Fillable Promissory Note Form for North Carolina

North Carolina Promissory Note - Usage Guidelines

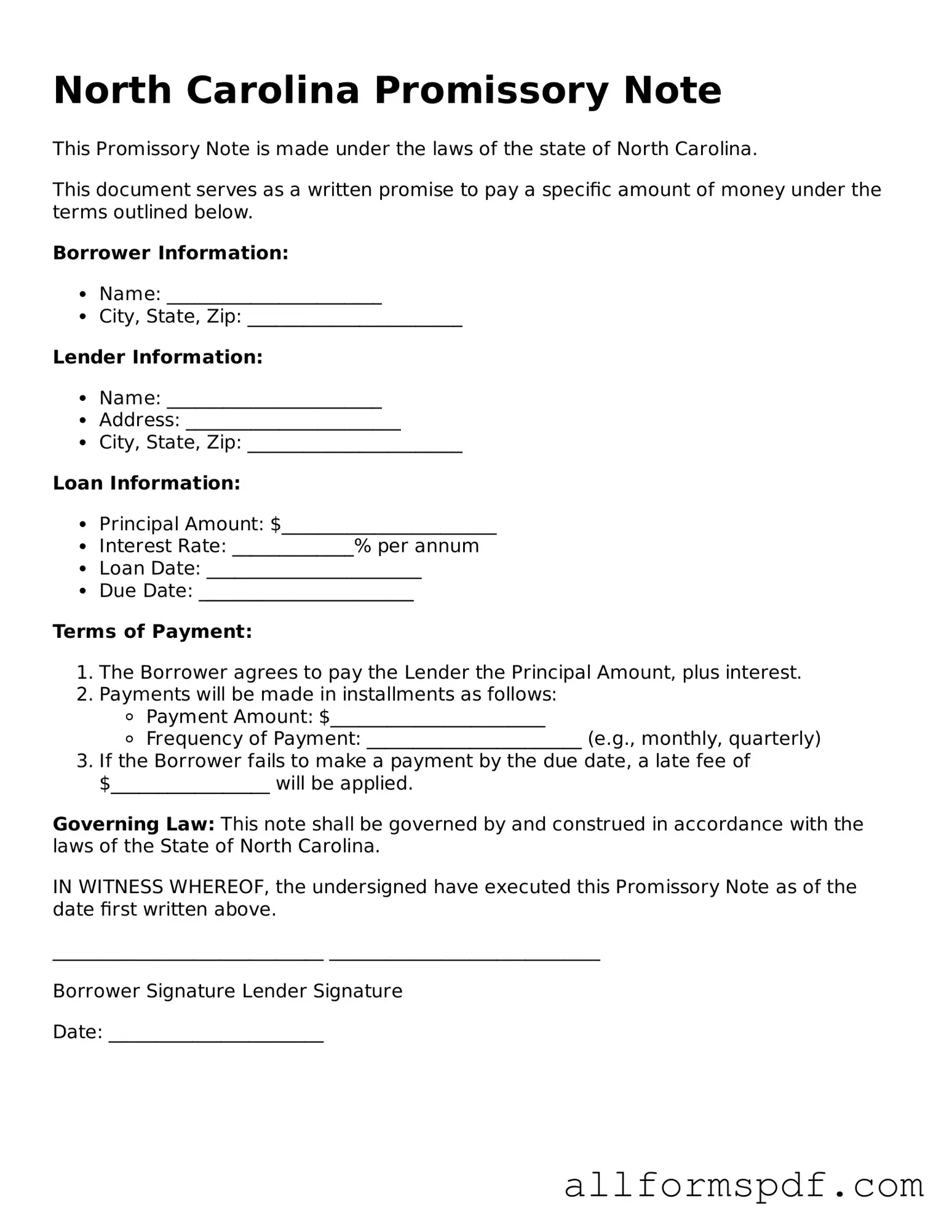

Filling out the North Carolina Promissory Note form is an important step in documenting a loan agreement. Once the form is completed, it should be signed by all parties involved. This ensures that everyone understands the terms of the loan and agrees to them. Below are the steps to guide you through the process of filling out the form.

- Begin by entering the date at the top of the form. This is the date when the promissory note is created.

- Next, fill in the name and address of the borrower. This is the person who is receiving the loan.

- Then, provide the name and address of the lender. This is the individual or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount that the borrower is borrowing.

- Indicate the interest rate. This is the percentage that will be charged on the borrowed amount over time.

- State the repayment terms. Include the schedule for payments, such as monthly or quarterly, and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. This clarifies the consequences of late payments.

- Provide details about any collateral, if applicable. This is an asset that secures the loan.

- Finally, both the borrower and lender should sign and date the form. This signifies that both parties agree to the terms outlined in the note.

