Fillable Quitclaim Deed Form for New Jersey

New Jersey Quitclaim Deed - Usage Guidelines

After completing the New Jersey Quitclaim Deed form, you will need to file it with the county clerk’s office where the property is located. This step is crucial to ensure the transfer of ownership is legally recognized. Make sure to keep a copy for your records.

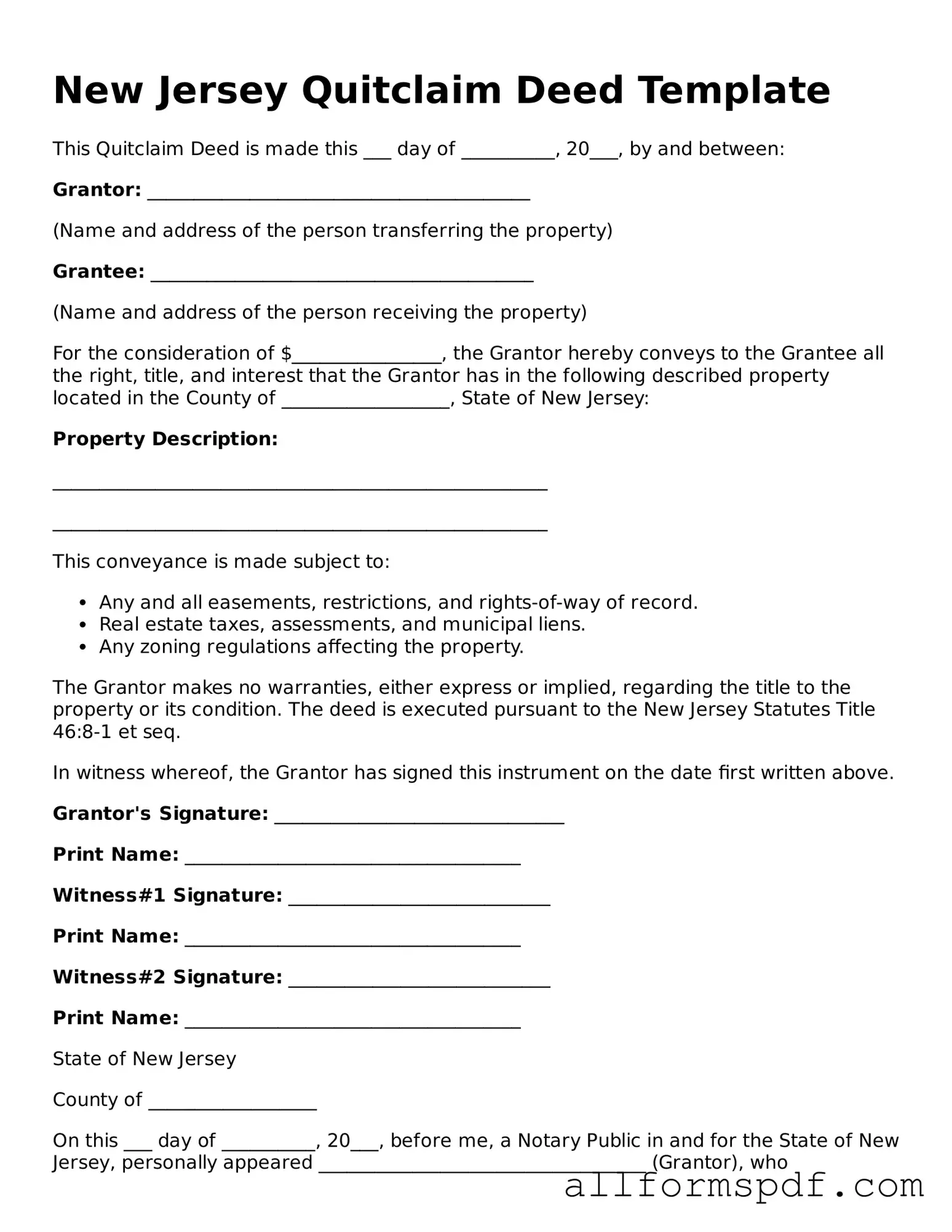

- Obtain the New Jersey Quitclaim Deed form. You can find it online or at your local county clerk’s office.

- Enter the name of the grantor (the person transferring the property) at the top of the form.

- Provide the name of the grantee (the person receiving the property) in the designated space.

- Include the property description. This should include the address and any relevant legal descriptions. Ensure accuracy to avoid future disputes.

- Specify the consideration amount. This is the value exchanged for the property, even if it’s nominal.

- Have the grantor sign the form in the presence of a notary public. The notary will then sign and stamp the document.

- Fill in the date of the transfer. This is typically the date when the grantor signs the deed.

- Check all entries for accuracy. Errors can lead to complications in the transfer process.

- Submit the completed form to the county clerk’s office along with any required fees.

Misconceptions

Understanding the New Jersey Quitclaim Deed can be challenging due to various misconceptions. Here are ten common misunderstandings clarified:

- Quitclaim Deeds Transfer Ownership Completely - Many believe that a quitclaim deed transfers full ownership rights. In reality, it only conveys whatever interest the grantor has in the property, which may be limited or nonexistent.

