally, some individuals forget to address the consequences of defaulting on the loan. The contract should outline what happens if the buyer fails to make payments. This can include details about late fees, the process for foreclosure, or any other remedies available to the seller. By not specifying these terms, both parties may find themselves in a difficult situation should a default occur.

Lastly, many people overlook the importance of signatures and dates. All parties involved must sign the contract to make it legally binding. Furthermore, dates should be included to indicate when the agreement was made and when payments are due. Missing signatures or dates can render the contract unenforceable, leading to confusion and potential legal complications.

Key takeaways

When filling out and using the Owner Financing Contract form, consider the following key takeaways:

- Clearly Define Terms: Specify the purchase price, interest rate, and payment schedule. This clarity helps both parties understand their obligations.

- Include Property Details: Provide a thorough description of the property. This should include the address, legal description, and any unique features.

- Outline Default Consequences: Explain what happens if either party defaults on the agreement. This section should detail potential remedies and procedures.

- Obtain Signatures: Ensure both parties sign and date the contract. This step is crucial for making the agreement legally binding.

- Consult a Professional: Consider having a lawyer review the contract. This can help avoid misunderstandings and ensure compliance with local laws.