Fillable Articles of Incorporation Form for North Carolina

North Carolina Articles of Incorporation - Usage Guidelines

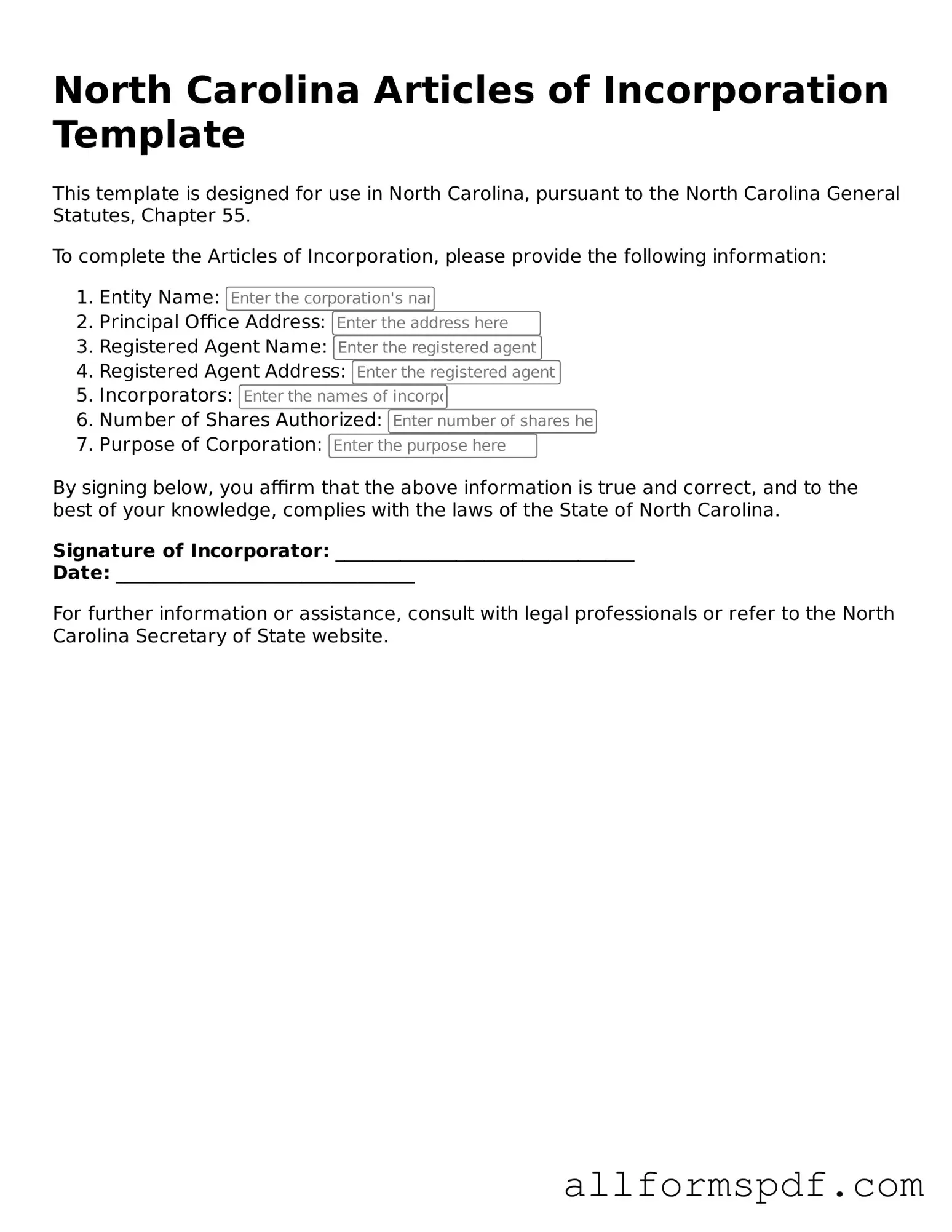

After gathering the necessary information, you are ready to complete the North Carolina Articles of Incorporation form. This document is essential for officially establishing your business as a corporation in the state. Follow these steps carefully to ensure accurate completion.

- Start by downloading the North Carolina Articles of Incorporation form from the North Carolina Secretary of State's website.

- Provide the name of your corporation. Make sure it is unique and includes "Corporation," "Incorporated," or an abbreviation like "Inc."

- List the principal office address. This must be a physical address in North Carolina, not a P.O. Box.

- Enter the name and address of the registered agent. This person or business will receive legal documents on behalf of the corporation.

- Specify the purpose of your corporation. Be clear and concise about the business activities you plan to undertake.

- Indicate the number of shares your corporation is authorized to issue. If applicable, include the par value of these shares.

- Provide the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that all incorporators have signed if there is more than one.

- Prepare the filing fee. Check the current fee on the Secretary of State’s website, as it may vary.

- Submit the completed form and payment to the North Carolina Secretary of State by mail or online, depending on your preference.

Once you submit the form, the state will review it. If everything is in order, you will receive confirmation of your corporation's formation. This is an important milestone for your business.

