Fillable Deed in Lieu of Foreclosure Form for Ohio

Ohio Deed in Lieu of Foreclosure - Usage Guidelines

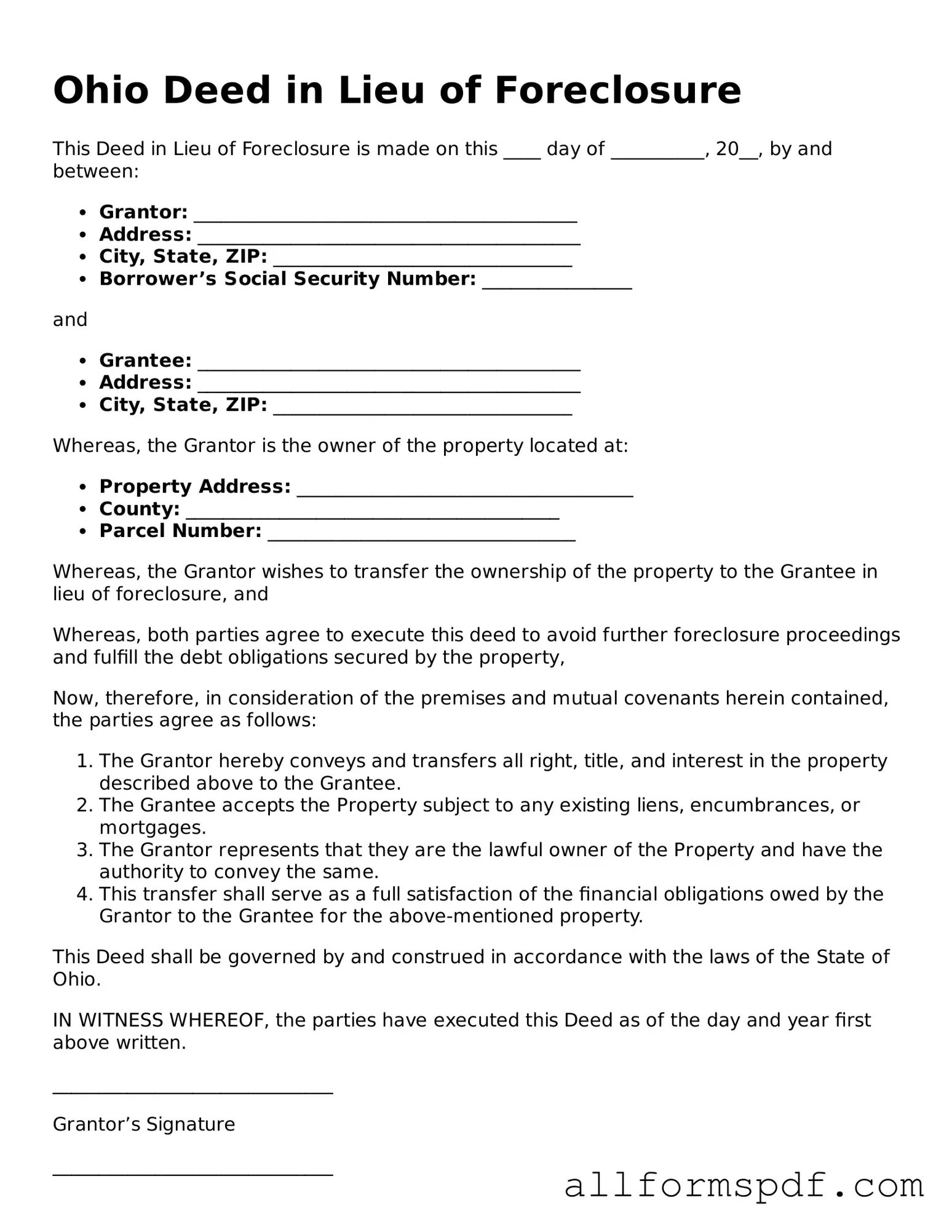

Once you have decided to proceed with the Deed in Lieu of Foreclosure, it’s essential to fill out the form accurately to ensure a smooth process. This document will be submitted to the lender, transferring ownership of the property back to them. Follow these steps to complete the form correctly.

- Obtain the Form: Download the Ohio Deed in Lieu of Foreclosure form from a reliable source or request it from your lender.

- Fill in the Grantor Information: Enter your full name and address as the current property owner. If there are multiple owners, include all names.

- Provide Grantee Information: Write the name of the lender or financial institution receiving the property. Include their address as well.

- Describe the Property: Clearly state the property address, including city, county, and zip code. If applicable, include the legal description of the property.

- Indicate the Consideration: This section usually states "for no consideration" since you are transferring the property to avoid foreclosure.

- Sign the Document: As the grantor, sign the form in the designated area. If there are multiple owners, all must sign.

- Notarize the Form: Take the completed form to a notary public. They will verify your identity and witness your signature.

- Submit the Form: Send the notarized form to your lender. Keep a copy for your records.

After submitting the form, the lender will process the deed. They may contact you for any additional information or documentation. Be prepared to follow up as needed to ensure everything is finalized smoothly.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure form can be challenging. Many people hold misconceptions about this legal process. Here are eight common misunderstandings:

- It eliminates all debts associated with the property. A deed in lieu of foreclosure only addresses the mortgage debt. Other debts, such as property taxes or homeowner association fees, may still be owed.

