Fillable Deed Form for New Jersey

New Jersey Deed - Usage Guidelines

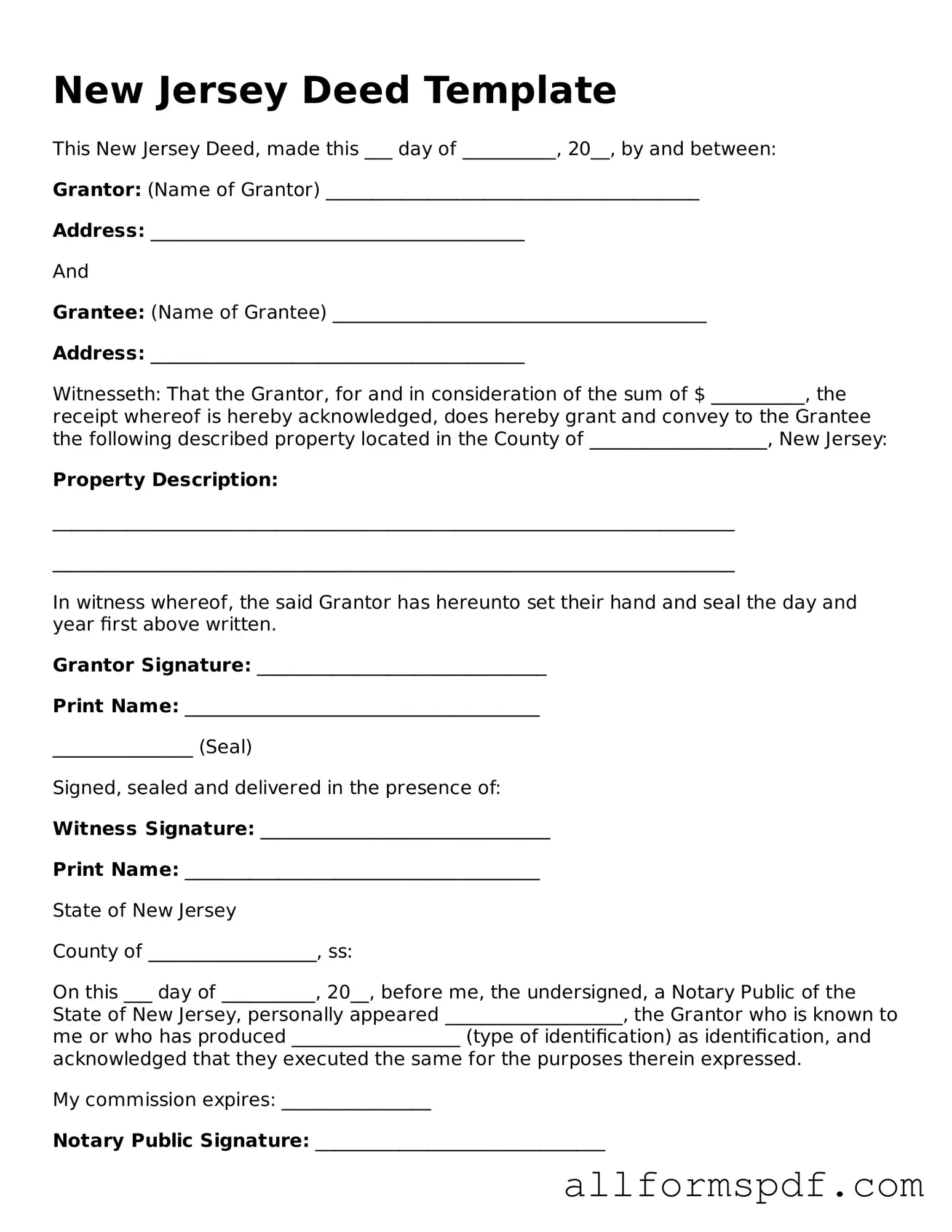

Once you have the New Jersey Deed form in hand, you are ready to begin the process of filling it out. This form is essential for transferring property ownership. After you complete the form, it will need to be signed, notarized, and then recorded with the county clerk’s office to ensure that the transfer is legally recognized.

- Begin by entering the date at the top of the form. This should reflect the date you are executing the deed.

- Identify the grantor, or the person transferring the property. Write their full name and address in the designated section.

- Next, provide the name and address of the grantee, the person receiving the property.

- Clearly describe the property being transferred. Include details such as the street address, block, and lot number, as well as any additional legal descriptions if necessary.

- Indicate the consideration amount, which is the price paid for the property. This may be a specific dollar amount or a statement indicating that the transfer is a gift.

- Include any relevant information regarding the type of ownership being conveyed, such as joint tenancy or tenancy in common.

- Both the grantor and grantee must sign the form. Make sure the signatures are in the appropriate places.

- Have the deed notarized. A notary public will verify the identities of the signers and confirm that the signatures are legitimate.

- Finally, take the completed and notarized deed to the county clerk’s office for recording. This step is crucial for making the transfer official.