After completing these steps, ensure that each party receives a copy of the signed document for their records. Keeping a copy is essential for reference in the future.

Misconceptions

- Misconception 1: A promissory note is the same as a loan agreement.

- Misconception 2: All promissory notes must be notarized.

- Misconception 3: A verbal promise is sufficient for a promissory note.

- Misconception 4: Promissory notes are only used for personal loans.

- Misconception 5: The borrower can change the terms of the note at any time.

- Misconception 6: Interest rates on promissory notes are always fixed.

- Misconception 7: Promissory notes do not require a repayment schedule.

- Misconception 8: Once signed, a promissory note cannot be canceled.

A promissory note is a written promise to pay a specific amount of money at a designated time, while a loan agreement outlines the terms and conditions of the loan itself.

Not all promissory notes require notarization. While notarization can add an extra layer of validation, it is not a legal requirement for the document to be enforceable in North Carolina.

A verbal promise is not sufficient. A promissory note must be in writing to be enforceable, as it provides clear evidence of the terms agreed upon by both parties.

Promissory notes can be used in various contexts, including business transactions, real estate deals, and student loans, not just personal loans.

The borrower cannot unilaterally change the terms of the promissory note. Any modifications must be agreed upon by both the borrower and the lender and documented accordingly.

Interest rates can be either fixed or variable, depending on the terms set forth in the promissory note. It is important to clarify this when drafting the document.

A repayment schedule is essential in a promissory note. It outlines when payments are due and helps both parties understand their obligations.

A promissory note can be canceled if both parties agree to do so in writing. However, this must be done formally to ensure that both parties are protected.

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of five dos and don'ts to consider.

- Do read the entire form carefully before starting.

- Do provide accurate information, including names and addresses.

- Do clearly state the loan amount and interest rate.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use incorrect or outdated information.

- Don't forget to check for any required witnesses or notarization.

- Don't rush through the process; take your time to ensure accuracy.

- Don't overlook the importance of understanding the terms of the note.

Popular State-specific Promissory Note Forms

Basic Promissory Note - Execution of the note requires signatures from both the borrower and lender.

Ohio Promissory Note Requirements - In case of default, the lender may have legal recourse to recover funds.

Having a solid understanding of the process and the necessary documents is essential for effective estate planning; resources like All Florida Forms can provide valuable assistance in preparing your Last Will and Testament, ensuring your intentions are clearly laid out and legally binding.

Promissory Note Template Illinois - The document can be used in various types of loans, including personal and business loans.

Common mistakes

Filling out a North Carolina Promissory Note form can seem straightforward, but several common mistakes can lead to complications down the line. One frequent error is failing to include all necessary details about the borrower and lender. The names, addresses, and contact information of both parties must be clearly stated. Omitting even one piece of this information can create confusion and make it difficult to enforce the note if issues arise.

Another mistake often made is neglecting to specify the loan amount clearly. While it may seem obvious, writing the amount in both numerical and written form is crucial. For example, stating “$5,000” and “five thousand dollars” helps prevent disputes about the actual loan amount. If only one format is used, it could lead to misunderstandings that complicate repayment.

People also frequently overlook the importance of including the interest rate. If the note is intended to bear interest, this must be explicitly stated. Without a clear interest rate, the note may be considered invalid under North Carolina law. Additionally, the terms of repayment should be detailed. This includes the payment schedule, whether payments are monthly, quarterly, or otherwise, and the due date for the final payment.

Lastly, many individuals forget to sign and date the Promissory Note. A signature is essential for the document to be legally binding. Both the borrower and lender should sign the note, and it is advisable to have a witness or notary present during the signing. This adds an extra layer of validity and can be beneficial if the agreement is ever challenged in court.

Key takeaways

When filling out and using the North Carolina Promissory Note form, it's essential to keep several key points in mind. Below are important takeaways to ensure clarity and compliance.

- Understand the Purpose: A promissory note serves as a written promise to repay a loan. It outlines the terms of the loan, including the amount, interest rate, and repayment schedule.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This identification is crucial for legal purposes.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be written numerically and in words to avoid any confusion.

- Detail the Interest Rate: Include the interest rate applicable to the loan. Specify whether it is fixed or variable, and ensure it complies with North Carolina laws.

- Outline the Repayment Terms: Clearly define the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Include Late Fees: If applicable, specify any late fees that will be charged if payments are not made on time. This helps to establish expectations for both parties.

- Signature Requirement: Both the borrower and lender must sign the document. This signature confirms agreement to the terms outlined in the note.

- Keep Copies: After completing the promissory note, both parties should retain a signed copy for their records. This ensures that both have access to the agreed-upon terms.

By following these takeaways, individuals can effectively navigate the process of filling out and utilizing the North Carolina Promissory Note form.