Fill Out Your Mortgage Statement Form

Mortgage Statement - Usage Guidelines

Filling out the Mortgage Statement form is an important task that helps ensure your mortgage payments are accurate and up to date. Follow the steps below to complete the form correctly.

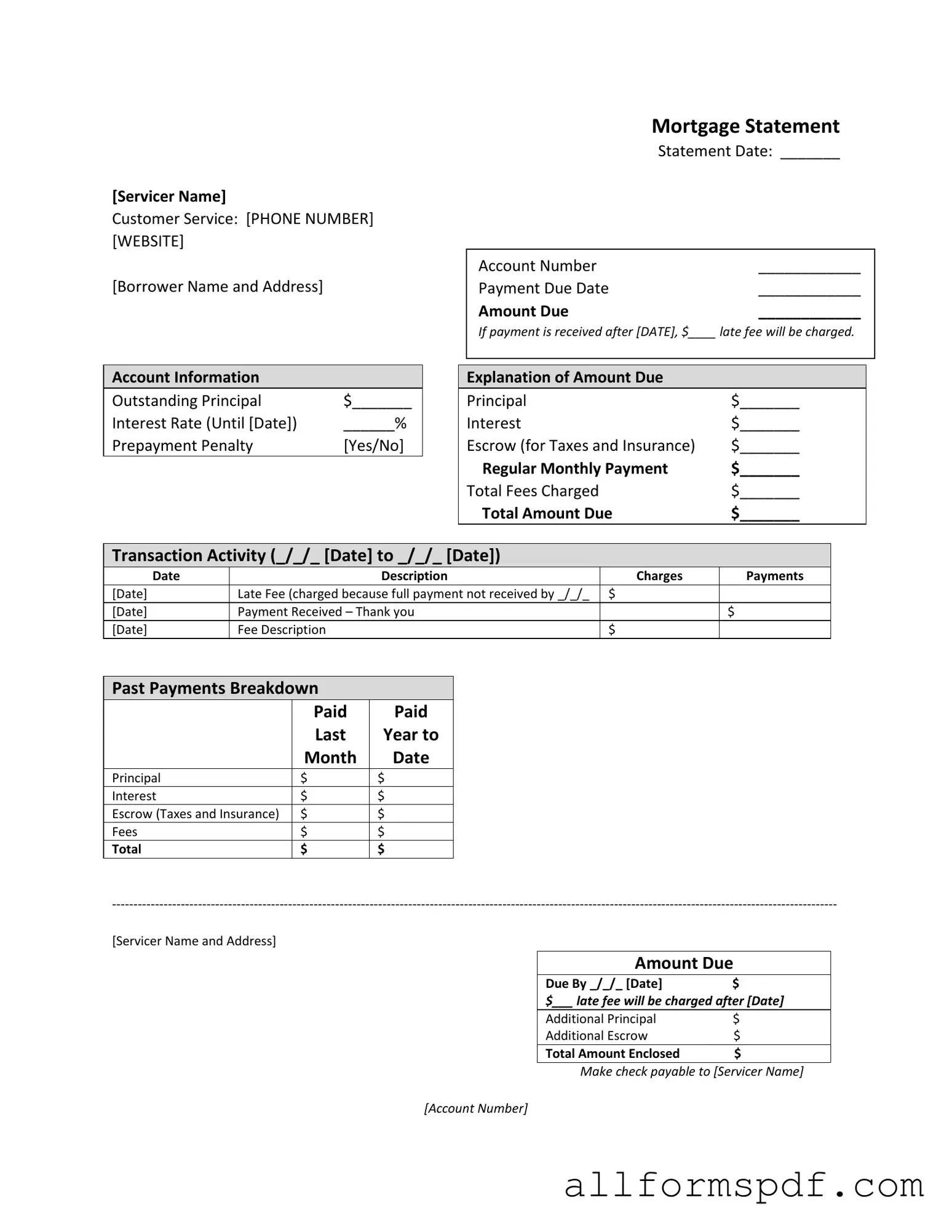

- Contact Information: Write the servicer's name, customer service phone number, and website at the top of the form.

- Borrower Information: Fill in your name and address in the designated section.

- Statement Details: Enter the statement date, account number, payment due date, and amount due.

- Late Fee Information: Note the date after which a late fee will be charged, and write the amount of the late fee.

- Account Information: Fill in the outstanding principal, interest rate, and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the amount due by entering the principal, interest, escrow (for taxes and insurance), regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: Record the date range for transaction activity. List each transaction with the date, description, charges, and payments.

- Past Payments Breakdown: Fill in the past payments for principal, interest, escrow, fees, and total amounts for the last year.

- Final Amount Due: Write the amount due, the due date, and the late fee information.

- Payment Instructions: Indicate the total amount enclosed and make the check payable to the servicer, including your account number.

- Important Messages: Review the important messages regarding partial payments and delinquency notices to understand their implications.

After completing the form, review all entries for accuracy. Make sure to send the form and any payment by the due date to avoid any late fees or penalties. If you have questions, consider reaching out to customer service for assistance.

Misconceptions

Understanding the Mortgage Statement form can be challenging. Here are eight common misconceptions that often arise:

- All payments are applied immediately. Many believe that once a payment is made, it is applied to the mortgage balance right away. However, partial payments are held in a separate suspense account until the full amount is received.

