Fillable Transfer-on-Death Deed Form for New Jersey

New Jersey Transfer-on-Death Deed - Usage Guidelines

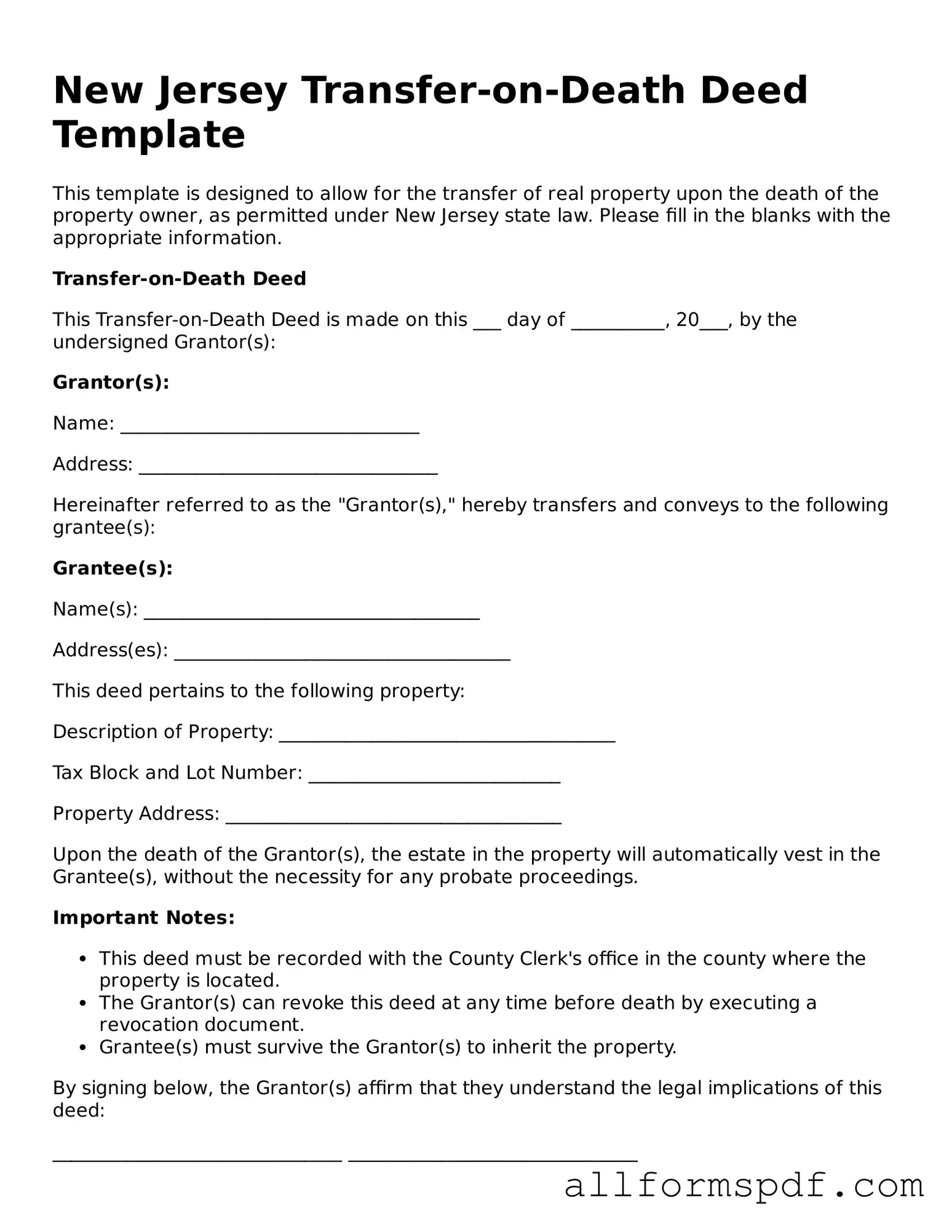

Filling out the New Jersey Transfer-on-Death Deed form is an important step in ensuring that your property is transferred to your chosen beneficiary upon your passing. Once completed, this form must be filed with the county clerk's office where the property is located. Below are the steps to guide you through the process of filling out the form.

- Begin by downloading the New Jersey Transfer-on-Death Deed form from the official state website or obtaining a physical copy from your local county clerk's office.

- At the top of the form, enter the name of the property owner (the grantor) as it appears on the property deed.

- Provide the grantor's address, including the city, state, and zip code.

- Next, identify the beneficiary who will receive the property. Write the full name of the beneficiary, ensuring it is spelled correctly.

- Include the beneficiary's address, including the city, state, and zip code.

- In the designated section, describe the property being transferred. This typically includes the property’s address and legal description, which can be found on the current deed.

- Sign the form in the presence of a notary public. Make sure that the notary public also signs and seals the document, confirming your identity and the authenticity of the signature.

- Make copies of the completed and notarized form for your records.

- Finally, file the original form with the county clerk's office where the property is located. There may be a filing fee, so check with the office beforehand.

