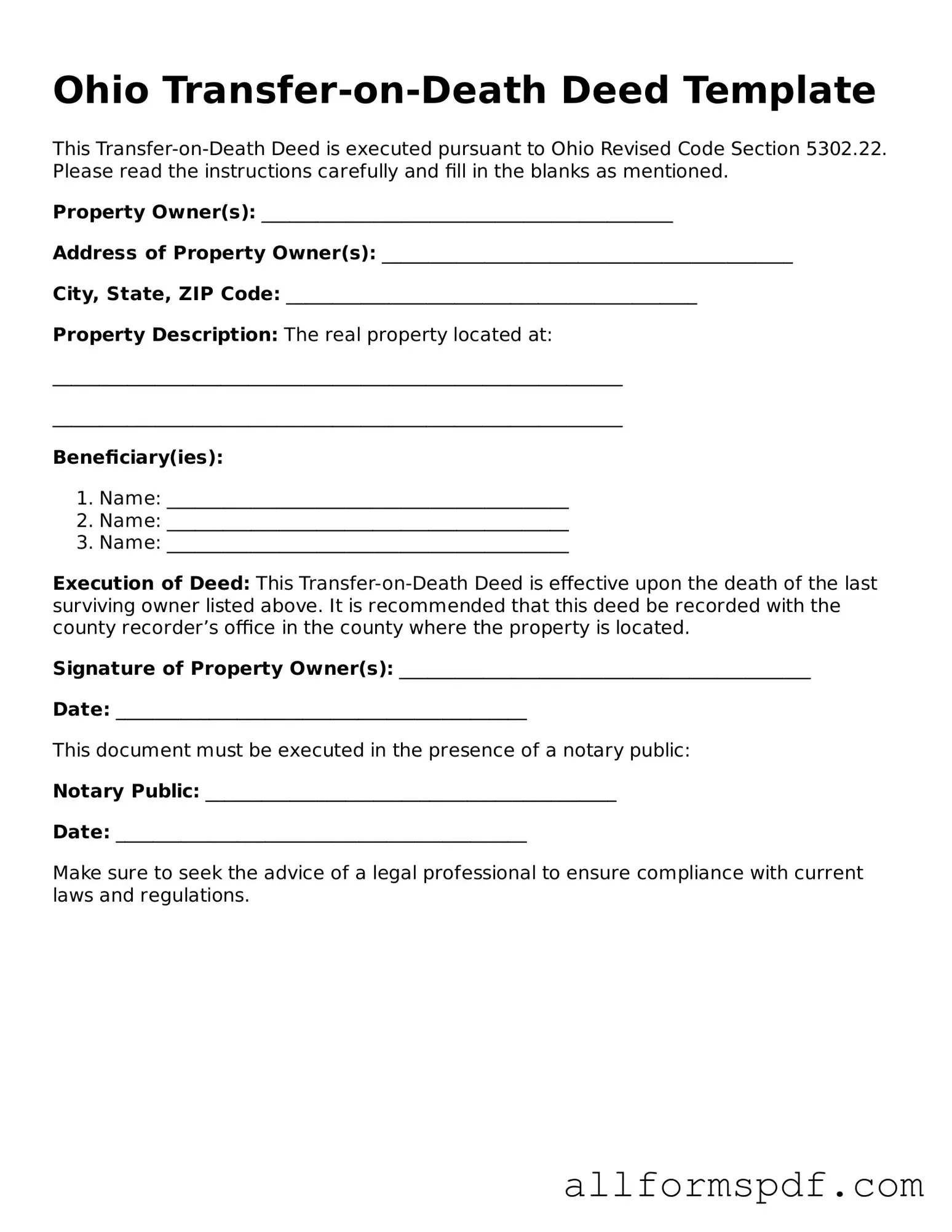

Fillable Transfer-on-Death Deed Form for Ohio

Ohio Transfer-on-Death Deed - Usage Guidelines

Filling out the Ohio Transfer-on-Death Deed form is an important step for ensuring that your property is transferred according to your wishes after your passing. Once you have completed the form, you will need to sign it in the presence of a notary public and then file it with the county recorder’s office where the property is located. This will make the deed effective and enforceable.

- Obtain the Ohio Transfer-on-Death Deed form. You can find it online or at your local county recorder's office.

- Fill in your name as the property owner in the designated section.

- Provide the address of the property you wish to transfer.

- Identify the beneficiaries who will receive the property after your death. Include their full names and addresses.

- Specify whether the transfer is to be made to all beneficiaries equally or if specific shares are designated.

- Include any additional instructions regarding the property transfer, if applicable.

- Sign the form in the presence of a notary public to ensure it is legally binding.

- File the completed and notarized form with the county recorder’s office in the county where the property is located.

Misconceptions

The Ohio Transfer-on-Death Deed (TOD) is a useful tool for transferring real estate upon death without going through probate. However, several misconceptions can lead to confusion about its use. Here are four common misconceptions:

- It automatically transfers property upon signing. Many people believe that simply signing a TOD deed means the property is immediately transferred to the beneficiary. In reality, the transfer only occurs upon the death of the property owner.

