Fillable Operating Agreement Form for North Carolina

North Carolina Operating Agreement - Usage Guidelines

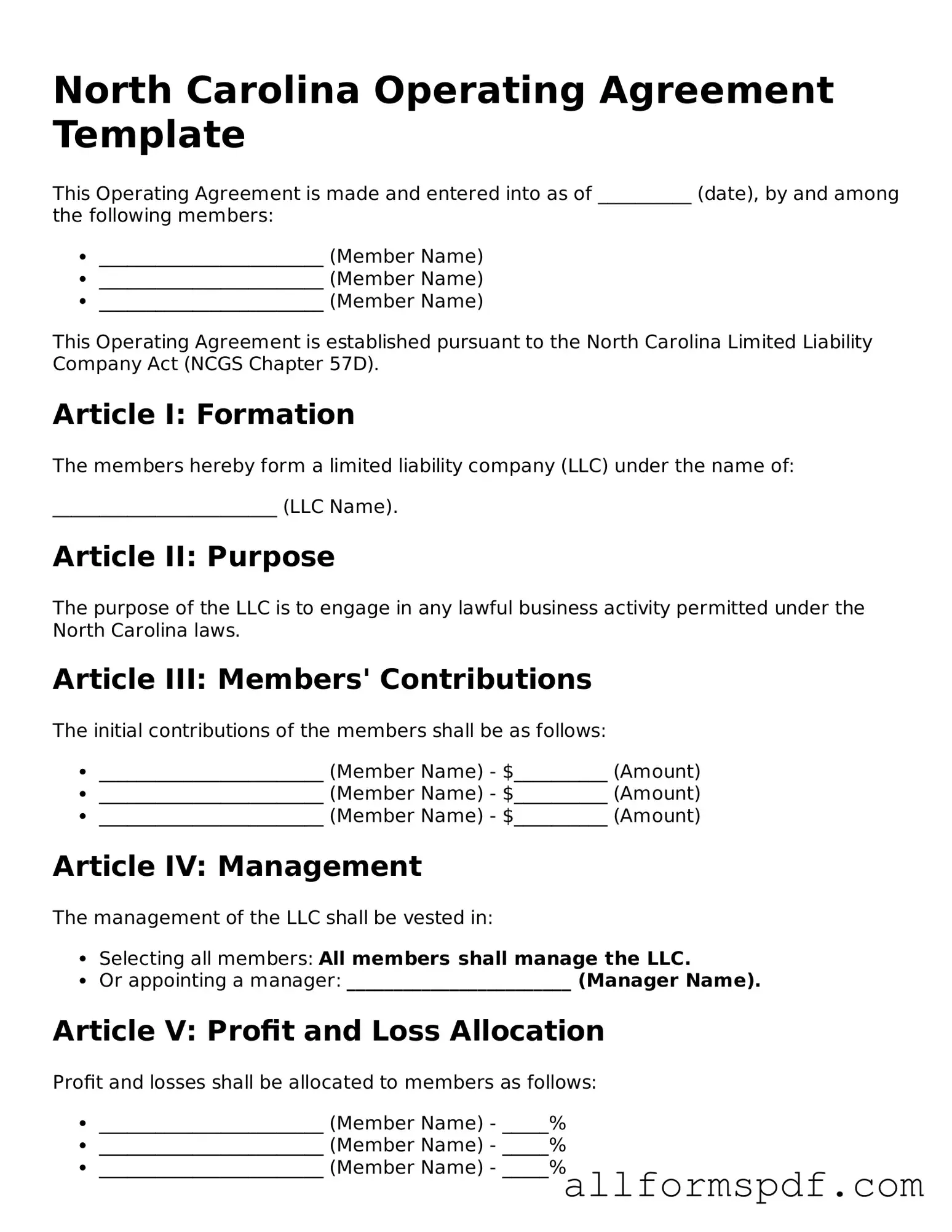

Once you have obtained the North Carolina Operating Agreement form, you will need to complete it accurately to ensure that all necessary information is provided. Follow these steps to fill out the form correctly.

- Begin by entering the name of your LLC at the top of the form. Ensure the name matches the one registered with the North Carolina Secretary of State.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include each member's percentage of ownership.

- Detail the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Outline the purpose of the LLC. Describe the business activities the LLC will engage in.

- Include provisions for the distribution of profits and losses among members. Clearly state how these will be allocated.

- Specify the duration of the LLC. Indicate whether it is perpetual or has a specific end date.

- Provide details on how decisions will be made within the LLC. Include voting rights and procedures for member meetings.

- Address any additional provisions that may be relevant to your LLC. This could include buyout agreements or procedures for adding new members.

- Review the completed form for accuracy. Make sure all required fields are filled out and that there are no errors.

- Sign and date the form. Ensure that all members also sign if required.

Misconceptions

Understanding the North Carolina Operating Agreement form is essential for anyone involved in a limited liability company (LLC). However, there are several misconceptions that can lead to confusion. Here are nine common myths about this important document:

- It’s only necessary for large businesses. Many believe that an Operating Agreement is only for larger companies. In reality, every LLC, regardless of size, benefits from having one to clarify ownership and operational procedures.

