Fillable Bill of Sale Form for North Carolina

North Carolina Bill of Sale - Usage Guidelines

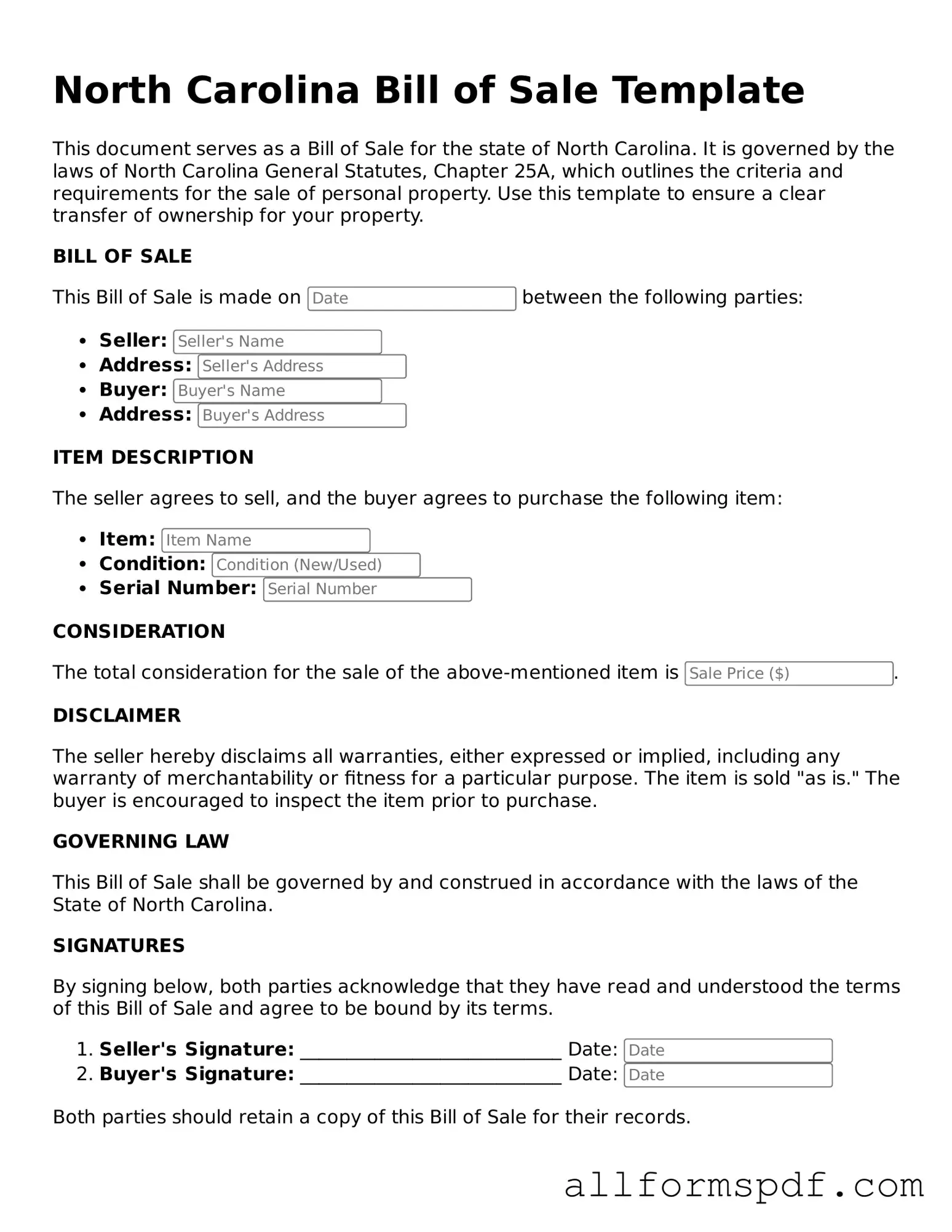

Once you have the North Carolina Bill of Sale form in hand, it's essential to fill it out accurately to ensure a smooth transaction. After completing the form, both the buyer and seller should keep a copy for their records. This document serves as proof of the sale and can be useful for future reference.

- Obtain the Form: Download the North Carolina Bill of Sale form from a reliable source or acquire a physical copy.

- Identify the Parties: Fill in the names and addresses of both the seller and the buyer. Ensure that all information is correct and legible.

- Describe the Item: Provide a detailed description of the item being sold. Include specifics like make, model, year, and any identifying numbers (such as VIN for vehicles).

