Fillable Durable Power of Attorney Form for Ohio

Ohio Durable Power of Attorney - Usage Guidelines

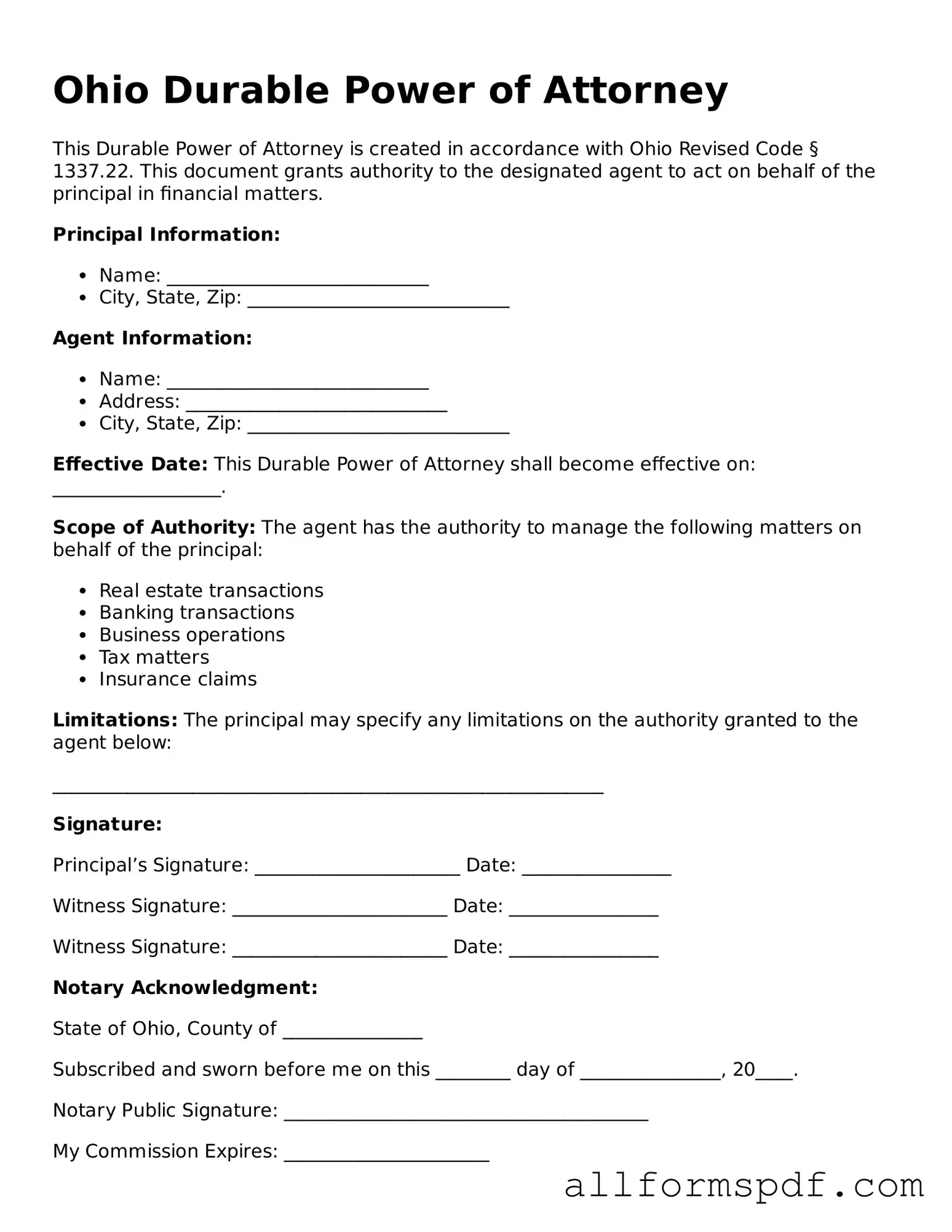

Filling out the Ohio Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. This document requires careful attention to detail. Below are the steps to complete the form correctly.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or at legal offices.

- Read the instructions carefully to understand the requirements.

- Fill in your full name and address at the top of the form.

- Identify the person you are appointing as your attorney-in-fact. Include their full name and address.

- Specify the powers you are granting. You can choose general powers or limit them to specific tasks.

- Include the date the power of attorney becomes effective. This can be immediate or upon a specific event.

- Sign the form in the designated area. Your signature must be dated.

- Have your signature witnessed by at least one person who is not related to you or your attorney-in-fact.

- Consider having the document notarized for added legal validity.

- Keep a copy of the completed form for your records and provide a copy to your attorney-in-fact.

