Fillable Transfer-on-Death Deed Form for Michigan

Michigan Transfer-on-Death Deed - Usage Guidelines

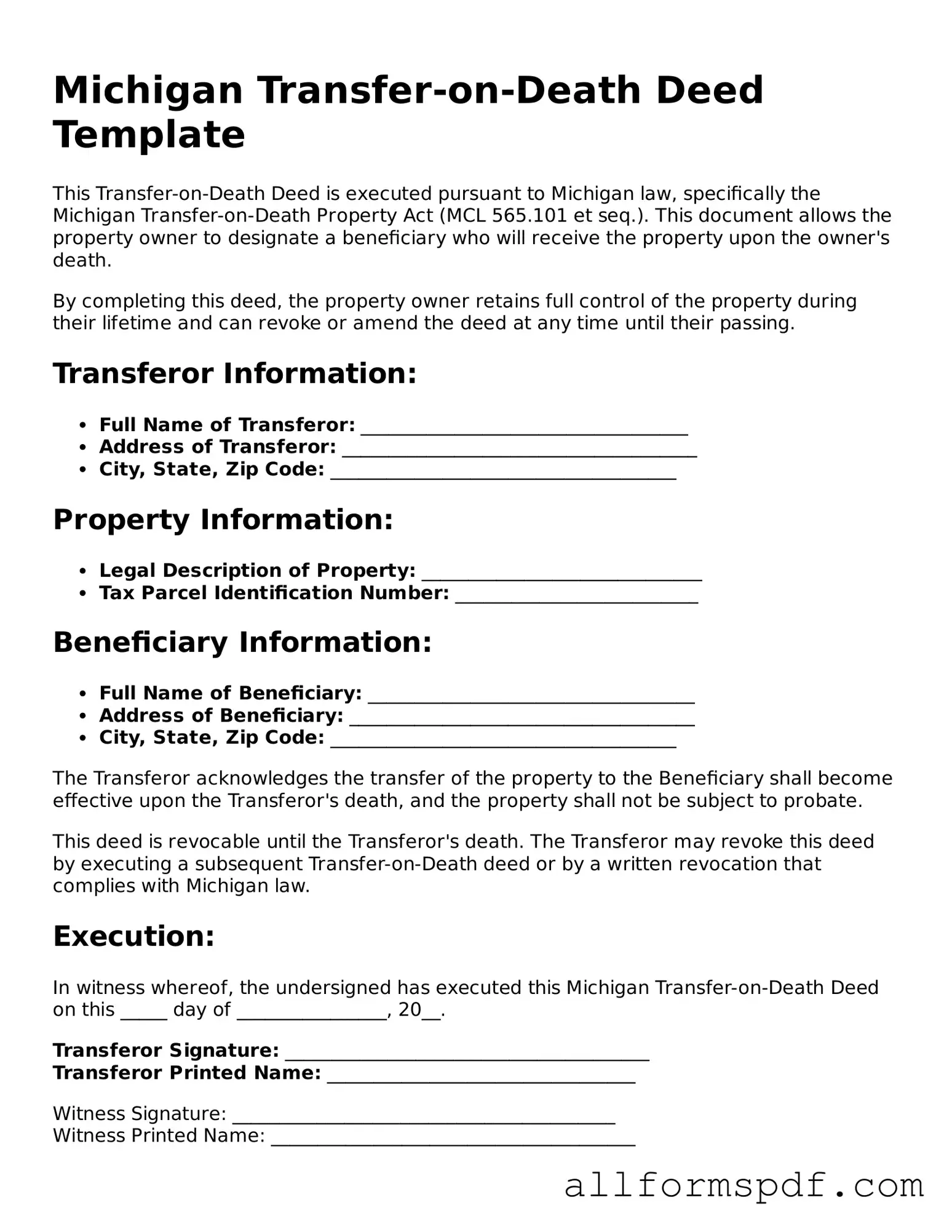

Once you have the Michigan Transfer-on-Death Deed form, you will need to complete it accurately to ensure it reflects your intentions regarding property transfer. Follow these steps carefully to fill out the form.

- Begin by entering your name and address in the designated fields at the top of the form.

- Provide a legal description of the property you wish to transfer. This can usually be found on your property deed.

- Include the name and address of the beneficiary or beneficiaries who will receive the property upon your passing.

- Clearly state the date on which you are filling out the form.

- Sign the form in the presence of a notary public. Your signature must be notarized to validate the deed.

- Ensure that the notary public completes their section, including their signature and seal.

- Make copies of the completed and notarized form for your records.

- File the original form with the county register of deeds in the county where the property is located. Be aware of any filing fees that may apply.

After completing these steps, the Transfer-on-Death Deed will be recorded, and the property will be set to transfer to the designated beneficiary upon your death, without going through probate.

Misconceptions

Understanding the Michigan Transfer-on-Death Deed can be challenging due to various misconceptions. Here are nine common misunderstandings about this important legal document:

-

Transfer-on-Death Deeds are only for wealthy individuals.

This is not true. Anyone can utilize a Transfer-on-Death Deed, regardless of their financial status. It is a useful tool for simplifying the transfer of property to heirs.

-

Using a Transfer-on-Death Deed avoids probate entirely.

