Fillable Last Will and Testament Form for Ohio

Ohio Last Will and Testament - Usage Guidelines

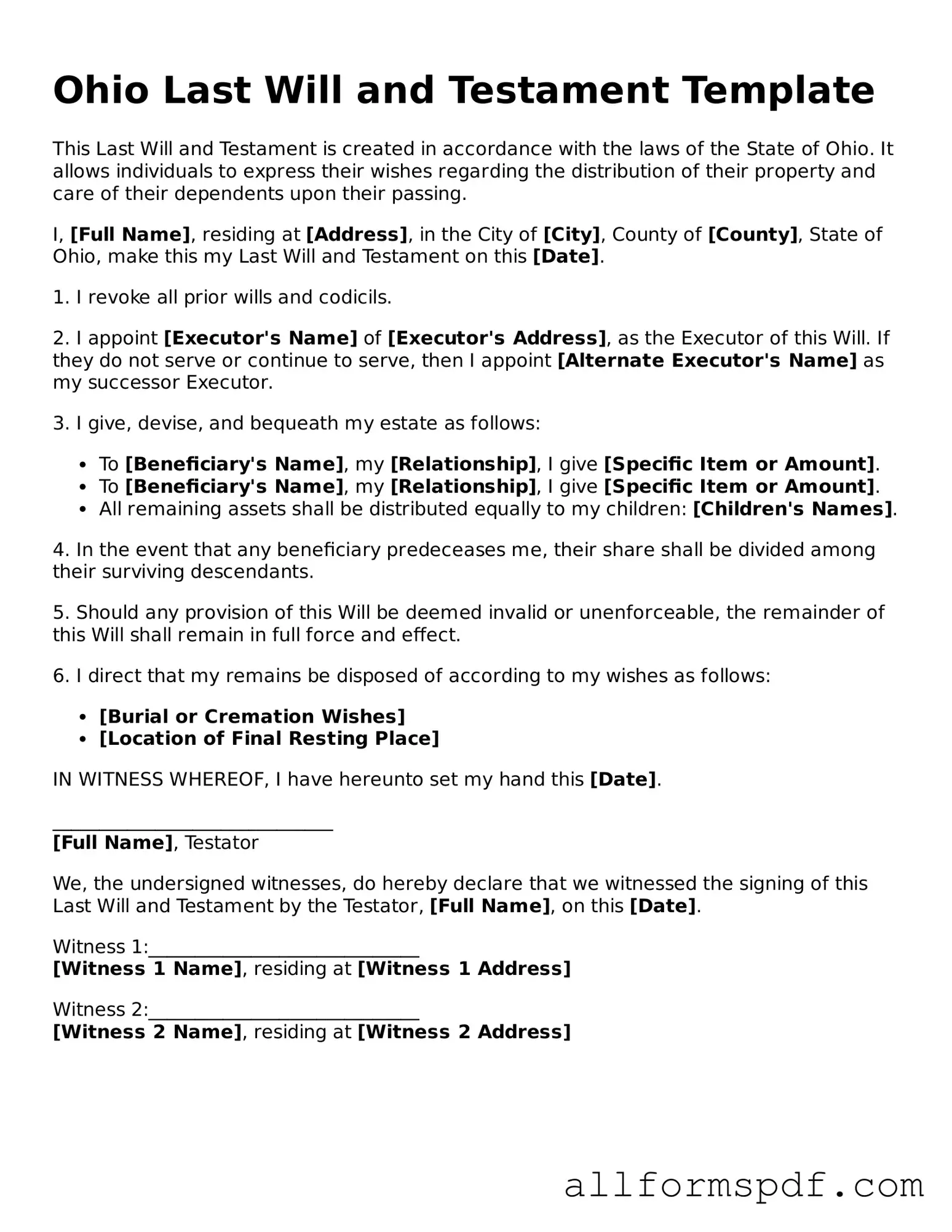

Completing the Ohio Last Will and Testament form is an important step in ensuring that your wishes are honored after your passing. Once you have filled out the form, you will need to sign it in the presence of witnesses and possibly have it notarized, depending on your specific circumstances.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your marital status. Indicate whether you are single, married, or divorced.

- Identify your children, if any, by listing their names and ages. If you have no children, indicate that clearly.

- Designate an executor for your will. This person will be responsible for carrying out your wishes. Include their full name and contact information.

- Outline how you want your assets distributed. Be specific about who receives what, whether it’s money, property, or personal belongings.

- If you have any specific wishes regarding guardianship for minor children, include that information in this section.

- Review the form for accuracy. Ensure all information is correct and complete.

- Sign the form in the presence of at least two witnesses. Make sure they also sign the document, acknowledging they witnessed your signature.

- Consider having the will notarized for added legal protection, although it is not always required.

Misconceptions

Understanding the Ohio Last Will and Testament can be tricky, especially with various misconceptions floating around. Here are nine common misunderstandings:

- Only wealthy people need a will. Many believe that wills are only necessary for those with significant assets. However, everyone can benefit from having a will, regardless of their financial situation. A will ensures that your wishes are followed and your loved ones are taken care of.

- Wills are only for the elderly. It’s a common belief that only older individuals need to prepare a will. In reality, life is unpredictable, and anyone over the age of 18 should consider creating one to protect their interests.

