Fillable Promissory Note Form for New Jersey

New Jersey Promissory Note - Usage Guidelines

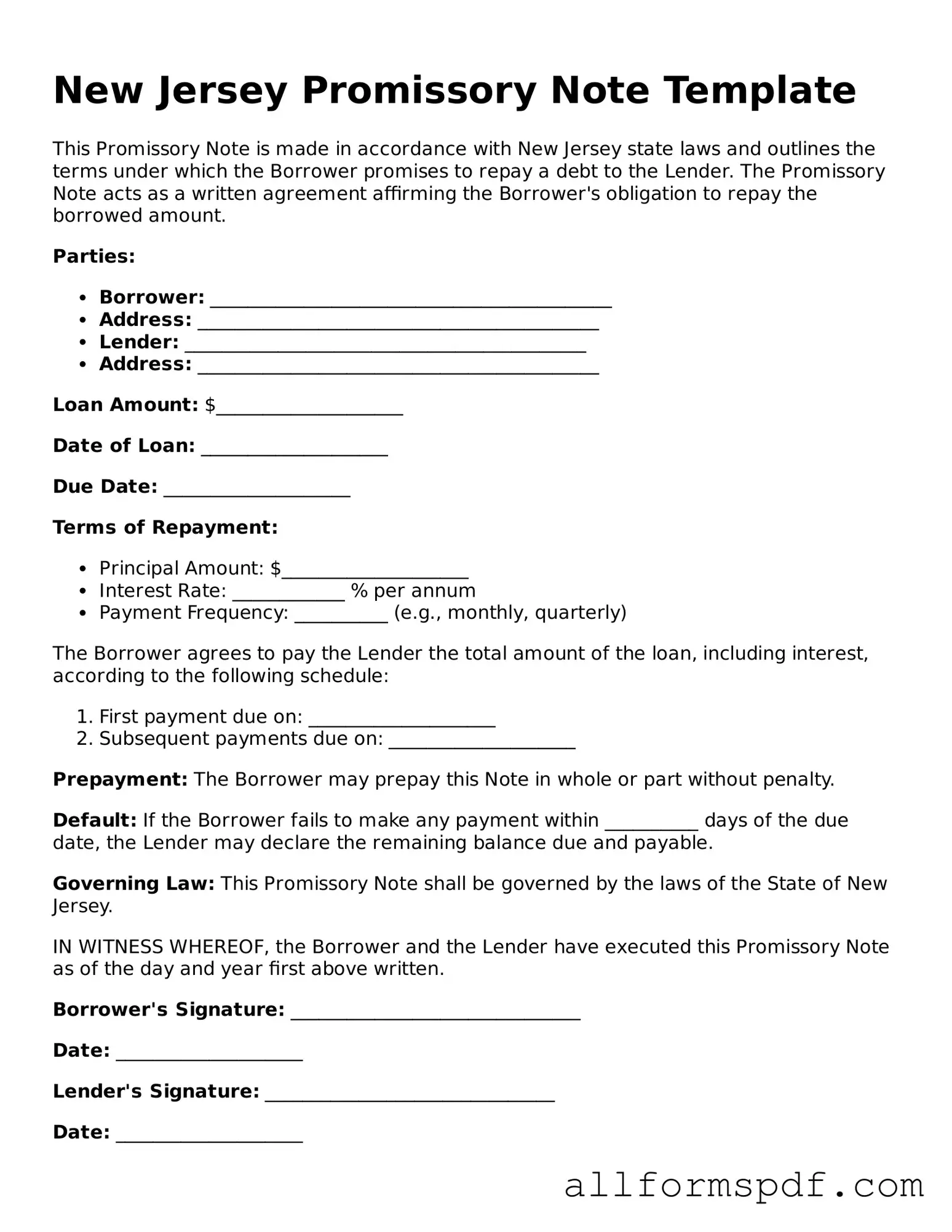

After obtaining the New Jersey Promissory Note form, you will need to complete it with specific information regarding the loan agreement. Ensure that all fields are filled out accurately to avoid any potential issues in the future.

- Begin by entering the date at the top of the form.

- Identify the borrower. Write the full legal name and address of the individual or entity borrowing the money.

- Next, provide the lender's information. Include the full legal name and address of the individual or entity lending the money.

- Specify the principal amount of the loan. This is the total amount of money being borrowed.

- Outline the interest rate. Indicate whether it is fixed or variable, and provide the applicable percentage.

- Detail the repayment terms. State how and when the borrower will repay the loan, including the payment schedule (e.g., monthly, quarterly).

- Include any late payment penalties. Specify the amount or percentage that will be charged if payments are late.

- Provide any additional terms or conditions. This may include prepayment options or other relevant details.

- Both parties must sign and date the form. Ensure that the signatures are dated to reflect when the agreement was made.

