Fillable Real Estate Purchase Agreement Form for New Jersey

New Jersey Real Estate Purchase Agreement - Usage Guidelines

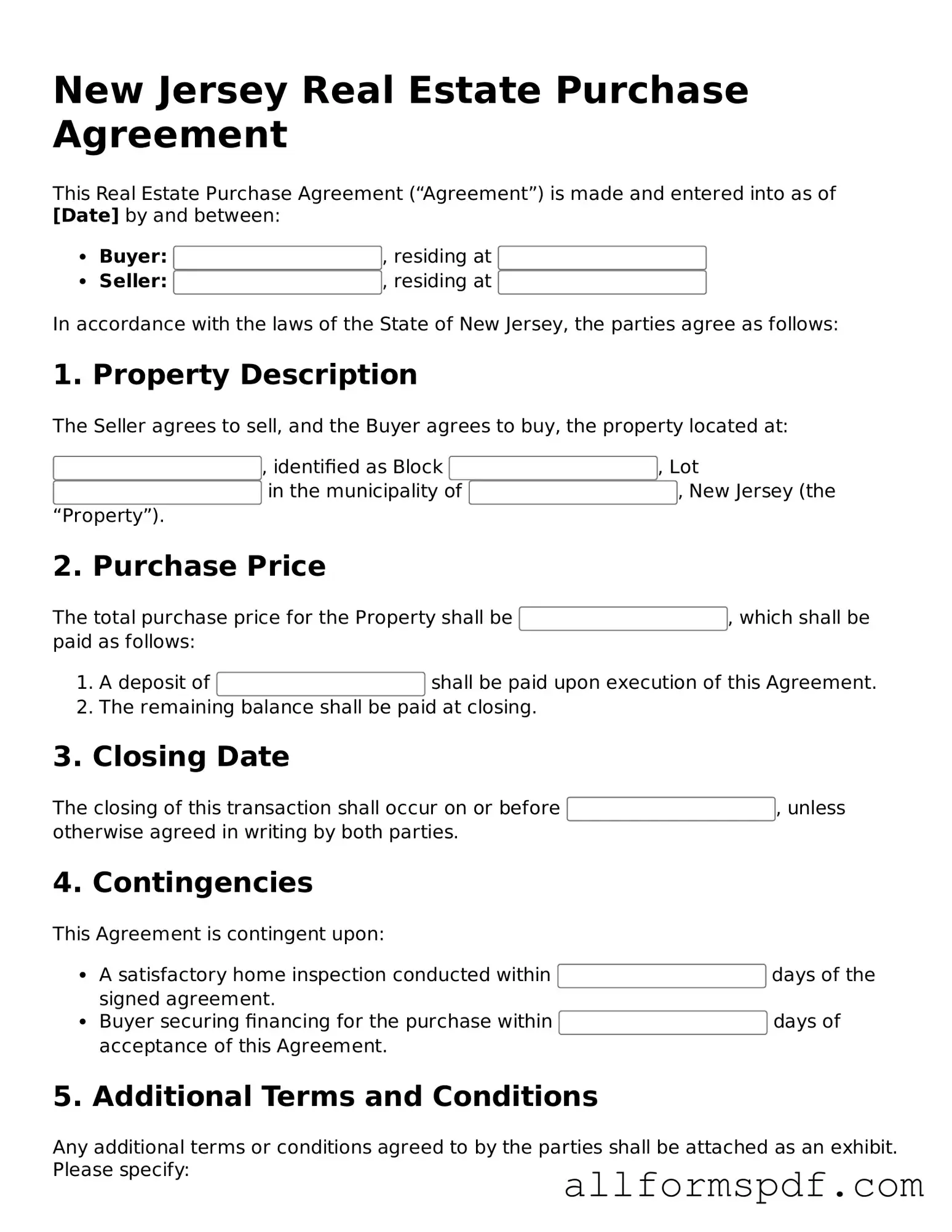

Completing the New Jersey Real Estate Purchase Agreement form is an essential step in the home buying process. This form outlines the terms and conditions of the property sale, ensuring both parties are on the same page. Below are the steps to effectively fill out the form.

- Obtain the Form: Acquire the New Jersey Real Estate Purchase Agreement form from a reliable source, such as a real estate agent or legal professional.

- Fill in Buyer Information: Enter the full names and contact details of all buyers involved in the transaction.

- Fill in Seller Information: Provide the full names and contact details of all sellers involved in the transaction.

- Property Description: Clearly describe the property being sold, including the address and any relevant details such as lot number or property type.

- Purchase Price: State the agreed-upon purchase price for the property.

- Deposit Amount: Specify the amount of earnest money deposit the buyer will provide and the method of payment.

- Closing Date: Indicate the proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspection requirements.

- Signatures: Ensure that all parties sign and date the agreement to validate it.

- Review: Carefully review the completed form for accuracy before submission.

After filling out the form, both the buyer and seller should retain copies for their records. It is advisable to consult with a legal expert or real estate professional to ensure all necessary details are included and compliant with New Jersey laws.

Misconceptions

Understanding the New Jersey Real Estate Purchase Agreement is essential for anyone involved in a property transaction. However, several misconceptions can lead to confusion. Below are seven common misconceptions about this important document:

- The agreement is only a formality. Many people believe that the purchase agreement is just a formality that can be overlooked. In reality, it is a legally binding contract that outlines the terms of the sale, including price, contingencies, and responsibilities of both parties.