- Handwritten wills are not valid. Some people think that only formally typed wills are acceptable. In Ohio, handwritten wills, known as holographic wills, can be valid if they meet certain criteria, such as being signed by the testator.

- Once a will is made, it cannot be changed. Many assume that a will is set in stone once it’s created. In fact, you can update or revoke your will at any time, as long as you follow the proper legal procedures.

- All assets automatically go to the spouse. A common misconception is that a surviving spouse will inherit everything. Depending on how assets are titled and the presence of a will, this may not be true. It’s essential to specify your wishes in your will.

- Wills avoid probate. Some believe that having a will means their estate will bypass probate. However, wills must typically go through the probate process, which is the legal procedure for distributing assets after death.

- Only a lawyer can create a valid will. While it’s advisable to consult with a lawyer for complex estates, individuals can create a valid will on their own using Ohio’s statutory form, provided they adhere to the state's requirements.

- Witnesses are not necessary. Some think that a will can be valid without witnesses. In Ohio, having at least two witnesses sign the will is crucial for its validity, ensuring that the document is legitimate.

- All debts are forgiven upon death. It’s a misconception that debts disappear when someone passes away. In reality, the deceased's debts must be settled from their estate before any assets can be distributed to heirs.

Clearing up these misconceptions can help individuals make informed decisions about their estate planning in Ohio.

Dos and Don'ts

When filling out the Ohio Last Will and Testament form, it is essential to approach the process with care and attention to detail. Here are four important dos and don'ts to keep in mind:

- Do: Clearly state your intentions regarding the distribution of your assets.

- Do: Include the full names and addresses of your beneficiaries.

- Don't: Use vague language that could lead to confusion or misinterpretation.

- Don't: Forget to sign the document in the presence of witnesses, as required by Ohio law.

Popular State-specific Last Will and Testament Forms

New Jersey Last Will and Testament Pdf - A legal document outlining how a person's assets will be distributed after their death.

Wills in Georgia - Can be updated as your circumstances or relationships change over time.

For those in Arizona needing to delegate authority effectively, understanding the role of a Power of Attorney can be pivotal in managing responsibilities. This document provides robust legal backing for your chosen representative to act on your behalf, ensuring that crucial decisions are made according to your preferences. To learn more about this important form, you can refer to our guide on the essential aspects of the Power of Attorney process and its implementation.

Free Michigan Will Forms to Print - Facilitates the emotional process for families by reducing uncertainty.

Common mistakes

Creating a Last Will and Testament is an important step in ensuring your wishes are honored after your passing. However, many people make mistakes while filling out the Ohio form, which can lead to complications down the line. Here are ten common errors to avoid.

One significant mistake is failing to date the will. Without a date, it can be challenging to determine which version of the will is the most current. This oversight can lead to disputes among heirs, as they may not know if an older will or the new one should be followed.

Another frequent error is neglecting to sign the will in front of witnesses. In Ohio, the law requires that you have at least two witnesses present when you sign your will. If this step is skipped, the will may not be considered valid.

People often forget to include a residuary clause. This clause outlines what happens to any assets not specifically mentioned in the will. Without it, those assets may be distributed according to state law, which may not align with your wishes.

Some individuals make the mistake of not being specific about their beneficiaries. Vague language can lead to confusion. For example, stating “my children” without naming them can create disputes if there are stepchildren or adopted children involved.

Another common issue is failing to update the will after major life events. Changes such as marriage, divorce, or the birth of a child should prompt a review and possible revision of your will. Neglecting to do so may result in unintended consequences.

People sometimes overlook the importance of naming an executor. This person will be responsible for carrying out your wishes, so it’s crucial to choose someone trustworthy and capable. Failing to name an executor can lead to delays and confusion in the probate process.

Using outdated forms is another mistake. Laws change, and so do the requirements for a valid will. Always ensure you are using the most current version of the Ohio Last Will and Testament form to avoid legal issues.

Some individuals mistakenly believe they can create a will without legal guidance. While it is possible to fill out the form on your own, consulting with a legal professional can help ensure that your will meets all legal requirements and accurately reflects your wishes.

Another error is not considering tax implications. Some assets may be subject to estate taxes, and failing to plan for this can reduce the inheritance your beneficiaries receive. Understanding these implications can help you make informed decisions.

Finally, neglecting to store the will in a safe place is a common mistake. If the will is lost or destroyed, it may be difficult or impossible to enforce your wishes. Consider a safe deposit box or a secure location at home to keep your will accessible yet protected.

Key takeaways

When filling out and using the Ohio Last Will and Testament form, keep these key takeaways in mind:

- Clear Identification: Ensure you clearly identify yourself and your beneficiaries. Include full names and addresses to avoid confusion.

- Executor Appointment: Designate an executor who will carry out your wishes. Choose someone you trust to manage your estate responsibly.

- Signatures Required: Your will must be signed by you in the presence of at least two witnesses. Their signatures are essential for the will to be valid.

- Revocation of Previous Wills: Clearly state that this will revokes any prior wills. This helps prevent any disputes regarding older documents.

- Storage and Accessibility: Store your will in a safe place, but ensure that your executor knows where to find it. Accessibility is crucial for executing your wishes.