Fillable Tractor Bill of Sale Form for New Jersey

New Jersey Tractor Bill of Sale - Usage Guidelines

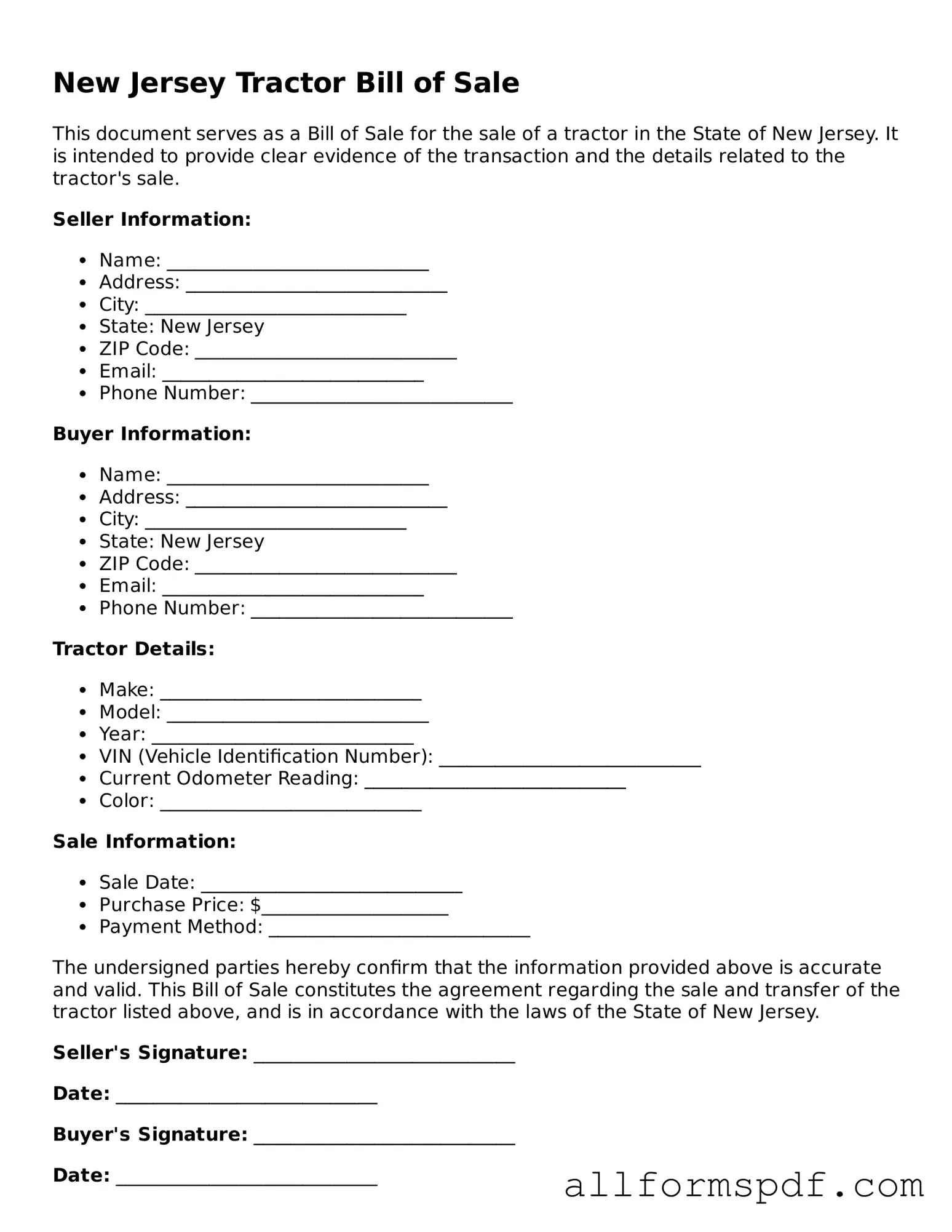

Filling out the New Jersey Tractor Bill of Sale form is a straightforward process that ensures the transfer of ownership is documented properly. Once you have completed the form, both the buyer and seller should retain a copy for their records. Follow these steps to accurately fill out the form.

- Obtain the form: Download the New Jersey Tractor Bill of Sale form from a reliable source or acquire a physical copy from your local DMV.

- Fill in the date: Write the date of the transaction at the top of the form.

- Enter seller information: Provide the full name and address of the seller. Ensure that all details are accurate.

- Enter buyer information: Include the full name and address of the buyer. Double-check for any errors.

- Describe the tractor: Fill in details about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price: Clearly state the agreed-upon sale price for the tractor.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction.

- Make copies: After completing the form, make copies for both parties to keep for their records.

Misconceptions

The New Jersey Tractor Bill of Sale form is often misunderstood. Here are nine common misconceptions and clarifications regarding this important document.

-

It is not necessary for all tractor sales.

Some people believe that a bill of sale is optional for all tractor transactions. However, a bill of sale provides proof of ownership and is required for registration in many cases.