Misconceptions

When it comes to the North Carolina Articles of Incorporation, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

Anyone can file Articles of Incorporation without restrictions.

In reality, only individuals who meet specific criteria can file. Typically, at least one incorporator must be a natural person over the age of 18.

-

The Articles of Incorporation are the same as a business license.

This is not true. The Articles of Incorporation establish the existence of a corporation, while a business license allows you to operate legally in your locality.

-

Filing Articles of Incorporation guarantees tax-exempt status.

Filing does not automatically grant tax-exempt status. Nonprofit organizations must apply separately for this designation with the IRS.

-

Once filed, Articles of Incorporation cannot be changed.

This is a misconception. Amendments can be made to the Articles of Incorporation if necessary, following the proper procedures.

-

Only corporations need Articles of Incorporation.

While primarily associated with corporations, other business entities, such as nonprofits, also require Articles of Incorporation to be recognized legally.

Dos and Don'ts

Filling out the North Carolina Articles of Incorporation form is an important step in establishing your business. To ensure a smooth process, consider the following dos and don’ts:

- Do provide accurate and complete information. Every detail matters.

- Do double-check the names of your corporation. They must be unique and compliant with state regulations.

- Do include the registered agent's name and address. This is crucial for official communications.

- Do specify the purpose of your corporation clearly. A well-defined purpose can help avoid future issues.

- Do ensure you sign the form. An unsigned form may be rejected.

- Don't rush through the form. Take your time to avoid mistakes.

- Don't use abbreviations or shorthand. Clarity is key.

- Don't forget to include the correct filing fee. An incorrect payment can delay processing.

- Don't skip the review process. Have someone else look over your application before submission.

- Don't assume you can make changes after submission. Amendments can be time-consuming.

Popular State-specific Articles of Incorporation Forms

How to Get a Copy of Your Articles of Incorporation - Sets guidelines for the management structure.

Ohio Llc Filing - Defines the company's name and purpose.

Llc Articles of Organization Nj - All business owners should be current on their Articles of Incorporation status.

For those interested in safeguarding sensitive information, the procedure to utilize a reliable Non-disclosure Agreement form in Arizona is fundamental. This legal document is crucial for parties looking to maintain confidentiality and secure their proprietary information effectively.

How Do I Get a Copy of My Articles of Incorporation in Georgia - Outlines the roles and responsibilities of corporate officers.

Common mistakes

Filing the Articles of Incorporation in North Carolina is a crucial step for anyone looking to start a corporation. However, many people make common mistakes that can delay the process or lead to complications down the line. Understanding these pitfalls can save time and frustration.

One frequent error is failing to choose an appropriate name for the corporation. The name must be unique and not similar to existing businesses in North Carolina. Additionally, it should include a corporate designation such as “Corporation,” “Incorporated,” or an abbreviation like “Inc.” Neglecting this requirement can result in rejection of the application.

Another mistake is not providing a valid registered agent. The registered agent must have a physical address in North Carolina and be available during business hours. Some people mistakenly list a P.O. Box or fail to designate an agent altogether, which can lead to legal issues later.

Inaccurate information about the corporation's purpose is also a common issue. The Articles of Incorporation require a clear statement of purpose. Vague or overly broad descriptions can cause confusion and might not meet state requirements.

Many applicants overlook the importance of including the correct number of shares the corporation is authorized to issue. This detail is critical for establishing ownership and investment. Failing to specify this can lead to complications when trying to raise capital.

Another area where mistakes often occur is in the incorporation date. Some individuals forget to include a specific date or mistakenly put a future date. This can create unnecessary complications and delays in processing the application.

People sometimes forget to sign the Articles of Incorporation. Without the necessary signatures, the document is considered incomplete. This simple oversight can result in rejection and require resubmission.

Inaccurate contact information is another common error. Providing outdated or incorrect addresses and phone numbers can hinder communication from the state. It is essential to ensure that all contact details are current and accurate.

Another mistake involves not paying the required filing fee. Each incorporation requires a specific fee, and failing to include this payment can result in delays. Be sure to check the current fee schedule before submitting your application.

Lastly, some individuals do not keep copies of their submitted Articles of Incorporation. Having a copy for your records is important for future reference and for any legal matters that may arise. Always make sure to retain a copy of the filed documents.

Key takeaways

Filling out the North Carolina Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the state. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They officially create your business entity and outline its basic structure.

- Provide Accurate Information: Ensure that all information, such as the corporation's name, address, and registered agent, is correct. Mistakes can lead to delays or legal issues.

- Specify the Business Purpose: Clearly state the purpose of your corporation. This helps define what activities the corporation will engage in and can impact future legal matters.

- Consider the Number of Shares: Decide how many shares your corporation will issue and their par value. This affects ownership structure and potential fundraising efforts.

- File with the Secretary of State: Submit the completed form to the North Carolina Secretary of State along with the required filing fee. This step is essential for your corporation to be legally recognized.