Fill Out Your Netspend Dispute Form

Netspend Dispute - Usage Guidelines

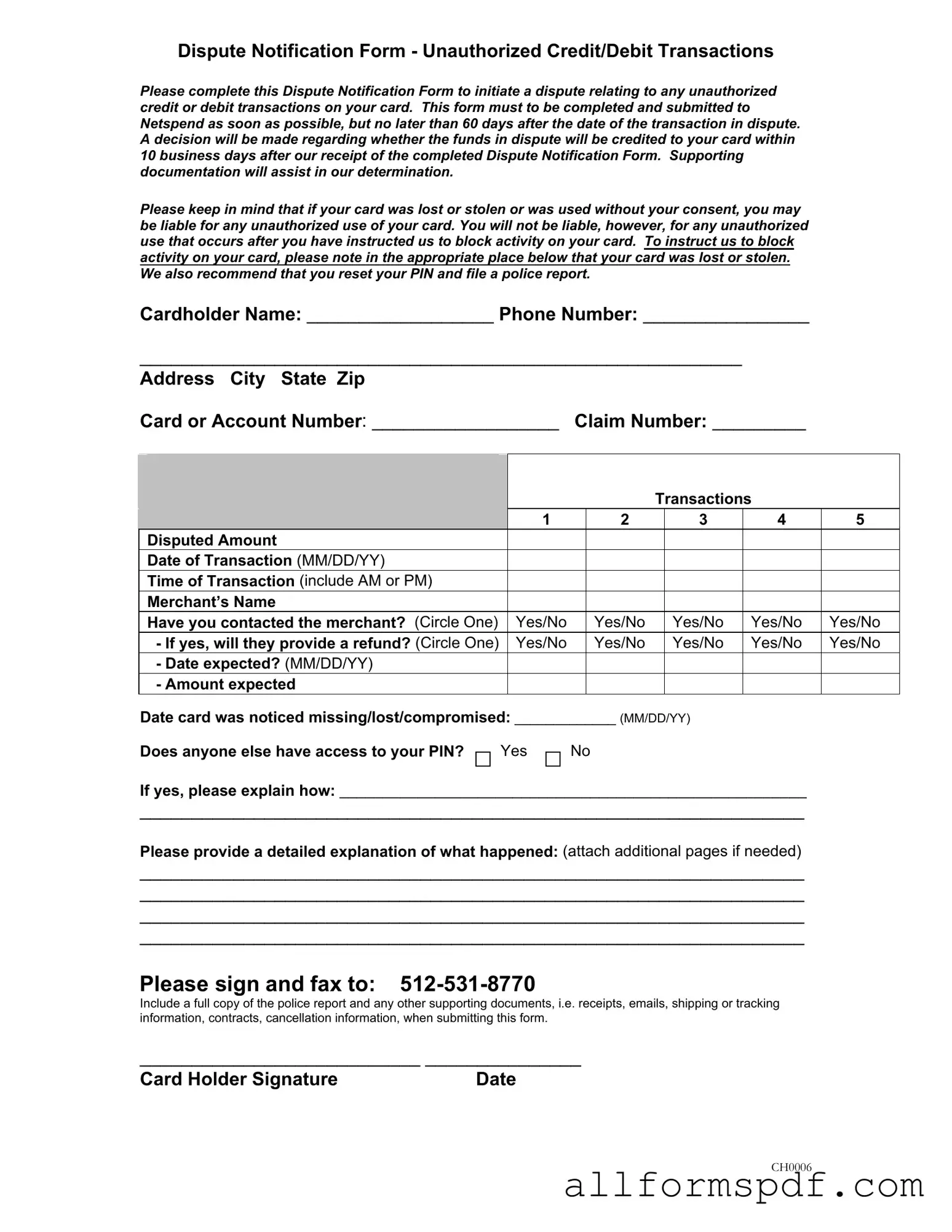

Once you have completed the Netspend Dispute form, you will need to submit it along with any supporting documents. This submission is essential for initiating your dispute regarding unauthorized transactions. After receiving your completed form, Netspend will review the information and make a decision within 10 business days. It’s important to ensure that all details are accurate to facilitate a smooth process.

- Begin by filling in your Cardholder Name.

- Enter your Phone Number.

- Provide your Address, including City, State, and Zip Code.

- Write down your Card or Account Number.

- Fill in the Claim Number if applicable.

- For each transaction you are disputing (up to 5), complete the following:

- Disputed Amount

- Date of Transaction (format: MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant (Circle Yes or No).

- If yes, will they provide a refund? (Circle Yes or No).

- If yes, provide the Date expected (format: MM/DD/YY).

- Indicate the Amount expected.

- Record the Date card was noticed missing/lost/compromised (format: MM/DD/YY).

- Answer whether anyone else has access to your PIN (Circle Yes or No). If yes, explain how.