Misconceptions

Understanding the Ohio Durable Power of Attorney form is essential for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: A Durable Power of Attorney gives unlimited power to the agent.

- Misconception 3: The Durable Power of Attorney becomes invalid upon the principal's incapacity.

- Misconception 4: A Durable Power of Attorney can only be used for financial matters.

This is not true. Anyone, regardless of age, can benefit from having a Durable Power of Attorney. It is particularly useful for individuals who may become incapacitated due to illness or injury at any age.

While the agent does have significant authority, the powers granted can be limited based on the principal's wishes. The document can specify which powers the agent has, ensuring control over important decisions.

This is incorrect. The "durable" aspect means that the authority continues even if the principal becomes incapacitated. This is one of the key benefits of this type of power of attorney.

While many people associate it with financial decisions, a Durable Power of Attorney can also cover healthcare decisions. This allows the agent to make medical choices on behalf of the principal if they are unable to do so.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it is important to approach the process with care. Here are some essential dos and don'ts to consider:

- Do read the entire form carefully before filling it out to ensure you understand all sections.

- Do provide accurate and complete information about yourself and the person you are appointing as your agent.

- Do sign and date the form in the presence of a notary public to ensure its validity.

- Do keep a copy of the completed form for your records and provide a copy to your agent.

- Don't rush through the process; take your time to make informed decisions.

- Don't leave any sections blank, as this may lead to confusion or invalidation of the form.

- Don't hesitate to seek assistance if you have questions about the form or the implications of your choices.

Popular State-specific Durable Power of Attorney Forms

Power of Attorney New Jersey - It's important to review and update the form regularly to reflect your current wishes.

When engaging in the sale of a vehicle in Florida, it's important to have the necessary documentation to ensure a smooth transaction. The Florida Motor Vehicle Bill of Sale form is an essential tool that not only records the details of the sale but also protects both parties involved. For a comprehensive understanding and easy access to this important document, you can visit All Florida Forms, where you'll find the form ready for use.

Durable Power of Attorney Illinois - Insurance companies and banks may require this form for access.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in Ohio can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to specify the powers granted to the agent. Without clear instructions, the agent may not understand their authority, which can create confusion during critical situations.

Another mistake involves not signing the form correctly. In Ohio, the principal must sign the DPOA in the presence of a notary public. If this step is overlooked, the document may not be legally valid. Additionally, some individuals forget to date the form. A lack of a date can raise questions about when the powers were granted, potentially complicating matters when the document is needed.

People often neglect to choose an alternate agent. If the primary agent is unable or unwilling to act, having a backup ensures that the principal’s wishes can still be honored. Failing to do so can lead to delays and complications in decision-making.

Another common oversight is not discussing the DPOA with the chosen agent. It is essential for the agent to understand their responsibilities and the principal’s wishes. Without this conversation, the agent may be unprepared for the role they are expected to fulfill.

Some individuals also make the mistake of using outdated forms. Laws can change, and it is important to use the most current version of the DPOA form to ensure compliance with Ohio law. Using an old form can lead to invalidation of the document.

Moreover, people sometimes fail to consider the scope of the powers they are granting. A DPOA can be general or limited, and it is crucial to clearly define what decisions the agent can make on behalf of the principal. Ambiguity can lead to disputes among family members or other interested parties.

Another issue arises when individuals forget to inform relevant institutions about the DPOA. Banks, healthcare providers, and other entities may need a copy of the document to recognize the agent’s authority. Without proper notification, the agent may face obstacles when trying to act on behalf of the principal.

Lastly, some may underestimate the importance of regular reviews of the DPOA. Life circumstances can change, and it is wise to revisit the document periodically to ensure it still reflects the principal's wishes. Failing to do so can result in outdated decisions that no longer align with the principal's current situation.

Key takeaways

Understanding the purpose of a Durable Power of Attorney (DPOA) is essential. This document allows you to appoint someone to make decisions on your behalf if you become unable to do so.

Choose your agent wisely. Your agent should be someone you trust completely, as they will have significant authority over your financial and legal matters.

Be clear about the powers you are granting. The DPOA can be tailored to suit your needs, whether you want to give broad powers or limit them to specific tasks.

Ensure the document is signed and dated. In Ohio, your DPOA must be signed by you and, in most cases, witnessed by at least one person or notarized.

Keep copies of the DPOA in accessible places. Make sure your agent and any relevant financial institutions have copies so they can act on your behalf when needed.

Review the document periodically. Life changes, such as moving, changes in relationships, or health issues, may necessitate updates to your DPOA.

Understand that the DPOA remains effective even if you become incapacitated. This is what makes it “durable.” However, you can revoke it at any time while you are still competent.