Fillable Last Will and Testament Form for North Carolina

North Carolina Last Will and Testament - Usage Guidelines

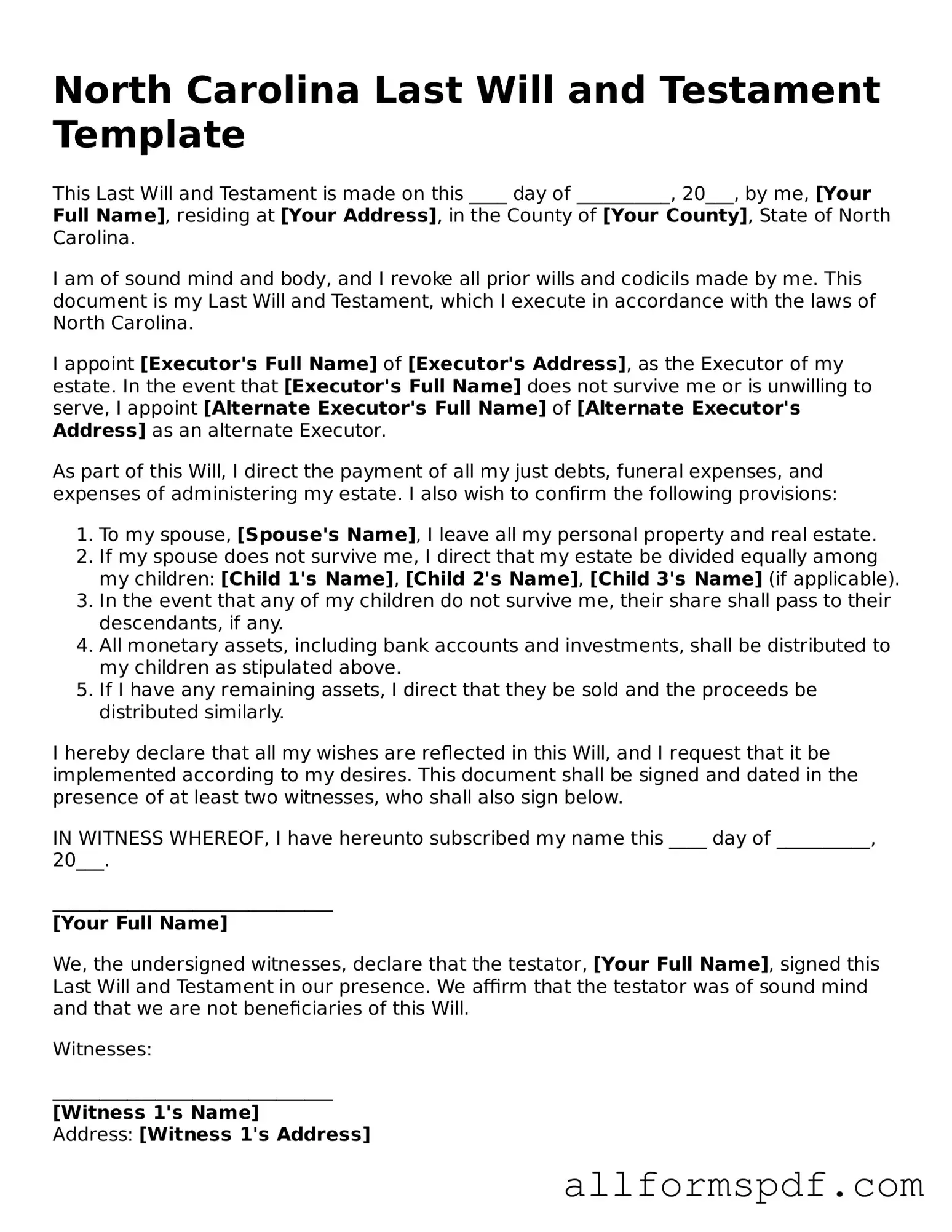

After obtaining the North Carolina Last Will and Testament form, you will need to carefully fill it out to ensure your wishes are documented. This process involves providing personal information and designating beneficiaries. Once completed, the will must be signed and witnessed according to state requirements.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth.

- Identify your marital status (single, married, divorced, etc.).

- List your children’s names and ages, if applicable.

- Designate an executor by naming the person you trust to carry out your wishes.

- Specify how you want your assets distributed among your beneficiaries.

- Include any specific bequests, such as gifts of property or money to individuals or organizations.

- Sign and date the form in the designated area.

- Have at least two witnesses sign the document, ensuring they are not beneficiaries.

Misconceptions

When it comes to creating a Last Will and Testament in North Carolina, several misconceptions can lead to confusion. Understanding the facts can help ensure that your wishes are carried out as you intend. Here are four common misconceptions:

- A handwritten will is not valid. Many people believe that only formally typed documents can be considered valid wills. In North Carolina, a handwritten will, also known as a holographic will, can be valid if it is signed by the testator and the material provisions are in their handwriting.

