Fillable Employment Verification Form for New Jersey

New Jersey Employment Verification - Usage Guidelines

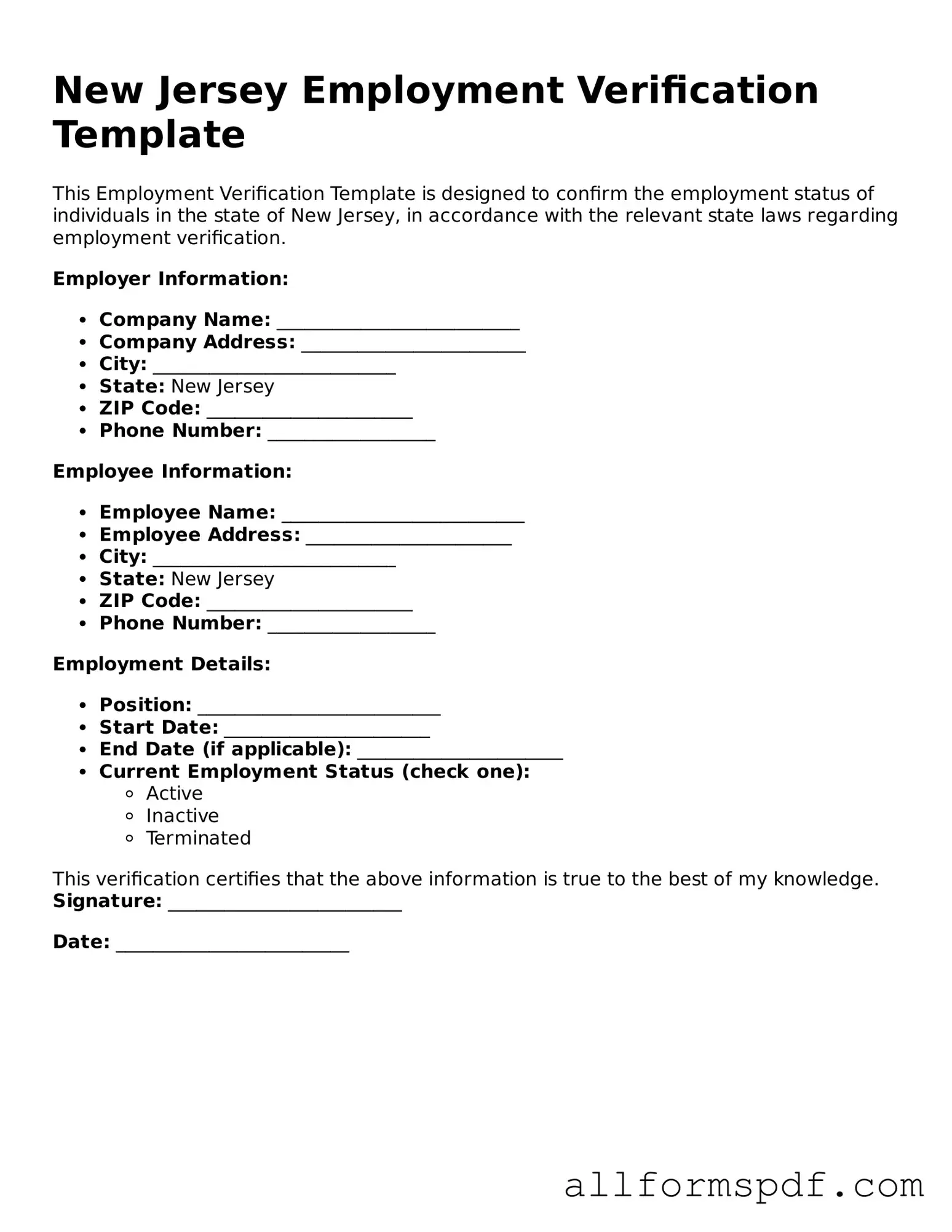

Completing the New Jersey Employment Verification form is a straightforward process. Once you gather the necessary information, you can fill out the form accurately to ensure it meets the requirements. Follow these steps to complete the form effectively.

- Obtain a copy of the New Jersey Employment Verification form from the relevant source.

- Read the instructions carefully to understand what information is required.

- Enter the employee's full name in the designated field.

- Provide the employee's Social Security number, ensuring accuracy.

- Fill in the employee's job title and department.

- Indicate the start date of employment and, if applicable, the end date.

- List the employer's name and address, including any relevant contact information.

- Include the employer's tax identification number if required.

- Sign and date the form in the appropriate sections.

- Review all entries for accuracy before submitting the form.

Misconceptions

Misconceptions about the New Jersey Employment Verification form can lead to confusion for both employers and employees. Here are seven common misunderstandings:

- It is only required for new hires. Many believe that the Employment Verification form is only necessary when hiring new employees. In reality, it may also be required for current employees seeking certain benefits or promotions.