- It is a quick and easy solution. While it can be faster than a traditional foreclosure, the process still requires negotiation with the lender and can take time to finalize.

- It allows the homeowner to stay in the property. Once the deed is transferred to the lender, the homeowner must vacate the property. This is not a means to avoid moving out.

- All lenders accept a deed in lieu of foreclosure. Not every lender will agree to this option. Some may prefer to proceed with foreclosure instead.

- It has no impact on credit scores. A deed in lieu of foreclosure will still negatively affect a homeowner's credit score, though it may be less damaging than a full foreclosure.

- It is only available to those in financial distress. While many who pursue this option are struggling, it can also be used by homeowners looking to simplify their financial situation.

- It absolves the homeowner of all liability. In some cases, lenders may still pursue a deficiency judgment for the remaining balance on the mortgage after the deed is transferred.

- It is the same as a short sale. A deed in lieu of foreclosure involves transferring ownership to the lender, while a short sale requires selling the property for less than what is owed on the mortgage.

Being informed about these misconceptions can help homeowners make better decisions regarding their financial situations and the options available to them.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here are some important dos and don’ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and legal descriptions.

- Do consult with a legal professional if you have any questions or concerns about the form.

- Do keep copies of all documents for your records after submission.

- Do sign the form in the presence of a notary public to ensure its validity.

- Do submit the form to the appropriate county recorder's office promptly.

- Don’t leave any sections blank. Incomplete forms may be rejected or cause delays.

- Don’t rush through the process. Take your time to review each detail carefully.

- Don’t forget to notify your lender about your intention to file the deed.

- Don’t ignore any legal obligations or requirements that may apply to your situation.

- Don’t assume that the deed will automatically relieve you of all debts. Understand your financial obligations fully.

Popular State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Homeowners must provide clear title to the property, meaning no outside claims should exist.

To facilitate a smooth transaction, it's important to understand the role of the Arizona Motor Vehicle Bill of Sale in the buying and selling process. This document provides necessary details that safeguard both parties involved, making it an indispensable part of vehicle ownership transfer.

Georgia Foreclosure Laws - Borrowers often find this path to be more respectful and less confrontational than a foreclosure battle.

Common mistakes

Filling out the Ohio Deed in Lieu of Foreclosure form can be a complex process, and mistakes can lead to delays or complications. One common mistake is not including all necessary parties. When multiple individuals are involved in the property, all owners must sign the form. Omitting someone can invalidate the deed.

Another frequent error is failing to provide accurate property information. This includes the legal description of the property. An incomplete or incorrect description can create confusion and may result in the deed being rejected.

People often overlook the requirement for notarization. The deed must be signed in front of a notary public. Without this crucial step, the document may not be legally binding, which can cause significant issues down the line.

Some individuals forget to check for any outstanding liens on the property. If there are existing liens, the deed in lieu may not be accepted. It’s essential to resolve these issues before proceeding with the form.

Another mistake involves not understanding the implications of signing the deed. Some people may not realize that by signing, they are giving up their rights to the property. It's important to fully understand what this means before moving forward.

Additionally, failing to communicate with the lender can lead to problems. It’s crucial to inform the lender of the intention to execute a deed in lieu. Clear communication can help avoid misunderstandings and ensure a smoother process.

People sometimes neglect to provide a valid reason for the deed in lieu. Lenders often require an explanation for why the borrower is unable to continue making payments. Providing this context can help facilitate the process.

In some cases, individuals do not keep copies of the completed form. It's important to retain a copy for personal records. This can serve as proof of the transaction and may be needed for future reference.

Another mistake is not considering tax implications. A deed in lieu of foreclosure can have tax consequences. Consulting with a tax professional before signing can help avoid unexpected financial burdens.

Finally, many fail to seek legal advice. Navigating the complexities of a deed in lieu can be daunting. Consulting with a legal expert can provide clarity and ensure that all aspects of the process are handled correctly.

Key takeaways

Filling out and using the Ohio Deed in Lieu of Foreclosure form is an important process for homeowners facing foreclosure. Here are some key takeaways to keep in mind:

- Understand the Purpose: A deed in lieu of foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure proceedings.

- Eligibility Criteria: Ensure you meet the lender's requirements. This often includes being unable to make mortgage payments and having no other liens on the property.

- Consult Legal Counsel: It is advisable to seek legal advice before proceeding. An attorney can help you understand the implications and ensure your rights are protected.

- Prepare Necessary Documentation: Gather all relevant documents, including the mortgage agreement and any correspondence with the lender.

- Complete the Form Accurately: Fill out the deed in lieu form carefully. Any mistakes or omissions can delay the process or lead to complications.

- Submit to the Lender: After completing the form, submit it to your lender along with any required documents. Keep copies for your records.

- Understand Consequences: Be aware that a deed in lieu may impact your credit score and may have tax implications. It is essential to understand these before proceeding.

By keeping these points in mind, homeowners can navigate the process more effectively and make informed decisions regarding their financial future.