Fillable Operating Agreement Form for New Jersey

New Jersey Operating Agreement - Usage Guidelines

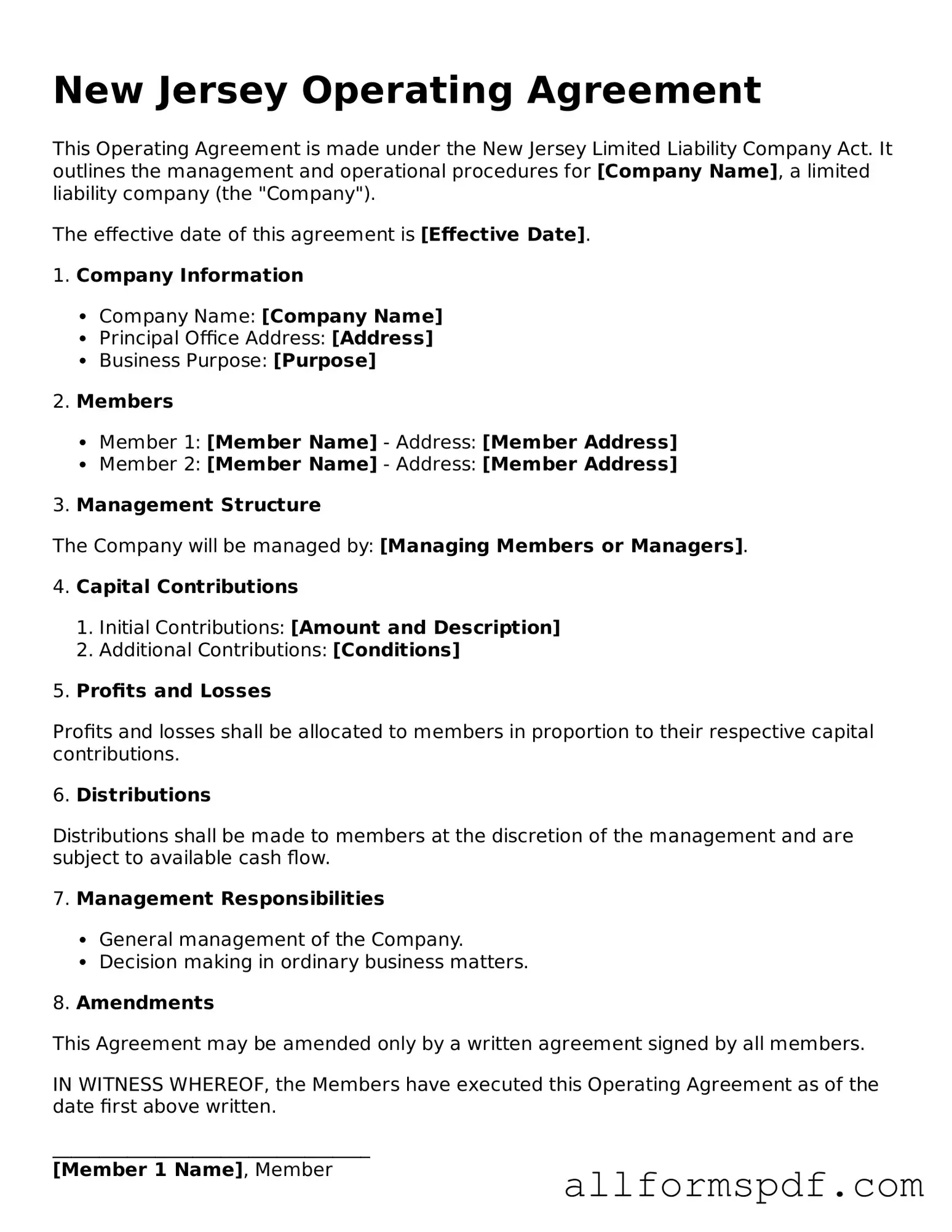

Filling out the New Jersey Operating Agreement form is a straightforward process that requires careful attention to detail. Once completed, this document will serve as a foundational agreement for your business, outlining the roles and responsibilities of members and the operational procedures of your LLC. Follow these steps to ensure you fill out the form correctly.

- Gather Necessary Information: Collect details about your LLC, including its name, address, and the names of all members.

- Start with the Basic Information: Fill in the name of your LLC at the top of the form. Ensure that it matches the name registered with the state.

- Provide Member Details: List the names and addresses of all members. Make sure to include their ownership percentages or contributions.

- Outline Management Structure: Specify whether your LLC will be member-managed or manager-managed. Clearly indicate who will handle day-to-day operations.

- Define Voting Rights: Describe the voting rights of each member, including how decisions will be made and what constitutes a quorum.

- Include Profit and Loss Distribution: State how profits and losses will be allocated among members. This could be based on ownership percentages or another agreed-upon method.

- Set Terms for Changes: Detail the process for adding or removing members, as well as how to handle the transfer of ownership interests.

- Review and Sign: Once all sections are completed, review the document for accuracy. Have all members sign and date the agreement.

After completing the form, keep a copy for your records and consider filing it with your LLC's official documents. This step helps ensure that all members understand their roles and responsibilities, providing a solid foundation for your business's operations.