- Witnesses must be family members. Some individuals think that only family members can serve as witnesses to a will. In reality, North Carolina law allows any competent adult to witness a will, regardless of their relationship to the testator. However, it is advisable to choose witnesses who are not beneficiaries to avoid potential disputes.

- Once a will is created, it cannot be changed. This is a common myth. A will can be amended or revoked at any time as long as the testator is of sound mind. North Carolina allows for changes to be made through a codicil or by creating an entirely new will.

- All assets must be included in the will. Some people think that every single asset must be listed in their will. In North Carolina, while it is advisable to include major assets, certain types of property, like jointly owned property or assets with designated beneficiaries, may not need to be mentioned in the will at all.

Understanding these misconceptions can help you navigate the process of creating a Last Will and Testament in North Carolina with greater confidence.

Dos and Don'ts

When preparing a Last Will and Testament in North Carolina, it is crucial to follow certain guidelines to ensure that your wishes are honored and that the document is legally binding. Here are four key actions to take and avoid.

- Do: Clearly identify yourself at the beginning of the document. Include your full name and address to avoid any confusion about your identity.

- Do: Specify your beneficiaries. Clearly state who will inherit your assets to prevent disputes among family members.

- Do: Sign the document in the presence of at least two witnesses. Their signatures will help validate your will.

- Do: Keep your will in a safe place and inform your executor about its location. This ensures it can be easily accessed when needed.

- Don't: Use vague language. Ambiguities can lead to misunderstandings and potential legal challenges.

- Don't: Forget to date the document. An undated will can create confusion regarding its validity.

- Don't: Attempt to make changes without following proper procedures. Altering the will without proper witnessing can invalidate it.

- Don't: Leave out important details about your assets. Ensure all significant possessions and accounts are accounted for.

Popular State-specific Last Will and Testament Forms

New Jersey Last Will and Testament Pdf - Typically favored over state law for asset distribution after death.

Free Michigan Will Forms to Print - Gives the testator the ability to choose an executor to manage the estate.

Online Will Ohio - A document that allows one to leave charitable donations after passing away.

For landlords needing to navigate lease violations, the process of issuing a Notice to Quit is crucial. This form aids in formally addressing tenant issues and establishes a timeline for resolution or vacating the premises, ensuring legal compliance and protecting landlord rights.

Wills in Georgia - Helps avoid confusion and disputes among family members regarding your wishes.

Common mistakes

Filling out a Last Will and Testament form in North Carolina is a crucial step in ensuring that your wishes are honored after your passing. However, many individuals make common mistakes that can lead to complications. Understanding these errors can help you avoid pitfalls that might invalidate your will or create confusion among your loved ones.

One frequent mistake is failing to clearly identify the beneficiaries. It is essential to use full names and, if possible, include their relationship to you. Vague terms like "my children" or "my family" can lead to disputes. When beneficiaries are not clearly defined, it can create unnecessary tension among family members.

Another common error is neglecting to sign the will properly. In North Carolina, the will must be signed by the testator, which means the person making the will must write their signature at the end of the document. If this step is overlooked, the will may not be considered valid.

Some individuals also forget to have witnesses present when signing the will. North Carolina requires that the will be signed in the presence of at least two witnesses. If the witnesses do not sign the document, it may not hold up in court, leading to delays and complications for your heirs.

Additionally, people often fail to update their wills after significant life events, such as marriage, divorce, or the birth of a child. These changes can significantly impact your wishes, and neglecting to revise your will can lead to unintended consequences.

Another mistake is using outdated forms or templates. Laws regarding wills can change, and using an old version may not comply with current regulations. It is crucial to ensure that you are using the most recent form to avoid any legal issues.

Moreover, individuals sometimes forget to specify how debts and taxes will be handled. Without clear instructions, your estate could face unnecessary complications and delays during the probate process. It is essential to outline how you want debts settled to ensure a smoother transition for your heirs.

Lastly, many people overlook the importance of including a residuary clause. This clause addresses any assets not specifically mentioned in the will. Without it, any remaining assets could be subject to state intestacy laws, which may not align with your wishes.

By being aware of these common mistakes, you can take proactive steps to ensure that your Last Will and Testament accurately reflects your intentions. Taking the time to carefully review your will and consult with a professional can save your loved ones from unnecessary stress during a difficult time.

Key takeaways

Filling out and using the North Carolina Last Will and Testament form requires careful attention to detail. Here are some key takeaways to consider:

- Eligibility: To create a valid will in North Carolina, you must be at least 18 years old and of sound mind.

- Signature Requirement: The will must be signed by the testator (the person making the will) and witnessed by at least two individuals who are not beneficiaries.

- Revocation: A will can be revoked at any time by the testator. This can be done by creating a new will or by physically destroying the existing will.

- Probate Process: After death, the will must be submitted to the probate court to validate its authenticity and ensure the distribution of assets according to the testator's wishes.