Fillable Last Will and Testament Form for Michigan

Michigan Last Will and Testament - Usage Guidelines

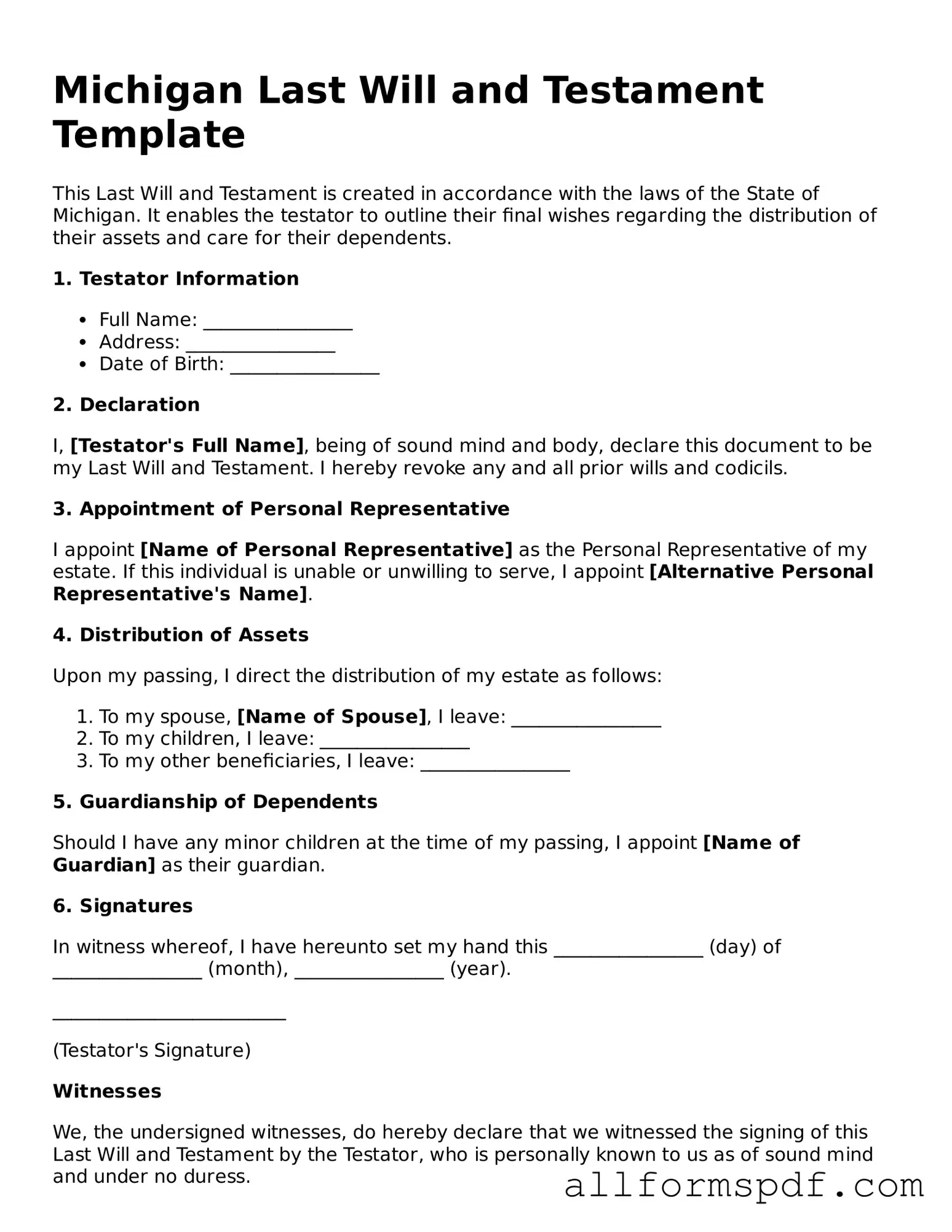

Once you have the Michigan Last Will and Testament form, you can begin filling it out. This process will help you express your wishes regarding the distribution of your assets after your passing. It is important to be clear and precise to avoid any confusion later on.

- Start by entering your full name at the top of the form.

- Provide your address, including city, state, and ZIP code.

- State your date of birth clearly.

- Identify your spouse, if applicable, by writing their full name.

- List your children’s names and ages, if any.

- Designate an executor by writing their full name and address. This person will carry out your wishes.

- Outline how you want your assets distributed. Be specific about who receives what.

- If you have any specific bequests, such as gifts to individuals or charities, list them clearly.

- Include any instructions for the care of minor children, if applicable.

- Sign the form in the presence of two witnesses. They must also sign the document.

- Make sure to date the form after signing.

After completing the form, keep it in a safe place and inform your executor and family members where it can be found. This will ensure that your wishes are honored when the time comes.