After you have submitted the form, it will be recorded in the public records. This ensures that your wishes regarding the transfer of your property are legally recognized and will be followed after your passing. It is advisable to keep a copy of the filed deed for your personal records and to inform the beneficiary about the arrangement.

Misconceptions

Many people have questions about the New Jersey Transfer-on-Death Deed form. Here are six common misconceptions that can lead to confusion:

-

It automatically transfers property upon death.

The Transfer-on-Death Deed does not transfer the property immediately. It only takes effect when the owner passes away.

-

It can be used for any type of property.

This deed is typically used for real estate only. It does not apply to personal property or other assets.

-

It eliminates the need for a will.

While the deed can simplify the transfer of property, it does not replace a will. A will is still important for addressing other assets and wishes.

-

All heirs must agree to the transfer.

The owner can designate beneficiaries without needing consent from all heirs. However, it's wise to communicate intentions to avoid conflicts.

-

It’s a complicated process.

Filling out the Transfer-on-Death Deed is straightforward. With the right information, it can be completed without much hassle.

-

It’s only for wealthy individuals.

This deed can be beneficial for anyone who owns property, regardless of their financial status. It helps ensure that property goes to the intended beneficiaries.

Understanding these misconceptions can help clarify how the New Jersey Transfer-on-Death Deed works and how it may benefit property owners.

Dos and Don'ts

When filling out the New Jersey Transfer-on-Death Deed form, it's essential to follow specific guidelines to ensure accuracy and legality. Here are eight important dos and don'ts to consider:

- Do ensure that you are eligible to use the Transfer-on-Death Deed in New Jersey.

- Do provide complete and accurate information about the property being transferred.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Don't leave any fields blank; incomplete forms may be rejected.

- Don't forget to record the deed with the county clerk's office after signing.

- Don't use vague language when describing the property; clarity is crucial.

- Don't attempt to make changes to the form after it has been notarized.

By adhering to these guidelines, you can navigate the process more smoothly and ensure that your intentions are honored. Careful attention to detail will help prevent potential disputes or legal complications in the future.

Popular State-specific Transfer-on-Death Deed Forms

How to Gift a House to a Family Member - Utilizing this deed can alleviate the burden on your loved ones by providing clear and straightforward instructions regarding your property after your death.

In the context of mobile home transactions, utilizing a New York Mobile Home Bill of Sale form is essential for ensuring a smooth and legally binding process. This form effectively captures all necessary details of the sale, thereby safeguarding the interests of both the buyer and the seller. For those looking to create this important document, resources such as smarttemplates.net/fillable-new-york-mobile-home-bill-of-sale can provide valuable assistance and templates to streamline the process.

Transfer on Death Deed Georgia Form - Before executing a deed, it's advisable to consider the long-term impacts of such transfers.

Common mistakes

Filling out the New Jersey Transfer-on-Death Deed form requires careful attention to detail. One common mistake is failing to include all required information about the property. The form must specify the complete legal description of the property. Omitting this can lead to complications during the transfer process.

Another frequent error is not properly identifying the beneficiary. It is essential to provide the full name and address of the individual who will receive the property upon the owner’s death. Inaccuracies here can result in disputes or delays in the transfer.

Many individuals overlook the need for signatures. The Transfer-on-Death Deed must be signed by the property owner. If this step is neglected, the deed will be considered invalid. Additionally, the form must be notarized to ensure its legal standing.

Some people mistakenly assume that the Transfer-on-Death Deed will automatically avoid probate. While this deed does allow for a transfer outside of probate, it is crucial to understand that certain conditions must be met for it to be effective. Failing to understand these nuances can lead to unexpected outcomes.

Inaccurate or incomplete witness information is another mistake that can undermine the validity of the deed. New Jersey law requires that the deed be witnessed by two individuals. If this requirement is not met, the deed may be challenged in court.

Another common pitfall is neglecting to record the deed with the county clerk’s office. Recording the deed is necessary to make it effective against third parties. Without proper recording, the intended beneficiary may face difficulties in asserting their claim to the property.

People also often forget to update the deed if their circumstances change. For example, if the beneficiary passes away or if the owner wishes to change the beneficiary, a new deed must be executed. Failing to make these updates can lead to unintended consequences.

Finally, many individuals do not seek legal advice when filling out the form. While it is possible to complete the deed without assistance, consulting with a legal professional can help ensure that all requirements are met and that the form is filled out correctly. This can save time and prevent potential issues in the future.

Key takeaways

- The New Jersey Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- To use this deed, the property owner must complete the form accurately, including the legal description of the property and the names of the beneficiaries.

- The deed must be signed by the property owner in the presence of a notary public to be valid.

- Filing the completed deed with the county clerk's office is necessary for it to take effect.

- Beneficiaries do not have any rights to the property until the owner's death, which helps maintain the owner's control during their lifetime.

- It is important to keep the deed updated if there are changes in beneficiaries or if the property is sold.

- Consulting with a legal professional is advisable to ensure compliance with all state requirements and to address any specific concerns.