Fillable Operating Agreement Form for Ohio

Ohio Operating Agreement - Usage Guidelines

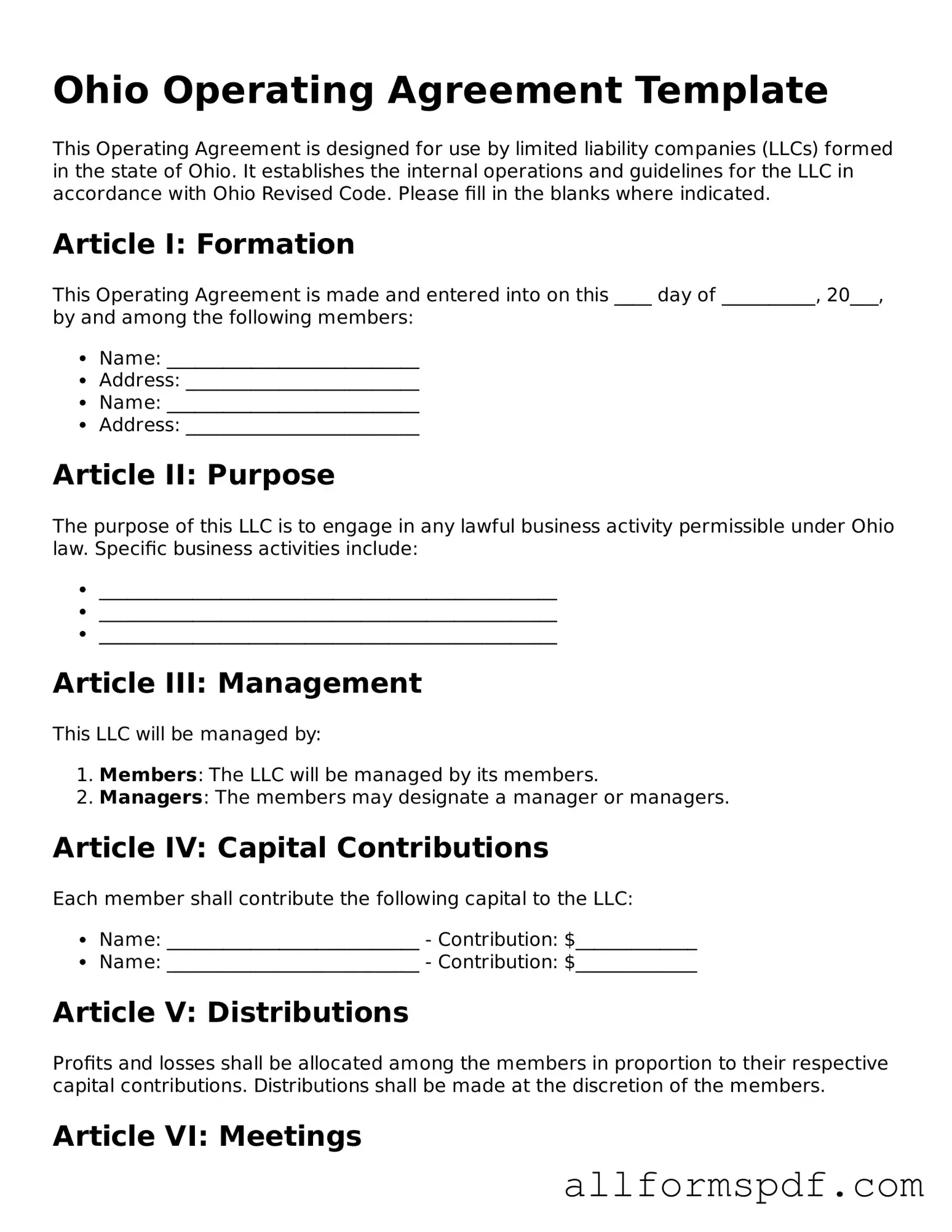

Completing the Ohio Operating Agreement form is an important step in establishing the framework for your business. This document will outline the management structure and operational procedures of your company. Once you have filled it out, you can move forward with your business operations, ensuring clarity and organization among members.

- Begin by downloading the Ohio Operating Agreement form from a reliable source.

- Fill in the name of your LLC at the top of the form. Ensure it matches the name registered with the state.

- List the principal address of your LLC. This should be a physical address, not a P.O. Box.

- Identify the members of the LLC. Include their names and addresses. If there are multiple members, make sure to provide information for each one.

- Specify the management structure. Decide whether the LLC will be member-managed or manager-managed and indicate this on the form.

- Outline the contributions of each member. This includes cash, property, or services provided to the LLC.

- Detail how profits and losses will be distributed among members. Be clear about percentages or amounts.

- Include provisions for adding or removing members in the future. This ensures flexibility as your business grows.

- Review the agreement for accuracy. Make sure all information is correct and reflects the intentions of the members.

