Fillable Mobile Home Bill of Sale Form for Ohio

Ohio Mobile Home Bill of Sale - Usage Guidelines

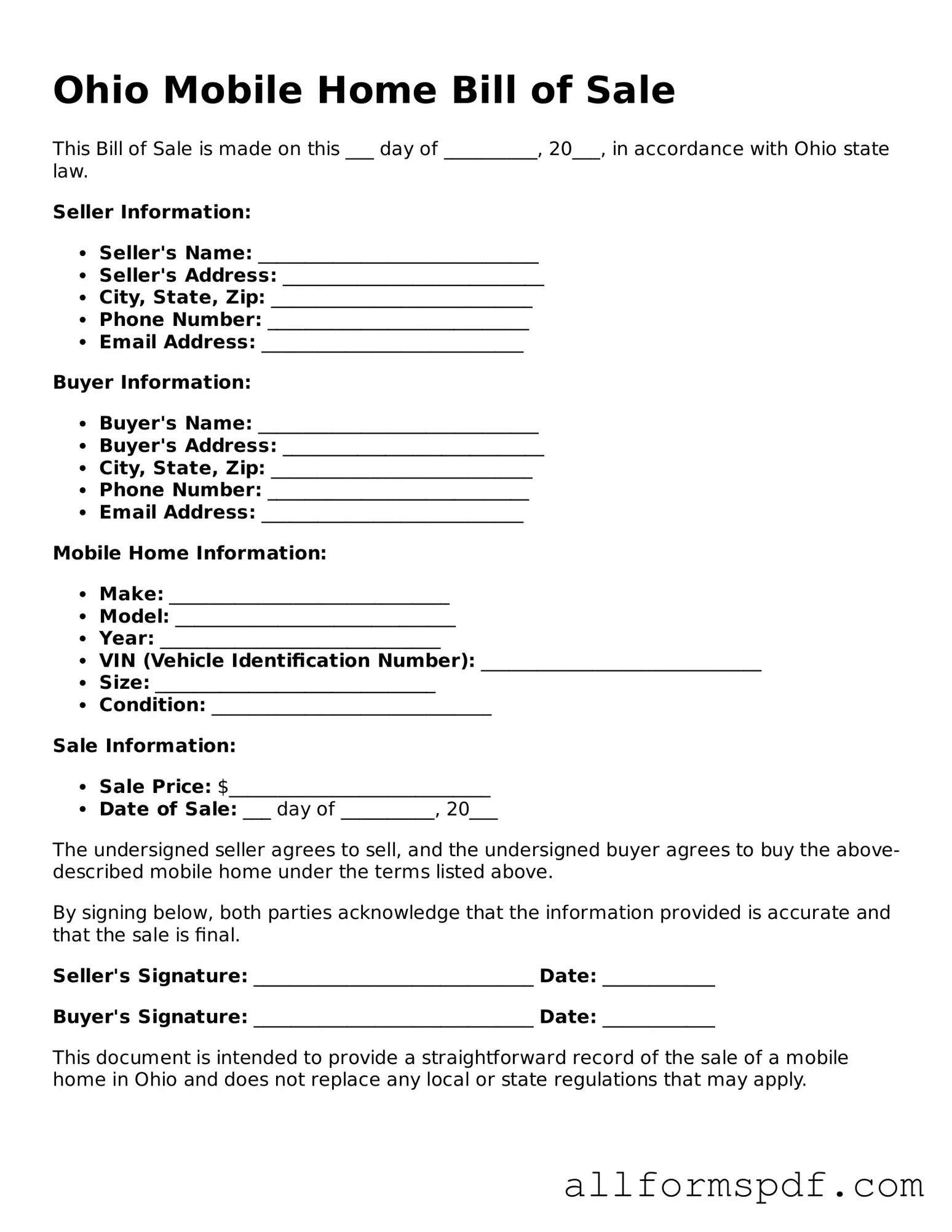

Once you have the Ohio Mobile Home Bill of Sale form in front of you, it's time to fill it out. This document will help you officially transfer ownership of a mobile home from one party to another. Follow these steps to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Next, fill in the seller's name and address. Make sure to provide complete information.

- Then, enter the buyer's name and address in the designated section.

- Provide a detailed description of the mobile home. Include the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the mobile home in the appropriate field.

- Both the seller and buyer should sign and date the form at the bottom.

- If applicable, have a witness sign the document as well.

After completing the form, keep a copy for your records. The buyer will need this document for registration and title transfer purposes. Make sure all parties involved retain their copies for future reference.

Misconceptions

The Ohio Mobile Home Bill of Sale form is an important document for anyone buying or selling a mobile home in Ohio. However, there are several misconceptions surrounding this form. Below is a list of common misunderstandings:

- It is not legally required. Some people believe that a Bill of Sale is optional. In reality, having a Bill of Sale is crucial for proving ownership and ensuring a smooth transfer of the mobile home.