Misconceptions

Understanding the New Jersey Operating Agreement form is crucial for anyone involved in a business entity, particularly limited liability companies (LLCs). However, several misconceptions can lead to confusion. Here are ten common misconceptions about the New Jersey Operating Agreement form:

- It is not necessary to have an Operating Agreement. Many people believe that an Operating Agreement is optional. In New Jersey, while it is not legally required, having one is highly recommended to outline the structure and operations of the LLC.

- All Operating Agreements must be filed with the state. Some assume that the Operating Agreement needs to be submitted to the state. In reality, it is an internal document and does not need to be filed with the New Jersey Division of Revenue.

- Operating Agreements are only for multi-member LLCs. This is a common misunderstanding. Even single-member LLCs benefit from having an Operating Agreement to clarify ownership and management practices.

- Once created, the Operating Agreement cannot be changed. Many believe that an Operating Agreement is set in stone. However, it can be amended as needed, provided all members agree to the changes.

- The Operating Agreement must follow a specific format. Some think there is a mandated format for the Operating Agreement. While it should cover essential topics, the structure can vary based on the specific needs of the LLC.

- Operating Agreements are only for large businesses. This misconception leads many small business owners to overlook the importance of an Operating Agreement. In fact, it can be particularly beneficial for small businesses to clarify roles and responsibilities.

- Verbal agreements are sufficient. Some individuals believe that a verbal agreement among members is enough. However, having a written Operating Agreement provides legal protection and clarity that verbal agreements cannot offer.

- Operating Agreements are only about financial matters. While financial arrangements are a component, Operating Agreements also cover governance, decision-making processes, and member responsibilities.

- Legal assistance is not needed to create an Operating Agreement. Many assume they can draft an Operating Agreement without professional help. Although templates are available, consulting with a legal expert ensures that the document meets all legal requirements and adequately protects the members’ interests.

- All members must agree on every detail of the Operating Agreement. While it is essential for all members to agree on the main points, not every detail needs unanimous consent. Members can designate specific decision-making powers to individuals or groups within the LLC.

By addressing these misconceptions, individuals can better understand the importance of the New Jersey Operating Agreement form and its role in promoting a successful business venture.

Dos and Don'ts

When filling out the New Jersey Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do read the instructions carefully before starting the form.

- Do provide accurate and complete information about the business and its members.

- Do consult with a legal professional if you have questions or uncertainties.

- Do keep a copy of the completed agreement for your records.

- Do ensure that all members sign the agreement where required.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't use vague language; be clear and specific in your descriptions.

- Don't ignore state-specific requirements that may apply to your business type.

Popular State-specific Operating Agreement Forms

Operating Agreement Llc Nc Template - An Operating Agreement can be revised to adapt to changing business needs.

An Agreement to Operate a Business in the Name of an Established Company - This form encourages transparency within the LLC’s operations.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. It's an essential tool for anyone who needs someone else to manage their vehicle affairs, especially when they're unable to do so themselves. For more information, you can refer to All Florida Forms.

Llc Operating Agreement Georgia Pdf - Essential for multi-member LLCs, it defines voting rights.

How to Create an Operating Agreement - Members can specify procedures for handling loans or credit arrangements.

Common mistakes

Filling out the New Jersey Operating Agreement form can be a straightforward task, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include all necessary members of the LLC. Each member's name and contribution should be clearly stated. Omitting a member can create confusion about ownership and responsibilities.

Another common mistake is not specifying the management structure of the LLC. Some people assume that it's obvious who will manage the business, but this should be explicitly detailed in the agreement. Whether the LLC will be member-managed or manager-managed, clarity is essential to avoid disputes in the future.

Many individuals also overlook the importance of including a clear description of the business purpose. A vague or overly broad purpose can lead to misunderstandings or legal challenges. It’s vital to articulate the specific activities the LLC will engage in, as this sets the foundation for the business's operations.

Inadequate provisions for profit and loss distribution is another mistake that can have significant implications. Members should agree on how profits and losses will be shared, which should be outlined in the agreement. Without this, disagreements can arise, potentially leading to legal issues.

Some people neglect to address the process for adding or removing members. An operating agreement should include clear guidelines on how new members can join and how existing members can exit. This ensures that the LLC can adapt over time while maintaining a clear structure.

Another frequent oversight is failing to include a dispute resolution process. Conflicts can arise among members, and having a predefined method for resolving disputes can save time and money. This could involve mediation or arbitration, and specifying this in the agreement can prevent costly litigation.

Additionally, many individuals do not review their operating agreement regularly. As circumstances change—such as new members joining or business goals evolving—it's important to revisit and update the agreement. An outdated operating agreement can lead to confusion and potential legal issues.

Finally, not seeking legal advice can be a significant mistake. While it might seem tempting to fill out the form without professional help, consulting with a legal expert can provide valuable insights. They can help ensure that the agreement meets all legal requirements and protects the interests of all members involved.

Key takeaways

Filling out the New Jersey Operating Agreement form is essential for defining the structure and operation of a limited liability company (LLC).

Each member's rights and responsibilities should be clearly outlined to avoid future disputes.

It is important to include provisions for profit distribution, decision-making processes, and member contributions.

The agreement should be reviewed and updated regularly to reflect any changes in membership or business operations.

While the form can be filled out independently, consulting with a legal professional can provide additional clarity and ensure compliance with state laws.