Once the form is completed and signed, retain copies for both the borrower and lender. This document serves as a formal agreement outlining the terms of the loan and should be kept in a safe place for future reference.

Misconceptions

Understanding the New Jersey Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can cloud this important financial tool. Here are nine common myths, along with clarifications to help you navigate this document effectively.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly in terms of terms, conditions, and legal requirements.

- A Promissory Note Must Be Notarized: Some think that notarization is mandatory for a promissory note to be valid. While notarization can enhance credibility, it is not a legal requirement in New Jersey.

- Only Banks Can Issue Promissory Notes: It’s a common misconception that only financial institutions can create promissory notes. Individuals can also draft these documents for personal loans.

- Promissory Notes Are Only for Large Loans: Many assume that promissory notes are reserved for significant amounts of money. However, they can be used for any loan amount, big or small.

- Verbal Agreements Are Sufficient: Some believe that a verbal agreement is enough to secure a loan. A written promissory note is crucial for clarity and legal protection.

- Interest Rates Must Be Included: There is a misconception that all promissory notes must specify an interest rate. While it’s common to include one, it is not strictly necessary.

- They Are Only Used in Business Transactions: Many think that promissory notes are solely for business purposes. In truth, they are frequently used in personal transactions as well.

- Once Signed, They Cannot Be Changed: Some people believe that a signed promissory note is set in stone. However, amendments can be made if both parties agree and document the changes properly.

- Defaulting on a Promissory Note Has No Consequences: Finally, a common myth is that defaulting carries no serious repercussions. In fact, failing to repay a promissory note can lead to legal action and damage to one’s credit score.

By debunking these misconceptions, individuals can better understand their rights and responsibilities when dealing with promissory notes in New Jersey. Knowledge is power, especially when it comes to financial agreements.

Dos and Don'ts

When filling out the New Jersey Promissory Note form, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure that your document is accurate and legally binding.

- Do include the full names and addresses of both the borrower and the lender.

- Do specify the amount of money being borrowed clearly.

- Do state the interest rate if applicable, and make sure it complies with New Jersey laws.

- Do outline the repayment schedule, including due dates and payment amounts.

- Do sign and date the document in the presence of a witness or notary if required.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to keep a copy of the signed note for your records.

- Don't ignore state laws regarding maximum interest rates and other regulations.

By following these guidelines, you can create a clear and effective Promissory Note that protects both parties involved in the transaction.

Popular State-specific Promissory Note Forms

Promissory Note Template Illinois - It can be secured with collateral or remain unsecured based on the agreement.

The Florida Motor Vehicle Power of Attorney form provides a seamless way for vehicle owners to delegate authority for tasks such as registration, titling, and selling, ensuring that their vehicle affairs are managed efficiently even when they are unavailable. For those looking for comprehensive documents related to this process, All Florida Forms offers a valuable resource.

Simple Promissory Note Template - Both parties should fully understand the terms before signing the promissory note.

Michigan Promissory Note - It is a legally binding contract that holds the borrower accountable for repayment.

Promissory Note Template Georgia - The borrower agrees to repay the loan amount in full as stated.

Common mistakes

Filling out a New Jersey Promissory Note can be straightforward, but many people stumble over common mistakes that can lead to confusion or legal issues down the line. One frequent error is incomplete information. When individuals neglect to fill in essential details, such as the names of the borrower and lender, or the loan amount, it creates ambiguity. This lack of clarity can lead to disputes about the terms of the agreement later on.

Another mistake involves incorrect dates. The date on which the note is signed is crucial. If it’s not clear when the agreement takes effect, it can complicate matters regarding repayment terms and deadlines. Additionally, failing to specify whether the repayment is due on a particular date or in installments can lead to misunderstandings. Always double-check the dates to ensure they reflect the intended timeline.

People often overlook the importance of interest rates as well. Not specifying an interest rate, or mistakenly writing down an incorrect one, can have significant financial implications. In New Jersey, if the interest rate is not clearly stated, it may default to the legal rate, which might not be favorable to either party. Clarity on this point is essential to avoid unexpected costs or penalties.

Lastly, many individuals forget to sign and date the document properly. A Promissory Note is not valid unless it is signed by the borrower. Some may think that a verbal agreement is enough, but without a signature, the document holds little weight in a legal context. Ensure that all parties involved sign and date the note to solidify the agreement and protect everyone's interests.

Key takeaways

When filling out and using the New Jersey Promissory Note form, keep these key points in mind:

- Ensure all parties involved are clearly identified. Include full names and addresses for both the borrower and the lender.

- Specify the loan amount clearly. This helps avoid any confusion later on regarding the amount owed.

- Outline the repayment terms. Include the interest rate, payment schedule, and due dates to establish clear expectations.

- Signatures are crucial. Both the borrower and lender must sign the document to make it legally binding.

- Keep a copy for your records. After signing, ensure all parties have a copy of the completed note for future reference.