Fillable Transfer-on-Death Deed Form for North Carolina

North Carolina Transfer-on-Death Deed - Usage Guidelines

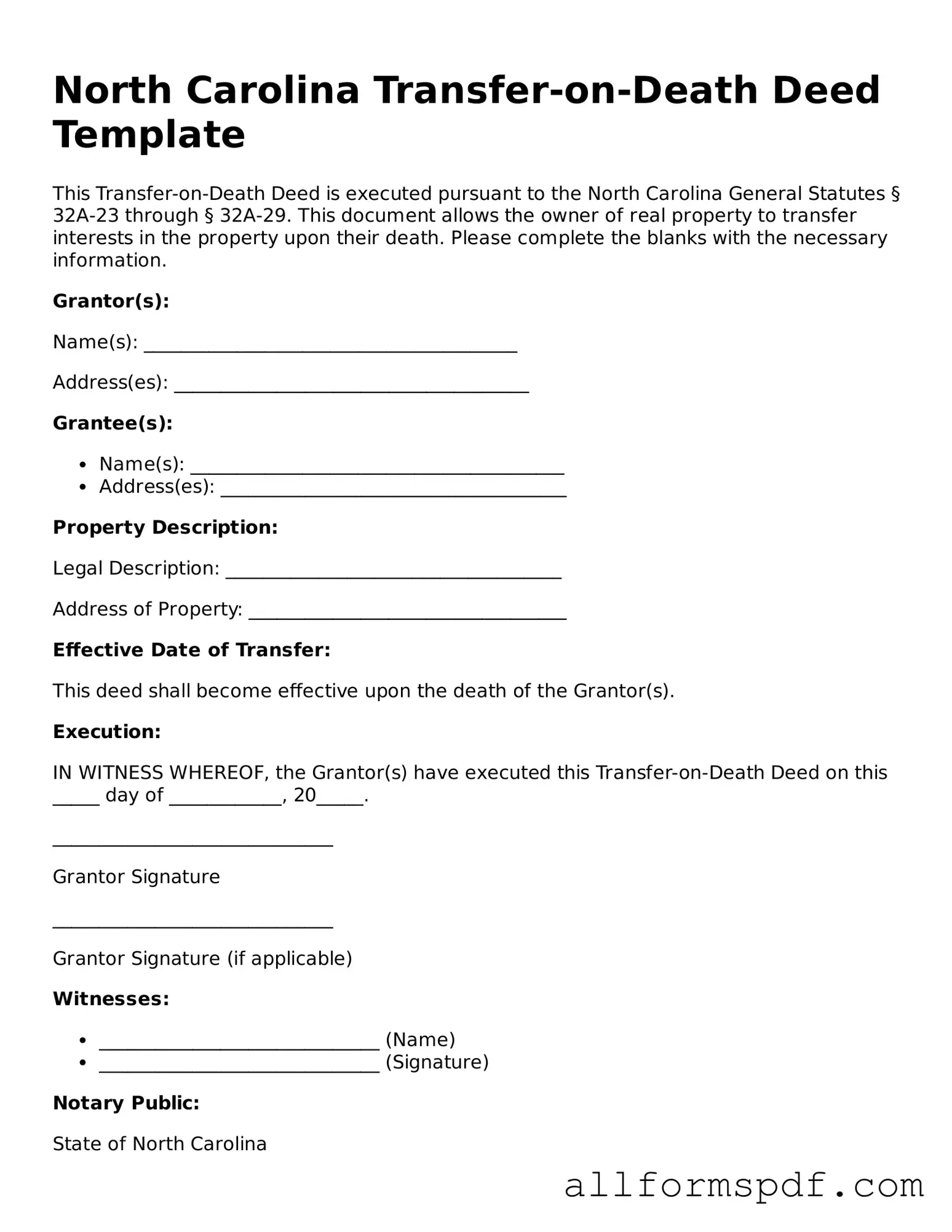

Filling out the North Carolina Transfer-on-Death Deed form requires attention to detail. Once completed, the form must be signed and recorded with the county register of deeds to ensure it is legally valid. Below are the steps to properly fill out the form.

- Obtain the Transfer-on-Death Deed form from a reliable source, such as the North Carolina Secretary of State's website or your local county office.

- Fill in the names of the current property owners in the designated section. Ensure that all names are spelled correctly.

- Provide the property address and legal description. This information can typically be found on your property tax bill or deed.

- Identify the beneficiaries by entering their names. Be specific about who will inherit the property upon your passing.

- Include the date of execution. This is the date you are signing the deed.

- Sign the deed in the presence of a notary public. This step is crucial for the document's validity.

- Ensure that the notary public completes their section, including their signature and seal.

- Make copies of the completed deed for your records.

- Submit the original deed to the county register of deeds for recording. Check with your local office for any required fees.

Misconceptions

Understanding the North Carolina Transfer-on-Death (TOD) Deed can be complex, and several misconceptions often arise. Here are ten common misunderstandings about this important legal tool.

- It automatically transfers property upon death. Many believe that a TOD deed transfers property immediately upon the owner's death. In reality, the property only transfers when the owner passes away, and the deed must be properly recorded.

- Only certain types of property can be transferred. Some think that a TOD deed can only be used for residential properties. However, it can apply to various types of real estate, including vacant land and commercial properties.

- A TOD deed avoids probate completely. While a TOD deed can help avoid probate for the property it covers, it does not eliminate the need for probate for other assets or debts of the deceased.

- The deed can be revoked at any time. Many assume that once a TOD deed is created, it cannot be changed. In fact, the owner can revoke or modify the deed at any time before their death.

