Fillable Tractor Bill of Sale Form for Michigan

Michigan Tractor Bill of Sale - Usage Guidelines

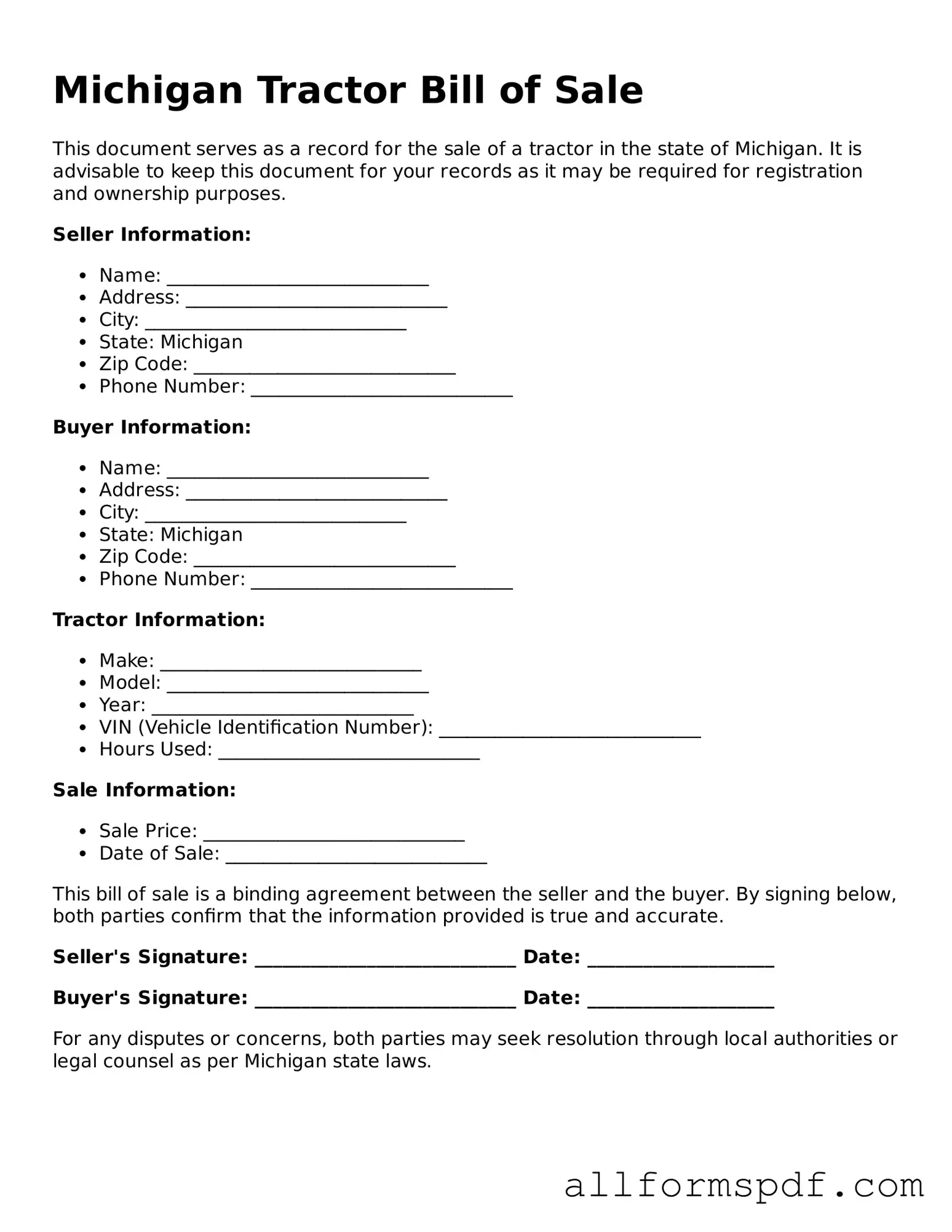

Once you have your Michigan Tractor Bill of Sale form ready, it’s time to fill it out accurately. This document is essential for the transfer of ownership and should be completed with care. Below are the steps to guide you through the process of filling out the form.

- Obtain the form: Ensure you have the correct Michigan Tractor Bill of Sale form. You can find it online or at a local DMV office.

- Seller's Information: Write the full name and address of the seller. Include the city, state, and zip code.

- Buyer's Information: Enter the full name and address of the buyer, ensuring accuracy in the details.

- Tractor Details: Fill in the tractor's make, model, year, and Vehicle Identification Number (VIN). This information is crucial for identification.

- Sale Price: Clearly state the sale price of the tractor. This should reflect the agreed amount between the buyer and seller.

- Date of Sale: Write the date when the transaction is taking place. This helps establish the timeline of ownership transfer.

- Signatures: Both the seller and buyer must sign and date the form. This confirms that both parties agree to the terms outlined.

- Notarization (if required): Some transactions may require notarization. Check local regulations to see if this step is necessary.