Misconceptions

- All deeds are the same. Many people believe that all deeds serve the same purpose, but this is not true. Different types of deeds, such as warranty deeds and quitclaim deeds, have distinct legal implications and protections for the parties involved.

- A New Jersey deed must be notarized. While notarization is a common practice, it is not a strict requirement for all deeds in New Jersey. However, having a deed notarized can help prevent disputes and ensure its validity.

- Deeds do not need to be recorded. Some assume that recording a deed is optional. In New Jersey, recording a deed is crucial for establishing public notice of ownership and protecting the rights of the property owner against future claims.

- Only a lawyer can prepare a deed. While having a lawyer is advisable for complex transactions, individuals can prepare a deed themselves, provided they understand the necessary legal requirements and terminology.

- Once a deed is signed, it cannot be changed. This is a common misconception. Deeds can be amended or revoked under certain circumstances, but it requires following specific legal procedures to ensure the changes are valid.

Dos and Don'ts

When filling out the New Jersey Deed form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of dos and don’ts:

- Do double-check the names of all parties involved. Ensure they are spelled correctly and match official documents.

- Do include a clear and accurate description of the property. This should include the address and any relevant lot or block numbers.

- Do sign the deed in the presence of a notary public. This step is crucial for the document's validity.

- Do keep a copy of the completed deed for your records. Having a copy can be helpful for future reference.

- Don't leave any fields blank. Fill out every required section to avoid delays in processing.

- Don't use abbreviations or shorthand. Clarity is vital, so write everything out in full.

- Don't forget to check for any local requirements. Different municipalities may have specific rules regarding deeds.

- Don't rush through the process. Take your time to ensure all information is accurate and complete.

Popular State-specific Deed Forms

Ohio Property Deed - A deed is a legal document that conveys ownership of property.

In order to ensure that all relevant details of a traffic incident are effectively recorded, drivers in Florida should utilize the Florida Traffic Crash Report form. This form helps to clarify the circumstances surrounding the accident, especially when no law enforcement report is available. For additional resources and support related to such incidents, you can visit All Florida Forms, which provides numerous templates and forms necessary for proper documentation.

How Does House Title Look Like - The form is vital for ensuring compliance with local property laws.

Common mistakes

Filling out the New Jersey Deed form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to provide the correct names of the parties involved. It is crucial that the names of both the grantor (the seller) and the grantee (the buyer) are spelled correctly and match the names on their identification documents. Any discrepancies can result in delays or even legal challenges.

Another mistake often made is neglecting to include the proper property description. A complete and accurate description of the property is essential. This should include the street address, lot number, and any relevant identifying information. Omitting details can lead to confusion and disputes over property boundaries.

Some individuals overlook the requirement for notarization. The New Jersey Deed form must be signed in the presence of a notary public. Failure to have the deed notarized can render it invalid. It is important to ensure that all signatures are properly witnessed and notarized to avoid future issues.

Additionally, many people forget to check for the correct type of deed being used. New Jersey offers various types of deeds, such as warranty deeds and quitclaim deeds. Each serves a different purpose, and selecting the wrong one can affect the rights and obligations of the parties involved.

Errors in the execution of the document can also occur. All parties must sign the deed in the appropriate places. Missing signatures or signatures that are not dated can lead to complications in the transfer of ownership. Careful attention to detail is necessary to ensure that all required sections are completed.

Another common oversight is failing to include the correct consideration amount. This refers to the price paid for the property. In New Jersey, this amount must be accurately stated on the deed. Incorrect figures can lead to issues with tax assessments and legal interpretations of the transaction.

People often neglect to file the deed with the appropriate county clerk's office. After completing the deed, it is essential to record it to provide public notice of the property transfer. Failing to file can result in the deed being considered invalid, which could affect ownership rights.

Some individuals may not be aware of the potential tax implications associated with the deed. New Jersey has specific tax requirements that must be met when transferring property. Not understanding these obligations can lead to unexpected financial liabilities.

Lastly, a lack of consultation with a real estate professional can be a significant mistake. While it is possible to fill out the deed form independently, seeking guidance from an attorney or real estate agent can help avoid pitfalls. Their expertise can provide clarity and ensure that all aspects of the deed are handled correctly.

Key takeaways

Filling out and using a deed form in New Jersey is an important process that requires careful attention to detail. Here are some key takeaways to keep in mind:

- Ensure that all parties involved in the transaction are correctly identified. This includes full names and addresses of both the grantor (seller) and grantee (buyer).

- Clearly describe the property being transferred. The legal description should be accurate and detailed, often referencing a survey or the property’s lot number.

- Signatures are crucial. The deed must be signed by the grantor, and if the property is owned jointly, all owners should sign to ensure a valid transfer.

- Consider having the deed notarized. While not always required, notarization adds an extra layer of authenticity and can help prevent disputes in the future.

- File the completed deed with the appropriate county clerk’s office. This step is essential for the deed to be legally recognized and to update public records.

By following these guidelines, you can help ensure that the deed process in New Jersey goes smoothly and that all legal requirements are met.