Fillable Tractor Bill of Sale Form for Ohio

Ohio Tractor Bill of Sale - Usage Guidelines

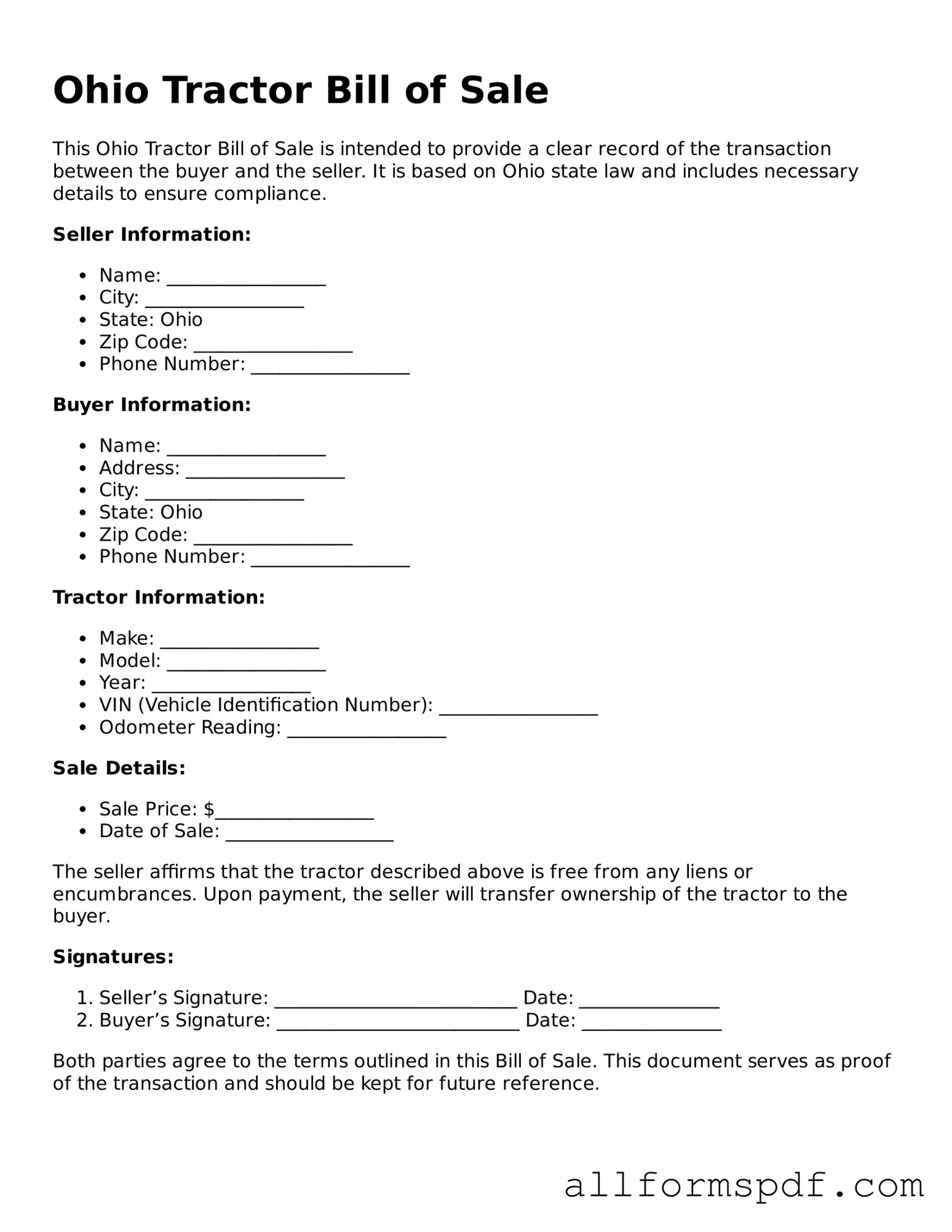

After obtaining the Ohio Tractor Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. This document serves as proof of the sale and includes essential details about the tractor and the parties involved. Follow these steps carefully to fill out the form correctly.

- Identify the Seller: Write the full name and address of the seller in the designated section.

- Identify the Buyer: Provide the full name and address of the buyer.

- Describe the Tractor: Fill in the tractor's make, model, year, and Vehicle Identification Number (VIN).

- Sale Price: Enter the agreed-upon sale price for the tractor.

- Date of Sale: Write the date when the sale is taking place.

- Signatures: Both the seller and buyer must sign the form to validate the transaction.

Once the form is completed and signed, both parties should retain a copy for their records. This document will be important for any future reference or legal purposes related to the transaction.