- Provide a detailed explanation of what happened. Attach additional pages if necessary.

- Sign the form and enter the Date of signing.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any other supporting documents, such as receipts or emails, when submitting the form.

Misconceptions

Misconceptions can lead to confusion when dealing with the Netspend Dispute form. Below are seven common misconceptions explained.

- The form must be submitted immediately after the transaction. Many believe that they need to submit the form right away. However, you have up to 60 days from the date of the transaction to file a dispute.

- All disputes will be resolved within a few days. Some assume that disputes will be settled quickly. In reality, a decision regarding the disputed funds will be made within 10 business days after receiving the completed form.

- Documentation is optional. It is a common belief that supporting documents are not necessary. In fact, providing documentation can significantly assist in the determination of your dispute.

- You are liable for all unauthorized transactions. Some individuals think they are responsible for all unauthorized uses of their card. You will not be liable for unauthorized transactions that occur after you report your card as lost or stolen.

- Contacting the merchant is not required. Many believe that they can skip contacting the merchant. However, it is advisable to do so, as this can sometimes lead to a quicker resolution.

- You cannot dispute multiple transactions at once. Some think that each transaction must be disputed separately. You can actually submit up to five transactions on one form.

- Filing a police report is unnecessary. There is a misconception that a police report is not needed. While not mandatory, including a police report can strengthen your case and support your claim.

Dos and Don'ts

When filling out the Netspend Dispute form, it is important to follow certain guidelines to ensure your submission is complete and effective. Here are some dos and don'ts:

- Do complete the form as soon as possible, ideally within 60 days of the disputed transaction.

- Do provide accurate information, including your cardholder name, phone number, and address.

- Do include all relevant details for each transaction you are disputing, such as the date, time, and merchant’s name.

- Do attach supporting documentation, such as a police report or receipts, to strengthen your case.

- Do indicate if your card was lost or stolen, and request to block activity on your card.

- Don't submit the form without double-checking for any errors or missing information.

- Don't forget to sign the form before faxing it to ensure it is processed.

Other PDF Forms

Citi Bank Voided Check - Quickly and easily receive government benefits through direct deposit.

In order to effectively create a secure framework for sharing confidential information, individuals and businesses in Florida often rely on a Florida Non-disclosure Agreement (NDA) form. This legally binding document ensures that sensitive information remains protected from unauthorized disclosure, aligning with state-specific statutes and regulations. By clearly defining the expectations surrounding privacy and information use, the NDA not only safeguards proprietary details but also encourages trust during collaborative efforts. For those seeking a reliable template, All Florida Forms offers an accessible resource to facilitate this important process.

1099 Fillable Form - Form 1099-NEC must be filed electronically if preferred, via the FIRE system.

How to Make Fake Insurance Card - Important information is contained on both sides of the card.

Common mistakes

Filling out the Netspend Dispute form can be straightforward, but many people make common mistakes that can delay the process. One frequent error is not submitting the form within the required timeframe. The form must be completed and sent to Netspend within 60 days of the disputed transaction. Missing this deadline can result in the dispute being denied, regardless of its validity.

Another mistake involves incomplete information. Many individuals fail to fill out all required fields, such as the cardholder name, account number, or details of the disputed transactions. Omitting this crucial information can lead to delays in processing the dispute, as Netspend may need to reach out for clarification.

Some people also neglect to include supporting documentation. The form advises attaching relevant documents like receipts, emails, or police reports. Without this evidence, Netspend may find it challenging to assess the dispute, which could result in a denial of the claim.

Additionally, individuals often overlook the importance of contacting the merchant prior to filing a dispute. If the merchant can resolve the issue directly, it may be unnecessary to pursue a dispute with Netspend. Not indicating whether contact was made can lead to confusion and prolong the resolution process.

Finally, many users do not provide a detailed explanation of the incident. The form requests a thorough account of what happened. A vague or unclear description may hinder Netspend's ability to understand the situation, potentially impacting the outcome of the dispute.

Key takeaways

Filling out the Netspend Dispute form correctly is essential for resolving issues related to unauthorized transactions. Here are some key takeaways to keep in mind:

- Timeliness is Crucial: Submit the form as soon as possible, but no later than 60 days after the disputed transaction.

- Document Everything: Include supporting documentation, such as receipts or emails, to strengthen your case.

- Response Time: Expect a decision regarding your dispute within 10 business days after Netspend receives your completed form.

- Liability Awareness: You may be liable for unauthorized transactions if your card was lost or stolen, unless you have reported it.

- Blocking Your Card: Indicate if your card was lost or stolen to instruct Netspend to block any further activity on it.

- Merchant Communication: Note whether you have contacted the merchant and if they are willing to provide a refund.

- Detailed Explanation: Provide a clear and detailed account of what happened, as this will help in the investigation of your dispute.