Fillable Real Estate Purchase Agreement Form for North Carolina

North Carolina Real Estate Purchase Agreement - Usage Guidelines

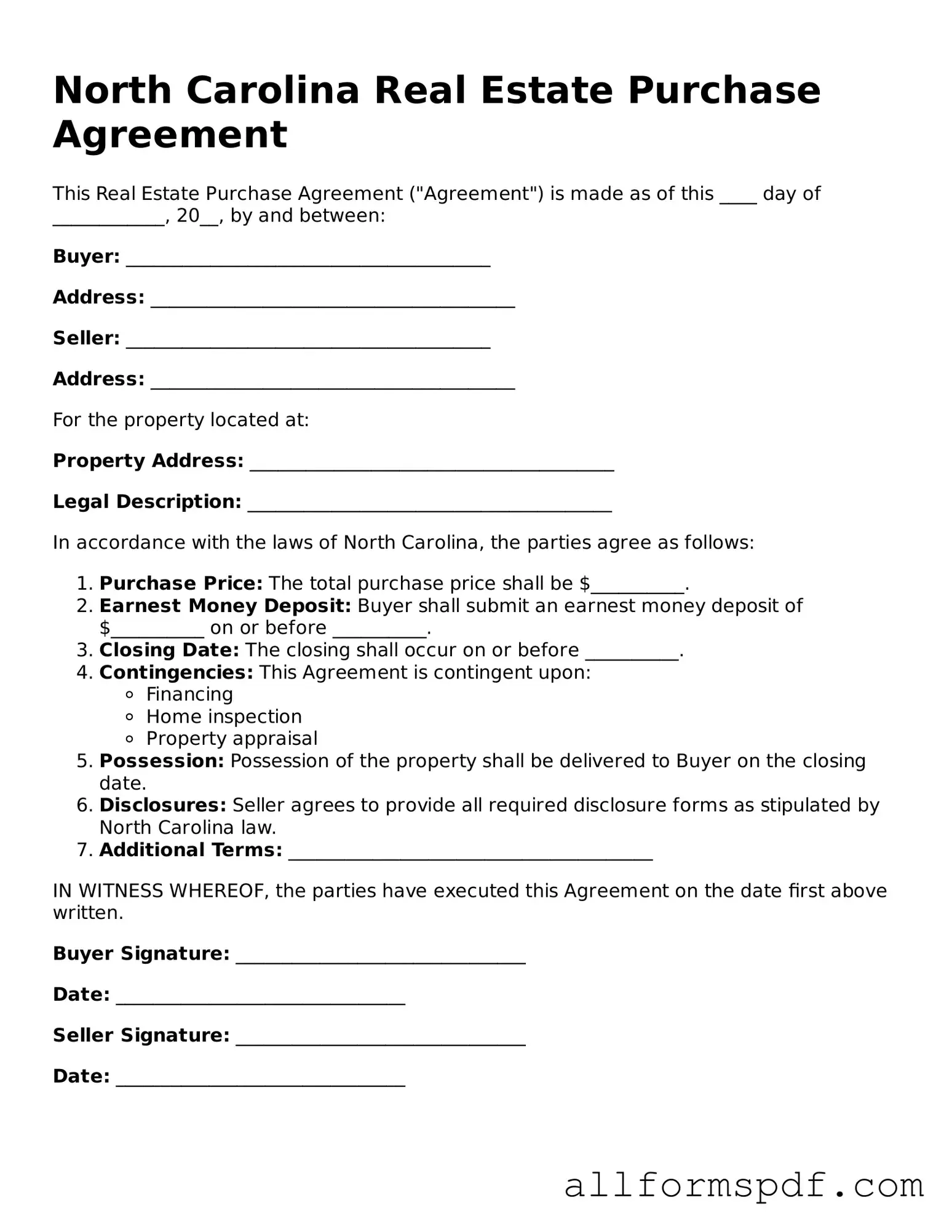

Once you have the North Carolina Real Estate Purchase Agreement form in hand, it’s time to begin the process of filling it out. This form is crucial for outlining the terms of the property sale and ensuring that both the buyer and seller are on the same page. Follow these steps to complete the form accurately.

- Gather necessary information: Collect details about the property, including the address, legal description, and any relevant identification numbers.

- Identify the parties: Clearly write the names of the buyer(s) and seller(s) at the top of the form.

- Specify the purchase price: Enter the agreed-upon purchase price for the property in the designated section.

- Include earnest money details: Indicate the amount of earnest money to be paid and the method of payment.

- Outline contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspections.

- Set closing date: Provide a proposed closing date for the transaction.

- Review additional terms: Fill in any additional terms or conditions that both parties have agreed upon.

- Signatures: Ensure that all parties sign and date the form at the end to validate the agreement.

After completing the form, both parties should review it carefully to confirm that all details are accurate and agreed upon. Once signed, the agreement serves as a binding document that outlines the terms of the real estate transaction.

Misconceptions

Misunderstandings about the North Carolina Real Estate Purchase Agreement form can lead to confusion for both buyers and sellers. Below is a list of common misconceptions, along with clarifications to help navigate the process more smoothly.

- It is a legally binding contract from the moment it is signed. While signing the agreement indicates intent, the contract may still be contingent upon certain conditions being met, such as inspections or financing.

- All real estate transactions require this specific form. Not all property sales necessitate the North Carolina Real Estate Purchase Agreement. Certain types of transactions, like those involving commercial properties, may require different documentation.

- Once signed, the terms cannot be changed. Amendments can be made to the agreement if both parties agree. It's important to document any changes in writing to avoid misunderstandings.