Misconceptions

The Ohio Tractor Bill of Sale form is an important document for the transfer of ownership of a tractor. However, several misconceptions exist regarding its use and requirements. Below are five common misconceptions explained.

- It is not necessary to have a Bill of Sale for a tractor in Ohio. Many people believe that a Bill of Sale is optional for tractor transactions. However, having a Bill of Sale is crucial for proving ownership and protecting both the buyer and seller in case of disputes.

- Only the seller needs to sign the Bill of Sale. Some individuals think that only the seller's signature is required. In reality, both the buyer and seller should sign the document to validate the transaction and ensure that both parties agree to the terms.

- The Bill of Sale must be notarized. There is a misconception that notarization is mandatory for the Bill of Sale to be valid. While notarization can add an extra layer of security, it is not a legal requirement in Ohio for this type of document.

- All tractors require the same Bill of Sale form. Many assume that one standard form can be used for all types of tractors. Different types of tractors may have specific requirements, so it is essential to use the correct form that corresponds to the type of tractor being sold.

- Once the Bill of Sale is signed, the transaction is complete. Some people think that signing the Bill of Sale finalizes the sale. However, the buyer should also ensure that the title is transferred and that all necessary registrations are updated to reflect the new ownership.

Dos and Don'ts

When filling out the Ohio Tractor Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do provide complete and accurate information about the tractor, including the make, model, and year.

- Don't leave any sections blank; all required fields must be filled out.

- Do include the Vehicle Identification Number (VIN) for proper identification.

- Don't use abbreviations or shorthand that could lead to confusion.

- Do sign and date the form to validate the transaction.

- Don't forget to have the buyer sign the form as well.

- Do keep a copy of the completed form for your records.

- Don't submit the form without verifying all details are correct.

- Do provide the purchase price clearly to avoid misunderstandings.

- Don't overlook any local requirements that may apply to the sale.

Following these guidelines will help ensure a smooth transaction and protect both the buyer and seller. Take your time and review the form carefully.

Popular State-specific Tractor Bill of Sale Forms

Do Tractors Have Titles in Texas - Buyers are encouraged to inspect the tractor before signing the bill.

For those navigating the complexities of insurance requirements in Florida, it is essential to understand the intricacies of the FR44 Florida form. This official document serves to validate that a motorist adheres to the required vehicle liability insurance limits set by the state. To clarify and assist with obtaining necessary forms, you can visit All Florida Forms for more information on the FR44 and other related documentation.

Common mistakes

Filling out the Ohio Tractor Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is not providing complete information about the tractor being sold. Buyers and sellers should ensure that all relevant details, such as the make, model, year, and Vehicle Identification Number (VIN), are accurately recorded. Missing or incorrect information can create confusion and may even affect the registration process.

Another mistake often made is failing to include the correct sale price. It's essential to document the agreed-upon price clearly. Some individuals may overlook this detail or write an ambiguous amount. This omission can lead to disputes between the buyer and seller or issues with tax authorities, who rely on the sale price for tax calculations.

Not signing the form is another common oversight. Both the buyer and seller must sign the Bill of Sale to validate the transaction. Without signatures, the document may not hold up as proof of sale in case of future disputes. It’s advisable to double-check that all required signatures are present before finalizing the sale.

People also sometimes forget to date the form. Including the date of the transaction is crucial for establishing when the sale occurred. This date can be important for legal purposes, such as determining ownership and liability. A missing date could lead to complications if questions arise later about the timing of the sale.

Lastly, not keeping a copy of the completed Bill of Sale is a mistake that can have serious consequences. After filling out the form, both parties should retain a copy for their records. This document serves as proof of the transaction and can be vital if any issues arise in the future. Keeping a copy ensures that both parties have access to the details of the sale, protecting their interests.

Key takeaways

When filling out and using the Ohio Tractor Bill of Sale form, there are several important points to keep in mind. Here are some key takeaways:

- Understand the Purpose: The bill of sale serves as a legal document that records the transfer of ownership of a tractor from the seller to the buyer.

- Gather Necessary Information: Collect all relevant details, including the names and addresses of both the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN).

- Be Accurate: Ensure that all information is filled out accurately. Mistakes can lead to complications in the transfer process.

- Include Sale Price: Clearly state the sale price of the tractor. This amount may be important for tax purposes.

- Signatures Required: Both the buyer and seller must sign the document. This signature confirms that both parties agree to the terms of the sale.

- Keep Copies: Make sure to keep a copy of the completed bill of sale for your records. This can be useful for future reference or in case of disputes.

- Check Local Regulations: Be aware of any additional requirements or regulations that may apply in your specific county or municipality in Ohio.

By following these guidelines, you can ensure a smooth transaction when buying or selling a tractor in Ohio.