- Quitclaim Deeds Are Only for Family Transfers - While often used among family members, quitclaim deeds can be utilized in various situations, including sales, partnerships, or settling disputes.

- Quitclaim Deeds Eliminate Liens - A common myth is that using a quitclaim deed clears any existing liens on the property. However, liens remain attached to the property, regardless of the deed type.

- Quitclaim Deeds Require Notarization - Some think that notarization is mandatory for all quitclaim deeds. In New Jersey, while notarization is recommended for recording, it is not strictly required.

- Quitclaim Deeds Are Only for Real Estate - Many assume that quitclaim deeds apply solely to real property. In fact, they can also be used for transferring interests in other types of property, such as vehicles or personal assets.

- Quitclaim Deeds Are Quick and Simple - While they are generally easier than other deed types, they still require careful consideration and proper execution to avoid future disputes.

- Quitclaim Deeds Are Irrevocable - Some believe that once a quitclaim deed is executed, it cannot be undone. In truth, it can be revoked or altered under certain circumstances.

- Quitclaim Deeds Are Always the Best Option - Not every situation calls for a quitclaim deed. In many cases, a warranty deed may provide better protection for the grantee.

- Quitclaim Deeds Are Only Used in New Jersey - This misconception overlooks that quitclaim deeds are recognized in many states across the U.S., each with its own rules and regulations.

- Quitclaim Deeds Can Be Used to Avoid Taxes - Some think that using a quitclaim deed can bypass tax obligations. However, tax implications still apply, and it is essential to consult a tax professional.

Being aware of these misconceptions can help individuals make informed decisions when considering a quitclaim deed in New Jersey.

Dos and Don'ts

When filling out the New Jersey Quitclaim Deed form, it is essential to follow specific guidelines to ensure the document is valid and effective. Here are nine important dos and don'ts to consider:

- Do provide accurate information about the grantor and grantee.

- Do include a complete legal description of the property.

- Do sign the deed in the presence of a notary public.

- Do check for any outstanding liens or mortgages on the property.

- Do record the deed with the county clerk's office after completion.

- Don't leave any fields blank on the form.

- Don't forget to date the deed before submission.

- Don't use vague descriptions of the property.

- Don't overlook the importance of consulting a legal professional if needed.

Popular State-specific Quitclaim Deed Forms

North Carolina Quit Claim Deed Pdf - It can also aid in the transfer process for vacation or rental properties.

Explore our guide to the crucial Motor Vehicle Bill of Sale document you need for purchasing or selling vehicles in Arizona. Learn more about its importance and ensure you have all necessary information at hand by visiting this essential Motor Vehicle Bill of Sale form.

Can I File a Quit Claim Deed Myself - Individuals should be cautious, as the absence of warranties means accepting potential risks.

Common mistakes

Filling out a New Jersey Quitclaim Deed form can be straightforward, but mistakes often happen. One common error is failing to include the correct names of the parties involved. It’s essential to ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match their legal identification. Any discrepancies can lead to confusion or even legal disputes down the line.

Another mistake is neglecting to provide a complete legal description of the property. This description should include details such as the lot number, block number, and any relevant boundaries. Without this information, the deed may not accurately reflect the property being transferred, which could create issues with future ownership claims or property taxes.

People also often overlook the need for proper notarization. A Quitclaim Deed must be signed in front of a notary public to be legally valid. Failing to have the deed notarized can render it ineffective, meaning the transfer of property may not be recognized. It's a simple step that can easily be forgotten but is crucial for the deed's legitimacy.

Lastly, many individuals forget to check for any outstanding liens or mortgages on the property. If there are existing debts associated with the property, these may not be cleared by simply transferring ownership through a Quitclaim Deed. This oversight can lead to financial complications for the grantee, who may find themselves responsible for those debts after the transfer.

Key takeaways

Filling out and using the New Jersey Quitclaim Deed form is straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without any warranties. It’s often used between family members or to clear up title issues.

- Gather Necessary Information: Before filling out the form, collect all relevant details, including the names of the grantor (seller) and grantee (buyer), property description, and the property’s address.

- Use Clear Language: Fill out the form using clear and concise language. Avoid any ambiguous terms that could lead to confusion.

- Signatures Required: Ensure that the grantor signs the deed in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Notarization: The notary public must also sign and stamp the document. This verifies the identity of the grantor and the authenticity of the signature.

- File with the County Clerk: After completing the deed, file it with the county clerk’s office in the county where the property is located. There may be a filing fee.

- Check Local Requirements: Some counties may have specific requirements or additional forms needed for filing. Check with your local office for any variations.

- Consider Tax Implications: Transferring property may have tax consequences. Consult a tax professional to understand any potential impacts.

- Keep Copies: After filing, keep copies of the signed and filed Quitclaim Deed for your records. This can be important for future reference.

- Consult an Attorney if Necessary: If you have questions or concerns about the process, consider consulting a real estate attorney for guidance.