While a Transfer-on-Death Deed allows property to pass outside of probate, it does not eliminate the need for probate in all circumstances. Other assets may still require probate proceedings.

-

A Transfer-on-Death Deed can be revoked only in writing.

This is a misconception. Although it is advisable to revoke the deed in writing, it can also be revoked by executing a new Transfer-on-Death Deed that explicitly states the revocation.

-

All types of property can be transferred using a Transfer-on-Death Deed.

Not all properties qualify. Typically, the deed is used for real estate, but personal property and other types of assets may not be included.

-

The Transfer-on-Death Deed must be notarized.

While it is recommended to have the deed notarized to ensure its validity, it is not a strict legal requirement in Michigan.

-

Heirs automatically inherit the property upon the owner's death.

This is misleading. The property transfer occurs only after the owner's death, and the heirs must still comply with any relevant laws or requirements to finalize the transfer.

-

A Transfer-on-Death Deed can only be created by an attorney.

While seeking legal advice is beneficial, individuals can prepare a Transfer-on-Death Deed themselves, provided they follow the necessary guidelines and requirements.

-

Once a Transfer-on-Death Deed is signed, it cannot be changed.

This is incorrect. The deed can be amended or revoked at any time before the owner's death, allowing for flexibility in estate planning.

-

Transfer-on-Death Deeds are not recognized in all states.

This is partially true. While many states do recognize Transfer-on-Death Deeds, each state has its own rules. It is essential to check the specific laws of Michigan and any other relevant states.

By understanding these misconceptions, individuals can make informed decisions about using a Transfer-on-Death Deed as part of their estate planning strategy.

Dos and Don'ts

When filling out the Michigan Transfer-on-Death Deed form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process.

- Do: Make sure to include the full legal names of all parties involved.

- Do: Clearly describe the property being transferred.

- Do: Sign the form in front of a notary public to ensure its validity.

- Do: Keep a copy of the completed form for your records.

- Don't: Forget to check for any local requirements that may apply.

- Don't: Leave any sections of the form blank; fill in all required information.

By following these steps, you can help ensure that your Transfer-on-Death Deed is completed correctly and serves its intended purpose.

Popular State-specific Transfer-on-Death Deed Forms

Transfer on Death Instrument - Property owners retain full control over their property until their passing.

When engaging in the sale of a vehicle in Florida, it is vital to utilize the Florida Motor Vehicle Bill of Sale form, as it not only records the sale but also safeguards both parties involved. For an easy reference to obtain this crucial document, you can visit All Florida Forms, ensuring that you have the appropriate paperwork that complies with state regulations.

How to Gift a House to a Family Member - The Transfer-on-Death Deed simplifies real estate transfers, ensuring that your wishes are followed without lengthy legal processes.

Problems With Transfer on Death Deeds - By choosing this option, you help ensure that your wishes are legally documented.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed form in Michigan can be a straightforward process, but many people make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure that your intentions are honored and that your property is transferred smoothly to your beneficiaries.

One of the most frequent errors is failing to include all required information. The TOD Deed requires specific details, such as the legal description of the property and the names of the beneficiaries. Omitting any of this information can render the deed invalid. It’s crucial to double-check that all fields are filled out completely.

Another common mistake is not signing the deed in front of a notary. Michigan law requires that the TOD Deed be notarized to be valid. Without a proper signature and notarization, the deed may not be recognized, which could lead to unintended consequences for your heirs.

People often forget to update the deed when circumstances change. Life events such as marriage, divorce, or the death of a beneficiary can affect your intentions. If you don’t update the deed accordingly, the property may not go to the person you intended, leading to disputes and confusion.

Additionally, some individuals mistakenly believe that a TOD Deed supersedes other estate planning documents. This is not always the case. If there are conflicting documents, such as a will or a trust, it can create legal challenges. Always ensure that your estate planning documents are in harmony with one another.

Another misstep is not considering the tax implications. While a TOD Deed allows for the transfer of property outside of probate, it does not exempt the property from estate taxes. Understanding how this transfer affects your overall tax situation is vital for effective estate planning.

Some people also overlook the importance of communicating their intentions to beneficiaries. It’s wise to have an open discussion with those you are naming in the deed. This not only helps to avoid surprises but also allows your loved ones to understand their roles and responsibilities regarding the property.

Finally, a significant error is not consulting with a legal professional. While it may seem simple to fill out the form, the nuances of property law can be complex. Seeking advice from an attorney who specializes in estate planning can help you avoid mistakes and ensure that your wishes are carried out effectively.

By being aware of these common mistakes, you can take proactive steps to ensure that your Transfer-on-Death Deed is filled out correctly. This will help provide peace of mind for you and your loved ones, knowing that your property will be handled according to your wishes.

Key takeaways

Filling out and using the Michigan Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer their property to a beneficiary upon their death without going through probate.

- Complete the Form Accurately: Ensure that all required information is filled out correctly, including the names of the property owner and the beneficiary, as well as a clear legal description of the property.

- Sign and Notarize: The deed must be signed by the property owner in the presence of a notary public to be valid. This step is crucial for the deed to be legally binding.

- Record the Deed: After signing, the deed should be recorded with the county register of deeds where the property is located. This step is necessary to make the transfer effective.

By following these guidelines, you can ensure that your Transfer-on-Death Deed serves its intended purpose smoothly and effectively.