- Have all members sign the agreement. This formalizes the document and makes it legally binding.

Misconceptions

Understanding the Ohio Operating Agreement form is crucial for anyone involved in a business partnership or limited liability company (LLC). However, several misconceptions can lead to confusion. Here are five common myths about the Ohio Operating Agreement:

- It's not necessary if you have a verbal agreement. Many believe that a verbal agreement is sufficient for managing a business. However, having a written operating agreement is essential. It clarifies roles, responsibilities, and procedures, reducing the likelihood of disputes.

- All members must sign the agreement for it to be valid. While it’s best practice for all members to sign, an operating agreement can still be valid even if not everyone signs it. The key is that it reflects the understanding and intentions of the members involved.

- The state of Ohio requires a specific format. Some people think there’s a one-size-fits-all template mandated by the state. In reality, Ohio does not impose a strict format. The agreement should include essential elements, but it can be tailored to fit the unique needs of the business.

- Once it's created, it never needs to be updated. This misconception can lead to problems down the road. An operating agreement should be revisited and updated regularly, especially when there are changes in membership, business structure, or laws affecting the LLC.

- It only addresses financial matters. Many assume the operating agreement is solely about finances. In truth, it covers a wide range of topics, including management roles, decision-making processes, and procedures for adding or removing members.

Being aware of these misconceptions can help ensure that your business is set up for success. A well-crafted operating agreement is a vital tool for any LLC, providing clarity and protection for all members involved.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do read the form thoroughly before starting. Understanding each section will help you provide the necessary information.

- Do include all members' names and addresses. This ensures that everyone involved is properly documented.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejections.

- Don't use vague language. Be clear and specific in your descriptions to avoid misunderstandings.

Popular State-specific Operating Agreement Forms

Operating Agreement Llc New Jersey - It can help attract investors by demonstrating sound governance.

In the realm of estate planning, the Florida Last Will and Testament form is indispensable for individuals seeking to secure their legacy. This document not only clarifies the distribution of assets and guardianship arrangements but also ensures that personal wishes are upheld. For those looking to create or update their will, resources such as All Florida Forms can provide essential guidance and templates to facilitate the process effectively.

Operating Agreement Llc Nc Template - This document helps establish the purpose and goals of the LLC.

Common mistakes

When filling out the Ohio Operating Agreement form, many individuals encounter common pitfalls that can lead to complications down the line. One frequent mistake is failing to clearly define the roles and responsibilities of each member. Without this clarity, misunderstandings may arise, causing friction among members and potentially jeopardizing the business's success.

Another common error involves neglecting to outline the management structure of the LLC. This section is crucial as it determines how decisions will be made and who has the authority to make them. If this is not specified, it can lead to confusion and disputes, particularly when important decisions need to be made.

Additionally, some people overlook the importance of including a provision for profit and loss distribution. This section should detail how profits and losses will be shared among members. Omitting this information can lead to disagreements later, especially if the business becomes profitable.

It’s also essential to address the procedures for adding new members or removing existing ones. Many individuals forget to include these provisions, which can create challenges if the membership needs to change. A clear process ensures that all members understand how changes will be handled and helps maintain harmony within the group.

Another mistake is failing to update the Operating Agreement as the business evolves. As circumstances change, the agreement should reflect those changes. Ignoring this can result in outdated information that no longer aligns with the business's current operations.

Finally, many individuals do not seek legal advice or review the agreement with a professional. While it might seem straightforward, having a knowledgeable person review the document can help identify potential issues and ensure that the agreement complies with Ohio law. Taking this step can save time and trouble in the future.

Key takeaways

When it comes to filling out and utilizing the Ohio Operating Agreement form, several key points can enhance your understanding and ensure that the document serves its intended purpose effectively.

- Understanding the Purpose: The Operating Agreement outlines the management structure and operational procedures of your LLC. It serves as a foundational document that guides how the business will be run.

- Member Roles: Clearly define the roles and responsibilities of each member involved in the LLC. This clarity helps prevent misunderstandings and conflicts down the line.

- Profit Distribution: Specify how profits and losses will be distributed among members. This aspect is crucial for financial planning and member satisfaction.

- Decision-Making Process: Establish a decision-making framework. Whether decisions require a majority vote or unanimous consent, outlining this process is essential for smooth operations.

- Amendments: Include a procedure for making changes to the Operating Agreement. This flexibility allows the LLC to adapt to evolving business needs.

- Dispute Resolution: Consider incorporating a method for resolving disputes among members. Having a plan in place can save time and reduce tension in challenging situations.

- Compliance with State Laws: Ensure that the Operating Agreement complies with Ohio state laws. This compliance is vital for the legality and enforceability of the document.

By focusing on these aspects, you can create a comprehensive Operating Agreement that not only meets legal requirements but also fosters a positive working relationship among LLC members.