- All agreements are the same. Some assume that all real estate purchase agreements are identical. However, each agreement can be tailored to fit the specific needs of the buyer and seller. Variations may exist based on local laws, property type, and individual circumstances.

- Once signed, the agreement cannot be changed. There is a belief that once the purchase agreement is signed, it is set in stone. In truth, amendments can be made if both parties agree to the changes. It is important to document any modifications properly.

- Only the buyer is responsible for the agreement. A common misconception is that only the buyer must adhere to the terms of the purchase agreement. In fact, both the buyer and seller have obligations outlined in the contract, and both must fulfill their responsibilities.

- The agreement guarantees a successful sale. Some individuals think that signing the purchase agreement guarantees that the sale will go through. However, the agreement often includes contingencies that may allow either party to back out under certain conditions, such as financing issues or inspection results.

- Legal representation is not necessary. Many believe that they can navigate the purchase agreement without legal help. While it is possible, having an attorney review the agreement can provide peace of mind and ensure that all terms are fair and legally sound.

- Real estate agents can handle everything. Some people think that their real estate agent will manage all aspects of the purchase agreement. While agents play a crucial role, they are not a substitute for legal advice. It is wise to consult an attorney to address any legal concerns.

By addressing these misconceptions, individuals can approach the New Jersey Real Estate Purchase Agreement with a clearer understanding. This knowledge can lead to more informed decisions and a smoother transaction process.

Dos and Don'ts

When filling out the New Jersey Real Estate Purchase Agreement form, it's essential to approach the process with care. Here are some important dos and don'ts to consider:

- Do read the entire agreement thoroughly before filling it out.

- Don't leave any sections blank; if a section doesn't apply, indicate that clearly.

- Do provide accurate and up-to-date information about both the buyer and seller.

- Don't use abbreviations or shorthand that could cause confusion.

- Do ensure that all parties sign and date the agreement where required.

- Don't rush through the process; take your time to double-check your entries.

- Do consult a real estate professional if you have any questions or uncertainties.

Following these guidelines can help ensure a smoother transaction and minimize potential issues down the line.

Popular State-specific Real Estate Purchase Agreement Forms

Illinois Real Estate Contract - It sets the purchase price and payment terms for the real estate transaction.

The Florida Traffic Crash Report form is crucial for documenting incidents where law enforcement reports are not generated but damage has occurred. This form allows drivers to detail their account of the accident, including necessary information about the involved vehicles and parties. For further assistance and to access the form, drivers can visit All Florida Forms, ensuring that they complete and submit the report within 10 days to adhere to Florida Statute 316.066(1)(e) and support their insurance claims.

Sale Contract for House - The agreement allows for negotiations between parties on terms of the sale.

Nc Association of Realtors - It may outline procedures for handling disputes before they escalate to litigation.

Common mistakes

Filling out the New Jersey Real Estate Purchase Agreement form can be a complex task. One common mistake is failing to include all necessary parties. Buyers and sellers must ensure that all individuals involved in the transaction are listed. Omitting a party can lead to legal complications later on.

Another frequent error involves incorrect property descriptions. The property should be accurately described, including its address and any distinguishing features. Inaccurate descriptions can create confusion and potential disputes over the property being sold.

Buyers and sellers sometimes neglect to specify the purchase price clearly. This amount should be stated explicitly to avoid misunderstandings. Leaving it blank or writing it ambiguously can lead to disputes down the line.

Additionally, people often overlook the importance of including contingencies. Contingencies protect the buyer and seller by outlining specific conditions that must be met for the sale to proceed. Failing to include these can result in unexpected issues during the transaction.

Not addressing the earnest money deposit is another mistake. This deposit shows the buyer's commitment to the purchase. The amount and terms should be clearly stated in the agreement to avoid confusion.

Another error involves ignoring the closing date. It is essential to specify when the closing will occur. This date should be agreed upon by both parties to ensure a smooth transaction.

Buyers and sellers sometimes neglect to review the form for completeness. Missing signatures or initials can invalidate the agreement. Each party should carefully review the document before submission.

Additionally, using outdated forms can lead to mistakes. Real estate laws change, and using an old version of the agreement may result in compliance issues. Always ensure the most current form is being used.

Finally, failing to consult with a real estate professional can be a significant oversight. Professionals can provide guidance and help avoid common pitfalls. Their expertise can be invaluable in ensuring the agreement is filled out correctly.

Key takeaways

When engaging in a real estate transaction in New Jersey, understanding the Real Estate Purchase Agreement (REPA) form is essential. This document serves as a binding contract between the buyer and the seller, outlining the terms of the sale. Here are some key takeaways to consider:

- Read Thoroughly: Before signing, both parties should read the entire agreement carefully. Understanding each section can prevent misunderstandings later on.

- Include All Necessary Details: The agreement must clearly state the property address, sale price, and any contingencies. Omitting important details can lead to disputes.

- Contingencies Are Important: Contingencies, such as financing or inspection requirements, should be included. These clauses protect the buyer and allow for an exit if certain conditions are not met.

- Understand the Earnest Money Deposit: This deposit shows the buyer's seriousness about the purchase. It is typically held in escrow and should be specified in the agreement.

- Review Closing Costs: Both parties should be aware of who is responsible for various closing costs. Clearly outlining these responsibilities in the agreement can avoid surprises at closing.

- Seek Professional Guidance: Consulting with a real estate attorney or agent can provide valuable insights. They can help ensure that the agreement complies with New Jersey laws and protects your interests.

By keeping these takeaways in mind, buyers and sellers can navigate the real estate process with greater confidence and clarity.