- The late fee is automatically charged every month. Some homeowners think they incur a late fee every month. In reality, the fee only applies if the payment is not received by the specified due date.

- Escrow is optional. Many assume that escrow accounts for taxes and insurance are optional. In fact, lenders often require them to ensure these expenses are paid on time.

- Interest rates are fixed for the life of the loan. It is a common belief that the interest rate remains unchanged. However, many loans have adjustable rates that can fluctuate over time.

- Delinquency notices are sent only after multiple missed payments. Some borrowers think they will not receive a notice until they have missed several payments. In fact, a notice can be issued after just one missed payment.

- All fees are clearly explained on the statement. Many individuals expect all fees to be detailed in the statement. However, some fees may not be explicitly listed, leading to confusion.

- Payments made toward principal reduce the total balance immediately. Some believe that any additional payment toward principal instantly reduces the outstanding balance. While this is true, it may not be reflected in the next statement until the account is updated.

- Mortgage counseling is only for those in severe financial trouble. Many think that mortgage counseling is only for those who are significantly behind on payments. In reality, it can benefit anyone experiencing financial difficulty or seeking guidance.

By addressing these misconceptions, borrowers can gain a clearer understanding of their mortgage statements and manage their loans more effectively.

Dos and Don'ts

When filling out the Mortgage Statement form, attention to detail is crucial. Here are some guidelines to follow and avoid to ensure a smooth process.

- Do double-check your personal information for accuracy, including your name and address.

- Do ensure that the account number is correctly entered to avoid processing delays.

- Do read the instructions carefully, especially regarding payment due dates and late fees.

- Do calculate the total amount due accurately, including principal, interest, and any fees.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank; incomplete forms may lead to complications.

- Don’t ignore the payment due date; late payments can incur additional fees.

- Don’t submit partial payments without understanding how they will be applied to your mortgage.

- Don’t forget to sign and date the form before submitting it.

- Don’t hesitate to reach out to customer service if you have questions or need assistance.

By following these recommendations, you can help ensure that your mortgage statement is processed correctly and that you remain informed about your financial obligations.

Other PDF Forms

Dnd 5e Character Sheet Fillable - Ancient oracle conveying prophetic visions.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. It's an essential tool for anyone who needs someone else to manage their vehicle affairs, especially when they're unable to do so themselves. For more information, you can access the document at All Florida Forms.

1099 Fillable Form - For payers, it’s important to keep a record of all issued 1099-NEC forms for audit purposes.

Common mistakes

When filling out the Mortgage Statement form, many people make common mistakes that can lead to confusion or delays. One frequent error is not including the correct Account Number. This number is crucial for identifying your mortgage account. Double-check this information to ensure it matches the statement.

Another mistake is neglecting to update the Borrower Name and Address. If there have been any changes, such as a marriage or relocation, it’s important to reflect that accurately. Inaccurate information can lead to miscommunication and delays in processing your payments.

Many individuals also forget to fill in the Payment Due Date correctly. This date is essential for determining when your payment is considered late. If you miss this, it can result in unexpected late fees.

Providing an incorrect Amount Due is another common issue. Ensure that you calculate the total amount accurately, including principal, interest, and any fees. An incorrect amount can lead to further complications down the line.

People often overlook the Transaction Activity section. It’s vital to review and fill this out accurately. This section provides a history of your payments and any fees charged. Missing this can create confusion about your payment status.

Not checking the Outstanding Principal and Interest Rate can also lead to mistakes. Ensure these figures are correct as they directly affect your payment amount. Any discrepancies can cause issues with your loan servicer.

Another common oversight is misunderstanding the Partial Payments policy. If you make a partial payment, it may not be applied to your mortgage until the full amount is received. Be sure to read this section carefully to avoid unexpected consequences.

People sometimes fail to respond to the Delinquency Notice. If you are late on your payments, it’s crucial to address this promptly. Ignoring this notice can lead to fees or even foreclosure.

Lastly, individuals may not utilize the resources available for those Experiencing Financial Difficulty. If you are facing challenges, seek assistance as soon as possible. There are options available that can help you manage your mortgage effectively.

Key takeaways

When filling out and using the Mortgage Statement form, there are several important aspects to keep in mind. Understanding these can help ensure that you manage your mortgage effectively.

- Review the Statement Date: This date indicates when the statement was generated. It is crucial for tracking your payment history and due dates.

- Check the Account Number: Always verify that the account number listed matches your mortgage account. This helps prevent any confusion regarding payments.

- Understand the Payment Due Date: This is the date by which your payment must be received to avoid late fees. Mark it on your calendar.

- Late Fees: If your payment is received after the due date, a late fee will be charged. Be aware of the amount and the date after which it applies.

- Account Information: Take note of the outstanding principal and interest rate. This information is vital for understanding your loan balance and interest costs.

- Prepayment Penalty: Check if there is a prepayment penalty. This can affect your decision to pay off the loan early.

- Transaction Activity: Review the transaction activity section to track any recent charges or payments made on your account.

- Partial Payments: Understand that partial payments are not applied to your mortgage but held in a suspense account until the full payment is made.

- Delinquency Notice: If you are late on payments, this notice will inform you of the consequences, including potential fees and foreclosure risks.

- Financial Assistance: If you are experiencing financial difficulty, look for information on mortgage counseling or assistance options provided on the back of the form.

By keeping these key takeaways in mind, you can navigate your mortgage statement with confidence and ensure timely payments to maintain your account in good standing.