- State the Sale Price: Clearly indicate the agreed-upon sale price for the item. This should be a specific dollar amount.

- Include the Date of Sale: Write the date when the transaction is taking place. This is important for record-keeping purposes.

- Signatures: Both the buyer and seller must sign the form. Ensure that both parties date their signatures to validate the transaction.

- Make Copies: After signing, make copies of the completed Bill of Sale for both the buyer and seller to keep for their records.

Misconceptions

Understanding the North Carolina Bill of Sale form is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- A Bill of Sale is only for vehicles. Many people believe that a Bill of Sale is only necessary for the sale of cars. In reality, it can be used for various personal property transactions, including boats, furniture, and equipment.

- A Bill of Sale does not need to be notarized. While notarization is not always required, having a Bill of Sale notarized can provide an extra layer of protection and verification for both parties involved in the transaction.

- The seller is responsible for taxes on the sale. This is a misconception. In North Carolina, the buyer is typically responsible for paying any applicable sales tax on the purchase, not the seller.

- A verbal agreement is sufficient. Some individuals think that a verbal agreement is enough to finalize a sale. However, having a written Bill of Sale is crucial for legal protection and clarity in the transaction.

- A Bill of Sale guarantees ownership. While a Bill of Sale serves as proof of the transaction, it does not guarantee clear title or ownership. Additional steps may be needed to ensure that the title is properly transferred.

- Only one copy of the Bill of Sale is necessary. It is important for both the buyer and seller to retain their own copies of the Bill of Sale for their records. This can be helpful in case of future disputes.

- Any format will work for a Bill of Sale. Although there is no specific format mandated by law, using a standardized Bill of Sale form ensures that all necessary information is included, reducing the risk of misunderstandings.

By clarifying these misconceptions, individuals can approach their transactions with greater confidence and understanding.

Dos and Don'ts

When filling out the North Carolina Bill of Sale form, it's important to ensure accuracy and clarity. Here are some guidelines to follow:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, such as make, model, and VIN for vehicles.

- Do clearly state the sale price to avoid any misunderstandings later on.

- Do sign and date the form to validate the transaction.

- Don't leave any sections blank; fill in all required fields to ensure completeness.

- Don't use abbreviations or shorthand that could lead to confusion about the information provided.

Popular State-specific Bill of Sale Forms

Bill of Sale Ohio - A Bill of Sale is often a requirement for insurance purposes.

For anyone looking to complete a transaction efficiently, a reliable option is the Alabama bill of sale form template, which provides essential details to finalize your sale. You can create your document by visiting the Alabama bill of sale form resource for further assistance.

Nj Bill of Sale for Car - A clear Bill of Sale can reduce the likelihood of buyer's remorse claims.

Common mistakes

When completing the North Carolina Bill of Sale form, individuals often overlook essential details. One common mistake is failing to include the correct date of the transaction. This date is crucial as it establishes the timeline of ownership transfer. Without it, disputes may arise regarding when the sale occurred, potentially complicating future transactions.

Another frequent error is neglecting to provide accurate vehicle or item identification. This includes the make, model, year, and Vehicle Identification Number (VIN) for vehicles. Incomplete or incorrect information can lead to confusion and issues with registration or title transfers. It is vital to double-check these details to ensure they match official records.

Many people also forget to obtain the necessary signatures. Both the seller and the buyer must sign the Bill of Sale for it to be legally binding. Without these signatures, the document may not hold up in court or during any disputes. Ensuring that all parties involved have signed can prevent future complications.

Lastly, individuals sometimes fail to keep a copy of the completed Bill of Sale. Retaining a copy is important for both the buyer and seller, as it serves as proof of the transaction. This documentation can be essential for future reference, especially if questions about ownership or payment arise. It is advisable to make copies before finalizing the sale.

Key takeaways

When filling out and using the North Carolina Bill of Sale form, keep the following key takeaways in mind:

- Accurate Information: Ensure that all details about the buyer, seller, and item being sold are correct and complete.

- Signatures Required: Both the buyer and seller must sign the document for it to be legally binding.

- Consider Notarization: While not always necessary, having the Bill of Sale notarized can add an extra layer of authenticity.

- Keep Copies: Each party should retain a copy of the Bill of Sale for their records.

- Understand Local Laws: Familiarize yourself with any local regulations that may affect the sale or transfer of ownership.

- Use Clear Language: Avoid ambiguous terms; clear language helps prevent misunderstandings later on.