Fillable Motor Vehicle Bill of Sale Form for Michigan

Michigan Motor Vehicle Bill of Sale - Usage Guidelines

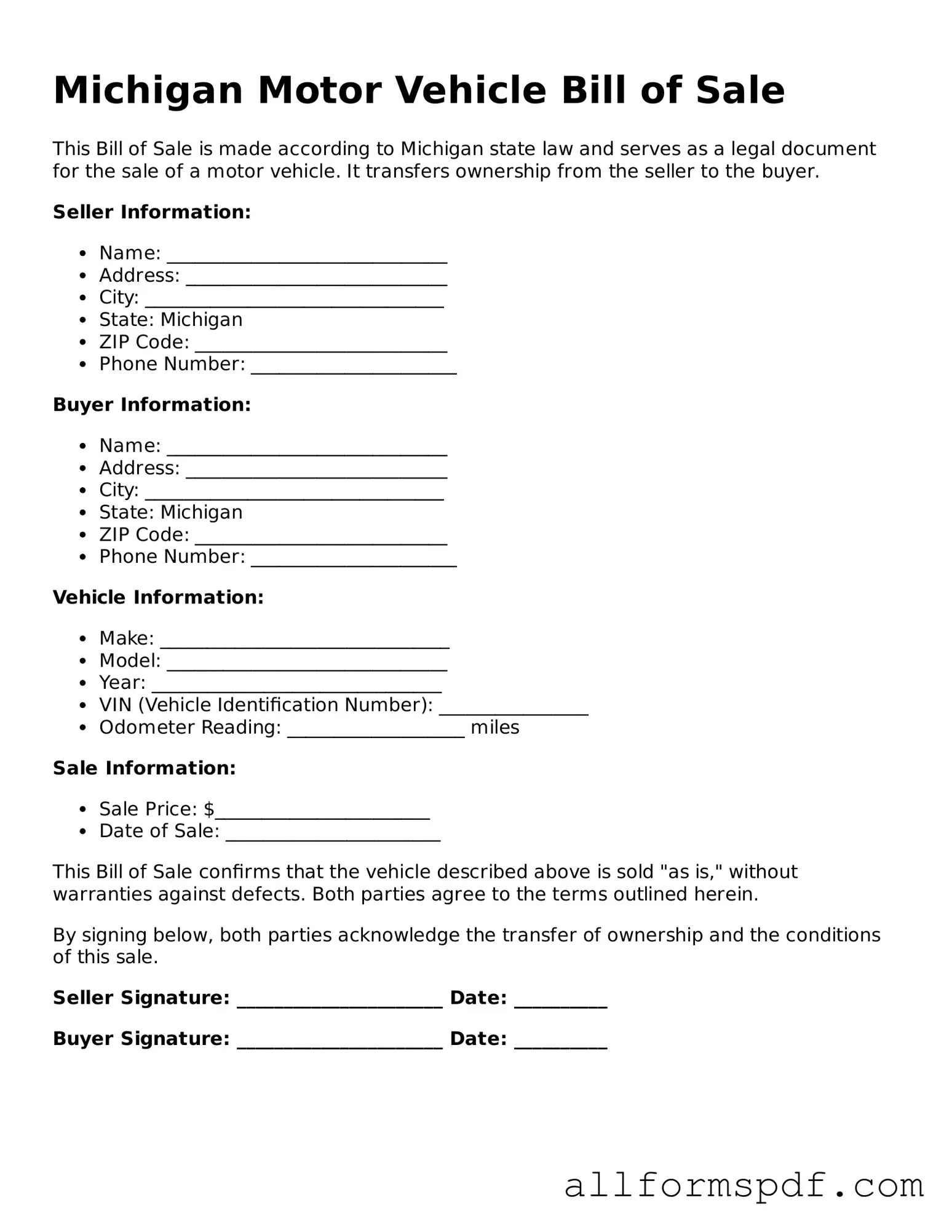

Once you have the Michigan Motor Vehicle Bill of Sale form ready, you will need to fill it out carefully. Ensure that all information is accurate to avoid any issues later. Follow these steps to complete the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the seller's full name and address in the designated fields.

- Next, enter the buyer's full name and address.

- Fill in the vehicle information, including make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the vehicle in the appropriate section.

- If applicable, note any trade-in vehicle details or additional terms of the sale.

- Both the seller and buyer should sign and date the form at the bottom.

After completing the form, both parties should keep a copy for their records. This document will be important for transferring ownership and registering the vehicle.