- It requires a lawyer to create. While having legal assistance can be beneficial, it is not mandatory to draft a TOD deed. Individuals can fill out the form themselves, provided they follow the guidelines.

- All heirs must agree to the deed. Some people believe that all potential heirs must consent to a TOD deed. This is not true; the property owner has the right to designate beneficiaries without needing approval from others.

- A TOD deed is the same as a will. A common misconception is that a TOD deed functions like a will. While both deal with the transfer of property, a TOD deed takes effect immediately upon death, whereas a will requires probate.

- Beneficiaries cannot be changed after the deed is created. Many think that once beneficiaries are named in a TOD deed, they cannot be altered. In reality, the owner can change the beneficiaries at any time before death.

- It affects the owner's ability to sell the property. Some believe that creating a TOD deed restricts the owner's ability to sell or mortgage the property. This is incorrect; the owner retains full control until death.

- Only one beneficiary can be named. There is a misconception that a TOD deed allows for only a single beneficiary. In fact, multiple beneficiaries can be designated, allowing for shared ownership after the owner's passing.

By clarifying these misconceptions, individuals can better understand how a Transfer-on-Death Deed works in North Carolina and how it can be a valuable tool for estate planning.

Dos and Don'ts

When filling out the North Carolina Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance with state laws. Here are nine essential dos and don’ts to consider:

- Do provide the full legal names of all parties involved, including the grantor and the beneficiary.

- Don't use nicknames or abbreviations; clarity is key.

- Do include a complete description of the property being transferred, including the address and parcel number if applicable.

- Don't leave out any details about the property; incomplete information can lead to complications.

- Do sign the deed in the presence of a notary public to ensure it is legally binding.

- Don't forget to have the notary public sign and seal the document; this step is crucial.

- Do file the completed deed with the appropriate county register of deeds office.

- Don't assume that filing is optional; without proper filing, the deed may not be valid.

- Do keep a copy of the filed deed for your records.

By adhering to these guidelines, you can navigate the process of filling out the North Carolina Transfer-on-Death Deed form with greater confidence and ensure that your intentions are honored.

Popular State-specific Transfer-on-Death Deed Forms

Problems With Transfer on Death Deeds - Transferring property via this deed can help maintain family harmony by reducing disputes.

Disadvantages of Transfer on Death Deed Illinois - Consulting with a professional can help clarify any questions regarding the deed.

For those considering legal documentation, understanding the benefits of a well-prepared comprehensive Power of Attorney form is vital. This document empowers the designated agent to act in crucial matters on behalf of the principal, ensuring that decisions align with the principal's wishes.

Tod Form Ohio - It is advisable to keep records of property ownership separate from the Transfer-on-Death Deed.

Common mistakes

Filling out a Transfer-on-Death Deed form in North Carolina can be a straightforward process, but many individuals make common mistakes that can lead to complications down the road. One of the most frequent errors is failing to include the full legal name of the property owner. It's essential to ensure that the name matches exactly with what is recorded in public records. Any discrepancies could cause significant delays or even invalidate the deed.

Another mistake often made is not clearly identifying the beneficiaries. It's crucial to provide the complete names and, if possible, the addresses of the individuals who will inherit the property. Omitting this information or using nicknames can lead to confusion and disputes among heirs.

Some people neglect to consider the implications of multiple beneficiaries. When designating more than one person, it's important to specify how the property will be divided. Will it be equal shares, or will one beneficiary receive a larger portion? Without clear instructions, misunderstandings can arise, leading to potential conflicts.

Inaccurate property descriptions are another common pitfall. The deed must include a precise legal description of the property, not just the address. A vague or incorrect description can result in the deed being challenged in court, causing unnecessary stress for all parties involved.

Many individuals also forget to sign the deed in the presence of a notary public. A signature without notarization can render the document invalid. The notary's role is to verify the identity of the signer and ensure that the signing is done willingly and without coercion.

People sometimes overlook the need to record the deed with the appropriate county register of deeds. Even if the deed is filled out correctly, failing to file it can mean that the transfer does not take effect. Recording the deed is a critical step that protects the interests of both the property owner and the beneficiaries.

Another frequent mistake is not keeping a copy of the completed deed. After the form is filled out and filed, it's wise to retain a copy for personal records. This ensures that all parties involved have access to the same information, preventing misunderstandings in the future.

Some individuals make the mistake of using outdated forms. Laws and regulations can change, and using an old version of the Transfer-on-Death Deed form may lead to issues. Always ensure that you are using the most current version available.

Finally, people often underestimate the importance of consulting with a legal professional. While it may seem straightforward, the nuances of property law can be complex. Seeking guidance can help avoid mistakes that could have lasting consequences for you and your loved ones.

Key takeaways

Understanding the North Carolina Transfer-on-Death Deed form is crucial for effective estate planning. Here are key takeaways to consider:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- To be valid, the deed must be signed by the property owner and notarized.

- It is essential to clearly identify the beneficiaries, including their full names and addresses.

- The deed must be recorded with the local register of deeds in the county where the property is located.

- Beneficiaries can only claim the property after the owner’s death, and they must file a claim to establish their ownership.

- Property owners can revoke or change the deed at any time before their death by executing a new deed.

- Consulting with a legal expert is advisable to ensure that the deed aligns with your overall estate plan and complies with state laws.

These takeaways highlight the importance of careful preparation and understanding of the Transfer-on-Death Deed in North Carolina. Taking action now can help secure your wishes for the future.