Fillable Articles of Incorporation Form for Ohio

Ohio Articles of Incorporation - Usage Guidelines

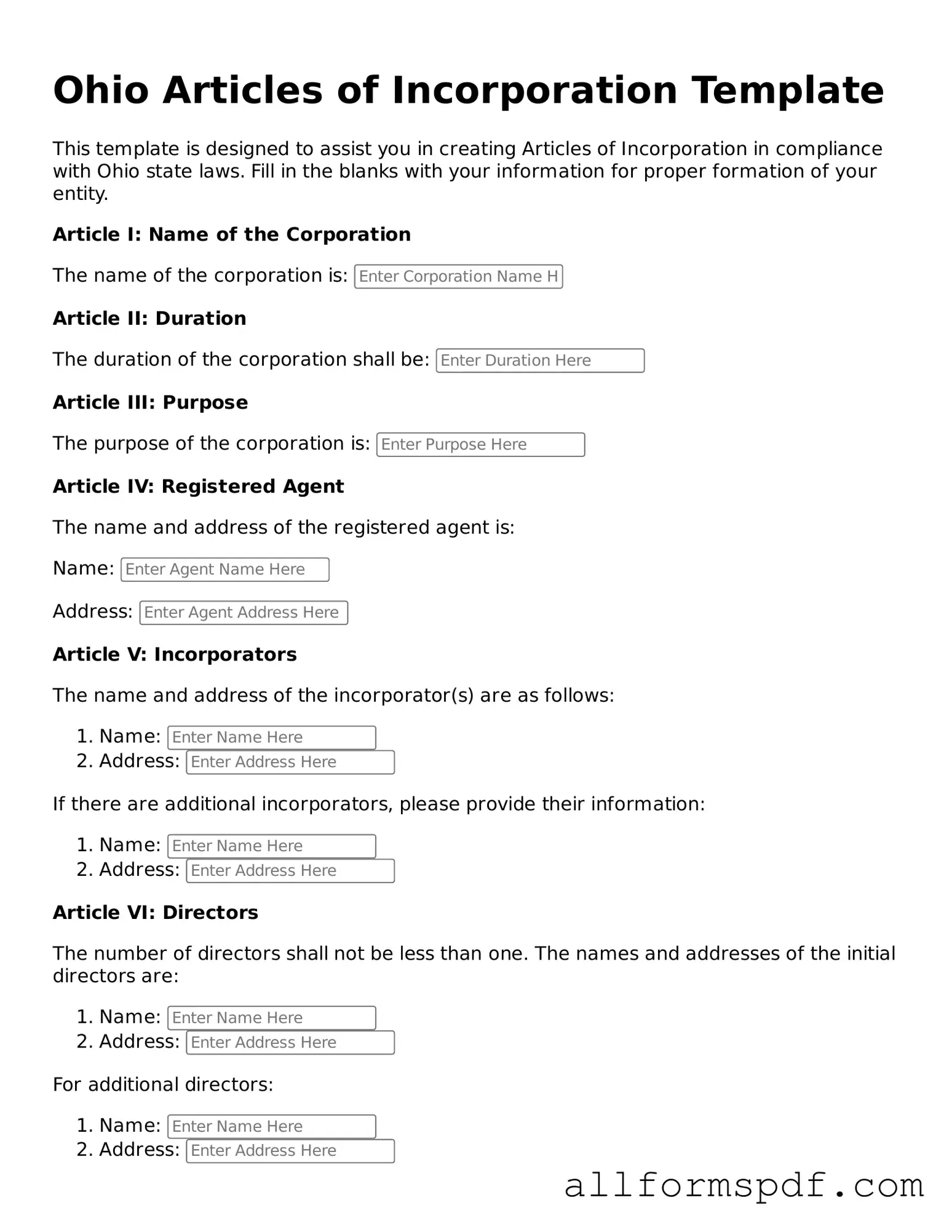

Once you have gathered the necessary information, you are ready to fill out the Ohio Articles of Incorporation form. This document is essential for officially establishing your corporation in Ohio. After completing the form, you will need to submit it to the appropriate state office along with the required filing fee.

- Obtain the Form: Download the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or request a physical copy.

- Provide the Corporation Name: Enter the desired name of your corporation. Make sure it complies with Ohio naming requirements and is not already in use.

- List the Principal Office Address: Fill in the street address of the corporation's main office. Include the city, state, and zip code.

- Specify the Purpose: Clearly state the purpose of your corporation. This can be a brief description of the business activities you plan to conduct.

- Identify the Registered Agent: Provide the name and address of the registered agent. This person or business will receive legal documents on behalf of the corporation.

- Include the Incorporator Information: Fill in the name and address of the individual or entity responsible for filing the Articles of Incorporation.

- Indicate the Duration: Specify whether the corporation will exist indefinitely or for a specific period.

- Sign and Date the Form: The incorporator must sign and date the form, confirming that the information provided is accurate.

- Prepare for Submission: Make copies of the completed form for your records. Include the filing fee, which can vary, and check the payment methods accepted.

- Submit the Form: Send the completed Articles of Incorporation to the Ohio Secretary of State’s office either by mail or online, depending on your preference.

Misconceptions

Understanding the Ohio Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion and missteps. Here are ten common misconceptions, along with clarifications to help navigate this important process.

- Filing the Articles is the only step to forming a corporation. Many believe that submitting the Articles of Incorporation is sufficient for creating a corporation. In reality, additional steps such as obtaining an Employer Identification Number (EIN) and complying with state and federal regulations are also necessary.

- Anyone can file the Articles of Incorporation. While it is true that individuals can file the form, it is often advisable to seek legal guidance. An attorney can help ensure that the form is filled out correctly and that all necessary provisions are included.

