Fillable Promissory Note Form for Ohio

Ohio Promissory Note - Usage Guidelines

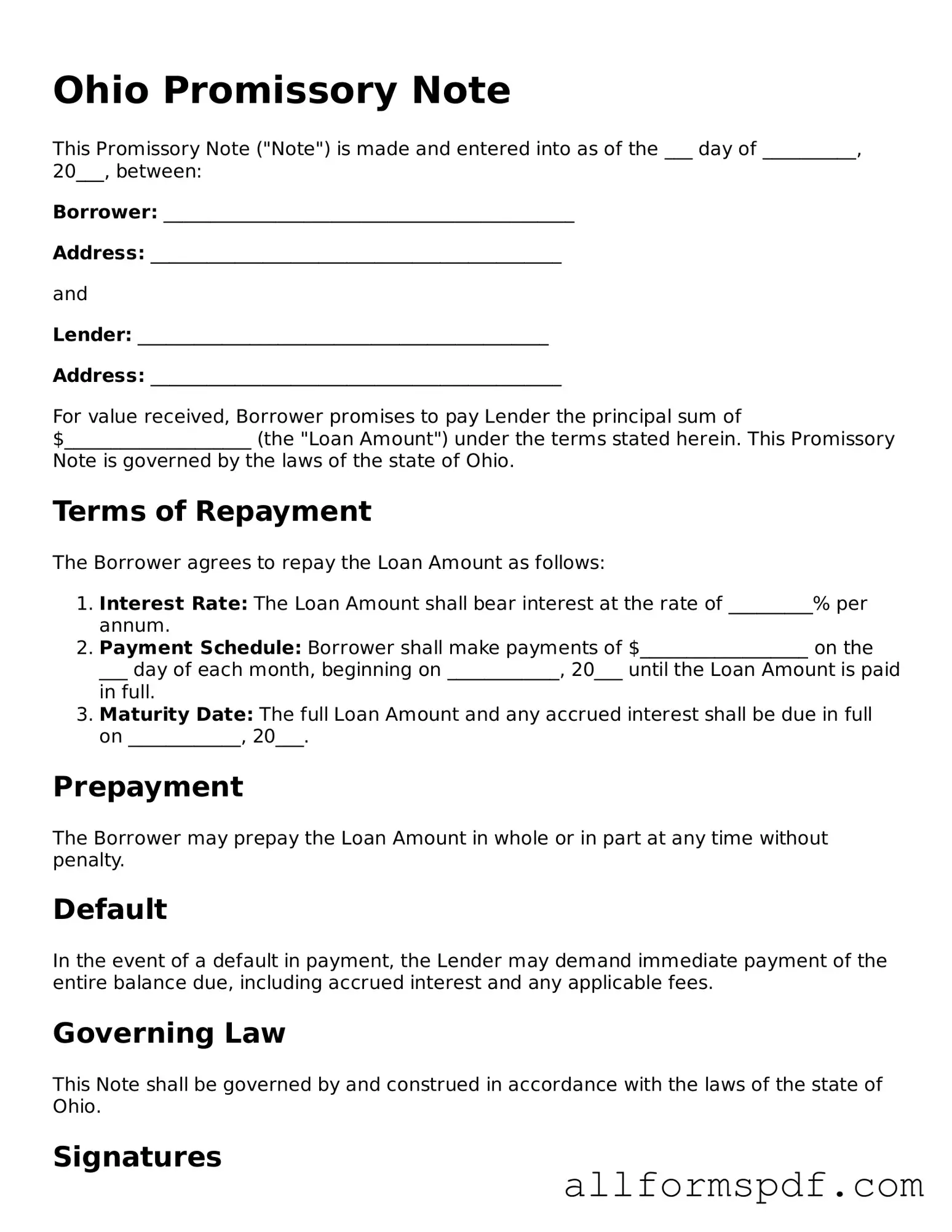

Once you have the Ohio Promissory Note form in hand, you will need to provide specific information to ensure it is filled out correctly. This document will require details about the borrower, the lender, and the terms of the loan. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. This date should reflect when the note is being created.

- Fill in the name and address of the borrower. This is the person or entity receiving the loan.

- Next, provide the name and address of the lender. This is the individual or organization providing the funds.

- Specify the principal amount of the loan. This is the total amount being borrowed.

- Indicate the interest rate, if applicable. Be clear about whether this is a fixed or variable rate.

- Outline the repayment terms. Include how often payments are due (e.g., monthly, quarterly) and the duration of the loan.

- If there are any late fees or penalties for missed payments, detail those terms in the appropriate section.

- Sign and date the document at the bottom. Both the borrower and lender should sign to acknowledge the agreement.