- It can be used for any type of property. Some individuals think that the TOD deed can apply to all kinds of property. However, it is specifically designed for real estate and cannot be used for personal property or bank accounts.

- Beneficiaries cannot be changed once named. There is a misconception that once you name a beneficiary on a TOD deed, you cannot change it. In fact, property owners can revoke or modify the deed at any time before their death, allowing them to change beneficiaries as needed.

- It eliminates the need for a will. Some believe that using a TOD deed means they do not need a will at all. While the TOD deed does allow for the direct transfer of real estate, it does not address other assets or provide guidance on other wishes, making a will still important for comprehensive estate planning.

Understanding these misconceptions can help property owners make informed decisions about their estate planning and ensure that their wishes are honored after their passing.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it is essential to follow specific guidelines to ensure the process goes smoothly. Below are five crucial dos and don'ts to keep in mind:

- Do ensure that you are the sole owner or have the authority to transfer the property.

- Do provide accurate and complete information about the property, including its legal description.

- Do sign the deed in the presence of a notary public to validate the document.

- Do keep a copy of the completed deed for your records after filing it with the county recorder.

- Do consult with a legal expert if you have questions about the implications of the transfer.

- Don't rush through the form; take your time to ensure all information is correct.

- Don't forget to check for any local regulations that may affect the transfer process.

- Don't leave out any required signatures, as this can invalidate the deed.

- Don't assume that the deed will automatically transfer ownership without proper filing.

- Don't neglect to inform your beneficiaries about the deed and its implications.

Popular State-specific Transfer-on-Death Deed Forms

Transfer on Death Instrument - Owners can also include conditions for the transfer in the deed.

In understanding the requirements for maintaining lawful driving privileges in Florida, it's important to note the significance of the FR44 Florida form, which certifies compliance with the state's financial responsibility laws. This form, issued by the Florida Department of Highway Safety and Motor Vehicles, must confirm that motorists carry the requisite vehicle liability insurance coverage of 100k/300k/50k. For more information on obtaining various official forms, you can visit All Florida Forms.

Problems With Transfer on Death Deeds - This is a popular estate planning tool that simplifies the transfer process for loved ones.

Common mistakes

When filling out the Ohio Transfer-on-Death Deed form, many individuals encounter common pitfalls that can lead to complications in the future. One of the most frequent mistakes is failing to include the legal description of the property. This description must be precise and can typically be found on the property deed. Omitting this information can create ambiguity and potentially invalidate the deed.

Another common error is not signing the form in front of a notary. In Ohio, the Transfer-on-Death Deed requires notarization to be legally binding. If the signature is not properly notarized, the document may not hold up in court, which can create significant issues for the intended beneficiaries.

People often forget to list all intended beneficiaries. When a property owner names a beneficiary, they should ensure that all individuals they wish to inherit the property are included. Leaving someone out can lead to disputes among family members and may complicate the transfer process.

Some individuals mistakenly assume that the Transfer-on-Death Deed automatically revokes any previous wills or estate plans. However, this is not the case. A Transfer-on-Death Deed operates independently of a will, so it is essential to review and update any existing estate planning documents to avoid conflicts.

Another mistake involves using outdated forms. The Ohio Secretary of State updates forms periodically, and using an old version may result in rejection by the county recorder's office. Always ensure that the most current form is being utilized to prevent unnecessary delays.

Failure to file the deed with the county recorder is a critical oversight. After completing the Transfer-on-Death Deed, it must be filed with the appropriate county office to be effective. Neglecting this step means that the deed will not be recognized, and the property may not transfer as intended.

Inaccurate information about the property owner can also pose problems. If the name on the deed does not match the owner’s legal name, it can create confusion and hinder the transfer process. Always double-check that names and details are correctly entered.

Some people overlook the importance of understanding how the deed affects taxes. While a Transfer-on-Death Deed allows for the transfer of property without probate, it does not exempt beneficiaries from property taxes. Understanding the tax implications is crucial for effective estate planning.

Additionally, individuals may not consider the implications of their current financial situation. If the property has liens or debts attached, these may not be resolved simply by creating a Transfer-on-Death Deed. It’s essential to address any financial obligations before transferring ownership.

Lastly, individuals sometimes forget to communicate their intentions with their beneficiaries. Clear communication can prevent misunderstandings and disputes later on. Discussing the details of the Transfer-on-Death Deed with family members can ensure that everyone is on the same page regarding the property transfer.

Key takeaways

Filling out and using the Ohio Transfer-on-Death Deed form can be straightforward if you keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: This deed allows you to transfer real estate to your beneficiaries without going through probate. It can simplify the process of passing on property after your death.

- Complete the Form Accurately: Ensure all required information is filled out correctly, including the names of the beneficiaries and a clear description of the property. Mistakes can lead to complications.

- Sign in Front of a Notary: The deed must be signed in the presence of a notary public. This step is crucial for the deed to be legally binding.

- File with the County Recorder: After signing, the deed needs to be filed with the county recorder’s office where the property is located. This step is necessary for the transfer to take effect.

By following these guidelines, you can ensure that your Transfer-on-Death Deed is properly executed and your wishes are honored.