-

Only licensed dealers can issue a bill of sale.

Individuals can create and sign a bill of sale. It is not limited to licensed dealers, although dealers often have their own standardized forms.

-

The form must be notarized.

Notarization is not a requirement for the New Jersey Tractor Bill of Sale. However, having it notarized can add an extra layer of authenticity.

-

All sales must be reported to the state.

While the bill of sale is important for the buyer and seller, it does not need to be reported to the state unless required for registration or taxes.

-

The bill of sale must include a warranty.

Many assume that a warranty is mandatory. In fact, the bill of sale can be written as "as-is," meaning no warranties are implied.

-

Only cash transactions require a bill of sale.

Regardless of the payment method—whether cash, check, or financing—a bill of sale is beneficial for documenting the transaction.

-

All information must be filled out completely.

While it is best to provide as much detail as possible, missing information does not invalidate the bill of sale. Essential details include the buyer's and seller's names, vehicle identification number (VIN), and sale price.

-

The bill of sale is only for used tractors.

New tractor sales also benefit from a bill of sale. It serves as a record of purchase for both parties, regardless of the tractor's age.

-

Once signed, the bill of sale cannot be changed.

If both parties agree, the bill of sale can be amended. It is important to document any changes and have both parties sign the updated version.

Dos and Don'ts

When filling out the New Jersey Tractor Bill of Sale form, it’s important to follow certain guidelines to ensure the document is accurate and legally binding. Below are ten things to do and not do during this process.

- Do provide accurate information about the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Do include the full names and addresses of both the buyer and seller.

- Do clearly state the sale price of the tractor.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed Bill of Sale for your records.

- Don’t leave any required fields blank; incomplete forms may cause issues later.

- Don’t use abbreviations or nicknames for names; full legal names are necessary.

- Don’t falsify any information regarding the tractor’s condition or history.

- Don’t forget to check for any local requirements that may need to be included.

- Don’t rush the process; take your time to ensure accuracy.

Popular State-specific Tractor Bill of Sale Forms

Tractor Bill of Sale Word Template - Aids in establishing a clear record of the sale date and price.

For buyers and sellers in Arizona, obtaining the necessary documentation is vital. A well-prepared contract can facilitate a smooth transaction, so be sure to check out this essential guide to the Motor Vehicle Bill of Sale requirements before proceeding with your sale.

Common mistakes

Filling out a bill of sale for a tractor in New Jersey may seem straightforward, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to provide complete information about the tractor. It’s essential to include details such as the make, model, year, and Vehicle Identification Number (VIN). Omitting any of these details can create confusion and potentially cause issues with registration.

Another mistake often seen is neglecting to include the purchase price. This figure is not just a formality; it establishes the value of the transaction for both parties. If the purchase price is missing, it may raise questions during tax assessments or future sales. Always ensure that this information is clearly stated.

People also sometimes forget to sign the bill of sale. Both the buyer and seller must sign the document for it to be legally binding. Without these signatures, the bill of sale lacks validity, which can lead to disputes later. Remember, a signature is more than just a formality; it signifies agreement and understanding between both parties.

Another common oversight involves the date of the transaction. Failing to include the date can lead to confusion regarding when the sale took place. This detail is crucial for record-keeping and for any future legal matters that may arise. Always double-check that the date is clearly written.

Inaccurate information about the buyer or seller is also a significant issue. People sometimes provide incorrect names, addresses, or contact information. This can complicate communication and may create problems if any issues arise after the sale. It’s vital to ensure that all personal information is accurate and up-to-date.

Moreover, individuals often overlook the importance of having a witness or notary present during the signing process. While not always required, having a third party can add an extra layer of security and legitimacy to the transaction. This step is particularly important if the sale involves a substantial amount of money.

Lastly, many people fail to keep a copy of the completed bill of sale for their records. This document serves as proof of the transaction and can be invaluable in case of disputes or for future reference. Always make sure to retain a copy for your files, as it can save you time and trouble in the long run.

Key takeaways

When dealing with the New Jersey Tractor Bill of Sale form, there are several important points to consider. This document serves as a crucial record of the transaction between the buyer and seller. Here are some key takeaways:

- Accurate Information is Essential: Ensure that all details, including the names, addresses, and contact information of both parties, are filled out correctly. Mistakes can lead to complications in ownership transfer.

- Vehicle Identification: The form requires specific information about the tractor, such as the make, model, year, and Vehicle Identification Number (VIN). This helps in clearly identifying the vehicle being sold.

- Sales Price: Clearly state the agreed-upon sales price. This figure is important for both parties and may also be relevant for tax purposes.

- Signatures Required: Both the seller and buyer must sign the form. This signature is a declaration that both parties agree to the terms outlined in the document.

- Keep Copies: After completing the form, both parties should keep a copy for their records. This serves as proof of the transaction and can be useful for future reference.

Understanding these key aspects can simplify the process of buying or selling a tractor in New Jersey. Properly completing the Bill of Sale not only protects both parties but also ensures a smooth transfer of ownership.