- The agreement protects both parties equally. While it aims to balance interests, the agreement may favor one party based on negotiations. Understanding the terms is essential for both buyers and sellers.

- It includes all possible contingencies. The form provides a framework, but specific contingencies must be added based on individual circumstances. Buyers should consider their unique needs when reviewing the agreement.

- Signing means you are committed to the sale. Depending on the contingencies included, either party may have the right to withdraw without penalties if specific conditions are not met.

- The form is standardized and cannot be customized. While there is a standard template, parties can negotiate terms and customize certain aspects to suit their specific situation.

- Real estate agents are responsible for understanding the contract. While agents can provide guidance, it is ultimately the responsibility of both parties to understand the terms and implications of the agreement.

- All agreements are the same across North Carolina. Local laws and practices can influence the specifics of the agreement. It's crucial to be aware of regional variations that may apply.

- The agreement guarantees a successful closing. Signing the agreement does not guarantee that the transaction will close. Various factors, such as financing issues or inspection results, can impact the final outcome.

Understanding these misconceptions can help buyers and sellers make informed decisions and foster smoother transactions in the real estate market.

Dos and Don'ts

When filling out the North Carolina Real Estate Purchase Agreement form, it's essential to approach the task with care. Here’s a list of dos and don’ts to help guide you through the process.

- Do read the entire agreement carefully before filling it out. Understanding each section will help you avoid mistakes.

- Do provide accurate and complete information. This includes names, addresses, and property details.

- Do consult with a real estate agent or attorney if you have questions. Their expertise can clarify any uncertainties.

- Do keep copies of all documents for your records. This will be helpful for future reference.

- Don't rush through the form. Taking your time can prevent errors that could delay the process.

- Don't leave any sections blank. If a section does not apply, write “N/A” to indicate it was considered.

- Don't ignore deadlines. Make sure you submit the agreement within the required time frame.

- Don't forget to sign and date the document. An unsigned form is not valid and could cause complications.

Popular State-specific Real Estate Purchase Agreement Forms

Sale Contract for House - It specifies the purchase price and payment details for the transaction.

Creating a Last Will and Testament is essential for anyone looking to secure their legacy and ensure that their wishes are honored after passing. With this important document, individuals can outline their preferences regarding the distribution of their assets and care for dependents, providing a clear directive that helps alleviate any potential disputes. For those in Florida, you can find a straightforward template to get started at All Florida Forms, making the process of estate planning more accessible and manageable.

Purchasing Agreement - May identify co-signers or guarantors involved in the purchase.

Common mistakes

When it comes to filling out the North Carolina Real Estate Purchase Agreement form, many buyers and sellers make common mistakes that can lead to confusion or even legal issues down the line. One of the most frequent errors is failing to provide complete information. This includes not listing the correct names of all parties involved or leaving out important details about the property. It's crucial to ensure that every piece of information is accurate and thorough.

Another common mistake is neglecting to specify the purchase price clearly. This can lead to misunderstandings between the buyer and seller. If the price is not clearly stated, it may create disputes later on. Always double-check that the numbers are correct and match what was agreed upon verbally.

People often overlook the importance of including contingencies in the agreement. Contingencies protect both parties by outlining conditions that must be met for the sale to proceed. Whether it’s securing financing or passing a home inspection, not including these can leave one party vulnerable.

Timing is another aspect that can be mishandled. Buyers and sellers sometimes forget to include important dates, such as the closing date or deadlines for inspections. These dates are crucial for keeping the transaction on track and ensuring that both parties meet their obligations.

In addition, many individuals do not fully understand the implications of the earnest money deposit. This deposit shows the buyer's commitment to the transaction, but if the terms surrounding it are not clear, it can lead to disputes. Clearly outline the amount and conditions under which it may be forfeited or returned.

Another mistake involves the property description. Failing to provide a detailed description can create confusion about what is being sold. It’s important to include not just the address, but also any relevant details about the property, such as boundaries or included fixtures.

Buyers often skip over the section regarding disclosures. Sellers are required to disclose certain information about the property, such as known defects or issues. If this section is left blank, it may raise red flags later in the process.

Many people also forget to review the agreement thoroughly before signing. Rushing through the document can lead to missed details that could have significant consequences. Taking the time to read everything carefully can save headaches later on.

Additionally, some individuals mistakenly assume that a verbal agreement is enough. The purchase agreement is a legally binding document, and relying solely on verbal promises can lead to misunderstandings. Always ensure that everything agreed upon is documented in writing.

Lastly, failing to seek professional advice is a common pitfall. Real estate transactions can be complex, and having a knowledgeable agent or attorney review the agreement can provide peace of mind. They can help identify potential issues and ensure that everything is in order before moving forward.

Key takeaways

When filling out and using the North Carolina Real Estate Purchase Agreement form, it is important to keep several key points in mind to ensure a smooth transaction.

- Understand the purpose of the form. This agreement outlines the terms and conditions of the sale of a property.

- Ensure all parties involved are clearly identified. Include the full names of the buyer and seller, as well as any agents representing them.

- Specify the property details. The address and legal description of the property must be accurate and complete.

- Include the purchase price. Clearly state the amount the buyer agrees to pay for the property.

- Outline the earnest money deposit. Indicate the amount and terms regarding this deposit, which shows the buyer's commitment.

- Set deadlines for key actions. This includes dates for inspections, financing, and closing to keep the process on track.

- Address contingencies. Specify any conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Review the closing costs. Clearly outline who will be responsible for various expenses related to the transaction.

- Sign and date the agreement. All parties must sign the document to make it legally binding.

By paying attention to these points, both buyers and sellers can navigate the real estate transaction process more effectively.