Fillable Promissory Note Form for Michigan

Michigan Promissory Note - Usage Guidelines

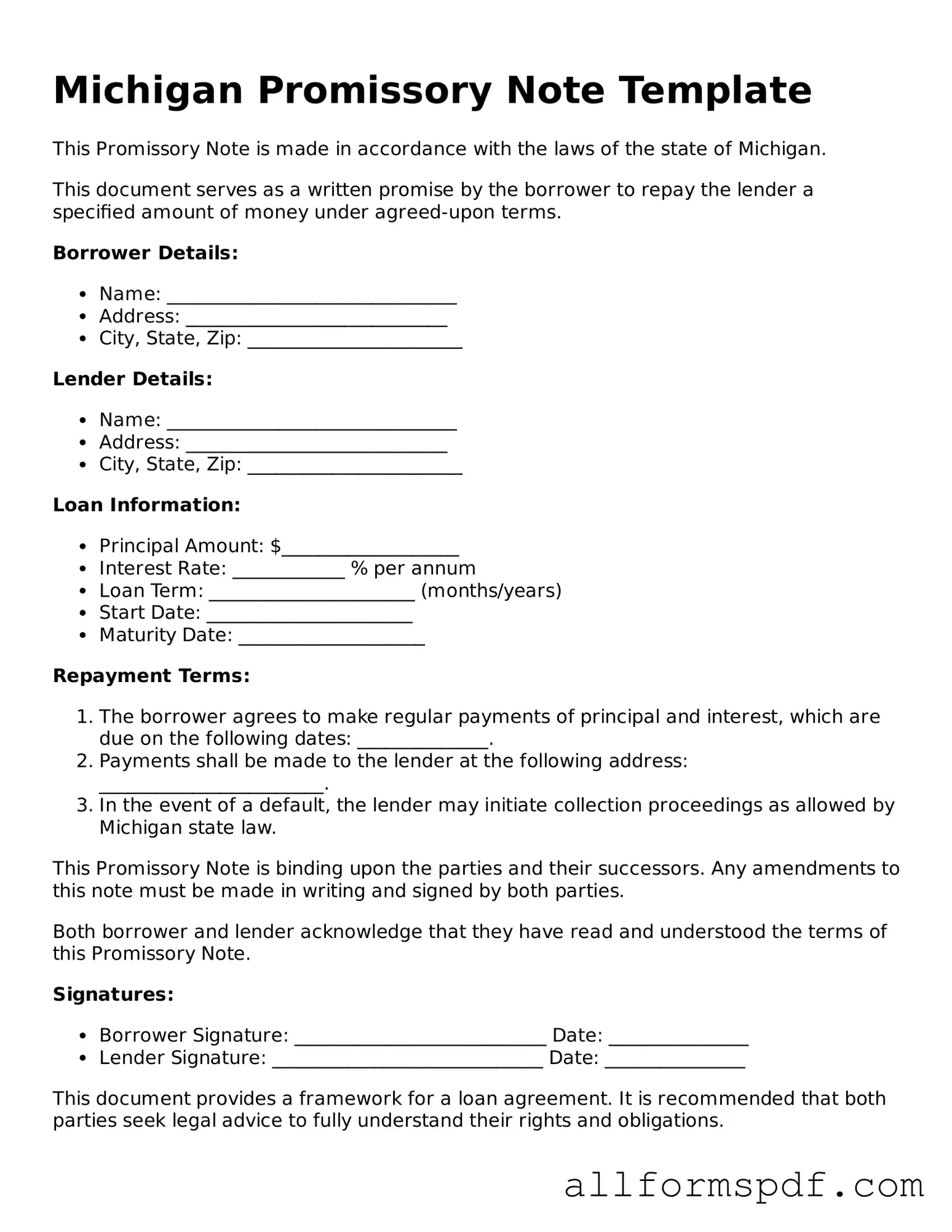

Filling out the Michigan Promissory Note form requires careful attention to detail. This document serves as a written promise to repay a loan under specified terms. Once completed, it will be essential for both the borrower and lender to retain a copy for their records, ensuring clarity and mutual understanding regarding the loan agreement.

- Begin by entering the date at the top of the form. This indicates when the agreement is made.

- Next, fill in the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Then, provide the name and address of the lender. This specifies who will receive the repayment.

- In the designated section, state the principal amount of the loan. This is the total amount borrowed.

- Clearly outline the interest rate, if applicable. This indicates how much extra will be paid in addition to the principal.

- Specify the repayment terms. Include details such as the due date for repayment and the frequency of payments (e.g., monthly, quarterly).

- If there are any late fees for missed payments, indicate those terms in the appropriate section.

- Both parties should sign and date the form at the bottom. This signifies agreement to the terms laid out in the document.

After completing these steps, ensure that each party receives a copy of the signed Promissory Note. This document will serve as a legal record of the loan agreement and the obligations of both the borrower and lender.