- Only employers need to fill it out. Some think that only employers are responsible for completing the form. However, employees must also provide accurate information and signatures to validate their employment status.

- It serves the same purpose as a W-2 form. While both forms relate to employment, they serve different purposes. The Employment Verification form confirms employment status, whereas a W-2 reports annual wages and tax information.

- It is not legally binding. Some individuals assume that the form holds no legal weight. In fact, it can be used as evidence in disputes regarding employment status or benefits.

- It is only for full-time employees. This form is often mistakenly thought to apply only to full-time workers. In truth, it can also be used for part-time and temporary employees.

- There is a standard format that must be followed. Many believe that the Employment Verification form must adhere to a specific template. While there are guidelines, employers can create their own versions as long as they include necessary information.

- It is not necessary for remote workers. Some think that remote employees do not need to submit this form. However, remote workers are still subject to the same verification requirements as on-site employees.

Understanding these misconceptions can help ensure that both employers and employees comply with the necessary requirements and avoid potential issues down the line.

Dos and Don'ts

When filling out the New Jersey Employment Verification form, it is crucial to approach the task with care. Here are some essential dos and don'ts to consider.

- Do read the instructions carefully before you begin.

- Do provide accurate and complete information about your employment.

- Do ensure that all sections of the form are filled out, including dates of employment.

- Do double-check your entries for any spelling or numerical errors.

- Do sign and date the form to confirm its authenticity.

- Don't leave any sections blank unless instructed to do so.

- Don't provide false information, as this can lead to serious consequences.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

Popular State-specific Employment Verification Forms

Is E-verify Mandatory in Georgia - Assists in ensuring candidates meet job qualifications.

When entering into business agreements, it is crucial to utilize a Florida Non-disclosure Agreement (NDA) form, which serves as a vital tool for safeguarding confidential information. By establishing clear guidelines on what constitutes sensitive material, this form helps prevent unauthorized sharing and establishes trust among parties involved. To facilitate this process further, you can access a comprehensive template at All Florida Forms, ensuring compliance with the specific legal standards required in Florida.

Common mistakes

Filling out the New Jersey Employment Verification form may seem straightforward, but many individuals stumble upon common pitfalls that can lead to delays or complications. One of the most frequent mistakes is providing incomplete information. When sections of the form are left blank, it can create confusion and result in unnecessary follow-up requests. Always ensure that every required field is filled out accurately.

Another common error involves the misrepresentation of employment dates. It's crucial to double-check the start and end dates of employment. Incorrect dates can raise red flags and may even jeopardize a person's eligibility for certain benefits. Accuracy in this area is essential to maintain credibility.

Additionally, people often overlook the importance of using the correct job title. A job title should reflect the position held during the employment period. Mislabeling one's role may lead to misunderstandings about the nature of the work performed, which can affect the verification process.

Many individuals also fail to provide the necessary contact information for their previous employers. Without accurate phone numbers or email addresses, the verification process can stall. Including up-to-date contact details ensures that the verification can be completed smoothly and efficiently.

Another mistake is neglecting to sign and date the form. A signature is not merely a formality; it confirms that the information provided is true and accurate. Submitting an unsigned form can lead to immediate rejection or delays in processing.

Some people may also mistakenly assume that all documentation is unnecessary. While the form itself is crucial, supporting documents such as pay stubs or tax forms can enhance the verification process. Providing these additional materials can help clarify any discrepancies and speed up the overall procedure.

Inaccurate spelling of names or addresses is yet another frequent error. Simple typos can create significant obstacles in the verification process. It's advisable to review all entries carefully, ensuring that every detail is correct.

Moreover, failing to follow the specific instructions provided with the form can lead to complications. Each form may have unique requirements, and overlooking these can result in the submission being deemed invalid. Always read the instructions thoroughly before completing the form.

Lastly, not keeping a copy of the submitted form can be a mistake. Having a record of what was submitted can be invaluable in case any questions or issues arise later. It serves as a reference point and can simplify future communications regarding employment verification.

Key takeaways

When filling out and using the New Jersey Employment Verification form, there are several important points to keep in mind. These will help ensure that the process goes smoothly and that you provide the necessary information accurately.

- Understand the Purpose: The form is used to verify employment status for various reasons, including loan applications, government assistance, or other legal matters.

- Gather Required Information: Before starting, collect all necessary details about the employee, such as their name, job title, and employment dates.

- Be Accurate: Double-check all entries for accuracy. Mistakes can lead to delays or complications in processing.

- Sign and Date: Ensure that the form is signed and dated by the appropriate authority to validate the information provided.

- Submit Promptly: Once completed, submit the form as soon as possible to avoid any unnecessary delays in whatever process requires it.

- Keep Copies: Always retain a copy of the completed form for your records. This can be useful for future reference.

- Know the Recipient: Make sure you know who will receive the form and follow any specific submission guidelines they may have.

- Follow Up: If you don’t receive confirmation of receipt, it’s a good idea to follow up to ensure that the form was received and processed.