Fillable Motor Vehicle Bill of Sale Form for Ohio

Ohio Motor Vehicle Bill of Sale - Usage Guidelines

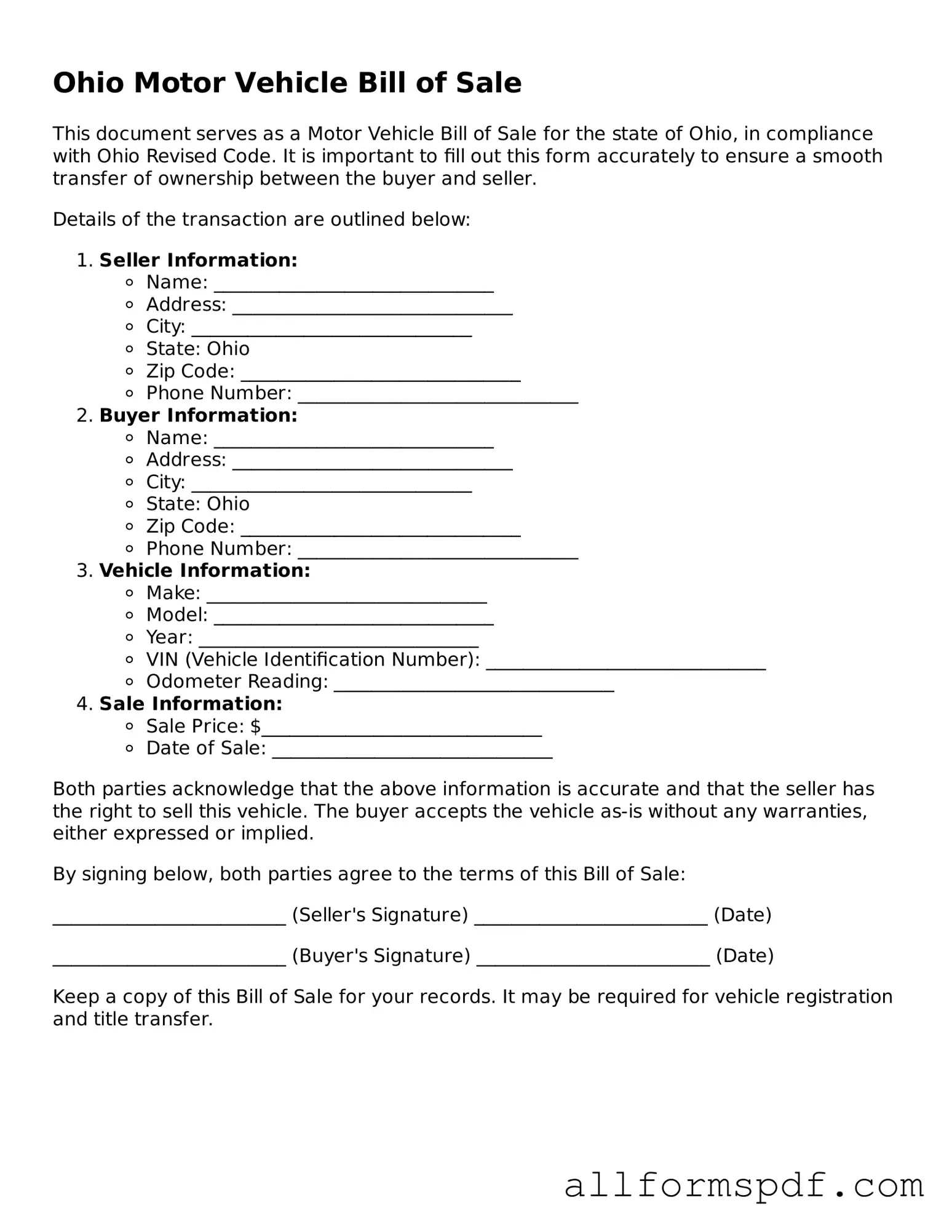

After obtaining the Ohio Motor Vehicle Bill of Sale form, you will need to complete it accurately to ensure a smooth transfer of ownership. This document serves as proof of the transaction between the buyer and seller. Following the steps below will help you fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Next, provide the seller's full name and address. Make sure to include the street address, city, state, and zip code.

- Then, fill in the buyer's full name and address in the designated area, including all necessary details similar to the seller's information.

- In the section for vehicle information, enter the make, model, year, and vehicle identification number (VIN) of the vehicle being sold.

- Indicate the odometer reading at the time of sale. This should reflect the mileage on the vehicle.

- Specify the sale price of the vehicle in the appropriate space. Ensure that this amount is clear and accurate.

- Both the seller and buyer must sign and date the form at the bottom. Signatures should be legible to avoid any confusion later.

Once the form is completed, it’s advisable for both parties to retain a copy for their records. This will serve as a reference in case any questions arise regarding the sale in the future.

