Fillable Lady Bird Deed Form for North Carolina

North Carolina Lady Bird Deed - Usage Guidelines

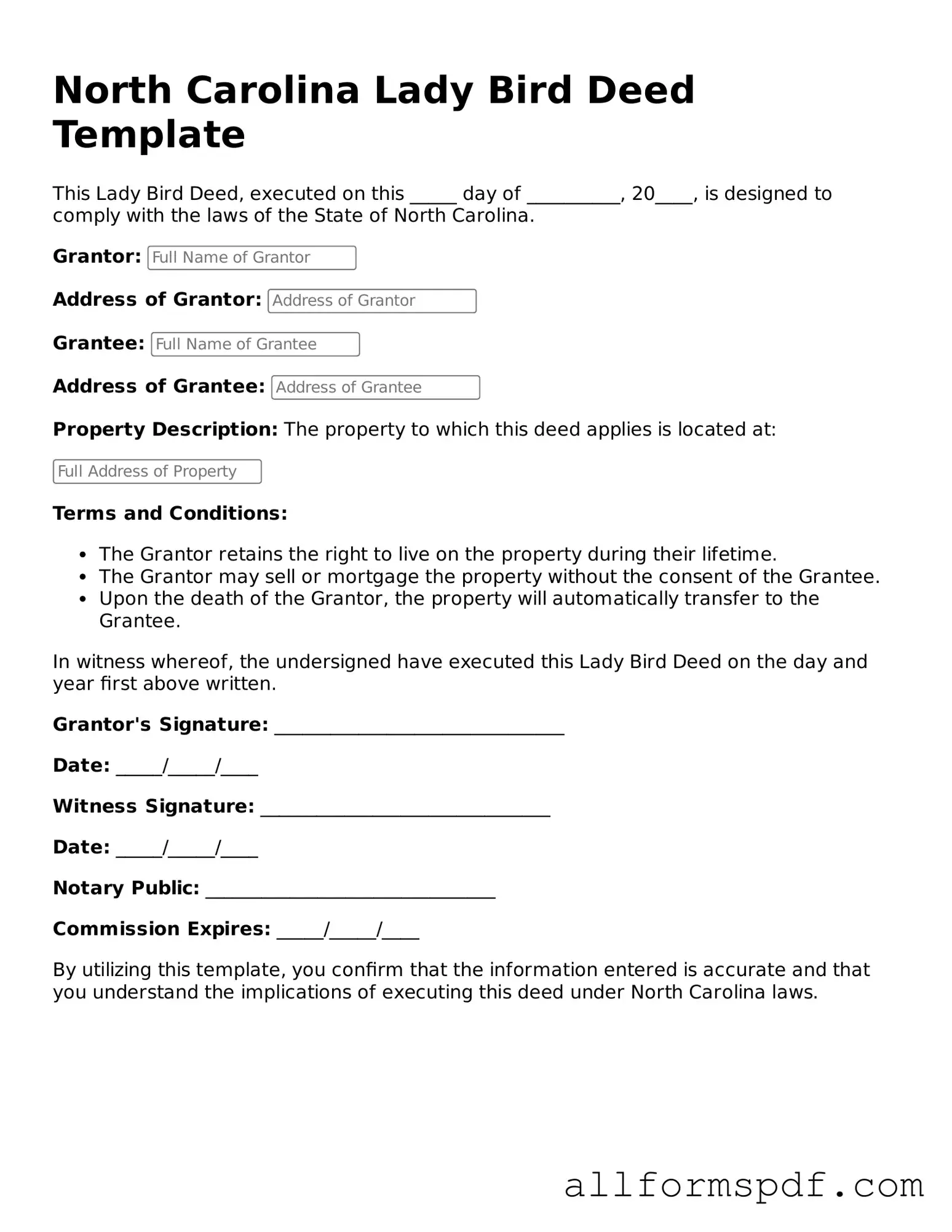

Filling out the North Carolina Lady Bird Deed form requires careful attention to detail. Once completed, this form will need to be signed and notarized before it can be recorded with the county register of deeds. Ensure that all information is accurate to avoid any issues during the recording process.

- Obtain the North Carolina Lady Bird Deed form from a reliable source or legal website.

- Begin by entering the name of the property owner(s) in the designated section. Make sure to use the full legal names.

- Provide the address of the property. This should include the street address, city, state, and zip code.

- Identify the beneficiaries by entering their names. These are the individuals who will receive the property upon the owner’s passing.

- Include any additional instructions or conditions regarding the property, if applicable. This may involve specifying rights or limitations for the beneficiaries.

- Review the form for accuracy. Check that all names, addresses, and details are correct.

- Sign the form in the presence of a notary public. Both the property owner(s) and the notary must be present for this step.

- After notarization, make copies of the signed form for your records.

- Submit the original notarized form to the county register of deeds for recording. Ensure you follow any local requirements regarding fees and submission methods.