- The Articles of Incorporation must be notarized. Contrary to popular belief, notarization is not a requirement for the Ohio Articles of Incorporation. The form can be submitted without a notary's signature, simplifying the process.

- All corporations must include a specific purpose in the Articles. Some think that a detailed purpose statement is mandatory. However, Ohio allows for a general purpose statement, which can simplify the filing process.

- Filing fees are the same for all types of corporations. Many assume that the filing fees are uniform across all corporation types. In fact, fees can vary depending on whether one is forming a for-profit or nonprofit corporation.

- Once filed, the Articles of Incorporation cannot be changed. There is a belief that the Articles are set in stone once submitted. However, amendments can be made later to update information or change corporate structure, though this requires a formal process.

- All states have the same requirements for Articles of Incorporation. Some people think that the process is uniform across the United States. In truth, each state has its own specific rules and requirements, making it crucial to understand Ohio's particular guidelines.

- Only large businesses need to file Articles of Incorporation. A common misconception is that only large companies need to incorporate. In reality, even small businesses or sole proprietorships may benefit from incorporation, as it provides liability protection and other advantages.

- The Articles of Incorporation are the same as the corporate bylaws. There is often confusion between these two documents. The Articles of Incorporation establish the existence of the corporation, while the bylaws govern its internal management and operations.

- Filing the Articles guarantees business success. Some entrepreneurs believe that completing the form will ensure their business thrives. While incorporation provides a legal structure, success depends on various factors, including market research, business planning, and effective management.

By addressing these misconceptions, individuals can approach the process of forming a corporation in Ohio with greater confidence and clarity. Understanding the nuances of the Articles of Incorporation is a crucial step toward building a successful business.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it’s important to be thorough and accurate. Here are some guidelines to follow:

- Do ensure that all required information is provided, including the name of the corporation, its purpose, and the registered agent's details.

- Do double-check the spelling of names and addresses to avoid any errors that could delay processing.

- Do sign and date the form to validate your submission.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't use abbreviations or informal names that could confuse the reviewing agency.

- Don't forget to include the filing fee, as submissions without payment will not be processed.

- Don't submit the form without reviewing it for accuracy and completeness.

Popular State-specific Articles of Incorporation Forms

Llc Articles of Organization Nj - It is essential for the Articles to align with the business's overall strategic goals.

For individuals seeking to navigate the complexities of legal documentation, understanding the nuances of the Power of Attorney process is essential. This allows the principal to hand over decision-making authority to a trusted agent. If you're ready to take control of your legal rights, start by reviewing the necessary guidelines to complete your Arizona Power of Attorney form.

How to Get a Copy of Your Articles of Incorporation - Defines the rights of shareholders.

Common mistakes

Filing the Ohio Articles of Incorporation is a crucial step for anyone looking to establish a corporation in the state. However, there are common mistakes that can lead to delays or complications in the incorporation process. Understanding these pitfalls can save time and ensure a smoother experience.

One frequent error is the omission of required information. Each section of the form must be completed accurately. For instance, failing to provide the correct name of the corporation can result in rejection. The name must be unique and not similar to existing corporations, which requires a thorough search before submission.

Another mistake often made is not including the purpose of the corporation. While it may seem straightforward, the purpose must be clearly defined. A vague or overly broad description can lead to questions from the state and may require additional clarification, prolonging the process.

Many people also overlook the necessity of listing the registered agent. The registered agent is responsible for receiving legal documents on behalf of the corporation. If this information is missing or incorrect, it could lead to significant legal issues down the line. It is essential to ensure that the agent’s name and address are current and accurate.

Additionally, some individuals fail to provide the correct number of shares that the corporation is authorized to issue. This detail is critical, as it determines ownership structure and can affect investment opportunities. It is advisable to consult with a knowledgeable individual when deciding on the number of shares to issue.

Another common error is neglecting to sign the form. A lack of signature can result in the rejection of the application. It is important to ensure that the form is signed by the appropriate individuals, typically the incorporators, to validate the submission.

People often forget to include the filing fee with their application. Each submission requires a fee, and failing to include this payment can delay the processing time significantly. It is advisable to check the current fee schedule and ensure that the payment method is acceptable to the state.

In some cases, individuals may not provide a valid mailing address for the corporation. This address is essential for official correspondence from the state. If the address is incorrect or not provided, important documents may not reach the corporation, leading to potential legal issues.

Lastly, many individuals do not take the time to review the completed form before submission. Simple typographical errors or inconsistencies can lead to complications. A thorough review can catch these mistakes, ensuring that the form is filled out accurately and completely.

Key takeaways

Filling out the Ohio Articles of Incorporation form is a crucial step in establishing a corporation in Ohio. Here are some key takeaways to keep in mind:

- The form requires basic information about your corporation, including its name, purpose, and principal office address.

- Choose a unique name for your corporation. It must not be similar to any existing business names registered in Ohio.

- Clearly state the purpose of your corporation. This can be broad but should reflect the nature of your business.

- Designate a registered agent. This individual or entity will receive legal documents on behalf of your corporation.

- Include the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Decide on the number of shares your corporation will be authorized to issue. This affects ownership and investment opportunities.

- File the form with the Ohio Secretary of State. This can often be done online, by mail, or in person.

- Pay the required filing fee. Be aware that fees may vary based on the type of corporation you are forming.

- Once approved, your corporation will be officially recognized. This allows you to operate legally in Ohio.

- Keep a copy of the filed Articles of Incorporation for your records. This document is essential for future business operations.

Understanding these key points will help ensure a smoother process when forming your corporation in Ohio.