Misconceptions

Understanding the Michigan Motor Vehicle Bill of Sale form is essential for anyone involved in buying or selling a vehicle in the state. However, several misconceptions often arise regarding this document. Below are eight common misconceptions, along with clarifications to help you navigate the process more effectively.

- A Bill of Sale is not necessary for vehicle transactions. Many people believe that a Bill of Sale is optional, but in Michigan, it serves as a crucial record of the transaction.

- Only the seller needs to sign the Bill of Sale. Both the buyer and seller should sign the document to validate the transaction and protect both parties' interests.

- A Bill of Sale is the same as a title. While a Bill of Sale documents the sale, the title is the official proof of ownership and must be transferred separately.

- It’s acceptable to use a generic Bill of Sale form. Using the specific Michigan Motor Vehicle Bill of Sale form is recommended to ensure compliance with state requirements.

- The Bill of Sale must be notarized. In Michigan, notarization is not required for the Bill of Sale, although it may add an extra layer of security.

- All vehicle sales require a Bill of Sale. A Bill of Sale is typically needed for sales involving motor vehicles, but certain transactions, such as gifts, may not require one.

- The Bill of Sale can be completed after the sale. It is best practice to complete the Bill of Sale at the time of the transaction to avoid any disputes later.

- There is no need to keep a copy of the Bill of Sale. Both the buyer and seller should retain copies of the Bill of Sale for their records, as it may be needed for future reference or legal purposes.

By addressing these misconceptions, individuals can approach the vehicle buying and selling process with greater confidence and clarity.

Dos and Don'ts

When completing the Michigan Motor Vehicle Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Here are eight essential dos and don'ts to consider:

- Do provide accurate vehicle information, including the make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and the seller to establish clear ownership transfer.

- Do specify the sale price clearly to avoid any disputes later on.

- Do date the form to indicate when the transaction took place.

- Don't leave any fields blank; incomplete forms can lead to complications during registration.

- Don't use white-out or any other correction fluid; instead, cross out mistakes and initial them.

- Don't forget to sign the form; both parties must provide their signatures for it to be valid.

- Don't neglect to keep a copy of the completed bill of sale for your records.

Popular State-specific Motor Vehicle Bill of Sale Forms

Nj Car Bill of Sale - The form is a requirement in many jurisdictions to register a vehicle.

Duplicate Title Ohio - Many buyers require a Bill of Sale before completing a purchase.

For those looking to navigate the intricacies of property transactions, understanding the significance of a bill of sale is crucial. A reliable resource is our guide on the comprehensive California bill of sale, detailing everything you need to know about creating and utilizing this essential document. Explore more in our informative piece on the California bill of sale process.

T-7 Bill of Sale - Simple to complete, usually requiring just a few minutes.

Vehicle Purchase Agreement - Aids both parties in keeping accurate records.

Common mistakes

Filling out the Michigan Motor Vehicle Bill of Sale form can be straightforward, but common mistakes can lead to complications. One frequent error is failing to include all required information. The form requires specific details about the vehicle, such as the Vehicle Identification Number (VIN), make, model, and year. Omitting any of these details can result in delays during the registration process.

Another mistake is incorrect or illegible signatures. Both the buyer and seller must sign the document for it to be valid. If either party’s signature is missing or difficult to read, it may cause issues later. It is essential to ensure that names are clearly written and match the names on the identification documents.

People often overlook the importance of including the sale price. The form must state the agreed-upon price for the vehicle. Leaving this section blank or writing an incorrect amount can lead to disputes or complications with tax assessments. It is advisable to double-check this information before finalizing the sale.

Additionally, not keeping a copy of the completed Bill of Sale can be problematic. After signing the document, both parties should retain a copy for their records. This serves as proof of the transaction and can be useful for future reference, especially if any issues arise regarding ownership or payment.

Finally, some individuals may forget to date the document. The date of the sale is a crucial piece of information that establishes when the transaction occurred. Without a date, it may be challenging to prove when ownership changed hands, which can complicate matters if disputes arise later.

Key takeaways

When filling out and using the Michigan Motor Vehicle Bill of Sale form, there are several important points to keep in mind:

- The form serves as a legal document that records the sale of a vehicle between a buyer and a seller.

- Both parties should ensure that all information is accurate, including the vehicle identification number (VIN), make, model, and year.

- The form must include the purchase price, which can help establish the value of the vehicle for tax purposes.

- It is advisable for both the buyer and seller to sign and date the form to validate the transaction.

- Keep a copy of the completed Bill of Sale for your records, as it may be needed for future reference or registration.

- The Bill of Sale does not transfer the title; the buyer must complete the title transfer process with the Michigan Secretary of State.