Misconceptions

Understanding the Michigan Promissory Note form is important for anyone involved in lending or borrowing money. However, several misconceptions often arise about this legal document. Here are five common misunderstandings:

-

Misconception: A Promissory Note must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note in Michigan. The note is valid as long as it is signed by the borrower and includes essential terms like the amount, interest rate, and repayment schedule.

-

Misconception: A verbal agreement is just as binding as a written Promissory Note.

Verbal agreements can be difficult to enforce. A written promissory note provides clear evidence of the terms agreed upon, making it much easier to resolve disputes if they arise.

-

Misconception: All Promissory Notes are the same.

Promissory notes can vary significantly based on the specifics of the agreement. Different terms, such as interest rates and payment schedules, can lead to different legal implications, so it’s important to tailor the note to fit the situation.

-

Misconception: A Promissory Note does not require specific language.

While the language used in a promissory note can vary, it should include certain key components to be enforceable. This includes the promise to pay, the amount, and the repayment terms. Ambiguities can lead to misunderstandings and legal issues.

-

Misconception: Once signed, a Promissory Note cannot be changed.

Changes can be made to a promissory note, but both parties must agree to the modifications. It’s advisable to document any changes in writing to avoid confusion in the future.

Being aware of these misconceptions can help individuals navigate the complexities of financial agreements more effectively.

Dos and Don'ts

When filling out the Michigan Promissory Note form, it's crucial to follow certain guidelines to ensure the document is valid and enforceable. Below are eight important dos and don'ts to keep in mind.

- Do provide accurate information. Ensure that all names, addresses, and amounts are correct to avoid any future disputes.

- Do clearly state the terms of the loan. Include the interest rate, payment schedule, and any penalties for late payments.

- Do sign and date the document. Both the lender and borrower should sign to make the agreement legally binding.

- Do keep a copy for your records. This ensures that both parties have access to the terms agreed upon.

- Don't leave any blanks. Every section of the form should be filled out completely to prevent misunderstandings.

- Don't use vague language. Be specific about the loan terms to ensure clarity for both parties.

- Don't forget to include the date of the agreement. This is essential for tracking payment timelines.

- Don't overlook the importance of legal review. If unsure about any terms, consult a professional to avoid potential issues.

By adhering to these guidelines, you can help ensure that the Michigan Promissory Note form is filled out correctly and serves its intended purpose effectively.

Popular State-specific Promissory Note Forms

Basic Promissory Note - Collateral may be required to secure the loan outlined in the note.

Obtaining a proper vehicle transfer is crucial, and our guide on how to create a reliable bill of sale in California can help you understand the necessary steps. For more information, refer to our thorough California bill of sale form template.

Simple Promissory Note Template - This form also provides evidence for tax purposes when documenting loans made to family or friends.

Ohio Promissory Note Requirements - Both parties should feel comfortable with the terms outlined to maintain a positive relationship.

Promissory Note Template Georgia - If a borrower fails to repay, the lender may claim the stipulated terms.

Common mistakes

Filling out a Michigan Promissory Note form can be straightforward, but there are common mistakes that individuals often make. One frequent error is failing to include all necessary information. The form requires specific details such as the names of both the borrower and the lender, the amount being borrowed, and the repayment terms. Omitting any of this information can lead to confusion or disputes later on.

Another mistake people make is not clearly defining the repayment schedule. It's essential to specify how and when payments will be made. This includes outlining the frequency of payments—whether they will be made weekly, monthly, or annually. If this information is vague or missing, it can create misunderstandings about when payments are due, potentially leading to missed payments and penalties.

Many individuals also overlook the importance of signatures. Both the borrower and the lender must sign the document for it to be legally binding. Some may assume that a verbal agreement is sufficient, but without signatures, the note may not hold up in court. This step is crucial in ensuring that both parties acknowledge and agree to the terms outlined in the note.

Finally, people often neglect to keep copies of the completed Promissory Note. After filling out the form and obtaining signatures, it is vital to make copies for both parties. This practice ensures that each individual has a record of the agreement, which can be referenced in case of any future disputes. Not having documentation can complicate matters significantly if disagreements arise.

Key takeaways

When dealing with a Michigan Promissory Note, understanding the key elements can help ensure a smooth process. Here are some important takeaways:

- The Michigan Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender.

- It is essential to include the names and addresses of both the borrower and the lender for clarity.

- The amount of the loan must be clearly stated in the document, ensuring both parties agree on the total sum.

- Specify the interest rate, if applicable. This can be a fixed rate or variable, but it should be clearly defined.

- Include the repayment schedule, detailing when payments are due and how much will be paid at each interval.

- Make sure to note any late fees or penalties for missed payments to avoid confusion later.

- Consider including a section on what happens in case of default, outlining the lender's rights.

- Both parties should sign and date the document to make it legally binding. Witnesses or notarization may also be required.

- Keep a copy of the signed Promissory Note for your records, as it serves as proof of the loan agreement.

- Review the document carefully before signing to ensure all terms are understood and agreed upon.

Taking the time to understand these key aspects can help protect both the borrower and the lender in the lending process.