Misconceptions

Understanding the Ohio Motor Vehicle Bill of Sale form is crucial for both buyers and sellers in vehicle transactions. However, several misconceptions often arise. Here are four common misunderstandings:

- Misconception 1: A Bill of Sale is not necessary for vehicle transactions.

- Misconception 2: The Bill of Sale must be notarized.

- Misconception 3: The Bill of Sale is only for private sales.

- Misconception 4: The Bill of Sale does not need to include vehicle identification details.

Many people believe that a Bill of Sale is optional. In reality, this document serves as a legal record of the transaction, providing proof of ownership transfer. It can be crucial for registration and tax purposes.

Some individuals think that notarization is a requirement for the Bill of Sale to be valid. While notarization can add an extra layer of authenticity, it is not legally required in Ohio for the Bill of Sale to be effective.

There is a belief that this document is only necessary for private transactions. However, whether buying from a dealer or a private seller, having a Bill of Sale is beneficial and often recommended for record-keeping.

Some may think that basic information is sufficient. In fact, including specific details such as the Vehicle Identification Number (VIN), make, model, and year is essential for clarity and to avoid future disputes.

Dos and Don'ts

When filling out the Ohio Motor Vehicle Bill of Sale form, it’s important to follow specific guidelines to ensure the document is valid and clear. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the vehicle, including the VIN, make, model, and year.

- Do include the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly to avoid any confusion.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any sections blank; fill out all required fields completely.

- Don't use white-out or make alterations to the form after it has been signed.

- Don't forget to check for any local requirements that may need to be included.

- Don't rush through the process; take your time to ensure everything is accurate.

Popular State-specific Motor Vehicle Bill of Sale Forms

T-7 Bill of Sale - Standardizes the vehicle selling process across different states.

A Bill of Sale is a crucial legal document that signifies the transfer of ownership between two parties, primarily for goods or personal property. This form typically includes essential details of the transaction, such as the item description, purchase price, and the names of the buyer and seller. For those looking to simplify the process, you can access a customizable template at PDF Documents Hub, which will assist in creating a comprehensive Bill of Sale form.

Truck Bill of Sale Form - The Motor Vehicle Bill of Sale can include information about the payment method, such as cash or a check.

Nc Dmv Title Lookup - Sellers can use it to provide proof that they have sold the vehicle.

Common mistakes

When filling out the Ohio Motor Vehicle Bill of Sale form, accuracy is crucial. One common mistake is failing to include the correct vehicle identification number (VIN). The VIN is unique to each vehicle and serves as its fingerprint. Omitting or miswriting this number can lead to confusion and potential legal issues down the line.

Another frequent error involves incorrect odometer readings. Sellers must accurately report the mileage at the time of sale. An incorrect reading can raise suspicions of fraud and may result in penalties. Always double-check the odometer before completing the form.

People often forget to date the form. A missing date can complicate the transfer of ownership. It is essential to indicate when the sale took place to establish a clear timeline for both parties involved.

Not including the seller's and buyer's full names and addresses is another mistake. This information is necessary for proper identification and can prevent disputes. Ensure that both parties’ details are clearly stated and accurate.

Another common oversight is neglecting to sign the document. Both the seller and the buyer must sign the Bill of Sale for it to be valid. Without signatures, the form lacks legal standing, which can create problems later on.

Some individuals fail to provide a complete description of the vehicle. This includes the make, model, year, and color. A vague description can lead to misunderstandings about the vehicle being sold. Providing detailed information helps clarify the transaction.

People sometimes overlook the importance of including the purchase price. This figure is crucial for tax purposes and for establishing the value of the transaction. Be sure to write down the agreed-upon price clearly.

Another mistake is not keeping a copy of the completed Bill of Sale. Both the buyer and seller should retain a copy for their records. This document serves as proof of the transaction and can be important for future reference.

Some sellers may not understand the implications of selling a vehicle "as-is." If this is the case, it should be clearly stated on the form. Failing to do so can lead to misunderstandings about warranties or guarantees.

Lastly, individuals may not be aware of additional state requirements. Ohio may have specific regulations that need to be followed when transferring ownership. It’s essential to research and comply with all relevant laws to ensure a smooth transaction.

Key takeaways

When filling out and using the Ohio Motor Vehicle Bill of Sale form, it's essential to keep several key points in mind to ensure a smooth transaction.

- Accurate Information: Provide complete and accurate details about the vehicle, including the VIN, make, model, year, and odometer reading. This information is critical for both the buyer and seller.

- Seller and Buyer Details: Include full names and addresses of both the seller and buyer. This helps in establishing clear ownership and contact information.

- Signatures Required: Both parties must sign the document. This signature confirms the agreement and the transfer of ownership.

- Record Keeping: Keep a copy of the completed Bill of Sale for your records. This document serves as proof of the transaction and can be important for future reference.