- Make copies of the completed form for both parties for their records.

Misconceptions

Understanding the Ohio Promissory Note form can be challenging. Here are five common misconceptions about it:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- Only Banks Can Use Promissory Notes: Some think that only banks or financial institutions can issue promissory notes. However, individuals can create and use them for personal loans as well.

- A Promissory Note Must Be Notarized: There is a common belief that a promissory note must be notarized to be valid. While notarization can provide additional legal protection, it is not a requirement for the note to be enforceable.

- Verbal Agreements are Enough: Some believe that a verbal agreement is sufficient for a loan. However, having a written promissory note is crucial for clarity and legal enforcement.

- Promissory Notes are Only for Large Loans: Many people think that promissory notes are only necessary for large amounts of money. In fact, they can be used for any loan amount, regardless of size.

By understanding these misconceptions, individuals can better navigate the use of promissory notes in Ohio.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it is essential to approach the task with care and attention to detail. Here are five important dos and don’ts to keep in mind:

- Do read the instructions carefully before starting. Understanding the requirements will help you avoid mistakes.

- Do provide accurate information. Ensure that all names, dates, and amounts are correct to avoid future disputes.

- Do sign and date the form. Your signature is crucial for the document to be legally binding.

- Don't leave any sections blank. If a section does not apply, indicate that clearly, rather than omitting it.

- Don't use unclear language. Be straightforward and precise in your wording to prevent ambiguity.

Popular State-specific Promissory Note Forms

Simple Promissory Note Template - The note may include a grace period, allowing the borrower additional time for payment without penalty.

Promissory Note Template Georgia - The lender can take legal action if the borrower defaults on the note.

Understanding the importance of a New York Mobile Home Bill of Sale form is essential for both buyers and sellers, as it solidifies the legal transfer of ownership while documenting the details of the transaction. For those looking to obtain this vital document, resources such as smarttemplates.net/fillable-new-york-mobile-home-bill-of-sale can be invaluable in ensuring all necessary information is captured correctly.

Promissory Note Template Illinois - Both parties can negotiate terms before finalizing the promissory note.

Common mistakes

Filling out the Ohio Promissory Note form can seem straightforward, but many individuals encounter common pitfalls that can lead to complications down the line. One frequent mistake is not including the correct names of the parties involved. It is essential to ensure that both the borrower and lender are accurately identified. Any discrepancies can create confusion and potentially invalidate the note.

Another common error is failing to specify the loan amount clearly. Writing the amount in both numerical and written form is crucial. If a borrower writes “$5,000” but spells it out as “five thousand dollars,” and there is a discrepancy, it could lead to disputes. Clarity in this area is vital to avoid misunderstandings.

Dates are another area where mistakes often occur. People sometimes forget to include the date the note is signed or the date when payments are due. This omission can lead to confusion regarding the timeline of the loan, affecting both parties’ expectations and obligations.

Many individuals also overlook the importance of detailing the interest rate. Whether the loan is interest-free or carries a specific rate, this information must be clearly stated. A vague or missing interest rate can lead to misinterpretations about the cost of the loan over time.

Payment terms should be clearly outlined, yet they often are not. Some people write vague terms, such as “monthly payments” without specifying the amount or the duration. Clear, detailed payment instructions help prevent misunderstandings and ensure that both parties are on the same page.

Another mistake is neglecting to include a late fee clause. If a borrower fails to make a payment on time, having a specified late fee can provide clarity and protect the lender's interests. Without this clause, there may be confusion about the consequences of late payments.

Signatures are critical, yet some individuals forget to sign the document altogether. Both the borrower and lender must sign the note for it to be legally binding. Additionally, not having witnesses or a notary when required can also render the document ineffective.

People often fail to keep a copy of the signed Promissory Note. This oversight can create difficulties if disputes arise later. Keeping a record ensures that both parties have access to the same information and can refer back to the original agreement.

Lastly, individuals may not seek legal advice before finalizing the note. While it may seem unnecessary, consulting with a legal professional can help identify potential issues and ensure that the document meets all necessary legal requirements. This step can save both parties time and money in the long run.

Key takeaways

When filling out and using the Ohio Promissory Note form, keep the following key takeaways in mind:

- Ensure that all parties involved are clearly identified. This includes the borrower and the lender. Providing full names and addresses helps avoid confusion.

- Specify the loan amount and the interest rate, if applicable. Clearly stating these details prevents misunderstandings about the terms of the loan.

- Include repayment terms. Outline when payments are due and the method of payment. This clarity helps both parties understand their obligations.

- Consider having the document notarized. While not always required, notarization can provide an extra layer of protection and authenticity to the agreement.