After completing the form, it’s advisable to keep a copy for your records. The buyer will need this document for registration purposes, so ensure it is filled out correctly and completely.

Misconceptions

Understanding the Michigan Tractor Bill of Sale form is essential for anyone involved in buying or selling a tractor. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

The form is only necessary for new tractors.

This is not true. The Bill of Sale is required for both new and used tractors to document the transfer of ownership, regardless of the tractor's age.

-

A verbal agreement is sufficient.

Many believe that a handshake or verbal agreement suffices. In reality, a written Bill of Sale provides legal protection and clarity for both parties involved in the transaction.

-

The form does not need to be notarized.

While notarization is not always required, having the Bill of Sale notarized adds an extra layer of authenticity and can help prevent disputes in the future.

-

Only the seller needs to sign the form.

Both the buyer and seller should sign the Bill of Sale. This ensures that both parties agree to the terms of the sale and acknowledges the transfer of ownership.

-

The form is the same as a title transfer.

While they are related, the Bill of Sale is not the same as a title transfer. The Bill of Sale documents the sale, while the title transfer is the official change of ownership recorded with the state.

Being aware of these misconceptions can help ensure a smoother transaction when dealing with tractors in Michigan.

Dos and Don'ts

When filling out the Michigan Tractor Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information about the tractor, including make, model, and year.

- Do include the Vehicle Identification Number (VIN) for proper identification.

- Do clearly state the sale price to avoid any confusion later.

- Do have both the buyer and seller sign the document to validate the transaction.

- Do keep a copy of the bill of sale for your records.

- Don't leave any fields blank; fill in all required information completely.

- Don't falsify any information; honesty is crucial in legal documents.

- Don't forget to date the document when signing.

- Don't overlook any state-specific requirements that may apply.

Popular State-specific Tractor Bill of Sale Forms

Do Tractors Have Titles in Texas - The form can establish the legal rights of the new owner.

Bill of Sale for Tractor - Provides a foundation for lease-to-own agreements if applicable.

The Florida Vehicle POA form 82053 is a legal document that allows someone to appoint another person to handle tasks related to their vehicle on their behalf. This could range from registration and titling to the sale or purchase of the vehicle. It provides a convenient way for vehicle owners to ensure their affairs are managed even when they cannot handle them personally. For additional resources and information, you can visit All Florida Forms.

Tractor Bill of Sale Word Template - Can be essential for tax reporting purposes for both parties involved.

Common mistakes

Filling out the Michigan Tractor Bill of Sale form can be a straightforward process, but mistakes can lead to complications. One common error is failing to provide accurate information about the tractor. This includes the make, model, year, and Vehicle Identification Number (VIN). Incomplete or incorrect details can create issues during registration.

Another frequent mistake is neglecting to include the purchase price. The form requires the seller to state the amount for which the tractor is being sold. Omitting this information can raise questions about the transaction and may complicate tax assessments.

Many individuals forget to sign the form. Both the seller and the buyer must provide their signatures to validate the transaction. Without these signatures, the document may be considered incomplete and unenforceable.

Some people also overlook the date of the sale. This date is important for record-keeping and can impact the buyer's ability to register the tractor. Ensuring that the date is clearly noted helps avoid future disputes.

Providing incorrect contact information is another common error. Buyers and sellers should include their full names, addresses, and phone numbers. This information is crucial for any follow-up communications or issues that may arise after the sale.

Many individuals fail to check for any liens on the tractor before completing the sale. A lien indicates that there are outstanding debts associated with the tractor. Buyers should ensure that the seller has clear ownership to avoid potential legal problems.

Some people do not make copies of the completed Bill of Sale. Keeping a copy for personal records is essential. This document serves as proof of the transaction and can be helpful in case of disputes or questions in the future.

Another mistake is not providing a clear description of the tractor's condition. Buyers appreciate knowing whether the tractor is in working order or if it has any issues. Including this information can help set realistic expectations for both parties.

Some individuals forget to include any warranties or guarantees associated with the sale. If there are any verbal agreements about the tractor's condition or future repairs, these should be documented on the Bill of Sale. This protects both the buyer and the seller.

Lastly, people often rush through the process without reviewing the entire form for accuracy. Taking the time to double-check each section can prevent many of these common mistakes. A careful review ensures that all necessary information is included and correct.

Key takeaways

When filling out and using the Michigan Tractor Bill of Sale form, there are several important points to consider. Understanding these key takeaways can help ensure a smooth transaction.

- The form must include accurate details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN).

- Both the seller and buyer should provide their names, addresses, and signatures to validate the sale.

- It is advisable to include the sale price and any terms of the sale to avoid disputes later.

- Keep a copy of the completed form for personal records; this serves as proof of the transaction.

- Consult local regulations or authorities if there are questions about additional requirements or fees associated with the sale.

By following these guidelines, individuals can navigate the process of buying or selling a tractor in Michigan more effectively.