Misconceptions

The North Carolina Lady Bird Deed is a useful estate planning tool, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions regarding property transfer and estate planning.

- It only benefits wealthy individuals. Many people think the Lady Bird Deed is only for the rich. In reality, it can benefit anyone who owns property and wants to ensure a smooth transfer to heirs.

- It avoids all taxes. Some believe that using a Lady Bird Deed means no taxes will be owed. While it can help avoid probate, it does not eliminate potential tax liabilities, such as capital gains taxes.

- It is the same as a traditional deed. A Lady Bird Deed differs significantly from a traditional deed. It allows the property owner to retain control during their lifetime while ensuring automatic transfer upon death.

- It can only be used for residential property. This misconception is common, but a Lady Bird Deed can be used for various types of real estate, including commercial properties.

- All states offer Lady Bird Deeds. Not every state recognizes Lady Bird Deeds. It is essential to check local laws, as this option is primarily available in certain states like North Carolina.

- It is a complicated process. Many people think that creating a Lady Bird Deed is overly complex. In reality, the process can be straightforward, especially with the help of legal professionals.

- Once created, it cannot be changed. Some believe that a Lady Bird Deed is permanent and cannot be altered. However, property owners can revoke or modify the deed as long as they are alive.

- It guarantees Medicaid eligibility. There is a misconception that using a Lady Bird Deed guarantees eligibility for Medicaid. While it can protect the property from being counted as an asset, eligibility depends on various factors.

- It is only for married couples. This is not true. A Lady Bird Deed can be used by individuals regardless of their marital status, making it accessible to a wide range of property owners.

Dos and Don'ts

When filling out the North Carolina Lady Bird Deed form, it's important to approach the process with care. Here’s a list of things you should and shouldn’t do:

- Do ensure you have the correct legal description of the property.

- Do include the full names of all grantors and grantees.

- Do review the form for accuracy before signing.

- Do consult a legal professional if you have questions.

- Do make copies of the completed form for your records.

- Don't rush through the process; take your time to understand each section.

- Don't leave any required fields blank.

- Don't forget to sign the form in front of a notary.

- Don't use outdated versions of the form.

- Don't assume that verbal agreements are enough; everything must be in writing.

Popular State-specific Lady Bird Deed Forms

Free Michigan Lady Bird Deed Pdf - The adaptability of the Lady Bird Deed makes it a popular choice for estate planning.

Obtaining the FR44 Florida form is essential for motorists in Florida, as it serves to confirm compliance with the state's insurance requirements. To facilitate this process, individuals can find useful resources and additional information at All Florida Forms, ensuring they meet the necessary coverage limits and maintain their driving privileges.

Common mistakes

Filling out the North Carolina Lady Bird Deed form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate legal descriptions of the property. This description must be precise and often requires information from the property deed. Omitting or misrepresenting this information can cause issues in the future.

Another mistake involves not including all necessary parties. The form requires the names of both the grantor and the grantee. If either party is missing, the deed may not be valid. Additionally, individuals sometimes forget to sign the document. A signature is essential for the deed to be legally binding.

Many people overlook the importance of having the deed notarized. A Lady Bird Deed must be notarized to ensure its authenticity. Without a notary’s signature and seal, the deed may not hold up in court. Some individuals also neglect to record the deed with the county register of deeds, which is crucial for public notice and protection of the property rights.

Errors can also arise from misunderstanding the implications of the deed. The Lady Bird Deed allows for the transfer of property while retaining certain rights. Failing to understand these rights can lead to unintended consequences regarding property use and transfer upon death.

Another common mistake is not consulting with a legal professional. While it is possible to fill out the form independently, seeking legal advice can help clarify any uncertainties. This can prevent costly errors that may arise from misinterpretation of the form's requirements.

People sometimes use outdated versions of the form. Laws and requirements can change, so it is vital to ensure that the most current version of the Lady Bird Deed is being used. Using an outdated form may result in noncompliance with current regulations.

Lastly, individuals may not take the time to review the completed form thoroughly. Simple typographical errors or omissions can invalidate the deed. It is advisable to double-check all entries before submission.

Key takeaways

When filling out and using the North Carolina Lady Bird Deed form, it is important to consider the following key points:

- Purpose: The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime.

- Retained Rights: The property owner retains the right to use, occupy, and sell the property without needing consent from the beneficiaries.

- Simplicity: This form simplifies the transfer process, avoiding the complexities of probate after the owner's death.

- Tax Implications: The deed may have implications for property taxes, so it is advisable to consult a tax professional.

- Revocation: The property owner can revoke the Lady Bird Deed at any time, allowing for flexibility in estate planning.

- Beneficiary Designation: Clearly identify the beneficiaries in the deed to ensure a smooth transfer of property rights.

- Witnesses and Notarization: The deed must be signed in the presence of a notary and may require witnesses, depending on local laws.

- Recording: To be effective, the deed must be recorded with the local county register of deeds.

Understanding these key points can aid in the effective use of the North Carolina Lady Bird Deed form.