Misconceptions

- Misconception 1: A will is only necessary for wealthy individuals.

- Misconception 2: A handwritten will is not valid in Michigan.

- Misconception 3: Once a will is created, it cannot be changed.

- Misconception 4: A will can control all aspects of your estate.

- Misconception 5: Having a will means your estate will avoid probate.

This is not true. Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed after your death and can simplify the process for your loved ones.

In Michigan, a handwritten will, also known as a holographic will, can be valid if it is signed and dated by the person making it. However, it is often better to use a formal will to avoid potential disputes.

This is false. You can change your will as many times as you need to. It’s important to update your will after major life events, such as marriage, divorce, or the birth of a child.

A will does not cover everything. Certain assets, like life insurance policies and retirement accounts, have designated beneficiaries and are not governed by your will.

This is a common misunderstanding. A will typically must go through probate, which is the legal process of validating the will and distributing assets. However, there are ways to minimize probate through trusts and joint ownership.

Dos and Don'ts

When filling out the Michigan Last Will and Testament form, it is important to follow certain guidelines to ensure that the document is valid and reflects your wishes. Here are some dos and don'ts to consider:

- Do clearly identify yourself at the beginning of the document.

- Do specify your beneficiaries and their relationship to you.

- Do designate an executor to manage your estate after your passing.

- Do sign the will in the presence of at least two witnesses.

- Do keep the original will in a safe place and inform your executor of its location.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date the will when you sign it.

- Don't attempt to make changes without following proper legal procedures.

- Don't leave out important details about your assets and debts.

Popular State-specific Last Will and Testament Forms

Online Will Illinois - Stimulates important conversations about mortality and legacy planning.

New Jersey Last Will and Testament Pdf - Helps prevent disputes among family members after your passing.

Wills in Georgia - A way to grant powers of attorney for financial or health decisions.

Creating a Last Will and Testament is essential for anyone looking to secure their legacy and ensure a smooth transition of their assets. It not only outlines the desires of the individual but also provides crucial information on the distribution of property and the appointment of guardians, thereby minimizing potential disputes among heirs. For those in Florida, utilizing the All Florida Forms can simplify the process and help ensure that all legal requirements are met, allowing for peace of mind in knowing that one's wishes will be honored.

Online Will Ohio - A written declaration that specifies beneficiaries and their shares of the estate.

Common mistakes

When filling out the Michigan Last Will and Testament form, many individuals inadvertently make mistakes that can lead to complications in the future. One common error is not properly identifying beneficiaries. It is essential to clearly state who will receive your assets. Failing to include full names or designating beneficiaries with vague terms can result in confusion or disputes among family members after your passing.

Another frequent mistake involves overlooking the requirement for witnesses. In Michigan, a will must be signed in the presence of at least two witnesses who are not beneficiaries. If this step is neglected, the will may be deemed invalid, which could lead to the distribution of assets contrary to your wishes. Ensuring that the signing process is conducted correctly is vital for the will's legality.

People often forget to update their wills after significant life changes, such as marriage, divorce, or the birth of a child. A will that does not reflect current circumstances may not serve its intended purpose. For instance, if a person gets divorced but does not update their will, the former spouse may still inherit assets, which can create unwanted outcomes.

Finally, individuals sometimes fail to consider the implications of digital assets. In today's digital age, many people have online accounts, cryptocurrencies, or digital property. Not addressing these assets in the will can lead to confusion and difficulty in accessing them after death. It is important to include instructions for handling digital assets to ensure that they are managed according to your wishes.

Key takeaways

When filling out and using the Michigan Last Will and Testament form, there are several important points to keep in mind. Understanding these key takeaways can help ensure that your will is valid and that your wishes are clearly communicated.

- Eligibility: To create a valid will in Michigan, you must be at least 18 years old and of sound mind.

- Written Document: Your will must be in writing. Oral wills are not recognized in Michigan.

- Signature Requirement: You must sign the will at the end. If you are unable to sign, you can direct someone else to sign on your behalf in your presence.

- Witnesses: At least two witnesses are required to sign the will. They should not be beneficiaries of the will to avoid potential conflicts of interest.

- Revocation: A will can be revoked at any time by creating a new will or by destroying the existing one. It is important to clearly communicate your intentions.

- Executor Appointment: Designate an executor in your will. This person will be responsible for managing your estate after your passing.

- Specific Bequests: Clearly outline any specific gifts or bequests you wish to make to individuals or organizations to avoid confusion.

- Residue Clause: Include a residue clause to specify how any remaining assets should be distributed after specific bequests have been made.

- Legal Storage: Keep your will in a safe place and inform your executor and family members of its location. This ensures it can be easily found when needed.

By following these guidelines, you can create a comprehensive and legally sound Last Will and Testament that reflects your wishes and provides clarity for your loved ones.