- It’s a legal requirement in North Carolina. While having an Operating Agreement is highly recommended, it is not legally required in North Carolina. However, not having one can lead to misunderstandings among members.

- It can’t be changed once created. Some people think that once an Operating Agreement is signed, it cannot be altered. In fact, it can be amended as needed, allowing flexibility as the business evolves.

- It only covers financial matters. Many assume that the Operating Agreement focuses solely on finances. However, it also outlines management structures, member responsibilities, and procedures for decision-making.

- All members must agree on every detail. There’s a misconception that unanimous agreement is needed for every aspect of the Operating Agreement. While consensus is important, the agreement can specify how decisions are made, allowing for majority rules in many cases.

- It’s the same as the Articles of Organization. Some confuse the Operating Agreement with the Articles of Organization. The Articles establish the LLC with the state, while the Operating Agreement governs internal operations.

- It doesn’t need to be written down. A common belief is that a verbal agreement is sufficient. In truth, a written Operating Agreement provides clarity and serves as a reference point in case of disputes.

- It’s only for multi-member LLCs. Individuals often think that Operating Agreements are only necessary for LLCs with multiple members. However, even single-member LLCs can benefit from having one to outline the owner’s intentions and protect their interests.

- Legal assistance is always required to draft one. While it’s wise to consult a legal professional, many templates and resources are available for those who prefer to create their own Operating Agreement. Just ensure it meets your specific needs and complies with state laws.

By dispelling these misconceptions, you can approach the North Carolina Operating Agreement with a clearer understanding of its purpose and importance. This knowledge empowers you to make informed decisions for your LLC.

Dos and Don'ts

When filling out the North Carolina Operating Agreement form, it is essential to approach the task with care and attention to detail. Here are ten guidelines to help ensure a smooth process.

- Do: Read the instructions thoroughly before starting.

- Do: Provide accurate and complete information about the members.

- Do: Clearly define the roles and responsibilities of each member.

- Do: Include provisions for decision-making processes.

- Do: Specify how profits and losses will be distributed among members.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank; every part must be addressed.

- Don't: Use ambiguous language that could lead to misunderstandings.

- Don't: Forget to date and sign the agreement.

- Don't: Neglect to consult with a legal professional if you have questions.

By following these guidelines, you can create a comprehensive and effective Operating Agreement that meets the requirements of North Carolina law.

Popular State-specific Operating Agreement Forms

How to Create an Operating Agreement - It serves to clarify any non-compete clauses amongst members.

In addition to its importance as a legal document, securing a New York Mobile Home Bill of Sale form can help ensure a smooth transaction for buyers and sellers alike, making it essential to access a reliable source, such as https://smarttemplates.net/fillable-new-york-mobile-home-bill-of-sale/, where one can find a fillable template that meets all legal requirements.

How to Make an Operating Agreement - The document helps clarify expectations around investment returns, promoting fairness among members.

An Agreement to Operate a Business in the Name of an Established Company - The Operating Agreement may provide for the appointment of managers.

Common mistakes

Filling out the North Carolina Operating Agreement form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is not including all necessary members in the agreement. Every member of the LLC should be listed, as omitting someone can create disputes later. Make sure everyone involved is accounted for.

Another mistake is failing to specify the management structure of the LLC. Some people assume that it’s obvious, but it’s important to clearly state whether the company will be managed by members or by appointed managers. This clarity helps prevent misunderstandings and ensures that everyone knows their roles and responsibilities.

Many individuals also neglect to outline the voting rights of members. Not detailing how decisions are made can lead to confusion and conflict. It’s wise to specify how votes will be counted and what percentage is needed for different types of decisions. This transparency fosters a smoother decision-making process.

Some people forget to include provisions for adding or removing members. Life changes, and so do business partnerships. By not addressing this in the Operating Agreement, you might face challenges if a member wants to leave or a new member wants to join. It’s better to have a plan in place from the start.

Another common oversight is failing to address how profits and losses will be distributed. If this is left vague, it can lead to disputes among members. Clearly stating how profits and losses will be shared ensures that everyone is on the same page and helps maintain harmony within the LLC.

Finally, many individuals overlook the importance of having the agreement reviewed by a legal professional. While it may seem like an unnecessary step, a review can catch mistakes that could cause issues later. Investing time in this process can save a lot of trouble in the future.

Key takeaways

Filling out and using the North Carolina Operating Agreement form is an important step for any business entity. Here are some key takeaways to consider:

- The Operating Agreement outlines the management structure of your business.

- It is essential for defining the roles and responsibilities of each member.

- This document helps prevent misunderstandings among members by clarifying expectations.

- It is not required by law in North Carolina, but it is highly recommended.

- Having a written agreement can protect your personal assets in case of business liabilities.

- Members can customize the agreement to suit their specific business needs.

- It should be signed by all members to ensure enforceability.

- Regular updates to the Operating Agreement are advisable as the business evolves.

- Consider consulting with a legal professional to ensure compliance with state laws.

- Keep a copy of the Operating Agreement in a safe place for future reference.

By understanding these key points, you can create a solid foundation for your business operations in North Carolina.