- Any form can be used. Many think that any generic Bill of Sale can suffice. However, using the specific Ohio Mobile Home Bill of Sale form is recommended to meet state requirements.

- It does not need to be notarized. Some assume that notarization is unnecessary. In fact, notarizing the document can add an extra layer of security and validation.

- It only applies to used mobile homes. There is a misconception that the form is only for used mobile homes. In truth, it is applicable for both new and used mobile home transactions.

- It can be completed after the sale. Many people think they can fill out the Bill of Sale after the transaction. It is best to complete the form at the time of sale to ensure all details are accurate and agreed upon.

- Only the seller needs to sign. Some believe that only the seller's signature is required. However, both the buyer and seller should sign the document to validate the transaction.

- It is not necessary for gifting a mobile home. There is a misconception that a Bill of Sale is not needed for gifts. Even in gift situations, having a Bill of Sale can help clarify ownership transfer.

- It does not require a description of the mobile home. Some think that a simple statement of sale suffices. In reality, the form should include detailed information about the mobile home, such as make, model, and VIN.

- Once signed, it cannot be changed. Many believe that the document is set in stone once signed. However, it can be amended if both parties agree to the changes.

- It is not needed for transactions involving a loan. Some think that if a loan is involved, a Bill of Sale is unnecessary. This is incorrect; a Bill of Sale is still important to document the transfer of ownership.

Understanding these misconceptions can help ensure that the process of buying or selling a mobile home in Ohio goes smoothly and legally.

Dos and Don'ts

When filling out the Ohio Mobile Home Bill of Sale form, it's important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do provide accurate information about the mobile home, including the make, model, and VIN.

- Do ensure that both the buyer and seller sign the document to validate the transaction.

- Do include the sale price and date of sale to establish clear terms.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields to avoid confusion.

- Don't use outdated forms; always use the most current version available.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to check local regulations that may apply to the sale of mobile homes.

Popular State-specific Mobile Home Bill of Sale Forms

Bill of Sale for Mobile Home - Guarantees the proper documentation of a mobile home sale.

Using a Power of Attorney form is vital for individuals who wish to appoint someone to act on their behalf in various situations. This document grants authority, ensuring that decisions regarding finances, healthcare, or legal matters are managed effectively. For Arizona residents seeking to understand this process better, our resource on how to complete the form is indispensable: understanding the Power of Attorney requirements.

Mobile Home Bill of Sale Template - This form can help avoid potential conflicts by formally outlining the sale's details.

Mobile Home Registration - This form enables sellers to officially document how and when the mobile home was sold.

Common mistakes

Filling out the Ohio Mobile Home Bill of Sale form can seem straightforward, but many people make common mistakes that can lead to complications later on. One of the most frequent errors is failing to include accurate information about the mobile home itself. Details such as the make, model, year, and vehicle identification number (VIN) are essential. Omitting any of this information can cause confusion and may even affect the transfer of ownership.

Another mistake often made is not providing the correct names and addresses of both the buyer and the seller. It’s crucial to ensure that all parties are correctly identified. If a name is misspelled or an address is incorrect, it can create legal issues down the line, especially if disputes arise regarding the sale.

Some individuals neglect to include the sale price of the mobile home. This detail is important not only for record-keeping but also for tax purposes. Leaving this section blank can lead to misunderstandings about the transaction and may raise questions from tax authorities.

Additionally, failing to sign and date the form is a common oversight. Both the buyer and the seller must sign the document to make it legally binding. Without these signatures, the sale may not be recognized, leaving both parties vulnerable to potential disputes.

Many people also forget to check the form for completeness before submitting it. It’s easy to overlook a blank space or a missing signature, but these small details can have significant consequences. Double-checking the entire document can prevent future headaches.

Another mistake is not providing a bill of sale copy to the buyer. After the form is completed and signed, it’s essential to give a copy to the buyer for their records. This serves as proof of the transaction and protects both parties in case of any future disputes.

Lastly, some individuals do not keep a copy of the completed form for themselves. Retaining a personal copy is important for record-keeping and can be helpful if any questions arise later. Keeping thorough documentation can save time and trouble in the future.

Key takeaways

When filling out and using the Ohio Mobile Home Bill of Sale form, consider the following key takeaways:

- The form serves as a legal document to transfer ownership of a mobile home from one party to another.

- Ensure that all parties involved are clearly identified, including full names and addresses.

- Accurate details about the mobile home, such as the make, model, year, and vehicle identification number (VIN), must be provided.

- The purchase price should be clearly stated to avoid any confusion regarding the transaction.

- Both the seller and buyer should sign and date the document to validate the agreement.

- Consider having the signatures notarized to enhance the document's credibility.

- Retain a copy of the completed form for personal records after the transaction is finalized.

- The form may need to be submitted to the local county auditor or title office for proper registration.

- Review state laws and regulations regarding mobile home sales to ensure compliance.